[ad_1]

Original caption: Nayuki Tea and Taigai’s parent company rushed to get “the first serving of milk tea”, and still suffered losses in the first three quarters of last year.

Summary

[El té de Nai Xue y la empresa matriz de Tai Gai corrieron por la “primera porción de té con leche” y aún sufrieron pérdidas en los primeros tres trimestres del año pasado]On the eve of the Lunar New Year, Na Xue’s tea parent company Nai Xue shouted “a good cup of tea, a smooth European bag” slogan Xuedi Tea Holdings Co., Ltd. submitted a prospectus to the Stock Exchange from Hong Kong. “Taiwan” is another brand of milk tea under their umbrella. If successfully traded, China will usher in the “first serving of milk tea.” (China Business News)

On the eve of the Lunar New Year, Nai Xue’s tea mother who shouted the slogan “a good cup of tea, a soft European bag”the company——Naixue’s Tea Holdings Co., Ltd. (hereinafter “Naixue’s Tea Holdings”) submitted a prospectus to the Hong Kong Stock Exchange, and “Taiwan” is another milk tea under its umbrella.MarkIf successfully included, China will usher in the “first part of milk tea”.

In 2015, founders Zhao Lin and Peng Xin opened the first Naxue tea, and his wife continued to expand. As of September 30, 2020, the number reached 422, with mid-range and high-end teas.PositioningIt has an average price of 27 yuan per cup; After 2016, a relatively human-friendly table cover was born. The current average price is 16 yuan. As of February 5, 2021, the continentShare63 stores. In the first three quarters of 2020, Nayuki’s tea holding income was 2.115 billion yuan.Lost27.513 million yuan.

Prior to 2019, Naxue’s Tea Holdings completed Round A, Round A +, and Round B-1 Funding. In 2019, it began preparing for listing, and the capital also smelled the opportunity. In 2020, venture capital like SCGC Capital and Hongtu Innovation joined. When round C of funding is completed,marketThe valuation is close to US $ 2 billion, about 13 billion yuan.RMB。

The prospectus shows that the company intends to use the funds raised over the next three years to expand the network of tea shops and increaseMarket penetration; Go ahead with the digitization of general operations to improve operational efficiency by enhancing technical capabilities;supply chainAbility to withstand scale expansion; the remaining HKD will be used as working capital and forbusinessuse.

Behind a crazy store opening

In 2015, the first Naxue tea was established in Shenzhen, followed by rapid expansion. The number has increased from 44 as of December 31, 2017 to 422 as of September 30, 2020, including 420 in 61 cities in mainland China, Hong Kong, China and Japan each have one. As of February 5, 2021, it has increased further to 507.

Naxue tea is positioned as a freshly brewed medium to high-end tea. As of the first three quarters of 2020, each tea shop in Naxue has an average daily sales of 20,100 yuan, with an average of 465 daily orders per store. with each order The average selling price is 43.3 yuan. If you see drinks only, as of February 5, 2021,productThe average price is 27 yuan.

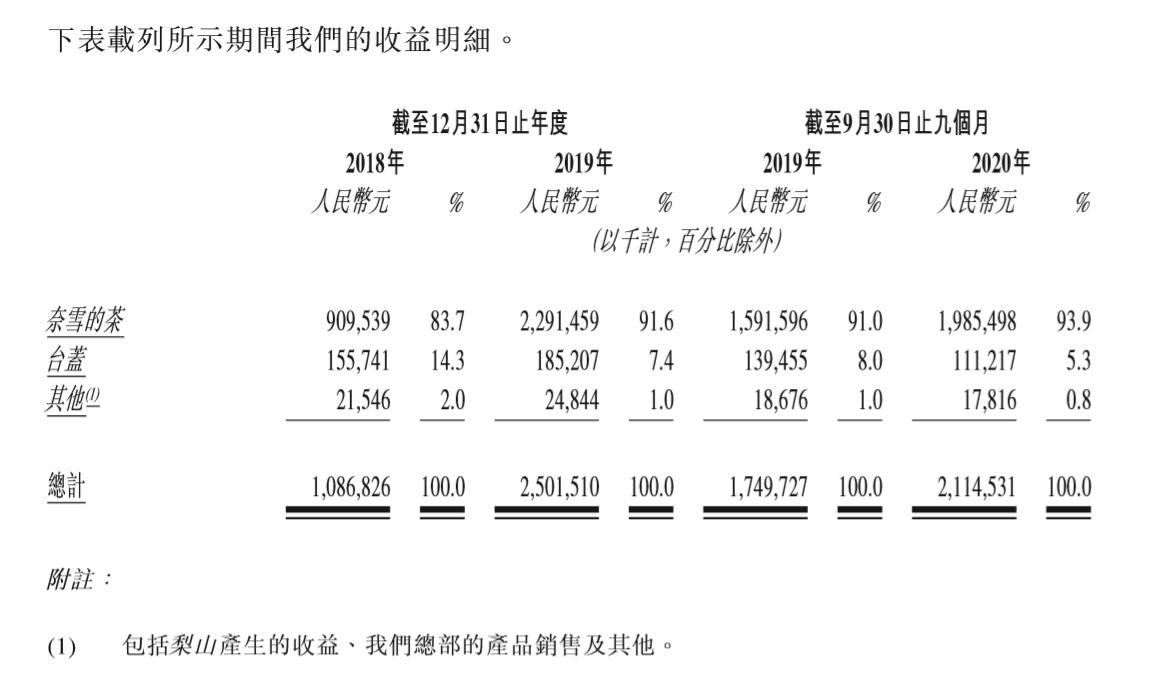

The leaflet shows that in 2018 and 2019, Nayuki teaOperating incomeRespectively 910 million yuan, 2.291 million yuan, the first three quarters of 2019 and the first three quarters of 2020 revenue was 1.592 million yuan and 1.985 million yuan, after 2019, the contribution to business income accounted for the proportion of total revenue increased to more than 91%.

In fact, in addition to the tea from the flagship brand Nayuki’s, Nayuki’s Tea Holdingsproduct lineAlso includes tablecloth and others. In 2018 and 2019, the operating income of the station coverage was 156 million yuan and 185 million yuan respectively; In the first three quarters of 2019 and the first three quarters of 2020, its revenue was 139 million yuan and 111 million yuan respectively; As of February 2021 on the 5th, there were a total of 63 stores located in 8 cities of Taigai.

Additionally, Naxue’s Tea Holdings previously operated another non-major sub-brand, Lishan, which generated very little revenue. As of February 5, 2021, it decided to stop the operation of the Lishan brand and close the two remaining stores.

(Source: Prospectus)

In the ongoing race, Naixue’s Tea Holdings operating income has grown significantly, with revenue of 1,087 billion yuan and 2,502 billion yuan in 2018 and 2019, respectively, and 1.75 billion yuan in revenue in the former three quarters of 2019 and 2020, respectively. 2,115 million yuan, but still losing money, the losses were 69,729 million yuan, 39.68 million yuan, 3,871 million yuan and 27,513 million yuan in the same period.

The financial report shows that the three main elements of Nayuki’s tea holding expenses are material costs, personnel costs, and rental expenses. 2018, 2019, the first three quarters of 2019, the first three quarters of 2020,Raw MaterialsCosts represented 35.3%, 36.6%, 35.8%, and 38.4% of total revenues, respectively. Personnel expenses represented 31.3%, 30.0%, 29.0% and 28.6% of total income, respectively. Rental expenses and property management expenses (equivalent toRight to useThe sum of the depreciation of assets and other rents and related expenses represented 17.8%, 15.6%, 15.6% and 15.2% of total income, respectively.

It is worth mentioning that the hygiene and safety of the food industry is particularly important. In May 2020, according to media reports, Nanchang consumer Ms Sun bought a European bag from a tea shop in Naixue. He bought it at 3pm. At 9 pm, he found that the bread was gray and moldy. In handling the incident, “Nayuki’s tea late at night, excuse me” quicklyWeiboHot search. Furthermore, Nayuki tea has been repeatedly engulfed in the “food safety” storm.

5The financing valuation of the round is approximately 13 billion yuan.

If successfully included, Nayuki’s tea will overtake Heytea and become the “first serving of milk tea,” so who will share this capital feast?

The prospectus shows that at the beginning of its establishment, Naixue Tea was operated by Shenzhen Pindao Catering Management Co., Ltd. (hereinafter “Shenzhen Pindao Management”); in January 2017, Shenzhen Pindao Management received Beijing Tiantu and Chengdu Tiantu In August of the same year, Shenzhen Pindao Management signed an A + round of financing with Chengdu Tiantu and Cao Minghui for a total of 22 million yuan; In November of the same year, Naixue tea left Guangdong Enter other major cities in China, such as Shanghai and Beijing.

As of September 2018, more than 100 Nayuki teas and more than 50 countertops were in operation across the country. In November, Shenzhen Pindao Management obtained B-1 round financing from Tiantu Dongfeng, Tiantu Xingnan and Tiantu Xingpeng, totaling 300 million yuan.

In 2019, Nayuki’s Hong Kong tea list was put on the agenda and began to build a structure due toReorganization, Shenzhen Pindao Management is held by Shenzhen Pindao Group and Pindao Holdings Hong Kong at 98.95% and 1.05% respectively. As of February 5, 2021, the operations of Shenzhen Pindao ManagementPerformanceYu Naixue tea stocks are consolidated.

In April 2020, Tea Holdings by Naixue and SCGC Capital Holdings Co., Ltd. (SCGC Capital), Hongtu Venture Capital Co., Ltd. (Hongtu Venture Capital), Hongtu Junsheng Venture Capital Co., Ltd. (Hongtu Junsheng Venture Capital) and Shenzhen Hongtu brightTo start a businessinvestmentbackgroundcamaraderieEnterprise (Limited) (Hongtu) signed a B-2 financing round totaling 200 million yuan; in June, it signed a B-2 round of financing with Court Card HK Limited (HLC) for a total of US $ 5 million; in December, with PAGAC Nebula Holdings Limited signed a Series C financing for a total of US $ 100 million.

In January 2021, according to media reports, after the completion of the C round of financing, Naxue’s tea holdings were valued at about $ 2 billion, or about RMB 13 billion.

Upon completion of the prospectus, Nayuki’s Tea HoldingsshareholderIncluding Lin Xin Holdings Co., Ltd. (established in September 2019 as a holding company and ultimately controlled by Zhao Lin and Peng Xin respectively), Tiantu entities (Tiantu Xingli, Chengdu Tiantu, Tiantu Dongfeng, Tiantu Tuxingnan and Tiantu Xingpeng) SCGC Entities (SCGC Capital, Hongtu Venture Capital and Hongtu Junsheng Venture Capital), Evermore Glory Limited (50% owned by Chief Technology Officer He Gang and his spouse Ma Xiaoming), Forth Wisdom Limited (the Incentive Plan of Nai Xue’s Cha Holdings capital is an overseas employee incentive platform), PAGAC Nebula Holdings Limited, Yonglegao International (an equity investment company), HLC.

(Article source: China Business News)

(Responsible editor: DF387)

I solemnly declare: The purpose of this information disclosed by Oriental Fortune.com is to spread more information and has nothing to do with this booth.

[ad_2]