[ad_1]

The original title was licensed by the world’s largest hedge fund,TeslaWhat happened?

US local time Friday, at close,Dow JonesThe industrial average index rose 27.7 points to 31,458.40 points, an increase of 0.09%. The S&P 500 index rose 0.47% to close at 3,934.83 points; technology stocks dominatedNasdaqThe composite index rose 0.50% to close at 14095.47 points. All three major stock indices set all-time closing highs.

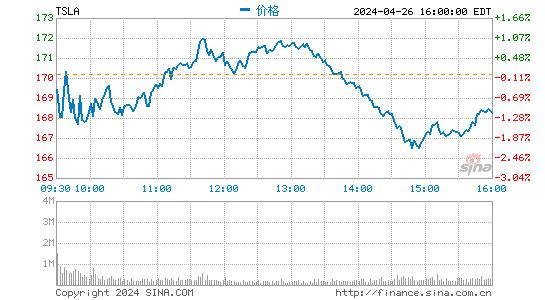

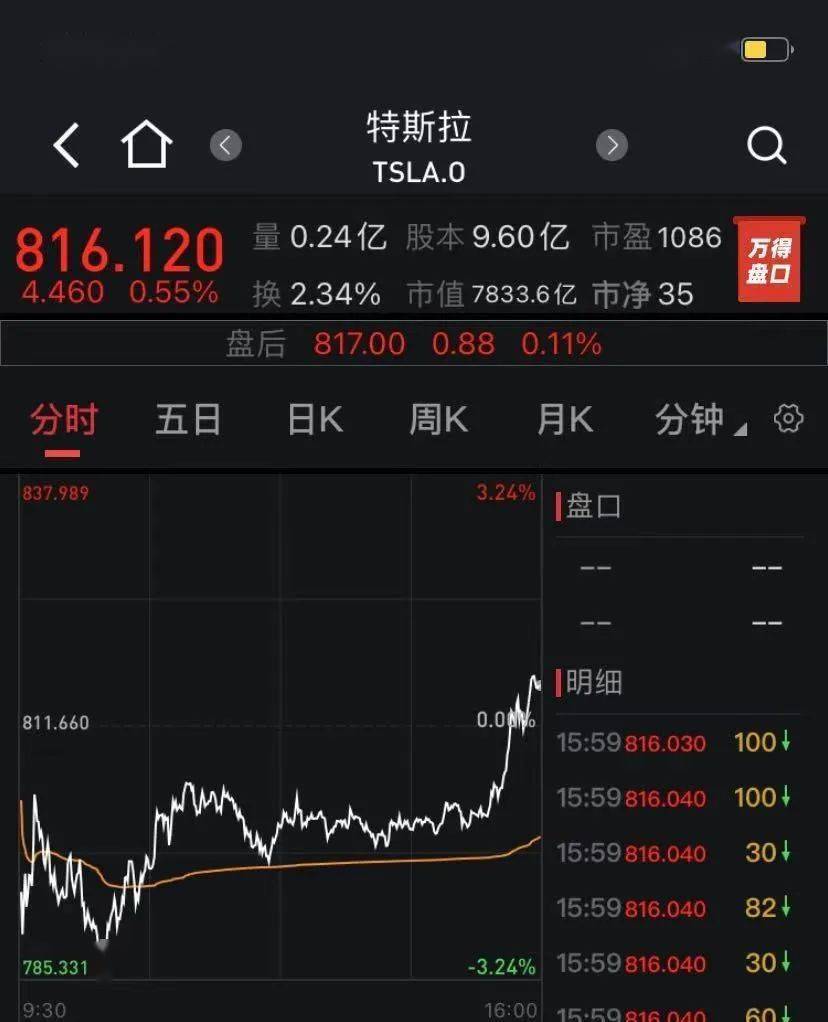

It should be noted thatOn February 12, the 13F report submitted by the Bridgewater Fund, the world’s largest hedge fund, to the US Securities Regulatory Commission showed thatHe cleared Tesla in the fourth quarter of last year and opened long positionsJPMorgan. Affected by this news, Tesla once fell more than 3% during the intraday session, but then stopped falling and rallied and was up 0.55% at the close.

Tesla’s annual growth rate reached 743% last year, and the annual increase to date is about 21%.

Chip stocks soar

Among the constituent shares of the Dow, Thursday’s secondary market announcement was better than the expected quarterly report.DisneyRejected at the beginning of the market, closing down 1.75%, while chip stocksIntelUp to 1.9%.

Most other chip stocks also continued to rise, Amkor Technology (AMKR) increased more than 5%,Applied Materials(AMAT) rose more than 3%, KLA Corp (KLAC) and the Lahm Research Institute (LRCX) rose more than 2%,Qualcomm(QCOM) andAMDIt was up more than 1%, but Nvidia (NVDA) fell 1.9%. The Philadelphia Semiconductor Index, an industry gauge, rose more than 1%, setting a new closing high.

FAANMG’s top six tech stocks fell just nearly 0.2%NetflixIt closed, but other stocks rose less,FacebookSlightly aboveAppleUp almost 0.2%,MicrosoftUp to 0.2%,GoogleParent company Alphabet rose 0.3%,AmazonUp almost 0.5%, Tesla up more than 0.5%

Among other popular technology stocks, PayPal closed up nearly 4.7%, an outstanding performance among stocks in the S&P 500 index.TwitterIt closed higher than 4.7%, increasing for ten consecutive days, approaching the all-time high of $ 73.31 in December 2013.

The blockchain sector continued its rebound, at the close,Canaan technologyUp 22.44%, Riot Blockchain up 14.37%; most industrial hemp stocks fell sharply,Sundial Producers fell 12.61%, Aurora Cannabis fell 13.75% and Tilray fell 9.83%.

The shares of Chinese folk concepts were mixed,WuNong NetworkUp to 102.3%,lycheeUp to 25.06%,AliSlimeIt fell 0.40%,PinduoduoIt fell 1.61%,JingdongUp to 0.23%,BaiduUp to 1.10%,BilibiliUp to 3.10%,IQIYIUp to 0.53%,NetEaseFell 0.26%,Tencent MusicIt fell 1.75%,Wei LaiIt fell 0.70%, Xiaopeng Motors fell 0.51%,idealAutomobiles fell 0.44%.

Qiaoshui licensed Tesla in the fourth quarter of last year

It’s worth noting that, according to foreign media reports, on February 12, the world’s largest hedge fund, the Bridgewater Fund, filed a 13F report with the US Securities Regulatory Commission.Approved Tesla in the fourth quarter of last year and opened long positions at JPMorgan Chase, Reduced its holdings of SPDR Gold Shares, SPDR S&P 500 ETF Trust is its largest holding of shares; Among the top ten top holdings, Alibaba has increased its holdings, and its holdings increased 19% month-over-month, ranking sixth, ranking 4th previously.

The Qiaoshui Fund liquidated 74 shares in the fourth quarter, including the sale of 35,650 Tesla shares.Opened a long position in 169 shares, of which 412,775 shares of JPMorgan Chase were purchased, andBank of America1.4 million shares, to buy 369,670 shares of Citigroup, to buyFuGuo bench714,665 shares and boughtMorgan stanleywithGoldman sachsWhile waiting for banking institutions, he bought Charles Schwab and bought 149,263 shares of Microsoft.

Increase in holdings of 233 shares, of whichWalmartHolding positions increased by 121% to 3.08 million shares,Procter & GambleHolding positions increased 120% to 2.7 million shares, while Pinduoduo holdings increased 30% to 1.42 million ADS.

Reduced holdings of 122 shares, of which NetEase fell 39% to 461,752 shares. The most significant stocks include SPDR S&P 500 ETF Trust (3.69 million shares), Vanguard FTSE Emerging Markets ETF (1.32 million shares), SPDR Gold Shares (2.9 million shares). shares)), Wal-Mart (3.08 million shares), Procter & Gamble (2.7 million shares).

In the fourth quarter,Bridgewater Fund’s disclosed scale of positions increased by 39%, valued at $ 11.6 billion。

According to documents filed by the United States Securities and Exchange Commission (SEC), billionaire Elon Musk’s younger brother, Kimbal Musk, sold shares of Tesla (TSLA. Musk) on Tuesday (February 9). United States), valued at $ 25.6 million.

The filing shows that it sold 30,000 directly owned shares at an average price of $ 853 per share. The 48-year-old Tesla board member and restaurant owner still owns 599,740 shares of the company, valued at approximately $ 483 million.

American economist Nuriel Roubini said this week:Before Tesla invested in cryptocurrencies, Musk’s tweet about Bitcoin was “market manipulation” behavior, and Musk should be investigated by the US Securities and Exchange Commission (SEC)。

Zeng Bini believes that Musk first declared his personal position in Bitcoin, increasing the price, and then said that Tesla has invested, which is also a crime to disrupt the market. The SEC should monitor the manipulation of asset prices by individuals who have an impact on the market.

Earlier this month, Tesla bought $ 1.5 billion worth of bitcoins, and Tesla had previously announced that it would accept bitcoins as payment. Affected by this, Bitcoin once soared to 48,000 US dollars.

In fact, before Tesla bought Bitcoin, Musk had posted several related comments in support of Bitcoin and triggered the “Dogecoin.”

US stocks report season performance exceeded expectations

Based on Tencent US stocks, analysts said the company’s earnings season performance is a positive factor affecting US stocks.Credit SuisseChief US equity strategist Jonathan Golub said in a report that, as of Thursday, US stock market earnings per share, which had already released its earnings report in the fourth quarter. quarter, exceeded the level of the same period last year. per share will set a record. He said: “Quick and generous government actions have mitigated the damage (related to the virus) and have resulted in big surprises in economic and corporate profits. The recovery of profits is much stronger than we could have imagined when the epidemic spread for the first time. “

With the end of the corporate earnings season for US stocks, the stronger-than-expected performance has encouraged investors. According to data from FactSet, about three-quarters of the companies in the S&P 500 Index have announced their results and more than 80% of the companies have exceeded expectations. The fourth quarter profit of the companies that make up the stock index is currently expected to increase by 2.8% year-on-year, which is a significant improvement compared to the fall of more than 9% expected at the end of December last year.

In addition, the good news of the new corona vaccine in the United States is also one of the factors driving the increase in American stocks.

On the 12th, the President of the United States announced that the US government.PfizerAnd Moderna each added an additional order for 100 million doses of the new corona vaccine, with the 200 million doses of the vaccine expected to be delivered in advance by the end of July.

According to the analysis, if these new vaccine orders can be delivered on time, the total number of vaccines in the United States will reach 600 million doses by the end of July, which can be used by 300 million people.

Moderna has confirmed that the United States government has purchased an additional 100 million doses of vaccine. The company issued a statement on February 11 that following the incorporation, the United States government has ordered a total of 300 million doses of vaccine.

So far, Moderna has provided 41 million doses of vaccines to the United States and more than 22 million Americans have been vaccinated. The company expects to provide 100 million doses of vaccine to the United States by the end of the first quarter of this year, with the total reaching 200 million doses by the end of May this year. However, Moderna also mentioned that the July delivery is just a “target.”

However, the new order does not mean that the vaccine supply can be expanded immediately. The US media noted that the new corona vaccine is still in short supply in most of the United States, and the new orders are primarily to avoid a shortage later this year.

Massive information, accurate interpretation, all in the Sina Finance APP

Editor in charge: Wang Han