[ad_1]

Source: Longzhong Information Subscription Number

Original title: Many new policies are about to be introduced to the international crude oil market to welcome the “Biden era.”

On January 20, Democrat Biden will be sworn in, officially becoming the 46th president of the United States, which also means that the Trump era will end. Biden’s keynote address on the first day of his new term has attracted a lot of attention and will make known his dominant ideas and policies in many fields. So how will Biden elaborate his views and what impact the new proposals will have in various fields. in international oil prices?

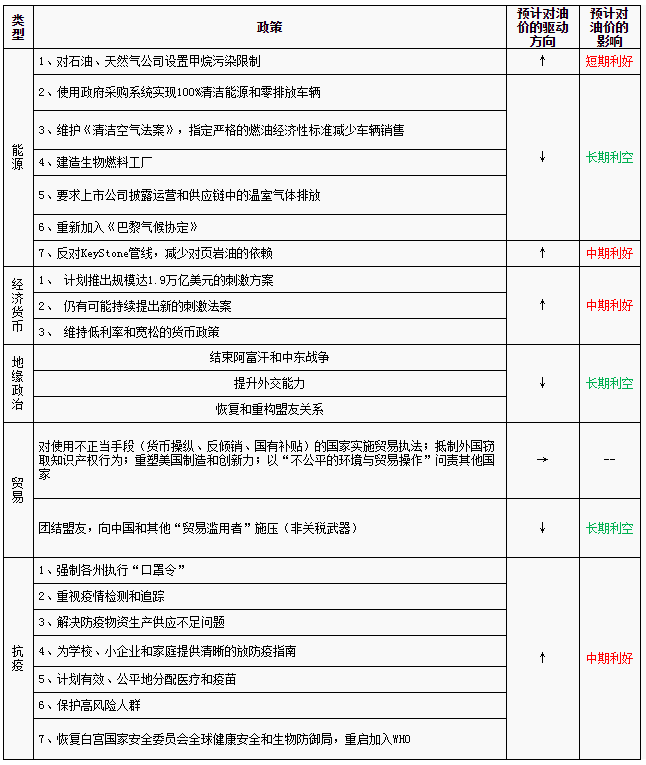

Table 1 Ideas of governance previously disclosed by Biden in various fields

Biden’s political thinking has been basically clear after taking office. The first step is to pass the 1.9 trillion economic stimulus bill to prevent and quickly control the epidemic, and provide assistance to residents and small and medium-sized businesses to pull the economy out of recession; The second step is to announce another fiscal stimulus plan in February. Job creation and investment in infrastructure are at the center, including spending on clean energy, health, and education, promoting rapid economic recovery. The new economic stimulus package and relaxed monetary policy will help boost market confidence and demand expectations. At the same time, it will continue to suppress the US dollar and benefit oil prices.

In terms of trade policy, Biden supports free trade and a return to multilateralism, and opposes malicious unilateral tariffs. Trade friction between the United States and China is expected to continue to decline. Biden once said, “The problem between the two countries is not the trade deficit.” It can be inferred that the future economy and trade between the United States and China will be more a contest of “global trade rules and competitiveness” than a “tariff war.” From today’s point of view, the first phase of the Sino-US trade deal will continue to move forward, rather than be canceled. Trade disputes started in the Trump era suppressed oil prices in 2018 and 2019. However, this pressure in the Biden era will obviously ease and the potential negative effects of oil prices will weaken to some extent.

In terms of geopolitics, Biden has repeatedly stated that he will return to the Iran nuclear deal. If sanctions on Iran’s crude oil exports are lifted, Iran will have room for them to increase from 1 to 2 million barrels of production, which will create negative pressure on oil prices. In addition, the relationship between the United States and Venezuela may also ease, the Trump-era high pressure policy on Venezuela no longer exists, and exports from Venezuela to China and other countries are also expected to improve. However, relations between the United States and Iran are still not Biden’s top priority after taking office, so when the United States announces its return to the Iran nuclear deal and when Iran announces that it will increase production and supply, they are important later concerns.

In terms of energy, Trump insisted on withdrawing from the “Paris Climate Agreement” and abolished the “Clean Energy Plan” and insisted on developing the traditional energy economy. Biden attaches great importance to new energy and plans to invest US $ 1.7 trillion in climate and environment to ensure that the United States achieves a 100% clean energy economy and achieves “net zero emissions” by 2050, and will quickly return to the Accord. Climate of Paris. In the election, Biden proposed to halt the issuance of new drilling promises on federal land and halt hydraulic fracturing (removal of tax incentives and subsidies for shale oil companies, etc.). This policy will affect drilling for shale oil in the United States. And the release of production capacity from wells drilled but not completed (DUC) (including deepwater mining in the Gulf of Mexico). Biden’s new energy policy has held back the demand side for crude oil negatively and will also have a profound impact on the future pattern of US crude oil consumption. Policies to stop drilling and hydraulic fracturing have hampered the shale oil industry recovery, which is positive support for oil prices. But in general, the impact of Biden’s energy policy on oil prices is primarily a long-term impact, which is not significant in the short term.

In summary, it can be seen that the directions of Biden’s policies in various fields on international oil prices are not consistent, and the periods of action are also different. So, in the short term, it’s worth paying close attention to the policies that Biden will determine in his inaugural address on day one, such as the $ 1.9 trillion stimulus plan likely to be implemented on day one. . The Biden era is about to reveal itself, and we will continue to pay attention to its subsequent impact on the international crude oil market.

Disclaimer: The content provided by Wemedia is derived from Wemedia and the copyright belongs to the original author. To reprint, contact the original author and obtain permission. Opinions in the article represent the author only, not Sina’s position. If the content involves investment advice, it is for reference only and should not be used as an investment basis. Investing is risky, so be careful when entering the market.

Massive information, accurate interpretation, all in the Sina Finance APP

Editor in Charge: Li Tiemin