[ad_1]

Source: Golden Circle

International spot gold on Monday (October 12) peaked at 1933 dollars and fell back because the negotiation process of the US economic stimulus plan was blocked. Although Republicans agreed to scale-up aid earlier, Democrats expect large-scale financial aid, which can be difficult to obtain Republican support.

Before the US election, it can be difficult for Democrats and Republicans to agree on a stimulus package. Gold lacks any further upside momentum, but as long as the expectation of a deal exists, gold will not drop sharply.

In other respects, European countries, including Italy, the United Kingdom and France, are considering new drastic measures to stop the spread of the new corona virus. The seventh round of India-China military commander-level talks began on October 12. The purpose of the meeting was to establish a timetable for disconnecting and easing tensions on the disputed eastern border.

US stimulus bill hard to beat, gold doubts

Last weekend, the Republicans and Trump were rumored to have agreed to scale up the economic aid, raising the aid ceiling to $ 2 trillion, and were willing and eager to agree on relief measures. The stimulus agreement is expected to move forward. According to the news, Trump will increase the size of the aid funds to $ 1.8 trillion in talks with Pelosi. Previously, Trump and the Republicans only supported $ 1.5 trillion.

Subsequently, the Secretary of the Treasury of the United States, Mnuchin, proposed that it could be increased to 1.9 trillion dollars, of which 400,000 million would come from the unspent amount of the previous round of stimulus bills. In fact, the new fiscal stimulus measures were $ 1.5 trillion. Pelosi rejected the proposal again last weekend, saying the proposal amounts to one step forward and two steps back.The stimulus plan is difficult to produce and gold lacks the drivers for a further rise after breaking the $ 1920 mark.

US Treasury Secretary Mnuchin and White House Chief of Staff Meadows said Monday they will continue to work with Democrats. The White House urged Congress to collaborate on the stimulus agreement and recommended that the “shortened version” aid bill be passed first to help small businesses.

Although the US gold reserves have not been audited for many years, how many stocks have been criticized, but there is no doubt that it is still the largest part. For historical reasons, many countries still have a large amount of gold stored in underground vaults in the United States, including some of the gold from China. According to rumors, 600 tons are in the United States. Germany and other European countries have been involved in the gold origin movement and I have not heard of any movement in China. What policy does China adopt towards gold? It only imports but does not export!

The bomb of the king of the golden bull: Biden wins the election

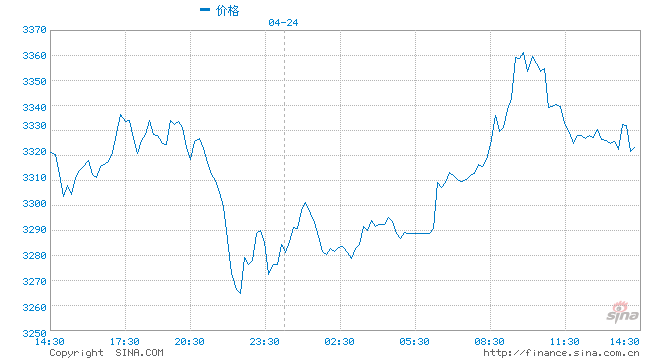

At present, the possibility of introducing a new round of stimulus plan before the general elections appears to have weakened, but the ongoing negotiationGold priceThis is good. As long as the negotiations continue, gold will not turn into a sharp decline, but if both parties announce the end of the negotiations, then the price of gold will weaken, but it will not necessarily fall below the recent low of $ 1848.00.

No matter who wins the election, the two parties will eventually reach a stimulus agreement. If Biden wins the election, Democrats will have a greater appetite for the scale of spending and more stimulus measures may lead to inflation. The Fed will keep interest rates low for a long time, and rising inflation will cause real interest rates to fall, which is good for gold.

The Washington Post cited the results of a joint poll with ABC News on October 11 and reported that the rate of popular support for US President Trump remains at 42% -54 when the general election is about to be held in just over three weeks. % He is behind his opponent Biden. Trump’s popular support rate has reportedly not changed much in recent months. Polls show Biden has an advantage in key changing states, but overall leadership is lower than the national average.

Gold perspective

Continued electoral chaos and uncertainty, social unrest, concerns about the fundamentals of the US dollar, continued economic chaos caused by the new crown pneumonia epidemic, unprecedented monetary and fiscal stimulus, and low real interest rates at negatives support gold. The good prospects for the new crown vaccine have somewhat suppressed the possibility of panic sales in the market.

Gold broke the $ 1900 mark last Friday, regained key resistance at $ 1920, established an uptrend and opened higher. The market outlook will further explore $ 1973, or return to the $ 2000 mark; Support below gold is centered at $ 1920 and $ 1900.

In the Fed’s loose monetary policy environment, fiscal stimulus policies help achieve average inflation targeting, lower real market interest rates, and gold gains medium-term bullish momentum. The US stock market rally is under pressure and funds may exit the stock market to allocate safe haven assets, such as gold. The strategic confrontation between China and the United States is intensifying in various fields and geopolitical risks will promote coverage of gold demand.

Disclaimer: The content provided by Wemedia is derived from Wemedia and the copyright belongs to the original author. To reprint, contact the original author and obtain permission. Opinions in the article only represent the author, not Sina’s position. If the content involves investment advice, it is for reference only and not an investment basis. Investing is risky, so be careful when entering the market.

Massive information, accurate interpretation, all in the Sina Finance APP

Editor in Charge: Tang Jing