[ad_1]

Original title: The Most Complete Hairstyle! These GEM rules have changed: the increase or decrease has increased to 20%, the threshold for opening an account is 100,000 yuan, and the exclusion standard has been largely adjusted. “ST” is added

Reformed again, the GEM registration system reform was officially launched.

On April 27, at the same time that the SFC publicly solicited opinions on the GEM reform and the main rules of the pilot registration system system, the Shenzhen Stock Exchange publicly requested simultaneously on the issuance of GEM shares and the revision rules of listings. Opinions and rules further clarify the relevant rules of the GEM registration system system.

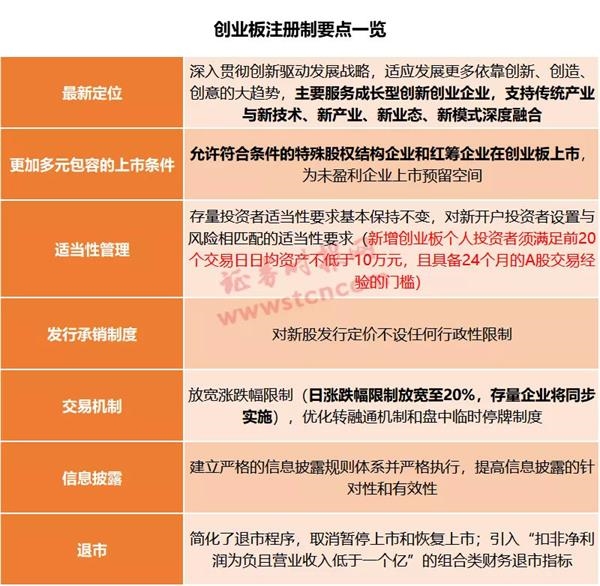

On the GEM registration system, the basic points are shown in the table below:

Let’s look at the specific points that the Securities Times reporter resolved based on the documents of the Shenzhen Stock Exchange.

How to implement the GEM registration system? 8 key points for “cool”

On April 27, the Shenzhen Stock Exchange issued and implemented a rule, and publicly solicited views on the eight main rules, which include the issuance of GEM and review of quotes, trading in securities and ongoing monitoring.

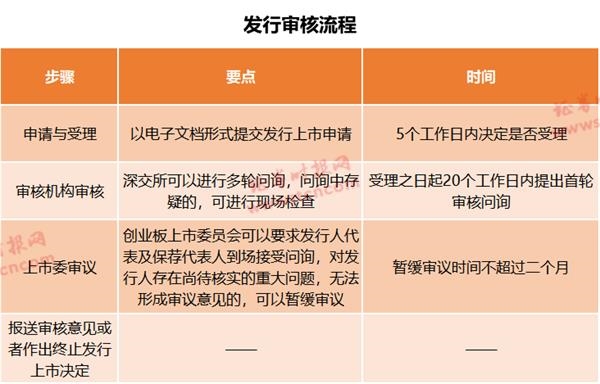

01. Emission audit: the audit time is up to 3 months.

In terms of issuance review, the GEM reform draws fully on the valuable experience of the science and technology board registration system and combines the existing audit practice and the experience of the GEM board to actively and consistently promote the GEM reform and the pilot registration system.

“Shenzhen Stock Exchange Issue and Listing Audit Rules (Draft for Request for Opinions)” (referred to as “Audit Standards”) clearly stipulates the content of the audit, methods, procedures, responsibilities parties and self-regulation, etc. Article 86, which includes general provisions, request and acceptance, review of the issuance and listing conditions, requirements and review of information disclosure, review procedures, suspension and termination of review, issues related to the review, management of self-discipline, etc. .

The main contents include:

One is to stipulate the content of the audit. The Shenzhen Stock Exchange checks whether the issuer complies with the issuance conditions, listing conditions and disclosure requirements. Based on paying attention to the issuance conditions and listing conditions, the Exchange focuses on whether the issuer’s disclosure of information complies with the true, accurate and complete requirements; whether it contains information that has a significant impact on investor investment decisions; issuance of documents and information on request for quotation If the content of disclosure is consistent; if the content disclosed in the issuance and listing request documents is concise and easy to understand.

The second is to clarify the audit methods, procedures, and deadlines. Conduct audits by asking questions and answering questions, urging issuers to disclose information truthfully, accurately and completely, and intermediaries to effectively fulfill the duty to verify disclosure of information. Clarify acceptance procedures, inquiries and responses, suspension and recall audits, listing committee review, record submission and other audit procedures, and clarify the entire audit process and time limit requirements for key nodes. The longest time for issuance and listing review is 3 months, and issuers and intermediaries cannot respond more than 3 months.

The third is to strengthen self-discipline supervision of violations. To clarify that the issuer is determined to be a false statement or to seriously interfere with the audit work of the exchange, the Shenzhen Stock Exchange may impose disciplinary sanctions that do not accept the issuance of listing request documents within 1 year at 5 years; Implement disciplinary measures that do not accept the issuance of listing request documents and information disclosure documents within 3 months to 3 years.

02. Refinancing: the time limit for the audit is reduced to 2 months

The “Review Rules for Listing and Issuance of GEM Listed Companies” stipulate the content, methods, procedures, responsibilities of all parties, and self-discipline oversight of the refinance review. The main design of the system is basically the same as that of the IPO. , Stipulating mainly the following aspects:

One is to clarify the key points of concern in the audit. The Shenzhen Stock Exchange mainly reviews the issuance conditions, listing conditions and disclosure compliance, focusing on whether intermediaries are legal and comply with opinions, whether the reasons and basis for relevant opinions are sufficient and whether the disclosure of information from publicly traded companies is true, accurate and complete. If you meet the relevant disclosure requirements.

The second is to compress the audit time limit and the links. The refinance review is basically the same as the initial review process, but the review time limit is reduced to 2 months, and the time to issue the first round of inquiries is shortened to 15 business days. Issuance of securities to specific objects need not be submitted to the listing committee for consideration.

The third is to optimize the system that applies simple procedures to issue shares for specific objectives. For small-scale qualified quick refinance, a simple review procedure is established, and the Shenzhen Stock Exchange will accept the request within 2 business days, and submit the registration to the China Securities Regulatory Commission within 3 business days from the date of acceptance, and will supervise it later.

The fourth is to strengthen self-discipline supervision of violations. The Shenzhen Stock Exchange will increase oversight and strengthen accountability for charter violations, violations, obstruction of inspections, and interference with audits encountered during the refinancing review process. At the same time, to avoid abuse of summary procedures, violations that use summary procedures to issue actions to specific objects will be dealt with again.

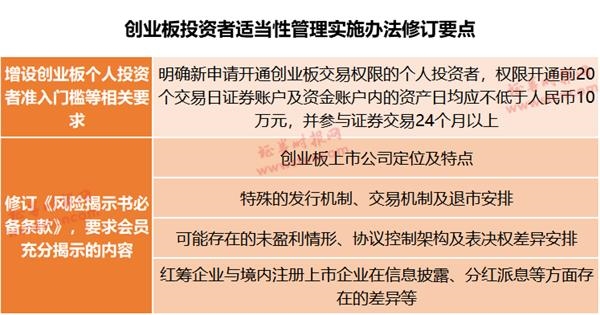

03. Proper investor management

In terms of investor suitability, the requirements for the suitability of stock investors remain basically unchanged. The main points of “Shenzhen Stock Exchange GEM Investor Suitability Management Implementation Measures (revised in 2020)” are as follows:

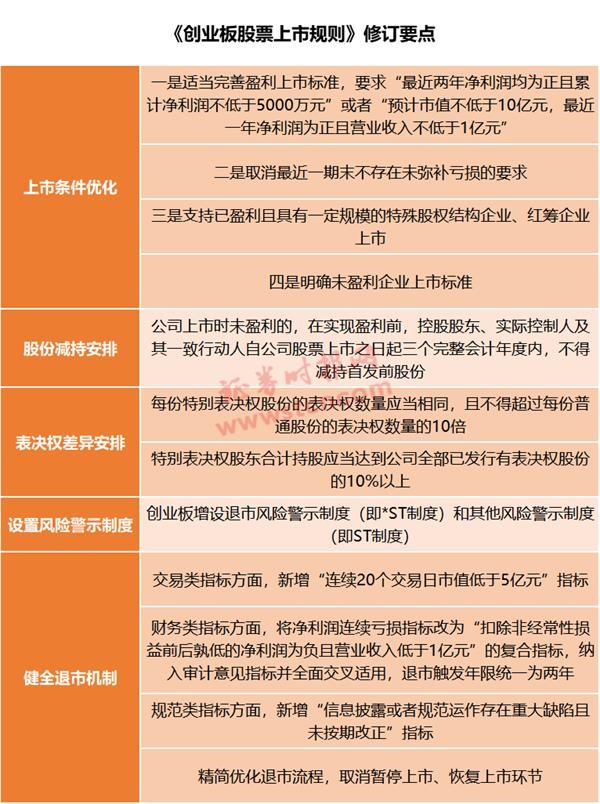

04. Important revision of the listing rules

The Shenzhen Stock Exchange stated that in order to implement the requirements of the new securities law and coordinate with the reform of the GEM and the pilot registration system, the Shenzhen Stock Exchange revised the “GEM Listing Rules” (hereinafter, the “Listing Rules”).

“Rule List” is a basic business rule for GEM’s ongoing oversight, and provides a strong institutional guarantee for GEM’s stable operation and healthy development. This review adheres to the principle of highlighting key points, problem orientation, and taking inventory into account: First, adapt to the needs of the reform. This review promotes and improves various systems such as listing, listing exclusion, information disclosure, corporate governance, mergers and acquisitions, capital incentives, etc., in accordance with the general requirements of the GEM reform and the pilot registration system, and clarifies the regulatory requirements for companies with special capital structures and world-class companies. To strengthen industry disclosure requirements, operational risks and fluctuations in performance of innovative entrepreneurship and unprofitable companies, and to improve the relevance and effectiveness of disclosure. The second is to seamlessly link the new securities law. The new securities law optimizes basic systems such as the issuance, listing, disclosure of information and exclusion from the list. This review comprehensively classifies and adjusts provisions that are inconsistent with the new securities law to ensure a smooth connection with the new securities law. The third is comprehensive optimization. In combination with GEM regulatory practice, the specific clause and chapter system was systematically revised, and clauses that were too specific and detailed were integrated to improve the simplicity of the rules.

The following are the main points of the reporter’s review of the “Listing Rules”:

05. Special trade regulations

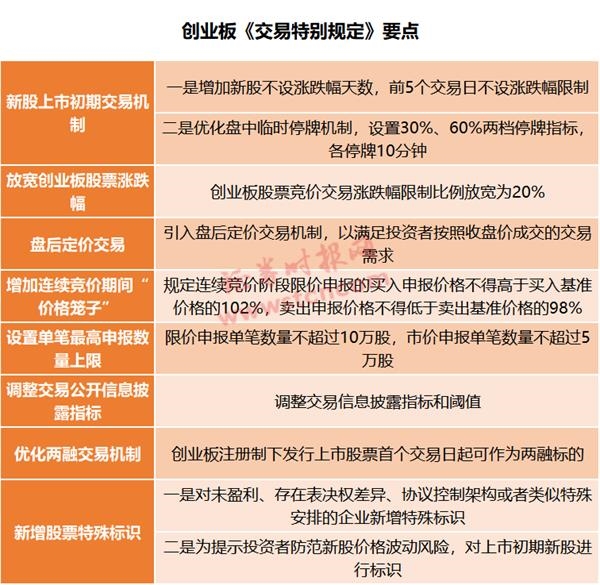

The Shenzhen Stock Exchange stated that the “Special GEM Stock Trading Provisions of the Shenzhen Stock Exchange (Consultation Draft)” (hereinafter the “Special Trading Rules”) has a total of six chapters and 32 articles , which include general rules, auction transactions, after-hours pricing transactions, and disclosure of transactions Information, other transaction matters, and supplemental provisions.

The following are the main points of the “Special Transactions Regulation” resolved by the reporter:

06. About the “GEM Listing Committee”

The Shenzhen Stock Exchange stated that the establishment of the GEM Listing Committee (hereinafter, the “Listing Committee”) will be in charge of verifying the issuance and listing of GEM securities.

In accordance with the “Administrative Measures of the Shenzhen Stock Exchange GEM Listing Committee” (draft for soliciting opinions), the listing committee members are mainly composed of experts outside the Shenzhen Stock Exchange and relevant professionals from the Shenzhen Stock Exchange, and are named by the Shenzhen Stock Exchange; the listing committee shall not exceed 60 committee members.

07. About the “Database of experts in industrial consulting”

The Shenzhen Stock Exchange stated that in order to accurately understand the industry characteristics of companies in the GEM listing and issuance work and improve the quality of business information disclosure, the Stock Exchange established an expert database, which is linked to new technologies,New industry, The new formats, the new models are closely related to authorized experts, well-known entrepreneurs and senior investment experts in industries closely related to the issue of disclosure of information related to the issuer’s business and technology, and whether the issuer and Reorganized listing target assets meet GEM requirements, etc. Provide professional consultation on issues and provide policy suggestions for relevant Institute work.

According to “Shenzhen Stock Exchange Consulting Industry Expert Database Working Rules” (draft for requesting opinions), the expert database consists ofNew industryIt is comprised of licensed experts, recognized entrepreneurs, and senior investment experts in industries closely related to the new format and new model, and can set up different consulting groups depending on the industry. All experts are part time.

08, on refinancing

If the listed shares issued under the GEM registration system can be used as two financing targets from the first day of trading, the agreed market-based declaration method will be launched to loan the securities from the securities company the same day that investors can sell securities, allowing strategic and offline investors Investors lend assigned shares.

How will the GEM registration system affect the market? Experts see it this way!

Professor Tian Lihui, dean of Nankai University Financial Development Research Institute, told the Securities Times reporter that the reform of the GEM registration system is a plan and a systematic reform, not a simple change from the approval system to the registration system. Through this reform, we can better serve the real economy, better invest in value, and better optimize the allocation of capital resources.

Senior investment banker Wang Jiyue believes that there are two central issues in GEM reform:

First, it is different from the science and technology board, it is a new incremental market reform. The GEM is a reform of the stock market. There are existing companies and investors, making it a key part of the comprehensive deepening of capital market reform.

The pilot registration system will be promoted throughout the market, and a market must first be tested. If GEM reform goes smoothly, market-wide registration system reform can be accelerated. The experience and lessons of the Board of Science and Technology registration system reform will be borrowed from the GEM, and the lessons learned from the GEM reform will also be learned from comprehensive reform in the future.

Second is the question of how to divide competition between various sectors.

April 27 is the day the selected New Third Board layer begins to receive materials. How can the GEM, the Science and Technology Board, and the New Third Board moderately displace the competition? The ideal state is that they overlap and compete with each other, but also have their own characteristics and focus, so that issuers, investors and intermediaries can choose according to their needs. It is the driving force for the development of the entire market that the comparison between the different sectors and learn to help.

Sun Jinju, assistant president and director of the Open Source Securities Institute, believes that the GEM registration system will help the market survive the fittest, the value of the shell will further weaken, and leading companies will stand out. Furthermore, GEM’s ability to serve “two new and six new” companies has been further strengthened, and technology leaders benefiting from improved financing capabilities will strengthen the strong. Third, companies with listed and derivative companies are expected to further revalue their businesses as the listing channels go further.

(Source: Securities Times Network)

(Editor in charge: DF380)

Solemnly declare: The purpose of this information posted by Dongfang Fortune.com is to spread more information, which has nothing to do with this booth.

[ad_2]