[ad_1]

For stocks, see Golden Unicorn’s authoritative, professional, timely, and comprehensive analyst research report to help you seize potential thematic opportunities.

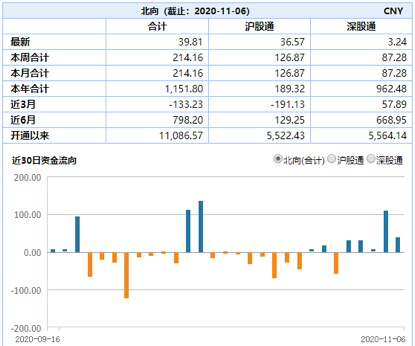

Northbound funds increased more than 21 billion yuan this week, these 10 stocks are the most popular

Hu Yu

After rising for several consecutive trading days, the bullish pace for A shares slowed on November 6, the three major stock indices collectively fell, and more than 2,800 individual stocks across the market fell.

Northbound funds have maintained a net inflow for the near future. This week’s cumulative net purchases surpassed 21 billion yuan, and it is obvious that they have increased their positions in pro-cyclical sectors such as steel, petrochemicals, brokerage and banks.

Based on the overall market performance, home appliances and automobiles made the biggest gains this week. In the opinion of brokerages, with the gradual elimination of the related disruptive factors in November, the market trading volume is expected to gradually recover and medium and long-term foreign capital inflows will remain ample. In terms of industry configuration, it is recommended to focus on the four main lines of infrastructure, finance and military industry.

A-shares welcome a good start in November

Northbound funds are looking for the bottom line

On November 6, the three major indices were unable to continue their bullish momentum from the beginning of the month, and the market lost 3,300 points several times and rebounded. At the close, the Shanghai Composite Index fell 0.24% to 3.32.16 points; the Shenzhen Component Index fell 0.40% to 13,838.42 points; the ChiNext Index adjusted significantly, closing 1.97% lower at 2,733.07 points.

Image source: wind

Although the market closed on Friday, from the perspective of the broader market this week (Nov 2-6), Nov A shares will be off to a good start again. At the close of Nov. 6, the Shanghai Composite Index and the Shenzhen Component Index closed up 2.72% and 4.55% respectively for the entire week, both establishing the highest weekly gains since August; the GEM index rose 2.91% during the week.

Image source: wind

Today, the three major indices collectively corrected and more than 2,800 individual stocks on the market fell. However, the movement of “smart money” funds to the north not only did not escape, but took advantage of the market slump to accelerate the grip.

Wind data shows that on the 6th, a total of 3.98 billion yuan of net purchases of funds northbound during the day, of which Shanghai Stock Connect finances net purchases of 3.658 million yuan, and Shenzhen Stock Connect finances net purchases of 324 million yuan. This week, the total net purchase of funds northbound was 21.416 billion yuan, marking a new single-week record of net purchases in the past five months.

Image source: wind

Which stocks attracted the most attention from northbound funds this week?

According to Wind data, this week (data updated to November 5) the largest increase in funds heading north isBaosteel, Cumulatively increased its holding of 96,283,700 shares,BOE AThe increase in holdings with 90,025,400 shares followed closely; the increase in the number of shares also includesSinopec、China Sea Securities、Tongling Nonferrous、Communications BankWait. From an industry perspective, most of the stocks with significant increases in positions belong to the procyclical sector, encompassing petrochemicals, oil, brokerages, banks, non-ferrous metals, etc.

Image source: wind

In terms of share price performance, Baosteel shares rose 15.92% this week, a weekly increase that is rare in recent years. BOE A rose 10.78% this week, Guohai Securities,Merchant Bank of China, Tongling Nonferrous Metals was also up more than 5% this week.

Northeast ValuesIt is noted that in terms of risk appetite, although market sentiment has declined slightly recently, the core logic of the market has not changed. The system of record continues to move towards the equity sector and the overall return on assets is falling. The long-term logic continues. Foreign investment, national institutions and resident deposits, etc. Long-term capital inflows into the market are ongoing.

Appliances and cars fly together

From an industrial sectors perspective, wind data shows that among the top 28 industries in Shenwan this week, the home appliance sector outperformed automobiles with a 12.86% increase, becoming the market leader this week. . Among the constituent actions,Hanyu GroupIt increased by 26.01% throughout the week,Konka deep A、Haier Zhijia、Midea Group、Boss ElectricWeekly earnings also exceeded 15%, the highest earnings, andGree Electric、Xiuqiang Stock(Protection of rights),Xinbao StockWait.

Image source: wind

The automotive sector ranked second with an increase of 10.17% this week. From the perspective of individual populations,King Long carA total increase of 32.98% throughout the week and a weekly increase of more than 20%Junda shares、Wencan Stock、Xingyu ActionsWait.

Image source: wind

Additionally, the non-ferrous metals, steel, mining and non-bank finance sectors were among the main beneficiaries this week. Similar to the capital-intensive surge style to the north, these sectors also belong to the pro-cyclical field.

For the household appliances sector,Tianfeng ValuesIt is noted that the general industry recovery trend in the third quarter is obvious and under the huge changes in the general environment, there is a high probability that new industry opportunities will emerge.

From an individual inventory perspective, it is recommended to pay attention to the recovery in demand caused by the post-completion cycle and the low base effect; From the perspective of the absolute growth rate, the small household appliances sector is still the most prosperous sub-industry; this time the category of clean appliances of the double eleven. The pre-sale situation is good and demand abroad expands sweepingrobotThe current boom in the industry is on the rise, and relevant stocks are encouraged to pay attention.

Regarding the auto sector, Huachuang Securities noted that the third quarter report disclosure has been completed and that many publicly traded auto companies have achieved performance growth above market expectations. This mainly reflects the unexpected recovery in auto industry sales and the elasticity of profit margins. The industry is expected to improve. It will last at least one year.

The market outlook suggests paying attention to the four main lines

Looking at the market outlook, what sectors and individual stocks have opportunities? What will happen to the pace of capital inflows north?

Yuekai Securities noted that recent market turmoil has made funds more cautious. Mainly due to the resurgence of the external epidemic and the slow performance of external drives and other factors, starting in November, with the gradual elimination of related shocks, the transaction volume is expected to gradually recover.

Chuancai Securities suggests that the market outlook can focus on four main lines: one is the infrastructure sector. The “new infrastructure” is expected to continue to maintain rapid growth in the fourth quarter. It is recommended to pay attention to the entire industrial chain of high-speed rail, new energy and communication equipment; the second is the financial sector. Because the overall valuation is low, performance is relatively stable. On the other hand, the reform of the capital market will promote the general development of the industry; the third is the military industry sector, the overall assessment of the sector is expected to increase; the fourth is procyclical and low valuation sectors such as coal and steel. Sector performance is good and the increase is small As the end of the year approaches, the risk appetite for funds diminishes and the undervalued sector is expected to benefit.

Sina Statement: This news is a reprint of Sina Cooperative Media Posting this article on Sina.com for the purpose of conveying more information does not mean that I agree with their views or confirm their description. The content of the article is for reference only and does not constitute investment advice. Investors trade accordingly at their own risk.

Massive information, accurate interpretation, all in the Sina Finance APP

Editor in charge: Chen Zhijie