[ad_1]

Original title: Interpretation: 12 months before IPO, investment is locked for three years How will investment institutions be affected?

Summary

[Interpretación: 12 meses antes de la OPI, ¿cómo se verán afectadas las instituciones de inversión por el período de bloqueo de tres años? ]Yesterday, the China Securities Regulatory Commission issued the “Guidelines for the application of regulatory rules – Disclosure of information of shareholders of companies applying for initial listing”, which stipulates that if the issuer submits an application for new shareholders within the 12 months, the above- the new shareholders mentioned must commit The shares cannot be transferred within the 36 months following the acquisition date. What impact does this new regulation have when lifting the ban and the rate of return on investment for investment institutions? We use figures to illustrate this situation. (Daily economic news)

Yesterday,China Securities Regulatory CommissionIssue the “Guidelines for the application of regulatory standards related to the initial quote requestcompanyshareholderDisclosure of information “, which stipulates: the issuer sends the request within 12 monthsshareholder, The aforementioned new shareholders will undertakeShareIt cannot be transferred within 36 months from the date of acquisition.

This new ruleinvestmentTime to lift the ban on the institution’s shareholding,Investment incomeHow much does the rate affect? We use figures to illustrate this situation.

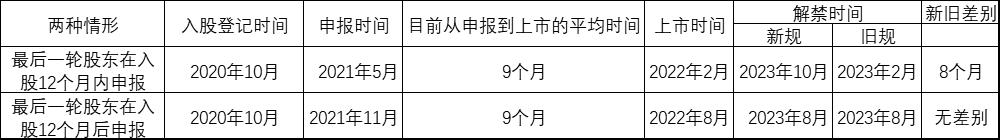

Table 1: The difference between the declarations of the new shareholders after their participations under the new and old regulations differs in the lifting time

As can be seen in the table above, given that the 36-month blocking period calculated in this new regulation begins from the date the new shareholder acquires the shares, assuming that the current average time from the declaration to the listing is of 9 months, if the last After the new round of equity participation, the company did not delay the declaration until 12 months after participation. Then the last round under the new rules “Surprise participationThe lifting of the ban on “shareholders” is 8 months after the previous regulations. The longer the review time from declaration to quote (i.e.IPOThe more severe the dammed lake), the smaller the difference between the old and new regulations.

And if the issuer chooses to file after 12 months of the latest round of recently increased shareholder equity, there is no difference between the old and new regulations.

marketIn general, people believe that the new regulations issued by the China Securities Regulatory Commission are aimed at alleviating the recurring barrier lake phenomenon of IPOs and motivating issuers to postpone filing time. In practice, this is the problem between the issuer and the investment institution in the last round of equity participation.GameTo decide.

If a company is good enough, it will be stronger for investors and you may decide not to postpone the declaration; but conversely, a company that is not good enough, or a company in the industry with obvious periodicity, may findPerformanceThe issue of increased uncertainty is more urgent to go public than companies with strong performance stability.demand。

At the same time, it is also an important factor if the barrier lake is discharged (i.e. the average time from declaration to inclusion).variableIt affects the difference in time for shareholders to lift the ban under the old and new regulations. Judging from the progress of the current review, the impact of the new regulations in time for the latest round of ban lifting by investment institutions is about half a year to a year. According to our calculations in case 1, the rise time is 8 more months.

So, according to the situation above 1, for the investment institutions of the companies that are about to declare, will the withdrawal of the reinvestment after the lifting of the ban eight months have little impact on the investment institutions?

This question is determined by two factors: One is how much the IRR (internal rate of return) of the investment institution has changed when the fundamentals of the company have not changed significantly and the multiples of return remain unchanged, and the exit time It ranges from six months to a year.A crotchOne year after listing, one and a half years, two years later, yourP / E ratio、Market valueHow much does the valuation index change?

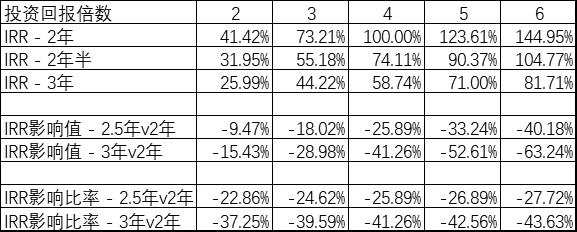

1) The impact of the investment withdrawal time extended from six months to one year on the IRR

Table 2: The impact of the extended exit time on the IRR under the condition of constant return multiplesStatistics

The above table assumes that the return multiple does not change (that is, regardless of the number of exit years, the return multiple is fixed), only the exit time is different, and the IRR of the investment institution changes. Take as an example the doubling of the investment (that is, multiples of return on the investment of 2 times), the exit IRR in 2 years is 41.41%, the exit IRR in 2.5 years is 31, 95% and the exit IRR in 3 years is 25.99%. The 2.5-year retirement was 22.86% lower than the 2-year IRR retirement, and the 3-year retirement was 37.25% lower than the 2-year IRR retirement.

It can be seen from the statistics in the table that the higher the return on investment multiple, the greater the impact of the exit time on the IRR. In other words, the better the project, if it can be withdrawn for half a year or a year before, the IRR performance will be much higher.。

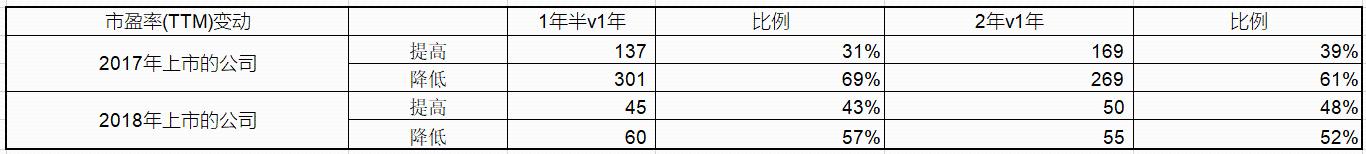

2) After a year and a half or two years after the listing of a company’s A shares, will its valuation increase or decrease relative to a year after listing?

Listed in 2017 and 2018the companyFor example, under the rules above, investment institutions can lift the ban one year after the companies go public, but under the new rules, lifting the ban on investment institutions can be delayed for a year and a half. to two years. We have calculated the changes in the price-earnings ratio and the market value of companies one and a half years after listing and two years after listing compared to one year after listing.

Table 3: One year, one year and a half and two years after the listing of the company’s A sharesAverage P / E ratioChanges

Note: The calculation of the P / E ratio excludes companies with a negative P / E ratio and companies with a P / E ratio greater than 150

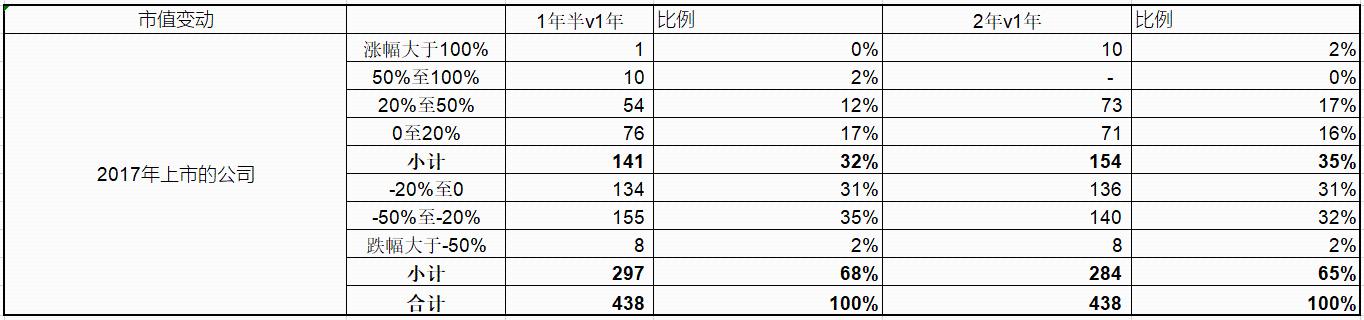

Table 4: Trends in the price-earnings ratio of companies after a year and a half and two years after listing

Table 5: Trends in changes in the market value of companies after a year and a half and two years after listing

From the perspective of the trend of the average price-earnings ratio, the change is not obvious after a year and a half and two years after the listing compared to one year after the listing. However, from the perspective of the trend of stock market earnings and changes in market value, as the listing time of listed companies increases in 2017, more companies have fallen in the ratio price-earnings and market value that companies have increased.However, when the waiting time increases to two years, the situation is no worse than when it is maintained for a year and a half.

Table 6: Changes in the market value of listed companies in 2017 after a year and a half and two years after listing compared to the year after listing

Table 7: Changes in market value of listed companies in 2018 after one and a half years and two years after listing compared to the year after listing

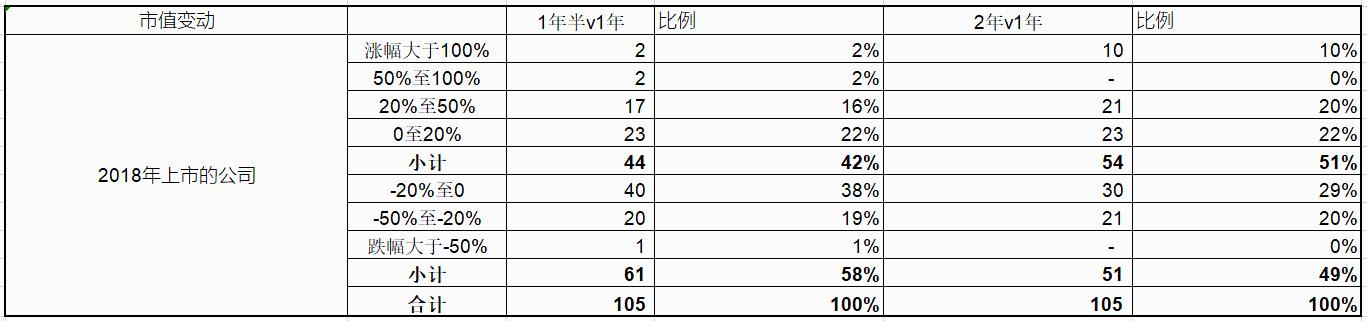

Analyzed from the trend of changes in market value, among companies that went public in 2017, 68% of companies went public after a year and a half of listing, compared to when they were listed for a year. year. The market value of the company fell. Among companies that were listed in 2018, 58% of the market value of companies fell after a year and a half of listing compared to the year of listing, and 49% of the market value of companies fell two years later to quote compared to the previous one. year of listing.

Thus,Consider the companies listed in 2017 and 2018 asshowsThe analysis shows that the lifting of the ban runs from half a year to a year, which is generally unfavorable for investment institutions that bought shares before the IPO. The probability of falling market value is greater than the probability of increasing market value.; On average, the price-earnings ratio hasn’t changed much.

More importantly, since time is an important factor in calculating the IRR (the IRR is an important indicator of the investment level of an investment institution), under the condition of the same return multiple, the IRR will be significantly reduced. due to the increase in waiting time.

Last year, pre-IPO investment was popular again, mainly because the speed of IPO review under the registry system accelerated. Compared to the first companies, the pre-IPO companies have a high certainty of return and a short investment lead time. The competence of investment institutions is not professional investment capacity, they are resources and connections. If the investment experience of the investment institution is not strong and you invest in a company that does not have sustainable development capacity, even if the holding period is increased from six months to one year, it is easy to find a longer exit time under the new regulations. and a decrease in the price-earnings ratio and market value of the company. The “double death effect” cannot obtain satisfactory returns.

(Source: Daily Economic News)

(Editor in charge: DF537)

I solemnly declare: The purpose of this information is to spread more information, and it has nothing to do with this booth.

[ad_2]