[ad_1]

Source: FX168

Original title: Gold bulls is hit! Pelosi admits pre-election stimulus plan may not pass Gold priceIt just collapsed around 1910

FX168 Financial News (Hong Kong) reported on Thursday (Oct 22) in Asian markets, the US dollar index rebounded and is now around 92.80; Spot gold fell rapidly in the short term, once close to 1910 US dollars per ounce. The rally in the dollar put pressure on gold prices. Also, the US fiscal stimulus package has been delayed. The Speaker of the US House of Representatives, Pelosi, believes that he may not be able to pass the stimulus package before the US presidential election. This statement disappointed the gold bulls.

On October 21 local time, the Speaker of the United States House of Representatives, Pelosi, said that it is possible to reach an agreement with the Secretary of the Treasury, Mnuchin, on a stimulus plan to face the impact of the new crown epidemic, but both houses of Congress may not pass the deal before November 3.

Following the latest round of talks between Pelosi and Mnuchin, White House Chief of Staff Meadows said Wednesday that “progress has been made in the last 24 hours” and that the goal is “to reach some kind of agreement. in the next 48 hours. ” Mnuchin reportedly proposed a blanket stimulus package of US $ 1.88 trillion, while Pelosi insisted on the US $ 2.2 trillion scale.

Pelosi said a deal needs to be negotiated with the Trump administration before the end of this week, so that the bill will pass next week before Election Day on Nov.3.

Meadows said the two sides still have multi-million dollar differences. The main difference between the two parties is that the Democratic Party hopes to provide assistance to state and local governments, especially the blue states where the epidemic is most severe; tax increases for businesses and tax cuts for the poor are around $ 246 billion. Both points were strongly rejected by the Republicans.

The two sides spent several months trying to reach an agreement to pass the latest batch of aid bills to alleviate the epidemic before the elections. Although the two sides have narrowed the scope of the blanket bailout offer: the White House increased its offer to nearly $ 1.9 trillion, but it is still less than the $ 2.2 trillion approved by the House of Representatives in early October. .

US President Trump stated that he believes that House Speaker Pelosi and Senate Democratic Leader Schumer “will not be willing to do anything right in the stimulus plan for our great American workers. , or for our great America itself. “

The Trump administration and Democratic Party leaders are scrambling to reach a new round of stimulus plan for the new crown epidemic ahead of the November 3 presidential election.

Market expectations for a stimulus plan ahead of the general election have fallen dramatically. The US stock market went from rising to falling after Pelosi’s speech; US stock index futures continued to weaken on Thursday, and S&P 500 stock index futures fell almost 0.9% by one point, a two-week low. .

Gold prices face the risk of further decline

Previously, because investors were optimistic that the United States would announce the new corona virus assistance program ahead of the November 3 presidential election, the price of gold rose nearly 1% on Wednesday, reaching a high. intraday for more than a week. Spot gold closed at 1923.35 US dollars / ounce, an increase of 16.95 US dollars or 0.89%, the intraday high of 1931.01 US dollars / ounce.

US. Michael Matousek, Chief Operating Officer at Global Investors, said: “The original deadline given by Pelosi was Tuesday. It has now been postponed to Friday. Knowing this, people think that the deal may be concluded in the near future, so that began to accumulate gold. “

However, after Pelosi declared that the stimulus package might not be approved before the election, the US dollar rallied and gold fell sharply from its peak.

The dollar index fell for the third day in a row, closing at 92.64, down 0.49%, the lowest intraday hitting 92.47, the lowest level since at least September 2. The US dollar index rebounded to around 92.80 in Asia on Thursday.

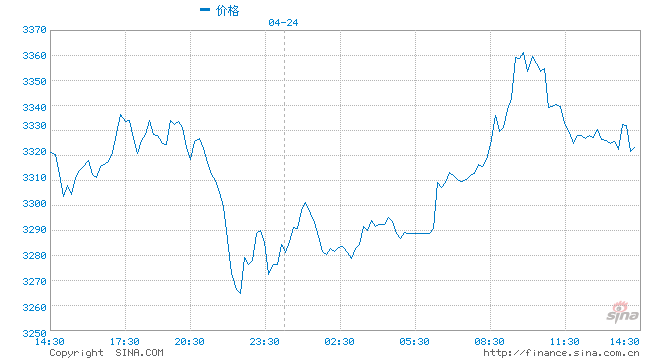

In the Asian market on Thursday, spot gold fell sharply in the short term, hitting a low of $ 1,910.56 an ounce.

Analysts noted that if the US elections fail to agree on a stimulus plan, gold prices may face the risk of a further decline. And if the US stimulus bill passes before the election, gold prices are expected to rise further.

Well-known financial website Economies.com wrote on Thursday that the price of gold was close to its long-awaited target price of $ 1,934.86 per ounce on Wednesday, but this level was strong resistance and the price of gold fell back. Investors they must be attentive to future operations.

Economies.com pointed out that if the price of gold remains below the level of US $ 1,934.86 an ounce, this will put pressure on the price of gold and it will go down. The first objective is US $ 1,901.80 an ounce. On the other hand, once the US $ 1,934.86 per ounce is captured, the price of gold will continue its upward trend and will reach the first upward target of US $ 1957.00 per ounce, with a higher target of US $ 1967.90 per ounce.

Yousef Abbasi, StoneX Global Market Strategist, said: “The market seems to be concerned about pre-election stimulus negotiations, which may have no way out. Republican senators have vetoed any proposal larger than their small-scale agreement, and all indications are that, The hope of stimulating the economy before the elections is still very little. “

The Washington Post quoted two people familiar with the matter as reporting that Senate Majority Leader McConnell told colleagues Tuesday that he had warned the White House not to reach a full-scale stimulus deal before the elections of November 3.

McConnell hinted that House Speaker Pelosi did not sincerely negotiate with Treasury Secretary Mnuchin, and reaching an agreement may undermine the Senate’s plan to confirm Judge Barrett’s nomination next week.

Steve Dunn, director of publicly traded products at Aberdeen Standard Investments, said in a telephone interview with Kitco News that investors probably shouldn’t expect any major aid bill to be introduced before the November 3 US election.

Seekingalpha analyst Adam Hamilton noted: “Before the new round of stimulus laws is released, the trend in gold prices is basically determined by the dollar index.”

Kevin Grady, president of Phoenix Futures and Options, said that gold price trends are directly related to stimulus measures because gold is driven by inflation. He added that the more money the government prints, the more the dollar depreciates.

Gold is considered a hedging tool against inflation, currency devaluation, and uncertainty. This year it has risen more than 26%. This is mainly due to the unprecedented stimulus measures introduced globally to cushion the economy from the recession caused by the coronavirus. Shock.

According to Commerzbank, gold is paying close attention to the US economic stimulus negotiations, Brexit news and the increase in coronavirus cases.

Massive information, accurate interpretation, all in the Sina Finance APP

Editor-in-Chief: Tang Jing