[ad_1]

oneCommentary

The

2020-04-27 22:59:40

Source:Shanghai Stock News

Author:Shao Hao Wang Hong

The next Guodian Nanzi

Everyone is looking forward to the official opening of the selected New Third Board layer.

National Equity Transfer Corporation officially launched the public offering and listing acceptance and review work on the selected layer today. As of press time, three new three-tier innovation companies on the board, including Guandian Defense, Qiguan Cable, and Yingtai Biological, have successively issued announcements that they have submitted application materials to the national stock transfer company.

Affected by this, the A-share venture capital sector index rose more than 4% on the day, and finally closed at 3.44%. For individual actions,Jiuding investment(600053,Consultation unit),Genesis Star(002243,Consultation unit),Huakong SEG(000068,Consultation unit) Strong daily limit,Luxin Ventures(600783,Consultation unit),Qianjiang Water Resources(600283,Consultation unit) And so on, the share price rose more than 5%.

3 companies take the lead in the “knock on the door” selection layer

Shanghai Securities News learned from market participants that some companies were quick to send application materials this morning when the select flat had just opened.

As of April 25, a total of Yingtai Biology, Guandian Defense, Guoyuan Technology, Blue Mountain Technology, Liujin Years, Ball Crown Cable, Fangda, Airong Software, Bettray, Longtai Home Furnishing, Chenyue Jian 13 companies including Guan, Runnong Water Saving and minimally invasive Optoelectronics were advised and accepted by the CSRC, and 3 of them submitted application materials today.

Watch Code Defense (832317)

Guandian Defense main UAV flight service and data processing, UAV system and intelligent defense equipment R&D, production and sales.

To the reporter’s knowledge, there is no comparable company in the Guandian Defense subdivision that is fully consistent with his business. In terms of gross profit margin, due to the different business segments, comparability is not solid. Compared to publicly listed companies, the gross profit margin of Guandian’s defense drone sales business is lower than that of comparable companies. In 2019, the gross profit margin of this business increased by 7 percentage points. In terms of operating capacity and solvency, the company is superior to comparable companies.

Ball Crown Cable (834682)

Ball Crown Cable is primarily engaged in the research and development, production and sales of wires and cables.

Data show that in 2018, the median earnings of publicly traded companies were 1.712 billion yuan, the spherical corona wire was 2.033 billion yuan, the median net profit was 98.604 billion yuan, and the wire spherical crown was 57.619 billion yuan. Revenue was at the median level of publicly traded companies in the same industry, and net profit was slightly lower than the median level of publicly traded companies.

Yingtai Biology (833819)

Yingtai Biological is primarily engaged in technical research, development, production, sales, and GLP services for original drugs, intermediates, and pesticide preparation.

Reportedly among the companies listed in the same industry (chemical pesticide manufacturing), Yingtai Biotechnology ranked first in revenue and profit scale. The company is higher than the average level of listed companies in the same industry, and its operating scale ranks second in China.

New third board introduced the “acceptance market”

Driven by the news that the new third board selection layer officially accepted the statement, today the third board’s market creation index opened wider and wider. As of 27, it closed at 1118.16 points, an increase of 1.21%, and this year’s increase was 22.24%.

The NEEQ market favors the 13 “quasi-selected layer” companies mentioned above, of which the Vietnam Construction Management Corporation morning has risen to 43.59%.

Zhou Yunnan, founder of Beijing Nanshan Investment, said that the conceptual stock volume of selected New Third Board stocks has increased, especially the 13 companies that have been advised and accepted, and are also leaders in intraday earnings.

Zhou Yunnan said this week’s third board acceptance companies will be publicized one after the other. This wave of the market is expected to continue. As the acceptance of the selection layer and the progress of the review, the list of the selection layer continues to be clear, and the new third-board market may continue to ferment. He believes that under the resonance effect of the reform dividend and the corporate growth dividend, the New Third Board will open the “bull of reform.”

Three companies have risk capital potential

What venture capital can the selected bond share?

Wind data shows that 3 of the above 13 “near-pick level” companies have received venture capital stocks, namely minimally invasive optoelectronics, Runnong water saving and Longtai home furnishings.

The Weichuang Optoelectronics 2019 annual report shows that at the end of the period, the company has an institutional shareholder, Wuhan Contemporary High-tech Venture Capital Management Co., Ltd.-Hubei Contemporary High-tech Venture Capital Fund Partnership (Limited Company).

The association has three shareholders, namely Wuhan Contemporary Technology Industry Group Co., Ltd. and Hubei High-techNew industry(300832,Consultation unit) Investment Group Co., Ltd. and Wuhan Contemporary High-tech Venture Capital Management Co., Ltd. hold 81.7%, 16.34% and 1.96% of the shares, respectively.

Wuhan Contemporary Technology Industry Group Co., Ltd. is at the helm of Ai Luming, which is actually controlledThree special cable cars(002159,Consultation unit),Renfu Medicine(600079,Consultation unit) And other listed companies.

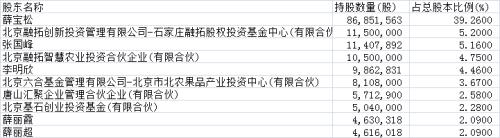

The 2019 Runnong Water Saving Annual Report shows that at the end of the period, the company had a total of 5 institutional investors, namely Beijing Rongtuo Innovation Investment Management Co., Ltd.-Shijiazhuang Rongtuo Equity Investment Fund Center (Limited Company), Beijing Rongtuo Smart Agricultural Investment Partnership Enterprise (Limited Company), Beijing Liuhe Fund Management Co., Ltd.-Beijing Beinong Fruit Industry Investment Center (Limited Company), Tangshan Convergence Enterprise Management Partnership (Limited Company), Beijing Keystone Venture Capital Fund (Company Limited).

Among them, Beijing Rongtuo Smart Agriculture Investment Partnership (Limited Company) has 4 shareholders, namelyDabeinong(002385,Consultation unit),Jin Zhengda(002470,Consultation unit),Plec(603566,Consultation unit) And Rongtuo Innovation Investment.

Beijing’s majority shareholder Keystone Venture Capital Fund (Limited Company) is a publicly traded company.Beijing investment development(600683,Consultation unit), The participation ratio is 43.08%.

Longtai Household’s 2019 annual report shows that at the end of the period, the company had two institutional investors, namely Suzhou Changxiang Phase II Equity Investment Partnership (Limited Company) and Ningbo Junrun Henghui Equity Investment Partnership (Limited Company).

In addition to investing in stocks through venture capital, some A-share companies also own shares directly in “quasi-select” companies.

The new flagship three-board company Bettray is focused on research and development of positive and negative electrode materials for lithium batteries, especially in the global market share of negative electrode materials.

In late 2019, China Baokong,China Baoan(000009,Consultation unit) It owns 48.5% and 26.98% of Bettray’s capital, respectively.

Among them, China Baoan is a company listed on the Shenzhen Stock Exchange, China Baokong is a holding subsidiary of China Baoan, meaning Bettray is a holding subsidiary of China Baoan.

Another “quasi-selection layer” company, Yingtai Biology, is a small and medium company.Winbond Health(002004,Consultation unit) As a holding subsidiary, at the end of 2019, Winbond Health had a 72.68% stake in Yingtai Biotechnology.