[ad_1]

Original title: IPO of the Science and Technology Innovation Board | Oceanwide Union’s “Go To Test” Scientific Innovation Board, backed by renowned investment institutions such as Shenzhen Venture Capital

Shenzhen Fanhai Tonglian Precision Manufacturing Co., Ltd.the company(Company abbreviation: Fanhai Union)Science and Technology Innovation BoardThe IPO was accepted by the Shanghai Stock Exchange on December 31, 2020. Sponsor isGuojin ValuesCompany Limited by Shares.

Oceanwide Union is a precision parts professionalproductThe manufacturer and solution provider is focused on providing customers with high precision, high density, complex shape, good performance and exquisite appearance of metal powder injection molding (MetalInjectionMolding, referred to as “MIM”).

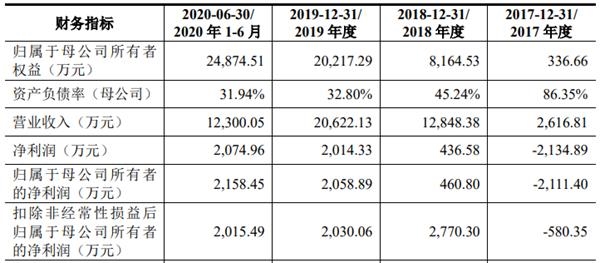

From 2017 to the first half of 2020, Oceanwide Union realizedOperating income26,168 million yuan, 128 million yuan, 206 million yuan, 123 million yuan; attributable to the owners of the parent companyNet profitThey are -21,114,400 yuan, 4.6080 million yuan, 20,588,900 yuan, and 21,584,500 yuan.

Image Source: Oceanwide Union Prospectus (draft application)

In accordance with the “Share listing and issuance review rules of the Shanghai Stock Exchange Science and Technology Innovation Board” and the “Stock listing rules of the Shanghai Stock Exchange Science and Technology Innovation Board Shanghai “and other relevant laws and regulations, the specific listing criteria selected by Oceanwide Union are as follows:” Estimated market value is not low inRMBOne billion yuan, the most recent yearNet profitIt is positive, and the operating income is not less than 100 million RMB. “

Based on the valuation level of comparable listed companies, Oceanwide UniLian expects a market value of not less than one billion yuan; operating income in 2019 will be 206 million yuan, and the company will be attributable to the parent company after deducting non-recurring profit and loss in 2019shareholderNetprofitIt is 20,300,600 yuan, which meets the requirement that the net profit in the most recent year is positive and the operating income is not less than 100 million yuan. Therefore, Oceanwide UniLian meets the requirements of the selected listing standards.

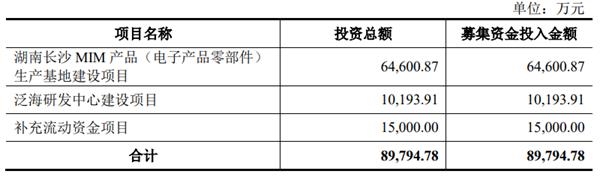

According to the fourth meeting of the first board of directors on September 28, 2020meetingAnd on October 14, 2020, the second storm in 2020General meeting of shareholdersAfter review and approval, Oceanwide Union plans to issue no more than 20 million RMB common shares (A shares). Net income is estimated to be 898 million yuan, which will be used to raise capital investment projects related to the company’s core business: Hunan Changsha MIM product production base construction project (electronic product parts ), ocean-wide R&D center construction project and liquidity supplement project.

Image Source: Oceanwide Union Prospectus (draft application)

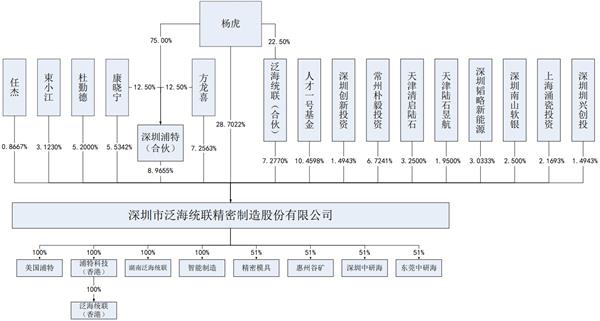

As of the signing date of the prospectus, the capital structure of Oceanwide Union is as follows:

Image Source: Oceanwide Union Prospectus (draft application)

Yang Hu directly owns 17,221,300 shares of the company, representing 28.70% of the company’s total share capital before the issue;camaraderie), Oceanwide Union (Association) indirectly controls 16.24% of the shares of the company and a total of 44.94% of the shares of Oceanwide Union. It is the majority shareholder of the company,Real controlFolks, the company is backed by reputable investment institutions like Shenzhen Venture Capital.

It should be noted that during the reporting period, Oceanwide UnionRelated transactionMany types of related transactions include acquisitionsProductAnd acceptService, Sales of goods, related leases,Related Warranty, Indirect related transactions and other types.

In addition, the Oceanwide Unigroup IPO also carries the following risks:

1. The risk of a high concentration of customers

Oceanwide Union and Foxconn,JabilTechnology, Keppel Communications, Kaisheng Group,Lead puzzle made、GoertekKnown in consumer electronicscompanyEstablished a cooperative relationship. During the reporting period, the company’s total sales to the top five customers accounted for 95.34%, 87.99%, 78.57%, and 75.15% of current operating income, respectively, and the concentration of customers was relatively high.

2. A relatively unique risk in the field of subsequent application of the product.

Today, the company’s main MIM products cover multiple categories, such as MIM products for handheld smart terminals, MIM products for smart handheld devices, and MIM products for aerial drones. They are mainly used in products such as tablets, drones, and smart wearable devices. They all belong to the field of consumer electronics and the field of application is relatively unique.

3. FoodproviderConcentration risk

During the reporting period, the mainRaw MaterialsFor food, it buys primarily from BASF, a world-renowned food manufacturer. During the reporting period, the company’s purchase of BASF raw materials accounted for the majority of the company’s MIM production use during the reporting period. same period.Purchase of raw materialsThe proportions of the total quantity were 80.62%, 47.00%, 54.36% and 62.88%, and the feed suppliers were relatively concentrated.

4. Risk of insolvency in accounts receivable

At the end of each reporting period, the company’s accounts receivable balances were 9,476,700 RMB, 53,077,100 RMB, 67,925,900 RMB, and 99,744,400 RMB. The distribution of accounts receivable to the company’s clients is relatively concentrated, the five main accounts receivable at the end of the reporting period represented 96.18%, 95.89%, 81.38% and 76.99% respectively.

(Source: Capital State)

(Editor-in-charge: younannan)

I solemnly declare: The purpose of this information is to spread more information, and it has nothing to do with this booth.

[ad_2]