[ad_1]

Summary

[¡Demandar a la primera victoria de Xiaomi del Departamento de Defensa de EE. UU.! El tribunal estadounidense prohíbe a la empresa ser incluida en la “lista negra”]On January 14 of this year, on the eve of the departure of former US President Trump, nine Chinese companies, including Xiaomi Group, were included in the so-called “military list.” -related blacklist. “Subsequently, Xiaomi sued the United States Department of Defense and the Treasury Department in the District Court of Colombia, demanding that the aforementioned” black blockade “decision be reversed. On March 13, according to CCTV News, a US federal judge issued a preliminary injunction against the prosecution of Xiaomi by the US Department of Defense, prohibiting the US Department of Defense from including Xiaomi as a policy of the call. “Chinese military-related enterprise” to take effect or implement. (Daily Economic News)

On January 14 of this year, on the eve of the departure of former US President Trump, nine Chinese companies, including Xiaomi Group, were included in the so-called “military blacklist.” Xiaomi later sued the United States Department of Defense and the Treasury Department in the District of Columbia Court, demanding that the aforementioned “black blockade” decision be reversed.

On March 13, according to CCTV News, a United States federal judgethe companyThe US Department of Defense prosecution issued a preliminary injunction prohibiting the US Department of Defense from listing Xiaomi as an alleged “relevant to the Chinese military.”business“Effectiveness or implementation of the policy.

Xiaomi responds: I feel relieved

CCTV News reported that Rudolph Contreras, a judge for the US District Court for the District of Columbia, believed that the US Department of Defense move was “arbitrary and erratic” and deprived the company of your legitimate legal rights. He also said that as the lawsuit develops, Xiaomi is likely to obtain a full reversal of the injunction and issue a preliminary injunction to prevent the company from suffering “irreparable harm.”

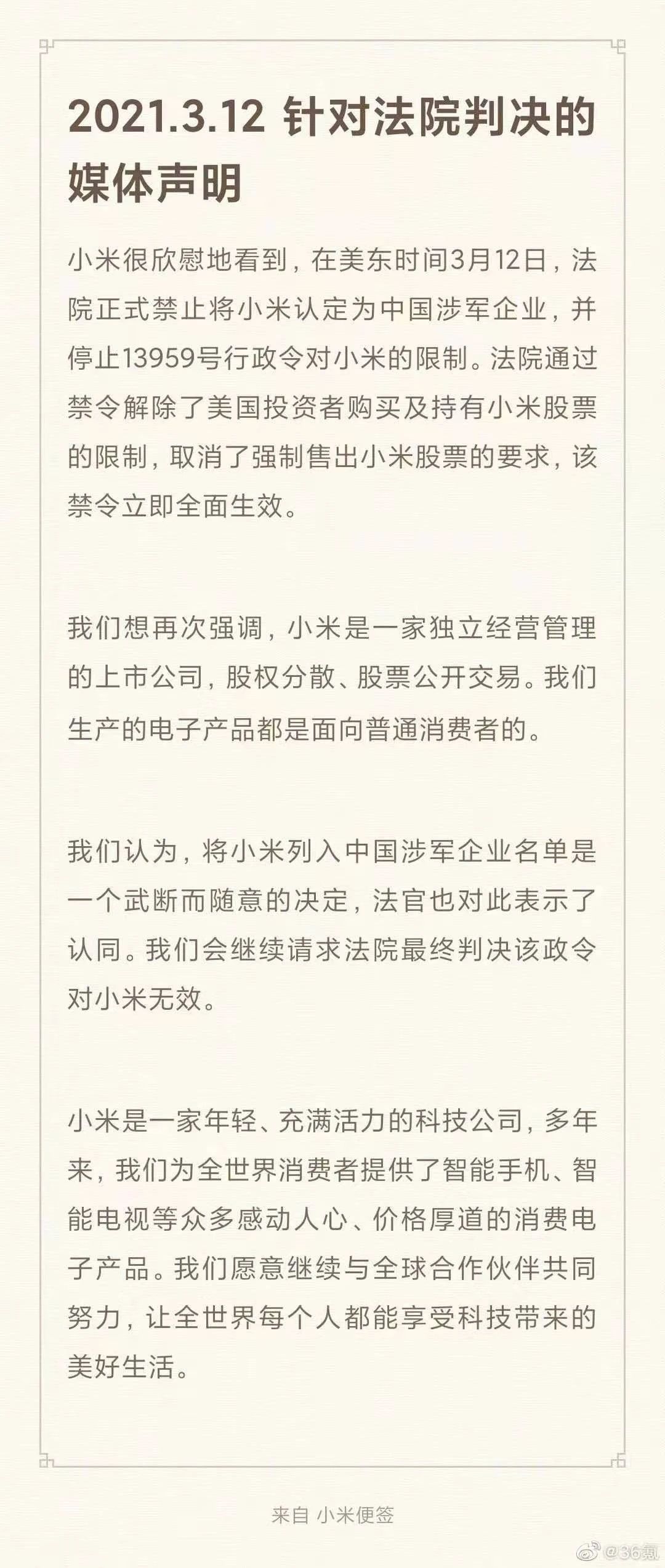

On the morning of March 13, Xiaomi Group responded that it was pleased and would continue to ask the court to finally rule that the decree was invalid, emphasizing that Xiaomi is a publicly traded company that manages and manages electronic products in a manner Independent.productOrdinaryconsumptionOf the person.

On January 14 of this year, under the leadership of the Trump administration, the Ministry of National Defense included 9 Chinese companies, including Xiaomi, on the blacklist of the so-called “relevant to the Chinese military.”investmentThe ban requires US investors to sell their shares in “blacklisted” companies before the deadline.

In late January, Xiaomi sued the US Department of Defense and the US Treasury in the US District Court for the District of Columbia. Xiaomi believes that in the decision of To include the company as a “Chinese military company” recognized by the NDAA, there was procedural injustice and factual misidentification in the decision of the two previous organizations to protect users, partners, employees andshareholderThe interest of the court requires the court to declare the decision illegal and reverse it.

At the close of Hong Kong shares on March 12, Xiaomi’s share price closed at 22.75Hong Kong dollar/ Share, totalMarket valueIt is 573.3 billion Hong Kong dollars (approximately 73.8 billion US dollars).

The spokesman for the Chinese Foreign Ministry said on many occasions that the United States has expanded the concept of national security, abused national power and ruthlessly repressed.High-tech chinaTech companies, serious breachesmarketPrinciples of economy and fair competition. Facts have repeatedly shown that the United States is an unreliable and credible country. This approach not only harms the legitimate rights and interests of Chinese companies, but also harms the interests of companies in the United States and other countries. It will seriously interfere with normal scientific and technological exchanges and trade exchanges between the two countries and even the world.industrychain,supply chainCause damage. The United States should immediately stop its unreasonable crackdown on Chinese companies, treat Chinese companies fairly, fairly, and non-discriminatory, and do more to facilitate Sino-US science and technology exchanges and economic and trade cooperation.

MSCI: Xiaomi B shares will not be removed at this time

After the US Department of Defense blacklisted Xiaomi, Xiaomi’s share price fell more than 10% that day. Subsequently, the share price continued to weaken. As of March 12, Xiaomi’s share price has fallen more than 20%.

Subsequently, the two main index compilersMing shengThe company (MSCI) and Russell Corporation have announced that Xiaomi will be removed from their index.

FTSE Russell said on March 5 that, in accordance with a previous US Presidential Executive Order, Xiaomi will be removed from the FTSE Global Total Index (FTSE Global Market Value Index) and the FTSE Global A-Share Index Series as of March 12 (FTSE Global China). An inclusion index is excluded).

Additionally, S&P Global Ratings also announced on its official website that it will remove Xiaomi and other companies from the S&P Dow Jones indices before the market opens on March 15.

To boost investor confidence, on March 11, Xiaomi’s board of directors decided to exerciseRepurchaseAuthorization, With a maximum total of HK $ 10 billion at irregular intervalsOpen marketRepurchaseShare Previously, on June 23, 2020, XiaomiGeneral meeting of shareholdersGive the board of directors a general mandate to buy back no more than 10% of the total shares. If calculated at the last closing price, the number of shares corresponding to the upper limit of the repurchase amount is 1.8% of the total shares of the company,Circulation2.2% of the shares. According to the relevant rules, the company can only execute the buyback after its annual report is released on March 24.

The Xiaomi Group board of directors believes that the buyback of shares in current market conditions can demonstrate that the company is confident in its own business prospects and prospects, and will ultimately benefit the company and create value for shareholders.

According to the data, Xiaomi Group’s share price has fallen from around HK $ 35 / share at the beginning of the year to HK $ 22.75 / share today, down 31.48%, and the value market share has dropped by about $ 300. one billion Hong Kong dollars.

As the Xiaomi “shut down” incident ushered in a turning point, on March 13, MSCI stated that it will not currently use the MSCI ACWI or MSCI China All-Share Index and unrelatedWeighted market capitalization indexOr remove Xiaomi B shares from the custom index. Will continue to pay attention to Xiaomi’s follow-up development.

For the Xiaomi Group to be “blocked”,CITIC valuesPublishedInvestigation reportthink,China MobilePreviously Listed Relevant by US Department of Defense June 2020Case study, There is a certainborrowIn view of the importance, if Xiaomi is still eliminated by the relevant index in the end, it may experience shocks in the short-term trading level, but the company’s share price will gradually return to fundamentals after the shock ends.

(Source: Daily Economic News)

(Editor in charge: DF142)

I solemnly declare: The purpose of this information is to spread more information, and it has nothing to do with this booth.

[ad_2]