[ad_1]

1commentary

2021-01-04 13:23:20

source:China Securities Journal

Secret of the protagonist!

At the beginning of the new year, the “three brothers” Weilai, Xiaopeng Motors and Ideal Motors, the new car manufacturing forces in the US stock market, announced the delivery status last year and many figures reached new maximums.

At the same time, the price of the Tesla Model Y fell 160,000 yuan on New Year’s Day, and the store was packed with people every minute. Today, the price range for the domestically produced Model 3 and Model Y has been narrowed down to the three new car-making forces. In the “Three British Wars” new energy vehicle market, will business be stolen from the new car manufacturing forces?

Various data sets new highs

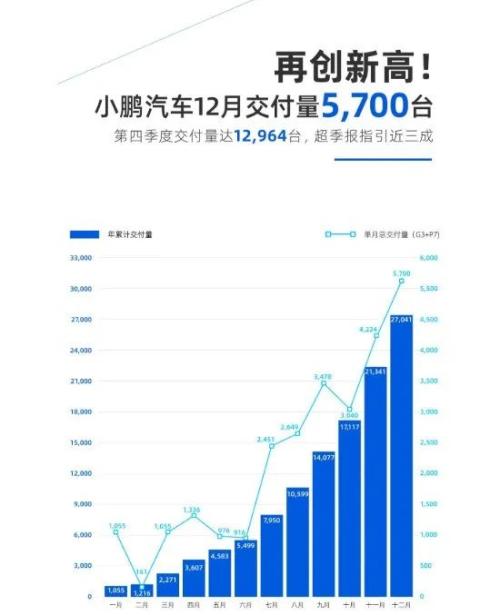

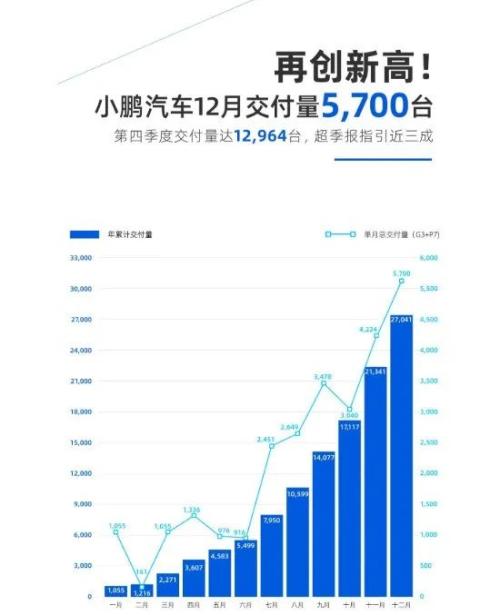

On January 4, Xiaopeng Motors released the delivery data for December 2020. In December 2020, the total delivery volume reached 5,700 units, a year-on-year increase of 326%, a record. In the fourth quarter of 2020, a total of 12,964 units were delivered, a year-on-year increase of 303% and a month-on-month increase of 51%. Among them, Xiaopeng P7 delivered a total of 8,527 units, an increase of 37% over the previous month.

In 2020, Xiaopeng Motors delivered 27,041 units for the full year, a 112% year-on-year increase.

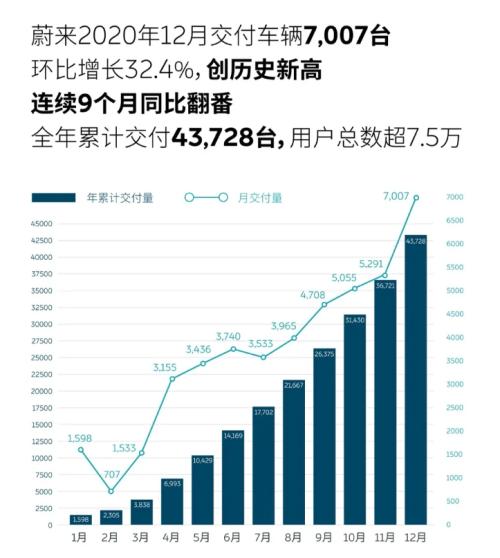

On January 3, Weilai released data showing 7,007 units were delivered in December 2020, setting a new record for single-month delivery for five consecutive months and achieving a doubling year-over-year for nine consecutive months.

Weilai delivered 43,728 units in 2020, a 121% year-on-year increase and the total number of users exceeded 75,000.

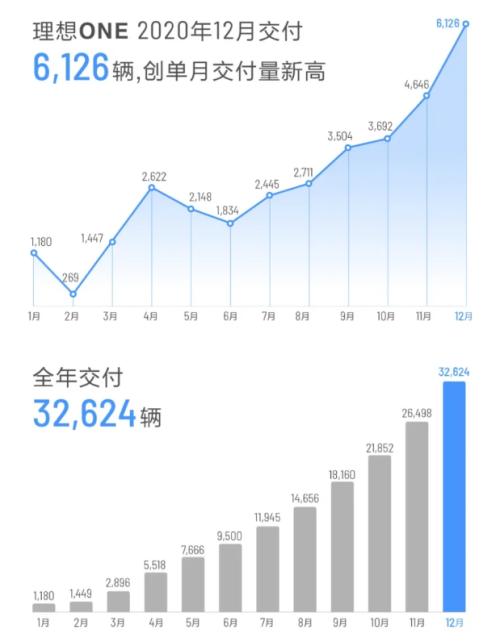

On January 2, Ideal announced the delivery data for December 2020 and the entire year. Ideal ONE delivered 6,126 vehicles in December 2020, an increase of 31.9% month-on-month and 529.6% year-on-year, setting a new record for monthly deliveries. At the same time, the number of new orders in December also hit a record. In the fourth quarter of 2020, Ideal ONE delivered 14,464 vehicles, a 67% increase over the third quarter.

In 2020, ideal ONE delivered a total of 32,624 vehicles.

Since 2020, driven by the rising Tesla share price, the prices of Weilai, Xiaopeng and Ideal Auto shares, which are traded on US stocks, have continued to rise. Wind data shows that the accumulated increase of Weilai in 2020 is 1112.44%; Xiaopeng Motors has a cumulative increase of 185.53% since its listing on August 27, 2020; Ideal Motors has a cumulative increase of 150.70% since its listing on July 30, 2020

“Hand in hand” with Tesla

With the arrival of the domestic Model Y from Tesla, the years of the “three brothers” seem to be over.

At the beginning of the new year, Tesla launched the domestic pure electric SUV Model Y. The starting prices of the long-life version and the high-performance version are respectively 339,900 yuan and 369,900 yuan, which is significantly lower than the previous imported version at 148,100 yuan and 165,100 yuan.

“EC6 and Model Y are in direct competition. To counter the Tesla Model Y’s price, we need to maintain some flexibility in the market.” On NIO Day a year ago, Li Bin, president and founder of Weilai, accepted the CSI Jun et al said in an interview.

From a price point of view, the Model Y price range has formed a deficiency with Weilai.

Currently, Weilai has three mass-produced models, namely EC6, ES6, EX8, of which EC6 is an electric coupe SUV, ES6 and EX8 are pure electric SUV. The entry prices for the three models are 368,000 yuan, 343,600 yuan, and 468,000 yuan, respectively.

Therefore, on the day the Tesla Model Y was launched, there was news on the internet that Weilai was suffering from a full-scale chargeback. Regarding the chargeback rumors, on January 3, Weilai co-founder and chairman Qin Lihong responded at the Weilai second-hand car business conference, saying, “We do not know the source of the cancellation news of Weilai subscription. Our order is very stable and keeps increasing. There is another common sense problem. Weilai’s official website has no relation to orders. “

Li Bin also said at the same time: “Some car companies set prices at cost, so the price will get lower and lower. However, Weilai has considered many factors in the future from the beginning. We will not allow the owners to of cars that buy Weilai suffer first. This is also the reason for Weilai’s relatively high gross profit loss in the first two years. “

In addition to Weilai, Tesla Model Y and Model 3 prices are currently in a head-to-head confrontation with ideal car prices and Xiaopeng Motors among the new car-making forces.

For example, the Ideal ONE price is 328,000 yuan, which is only 11,900 yuan lower than the price of the Tesla Model Y. With the continued price reduction of the domestic Model 3, the current price range of the Model 3 has fallen from the previous 250,000 to 420,000 yuan to 250,000 to 340,000 yuan, which is less than 3 yuan of the 227,700 yuan price of Xiaopeng P7. Ten thousand yuan.

Regarding Tesla’s price cuts, on January 3, Xiaopeng Motors CEO He Xiaopeng also expressed in his circle of friends: “This time we are pretty confident that friends will cut prices on New Year’s Day. New. Even the internal conference call has not been opened, and the data fully shows it. The price reduction has proven to be just a marketing method, and it is definitely a double-edged sword. “

From a sales perspective in 2020, the sales of new car manufacturers such as Weilai, Ideal and Xiaopeng are much lower than those of Tesla. According to data from the Travel Association, Tesla (China) sold 115,000 vehicles in the first 11 months of 2020; The combined sales of the three brands of Weilai, Ideal and Xiaopeng in the first 11 months of 2020 are not as good as those of Tesla. For sales in China, the “Three British Fighting Lu Bu” has a long way to go.

In the eyes of relevant observers, compared to the Model 3, the domestically made Model Y featured in this price cut is obviously scarier and has a greater impact on domestic new energy vehicles. This is because, compared to cars, Chinese consumers prefer SUVs. Compared to the electric car market that the Model 3 is in, the Model Y’s midsize electric SUV has better market prospects. In addition, ModelY will have an impact on all independent brands focusing on the high-end new energy vehicle market, and even traditional luxury brands, including BBA, regardless of price, performance, brand power. , etc.

BBA can’t stand still

Qin Lihong once said, “We are all happy that any electric car in the world is selling well.”

Cui Dongshu, general secretary of the Travel Association, also believes that Tesla’s price cut will not have a particularly large impact on the new forces in car building. The reason is that Tesla’s main competition is still targeting traditional luxury cars, and new car manufacturers’ products have more distinctive labels and features than Tesla. In particular, consumers have also recognized the good quality of service from high-end brands such as Weilai, and the loyalty of their circle groups is extremely high. Tesla’s price cuts won’t have a huge impact on them, mostly because of the traditional car market. Great influence.

In order to take advantage of the new energy vehicle market, BBA (Mercedes-Benz, BMW, Audi) has also launched its own electric vehicles in the mid-size SUV market. But from a price perspective, the price of BBA SUV electric vehicles of the same level is higher than that of fuel vehicles. For example, the price of the Mercedes-Benz EQC is approximately 50,000 more expensive than the Mercedes-Benz GLC; the BMW iX3 is approximately 50,000 more expensive than the BMW X3 and the Audi e-tron is more than 200,000 more expensive than the Audi Q5L.

Compared to fuel vehicles, the domestic Model Y has obvious price advantages compared to peer BBAs (Mercedes-Benz, BMW, Audi). For example, after this price cut, the entry price of the Model Y has been lower than the Mercedes-Benz GLC (midsize SUV) from 350,000 to 540,000 yuan, and the BMW X3 (midsize SUV) from 360,000 to 480,000 yuan. ; and the Audi Q5L (midsize SUV) The price of 387,800 to 498,000 yuan is also very close.

From the perspective of market participants, Tesla’s strategy is already very clear, that is, before traditional car companies begin their efforts, they must seize market share as soon as possible to form a monopoly similar to that of Apple in the mobile phone industry and then make money selling driverless software and services. And then trust the whole ecology of the product to make money.

Centaline Values(601375,Clinical Unit) He also pointed out that considering that the direction of automobile development is electrification, intelligence and sharing, the automobile ecosystem is expected to change after electrification, that is, the profit model of new automobile companies energy will gradually get rid of the traditional “build-sell” cars, and specials Sla’s price cut will speed up the restructuring process.