[ad_1]

For stocks, see Golden Unicorn’s authoritative, professional, timely, and comprehensive analyst research report to help you seize potential thematic opportunities.

LeTV’s Hot-Wanted Vendor Owing 12.2 Billion Yuan – Has Been Collecting Debts For Several Years And Is No Longer Expected To Pay It Back

Original: Red Star Capital Bureau

As the Spring Festival approaches, apps like Pinduoduo, Baidu and Douyin have launched the “war of the red envelopes”. Judging by the total number of red envelopes marked on each app icon, it ranges from 1 billion to 2.8 billion.

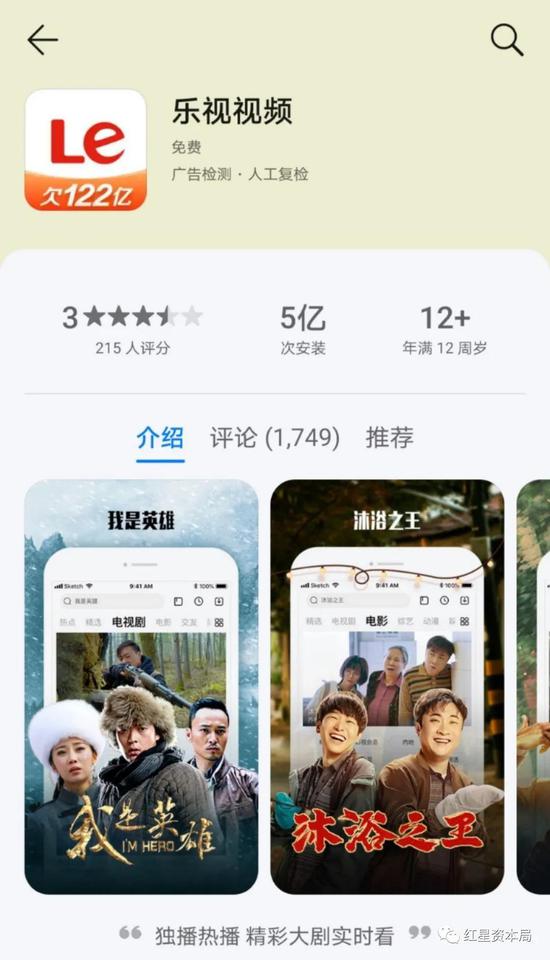

However, the LeTV Video APP did the opposite, linking “12.2 billion owed” on the APP icon, and even rushed to 7th place on the Weibo search list.

At press time, the topic # 乐 视 欠 122 亿 # reached 320 million views.

Data network

The app icon shows 12.2 billion owed

Customer support: normal operation, I don’t know the reason for the icon update

On February 7, Red Star Capital Bureau called the customer service number posted by the LeTV video app. Customer service said there was no notice about the “12.2 billion owed” on the icon, nor did they know the reason for the icon. upgrade. All sides function normally. “

At the same time, customer service told Red Star Capital Bureau that the development, operation and maintenance of the LeEco video APP is currently handed over to LeEco’s related company, LeRongzhixin Electronic Technology Co., Ltd. so that be responsible.

According to Tianyancha APP, Lerongzhixin Electronic Technology (Tianjin) Co., Ltd. was established in February 2012 with a registered capital of 375 million yuan. Its second shareholder is LeTV Information Technology (Beijing) Co., Ltd., with 36.4% of the shares.

On the same day, Red Star Capital Bureau made multiple calls announced by the company in industrial and commercial channels, but no one answered them.

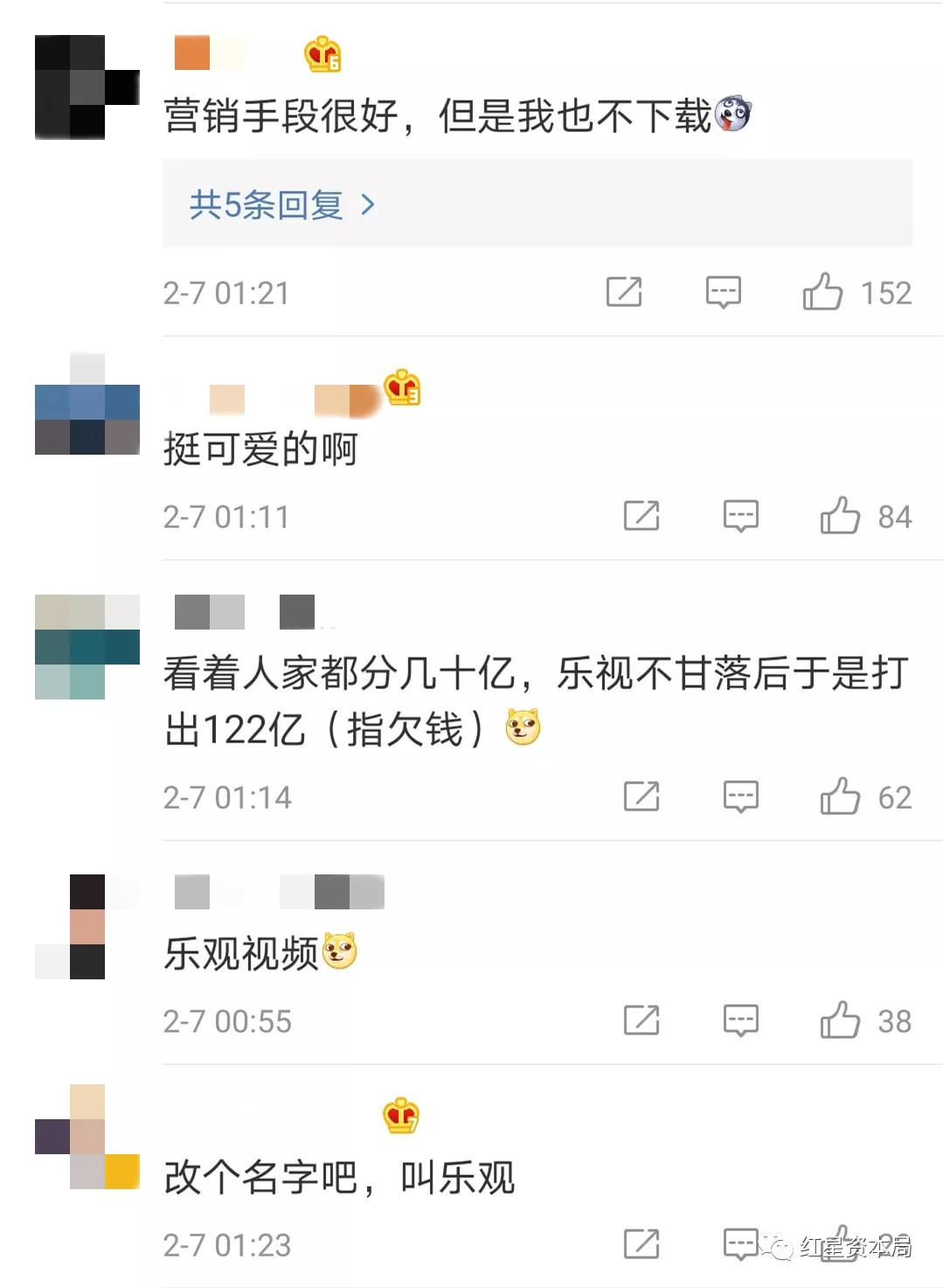

The Red Star Capital Bureau noted that after the topic # 乐 视 欠 122 亿 # appeared on the Weibo search list, it attracted the attention of many netizens. At press time, the reading volume of this issue reached 320 million.

Some netizens commented that “the red envelopes added by other applications are not as much money as LeTV should …”

Another netizen said: “Looking at the people divided into billions, LeEco is not willing to fall behind and reach 12.2 billion (referring to money owed).”

Some netizens commented, “Change your name, call it optimistic” and “optimistic video.”

Used to be a LeEco supplier:

4.5 million in arrears, no longer expected to be repaid

Netizens may take the “12.2 billion owed” on Le View as a joke and forget it after reading it. But for Lao Su (pseudonym), the 12.2 billion is much more concrete, because there is one of his 12.2 billion. Money.

Screenshot of Huawei App Store

In early 2015, LeEco had announced that there were 500 experience stores nationwide, and the goal in 2015 was to complete the opening of more than 3,000 experience store stores by the end of the year.

Lao Su became a LeEco store building supplier through a tender in 2016. It is responsible for supplying the LeEco brand store in the Southwest area. From the initial decoration to the showcase, going through the light box, he hired.

“It used to be more than 100 a month, but now these stores are basically closed,” Lao Su told the Red Star Capital Bureau.

It stands to reason that LeEco paid monthly, but never paid. At the end of 2016, Lao Su had personally gone to the LeTV headquarters in Beijing to collect bills. At that time, LeTV paid around 8.2 million yuan to Lao Su.

To recover debts, after entering 2017, Lao Su went to Beijing many times in more than a year. The longest stay in Beijing was more than 3 months, from May to September of that year. People just live in the lobby of LeTV Edificio.

In the end, LeTV repaid part of Lao Su’s accounts payable, and the arrears fell from 8.2 million yuan to 4.5 million yuan. As for the remaining 4.5 million yuan, it has yet to be paid.

Previously, Lao Su said in an interview with the Red Star Capital Bureau, “(The debt incurred by LeEco) is now bad debt. If you lose it, you lose. The weight of these pressures is that you feel uncomfortable. You can start over.” .

On February 7, Lao Su told Red Star Capital Bureau: “LeEco is like that, I don’t need to spend a lot of time paying attention to them. (APP) is out of date, I don’t pay attention to this matter. Anymore.”

Regarding the 4.5 million yuan LeTV still owes, Lao Su said, “I don’t have much hope right now (of going back).”

The scale of the debt exceeds 10 billion

The market value fell from 170 billion yuan to 700 million yuan.

In the heyday of LeTV, its founder Jia Yueting once proposed the “Seven Ecosystems of LeTV”, which include Internet content ecology, cloud ecology, sports ecology, large TV screen ecology, mobile phone ecology, ecology car and Internet ecology.

From LeTV.com to LeTV Sports, which owns the copyrights to major sporting events, to LeTV TV and LeTV mobile phones, “LeTV Ecology” almost covers the upstream and downstream of many industrial networks, creating a “LeTV Kingdom” .

The market value of LeTV (300104.SZ) once exceeded 170 billion yuan, but the LeTV stand was too big and soon ushered in a huge debt crisis.

In November 2016, Jia Yueting sent an internal letter “The Sea and the Flames of LeEco: Was it swallowed by big waves or did the ocean boil?” In the letter, Jia Yueting admitted that there was insufficient financial support, that pressure on the supply chain has increased, and that resistance has been obviously weak.

Red Star Capital Bureau reviewed LeTV’s 2019 annual report and found that prior to its delisting, the debt pressure was still enormous.

As of December 31, 2019, the notes and accounts payable within the scope of LeTV’s consolidated statements were 3,032 million yuan, mainly due to arrears from suppliers and service providers.

In addition, within the scope of LeTV’s consolidated statements, long and short-term loans totaled 555 million yuan, other current liabilities were 3.304 million yuan, and other non-current liabilities were 3.049 million yuan, mainly due to loans from institutions. financial and non-financial companies.

At the same time, in 2019, according to the judgment and progress of the LeTV Sports and LeTV Cloud breach warranty cases, and based on prudential considerations, LeTV has accumulated more than RMB 9.64 billion in liabilities for the LeTV Sports and LeTV Cloud cases.

Overall, LeTV’s debt scale remains in excess of tens of billions.

July 20, 2020 – LeTV’s last trading day for A shares, its closing price was set at 0.18 yuan per share, with a total market value of 718 million yuan.

“Lower lap country”

Will FF will bring Jia Yuetingnew Hope?

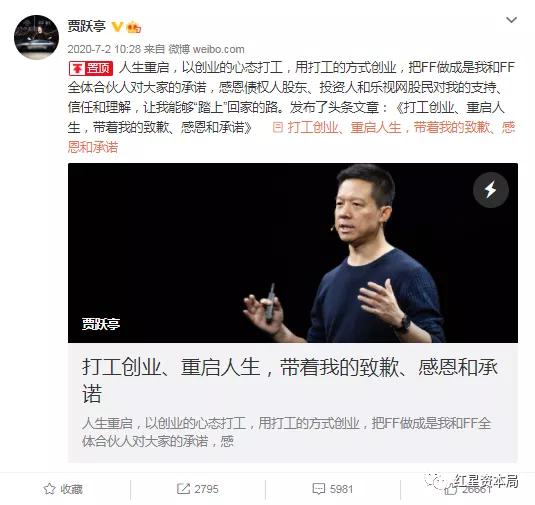

Shortly after the LeEco debt crisis erupted, Jia Yueting’s “return to China next week” became an obstacle. However, Jia Yueting is still obsessed with “making cars” abroad and has yet to return to China.

According to previous reports from the Red Star Capital Bureau, Jia Yueting’s innovative energy car company FF (Faraday Future) is currently seeking listing on the Nasdaq.

FF stated that it has jointly announced with special-purpose acquisition (also known as reverse merger) company Property Solutions Acquisition Corp (hereinafter “PSAC”) that it has reached a final agreement on the business combination. Upon completion of the transaction, the combined company will be in Nass. DAQ is listed under the stock code FFIE.

PSAC, Chinese for Special Purpose Acquisition Companies, also known as “Blank Check Companies”, is a back door listing method on the US stock market. In other words, through the “back door” of PSAC, FF will become a Nasdaq-listed company.

The transaction is reportedly expected to be completed in the second quarter of 2021.

If FF can be successfully listed, will Jia Yueting return to China?

“Working with all FF partners to make FF and return to China to promote the Sino-American dual home game strategy remains my primary mission for the next stage of my life,” Jia Yueting said in her current Weibo article. .

Disclaimer: The content provided by Wemedia is derived from Wemedia and the copyright belongs to the original author. To reprint, contact the original author and obtain permission. Opinions in the article represent the author only, not Sina’s position. If the content involves investment advice, it is for reference only and should not be used as an investment basis. Investing is risky, so be careful when entering the market.

Massive information, accurate interpretation, all in the Sina Finance APP

Editor in Charge: Yang Hongbu