[ad_1]

Original title: International oil prices suffered another heavy hit after a 6% drop! Epidemic in Europe again, the two countries announced the extension of the ban

After experiencing the great earthquake last week, the international oil price was again hit hard overnight.

Wind data shows that major US and Burundi oil contract prices fell more than 6% overnight. At 6 o’clock on March 24 Beijing time, their prices have corrected more than 15% from their recent highs on March 8.

Industry experts generally believe that the recurrence of the European epidemic and vaccine and vaccination supply problems are the fuse that triggered the recent fluctuations in international oil prices. However, in general, short-term adjustments do not change the bullish logic in the medium term. and the center of the price of crude will continue to rise in the next two years.

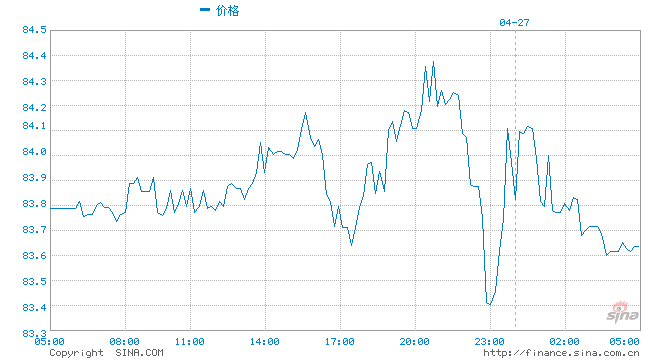

US oil fell below the $ 60 mark again

In the early morning of March 24 Beijing time, international oil prices continued to fall after opening lows, and US oil prices fell back below the $ 60 / barrel mark. At 6 pm on the 24th, NYMEX’s main crude contract fell 6.76% to $ 57.40 per barrel; the main ICE oil contract fell 6.35% to $ 60.42 a barrel.

Image source: wind

Image source: windIn terms of recent performance, international oil prices hit a record for the past 14 months on March 8. The price of the main NYMEX crude oil contract was once close to US $ 68 / barrel, and the price of the main ICE oil contract was even more than US $ 71 / barrel. Since then, the prices of the two oils have started to fluctuate and decline. Not long ago, its single-day drop averaged about 8% on March 18. At 6 o’clock on March 24 Beijing time, the prices of the two oils had a cumulative correction of 15.56% and 15.35% respectively from their highs on March 8.

Image source:Wind

Image source:WindThe drop in international oil prices also pushed the US oil and gas sector back across the board. Wind data shows that at the close of March 23 local time, Caron Oil fell more than 7%, Marathon Oil fell more than 6%, Murphy Oil fell more than 5%, Shell Oil-A fell almost 5% and Halliburton it fell. More than 3%.

Despite the drop in oil prices, US airline stocks did not show a positive trend overnight. Wind data shows that as of the close of March 23 local time, US aviation stocks fell across the board, United Airlines fell 6.81%, American Airlines fell 6.55%, Delta Airlines fell 4.88%, Boeing fell 3.98%, Southwest Airlines fell 3.14%. .

In terms of overall market performance, US stocks tumbled towards the close overnight. At the close, the Dow Jones fell 0.94% to 32,423.15 points; the Nasdaq fell 1.12% to 13,227.70 points; the S&P 500 Index fell 0.76% to 3,910.52 points.

Image source:Wind

Image source:WindResurgence of the epidemic in Europe

What caused oil prices to fall again? Market participants generally believe that it is still related to the rebound of the epidemic in Europe. The re-implementation of the blockade in some European countries has intensified market concerns about weak demand for crude.

According to CCTV News, Germany’s current lockdown measures will run until April 18, and a more stringent “long vacation lockdown” will be implemented during the traditional April 1-5 holiday period. During this period, all related shops and social venues in Germany will be closed, and any gathering in public places is strictly prohibited.

German Chancellor Angela Merkel emphasized at the press conference that due to the spread of the new variant of the coronavirus, the infection rate and the utilization rate of intensive care beds have increased dramatically, and the prevention of epidemics has again encountered enormous difficulties. Germany must stop the “exponentially rising third group.” Epidemic. “

The Netherlands also announced the extension of the ban. The Prime Minister of the Dutch Interim Cabinet, Rutte, announced on the 23rd that, in view of the continued increase in the number of confirmed cases of the new crown and the number of hospital admissions, the country will extend the ban currently implemented until April 20. . According to data released by the Dutch public health department on the same day, the number of new confirmed cases of new coronary pneumonia in the Netherlands during the week of March 17-23 was 46,005, an increase of 16% over The last week.

At the same time that the epidemic has recovered, the supply of vaccines in Europe and the progress of vaccination are also difficult to predict. According to CCTV News, on the 23rd local time, the executive director of the European Medicines Agency, Emer Cook, accepted the question of the European parliamentarians about the vaccination situation of the new crown throughout the EU. Cook said the EU should do everything possible to jointly improve vaccine production capacity. Thus increasing the production of vaccines. He said that the production of the new corona vaccine will affect the vaccination schedule across Europe.

The European Union is reported to have started the new vaccination crown in December last year, but the vaccination schedule is much lower than that of the United Kingdom, the United States, and Israel. Recently, member states have criticized the European Union’s vaccine program.

French President Macron visited the COVID-19 vaccination center in Valenciennes, a northern province, on March 23 local time. He said vaccination should be at the core of France’s response to the COVID-19 epidemic. He asked for the maximum promotion of the Vaccination Process from April., Vaccinate regardless of weekends and holidays.

Macron also said that the French government is still tracking the epidemic situation in various places and does not rule out imposing new prevention and control measures in areas where the situation has deteriorated. A total of 16 French provinces are currently implementing a new round of “bans,” and the northern province that Macron visited on the 23rd is one of them.

The short-term adjustment does not change the uptrend in the medium term

Regarding the recent correction in the international price of oil, Guotai Junan Futures believes that the fall in crude prices takes into account more short-term factors and assimilates the excessive increase of the previous period. Short-term price adjustments may be affected mainly by macroeconomic sentiment and liquidity expectations. However, under the control of OPEC + supply, fundamental support is strong. During or before the peak summer demand period, price increases remain a high probability event. In general, short-term adjustments will not change the medium-term bullish logic. At present, the fundamentals will remain exhausted under the premise that the vaccine will be effective in the next 3-6 months, and the crude oil price center will. further increase in the next two years.

Centaline Futures noted that there have been no major changes in the supply and demand of crude in the short term, and the logic of supply and demand has not changed. The main focus of the market is whether the OPEC + ministerial meeting held on April 1 can continue to keep the production quota cap unchanged; The signs of deterioration of the European epidemic have slowed the progress of the recovery of the demand for oil. Repeated epidemics have made the market aware of the complexity of the evolution of the epidemic. If subsequent demand the recovery can maintain resilience remains a great risk.

It is reported that the OPEC + ministerial meeting to be held on April 1 will determine the production policy for May. ING analysts said in a research report that ahead of the recent drop in oil prices, the market expects OPEC + to begin easing its production cuts. However, given current market conditions, OPEC + may be hesitant, especially if market sentiment does not improve before the meeting.

Editor: Zhang Nan and Wang Yin

Massive information, accurate interpretation, all in the Sina Finance APP

Editor in Charge: Li Tiemin