[ad_1]

Original title: The first wave of “baby boomers” will retire after 2 years. Experts suggest delaying retirement “step by step”

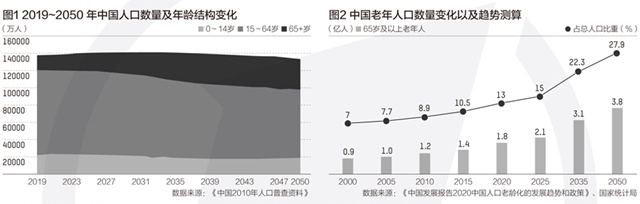

After the first wave of baby boomers reaches the 60-year threshold, the peak of retirement will begin in China. By then, tens of millions of retirees will pose a major challenge to the financial balance of China’s pension insurance fund.

Although China’s enterprise employee pension insurance fund has a cumulative balance of 4.5 trillion yuan, due to the inequality of misery and happiness between regions, it is difficult to adjust the situation. For the third quarter of this year, the central government’s special subsidy for local pension insurance has reached 5,800. More than 100 million yuan will be used to distribute pensions in the central and western regions and in the former industrial bases.

According to Yang Yansui, director of the Tsinghua University Employment and Social Security Research Center, the aging calendar does not allow the delay of retirement policy to be delayed again and again, and the specific plan and timetable for delay retirement should be introduced as soon as possible to cope with the start of 2023. Peak retirement.

Yang Yansui believes that retirement policy should adapt to the new normal, and a gradual “step-by-step” approach is a more appropriate option. Delaying retirement is not only a parametric reform of the pension insurance system, but more importantly, it is to establish a mechanism for receiving pensions that adapts to the longevity age and allows everyone to decide when to work “decreasing early and rising late. “

The forces of aging to delay retirement and accelerate

China Business News:He has been calling for reforms to the pension insurance system since 2012 and for an increase in the legal retirement age. What are your considerations?

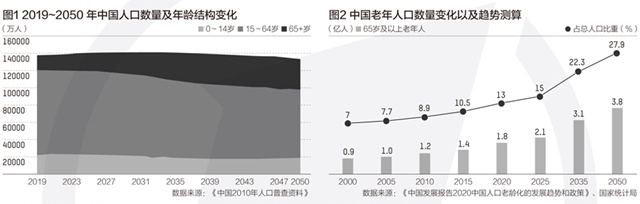

Yang Yansui:Every five years the age of the population increases, the entire economy, society and the labor market will undergo a qualitative change in stages. The aging calendar has already determined that we must reform the retirement age. 1963 was the peak year for the birth of the Chinese population. That year more than 29 million people were born. In the next ten years, the annual number of births exceeded 25 million. By the end of 2022, men born in 1963 will be 60 years old and retiring in large numbers, and the support burden of pension insurance will continue to increase.

Retirement has a two-way impact on the pension insurance fund. The payment will stop today and the payment will start tomorrow. Therefore, the substantial increase in the number of retirees will definitely increase the pressure on the income and expenses of the pension insurance fund. This impact is immediate from.

Under the impact of aging, the financial situation of China’s pension insurance fund is not optimistic. Judging from the 2020 Central Adjustment Fund budget, only 7 provinces are net contributing provinces, 21 provinces including Hunan and Anhui, and the Xinjiang Production and Construction Corps are net beneficiaries.

Therefore, it can be seen that it is urgent to increase the legal retirement age. Now until the end of 2022 is a very severe window period. The government should introduce a comprehensive pension insurance reform package that includes raising the statutory pension age as soon as possible to protect China Sustainable development of the pension insurance system.

China Business News:The gradual delay in retirement is the main direction of the current reform, and the relevant departments have also presented a plan to “extend one year every three years” a few years ago. In your opinion, can a plan like this small step and slow walk adapt to the current situation?

Yang Yansui:Although the relevant departments have not announced a complete postponement of the retirement plan, they have successively revealed some reforms in recent years. In general, the direction of incremental reforms will not change, but I think the speed will not be as slow. If it’s too late to take small steps like the original, it’s time to adopt a gradual “brisk walk”. Because the retirement age for women is relatively early, women can delay their retirement first, or both men and women can postpone it at the same time, but women fall behind a bit faster than men. After all, most jobs are not hard work now and the working conditions for men and women are not much different.

The pension he receives “decreases early and increases late”

China Business News:What you have been stressing about is raising the retirement age rather than raising the legal retirement age. Is there a difference?

Yang Yansui:Retirement is withdrawal from the job market. In the past, they were all state-owned companies, not all of them had another place to work when they retired from their work units, so they had to receive pensions to make ends meet. But now the job market has undergone fundamental changes. Older people can do a lot of work. Therefore, the concept of retirement should be forgotten and pay attention to the standard of retirement age. The state has established an “early decrease and late increase” mechanism to allow people to make their own decisions.

The age of longevity also requires that we separate the retirement age and the age to receive pensions. The so-called legal retirement age in developed countries is actually the age for receiving pensions. As for whether to withdraw from the labor market or continue working before receiving pensions, it is a personal opinion. It depends on your own situation.

What I am advocating is “decreasing early and increasing late,” that is, setting a standard age for receiving pensions, discount payments for those under this age and rewards for those over this age. This encourages those who choose to postpone retirement.

Furthermore, our country now has the conditions to “decrease early and increase late.” The national average pension level has reached 3,500 yuan. For example, you can receive 3000 yuan or 2500 yuan for early retirement, which will not cause poverty, while late retirement may be fine. Get more.Common peopleYou will figure out for yourself how to organize your retirement time so that it is profitable, so that everyone can decide when to do it.

Delaying retirement is not a simple reform of parameters but a reform of the system, we must establish a new retirement mechanism that adapts to the era of longevity.

The healthcare industry can attract tens of millions of older workers

China Business News:The main concern of the government when implementing deferred retirement should be the fear of affecting employment. On the one hand, it is concerned about reducing the jobs of young people and, on the other hand, it is also concerned about the unemployment of these older people after the delay. Do you have any suggestions on this?

Yang Yansui:It is a misunderstanding that delayed retirement affects youth employment, especially after the current intelligence and the rise of the internet, many traditional jobs are gone. Young people are jobs for young people and older people are jobs for older people There are very few crossings and the displacement effect is not obvious.

At the same time, the demand for aging has led to an increase in jobs in the healthcare industry and the talent gap is more than ten million. The higher the life expectancy of the population, the more they spend on health care and the greater their contribution to GDP. The jobs in these industries are very rich. For example, the health care industry needs tens of millions of medical social workers and health administrators. More importantly, the healthcare industry primarily needs older people, especially older women, who can become an important employment area for women after retirement.

It should also be noted that delaying retirement is a public policy issue that cannot be adapted by individuals themselves. A number of issues such as employment services, transfer training, social security, social status and business employment for the elderly must be guaranteed by the government through a set of policies and measures.

Massive information, accurate interpretation, all in the Sina Finance APP

Editor in Charge: Yang Yalong