[ad_1]

Source: FX168

Original title:[Cierre de oro]The IMF report revealed a ray of hope, and the sound of the dollar “rising” sent gold “falling” above US $ 30.

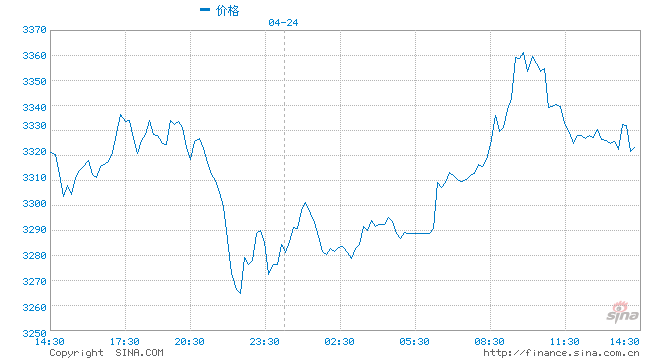

FX168 Financial News (North America) News Gold priceOn Tuesday (October 13) it fell 1.9% to less than $ 1,900 an ounce. The US dollar rose due to the stagnation in the US economic stimulus plan. At the same time, investors also paid attention to the slightly better than expected announcement from the International Monetary Fund (IMF). Economic report.

Spot gold closed at $ 1890.62 an ounce, $ 31.36 or 1.63% less, fell sharply after hitting a high of $ 1925.10 an ounce during the intraday session and refreshed the daily low at 1886 , $ 21 an ounce.

COMEX gold closed down 1.8% in December, at $ 1,894.60 an ounce.

The International Monetary Fund (IMF) released the “World Economic Outlook Report” on the 13th. The latest IMF report indicated that the world economy is expected to contract 4.4% this year, and the forecast in June it is 5.2%. This revision reflects a better-than-expected world economy in the second quarter, especially in advanced economies. After the gradual recovery of economic activity in May and June, economic activity began to be better than expected. In the third quarter, signs of recovery continued.

The IMF said that forecasts for the world economy are “somewhat less scary” because rich countries and China are recovering faster than expected.

David Meger, head of metals trading at High Ridge Futures, said: “The stagnation of Washington’s next round of economic stimulus plans will continue to put pressure on assets such as gold, which depend on the weakening of the dollar for the next wave of support. .

“Institutions such as the International Monetary Fund and the Federal Reserve have also indicated that the economic recovery is faster than they initially expected. Therefore, we believe that it may be necessary to reduce stimulus measures globally.”

The dollar rose 0.5% against other currencies, putting pressure on gold prices.

The Speaker of the US House of Representatives, Pelosi, said that the latest stimulus plan for the coronavirus proposed by President Trump did not meet the needs of the American people.

Edward Moya, senior market analyst at OANDA, said that in negotiating the fiscal stimulus agreement, “gold has been playing” and the latest stalemate “removes some of the short-term bullish factors that we expected.”

“But this means that we will introduce stimulus measures later, possibly early next year, which will lead to higher gold prices.”

Gold is considered a tool to protect against inflation and currency devaluation. During the new corona pandemic, unprecedented stimulus measures were introduced globally and gold has risen 25% this year.

Fundamental positive factors

1. According to Worldometers real-time statistics, as of 05:23 on October 14 Beijing time, there were 38.29 million confirmed cases of the novel coronavirus worldwide, with an increase from 261,167 to 38,895,616,1 , 08 million deaths and an increase from 3,829 to 1,089,034. example. The number of countries with more than 100,000 confirmed cases worldwide has risen to 44, and Sweden is the latest country to exceed 100,000. Furthermore, Guatemala has more than 90,000 confirmed cases. The number of confirmed cases of the new corona virus in the United States reached 8.08 million, with an increase from 4.2018 to 8,080,344, representing almost a quarter of confirmed cases globally; the number of deaths reached 220,000, with an increase from 668 to 220,686, representing almost a quarter of the global number of deaths.

2. On October 12 local time, Johnson & Johnson said that because one of the volunteers involved in the study developed an “unexplained illness,” the company decided to suspend clinical trials of its new corona vaccine candidate. Johnson & Johnson issued a statement stating that the company will suspend all clinical trials of the vaccine, including phase III clinical trials launched in late September. Currently, an independent committee and relevant experts from Johnson & Johnson are investigating and evaluating the subject’s condition. On the same day, a spokesperson for Eli Lilly also released a statement saying that, after careful consideration by the safety committee, Eli Lilly had suspended testing of antibody drugs against the novel coronary pneumonia.

3. Five people familiar with the matter revealed that the White House is selling more advanced military equipment to Taiwan and told Congress on Tuesday that the White House will seek to sell Taiwan’s MQ-9 drones and a coastal defense missile system. Ahead of these potential arms sales, Reuters first reported three other arms sales on Monday, sparking the ire of China. Reuters reported in September that as the Trump administration increased its pressure on China, up to seven major weapons systems were going through the U.S. export process.

4. The European Union earned the right to impose tariffs on US $ 4 billion on US products in retaliation for the subsidies received by the aircraft manufacturer Boeing BA. US Trade Representative Lighthizer said any move by the European Union to impose tariffs on US $ 4 billion worth of US aircraft and other goods “would clearly violate WTO principles and force the US to respond.” . He said Washington will step up action. Ongoing negotiations with Brussels to restore fair competition and resolve disputes.

5. A senior US envoy called China “the elephant in the room” on Monday and said Washington is eager to advance India’s interests in the Indo-Pacific region. US Under Secretary of State Stephen Biegun said the US is exploring how to strengthen India without changing what he called India’s “strong and proud tradition of strategic autonomy.” Biegun said the partnership between the four countries is driven by “common interests, not binding obligations, and is not intended to become an exclusive group.” Biegun said: “Any country that seeks freedom and the opening of the Indo-Pacific and is willing to take steps to ensure this should welcome cooperation with us.”

Fundamental negative factors

1. The International Monetary Fund (IMF) released the “World Economic Outlook Report” on the 13th. The latest IMF report indicated that the world economy is expected to contract 4.4% this year, and the forecast in June it is 5.2%. This revision reflects a better-than-expected global economy in the second quarter, especially in advanced economies. After the gradual recovery of economic activity in May and June, economic activity began to be better than expected. In the third quarter, signs of recovery continued. The IMF said that due to the faster-than-expected rebound in rich countries and China, the world economic forecast is “somewhat less scary.”

2. On Tuesday, the Speaker of the US House of Representatives, Pelosi, said that the package recently proposed by President Trump after canceling the negotiations is far from meeting the needs of the American people, but still hopes to reach an agreement . The Speaker of the US House of Representatives, Pelosi, told her fellow congressmen in a letter that the White House’s new corona virus assistance program did not provide enough support for health care problems. Late on Tuesday, Pelosi said she had no intention of meeting with Republicans in the Senate. US lawmakers declared that Pelosi had no intention of compromising with McConnell, the leader of the United States Senate Majority Party (Republican).

panorama

1. JPMorgan Chase (JP Morgan) said that if the American Democratic candidate Biden wins in the next general election in the United States, gold will benefit enormously and a lot of investors may flock to junk debt. The bank reported that the outcome of Biden’s election will lead to a sudden drop in US Treasury yields and the dollar will weaken, pushing gold prices up. The bank expects the average price of gold in the fourth quarter to remain at US $ 1,880 an ounce, which will be affected by Fed policy and inflation expectations.

2. David Meger, director of metals trading at High Ridge Futures, said: “The stagnation of Washington’s next round of economic stimulus plans will continue to put pressure on assets like gold, which are dependent on the weakening of the US dollar for the next wave of support The International Monetary Fund and the Federal Reserve, etc. The agency also noted that the economic recovery is faster than they initially expected, so we will think that it may be necessary to reduce stimulus measures globally “.

3. OANDA Senior Market Analyst Edward Moya said that in negotiating the fiscal stimulus deal, “gold has been playing” and the latest stalemate “removes some of the short-term bullish factors that we expected.” “But this means that we will introduce stimulus measures later, possibly early next year, which will lead to higher gold prices.”

4. Citibank analysts (Citibank) remain bullish on gold in the short term (tactical) and medium term (structural). They expect the price of gold to be US $ 2,200 / ounce in three months and US $ 2,400 / ounce in 6-12 months. They said: “Gold has not recovered from its two breakpoints (horizontal support is at 1900-1907 USD / oz, the downtrend line and the 55-day DMA resistance at 1937-1938 USD / oz). It is constructive. Support points are at $ 1837 and $ 1862 / ounce, and resistance points are at $ 1993 and $ 2075 / ounce. “” We are bullish on gold tactically and bullish on gold structurally. We maintain our target price within three months. At US $ 2,200 an ounce, the 6-12 month target price is US $ 2,400 an ounce. We will raise our forecast for the 2021 gold reference price by approximately US $ 300 an ounce, which is higher than the forecast updated in early July, reaching a record high of US $ 2,275. US dollars per ounce. “

Focus on the next trading day

12:30 Industrial Production of Japan in August

16:00 The President of the European Central Bank, Lagarde, makes a speech, announces the IEA monthlyrawMarket Report

17:00 European industrial departure in August

20:00 IMF officials hold a press conference and press conference

20:30 US Producer Price Index in September

21:00 The Vice President of the Federal Reserve, Clarida, gave a speech on economic prospects and monetary policy

At 03:00 the next day, Fed Vice President Quarles and Dallas Fed President Kaplan delivered speeches on financial regulation.

At 05:45 the next day, Lowe, the RBA president, delivered an online speech

06:00 the next day, Chairman Kaplan of the Federal Reserve Bank of Dallas chaired the civic meeting

Massive information, accurate interpretation, all in the Sina Finance APP

Editor in Charge: Tang Jing