[ad_1]

Last October, the long-short trend for gold and silver was relatively balanced, and the overall trend remained volatile. Huang Lichen believes that this is the result of the wide influence of long-short market factors. Heading into next week, the US general election will be the center of attention for the entire market. During the state election voting results and when the dust settles, the entire financial market can fluctuate sharply. The same goes for gold and silver. Check the gold level during the last general election. The volatility of $ 100 is particularly important for risk control during this election.

Specifically, US non-farm data for September underperformed, the minutes of the Federal Reserve meeting showed that interest rates will remain low for a long time, and the new round of the fiscal stimulus plan is expected to Be optimistic, that once raised the price of gold to a new high of 1933 this month, but the epidemic situation in Europe and the United States worsened. , Europe, Germany and France closed the city, the US dollar safe haven purchase demand increased, suppressing the gold trend, the price of gold once hit a new low of 1960 US dollars this month, but the uncertainty of the result The US election increased and the demand for safe haven gold increased. At the end of the month, the price of gold bottomed out and recovered by almost US $ 30. Finally, the monthly line closed due to the excessive strength of the US dollar and a negative cross was recorded.

International gold fell slightly this month. Gold TD followed the trend of international gold and fell for the third consecutive month. However, the decline gradually eased and did not fall below the low of 393 yuan the previous month. The bottom part showed some support. After the sharp drop in international silver in September, the trend in October rose and fell, and the uptrend narrowed. A small Yang line with a longer upper shadow was recorded. Silver TD continued the downward trend in September, but the price of silver did not break the low of 4628 yuan, and the fall in October was limited, and overall a small Yinxian was recorded with a longer upper and lower shadow.

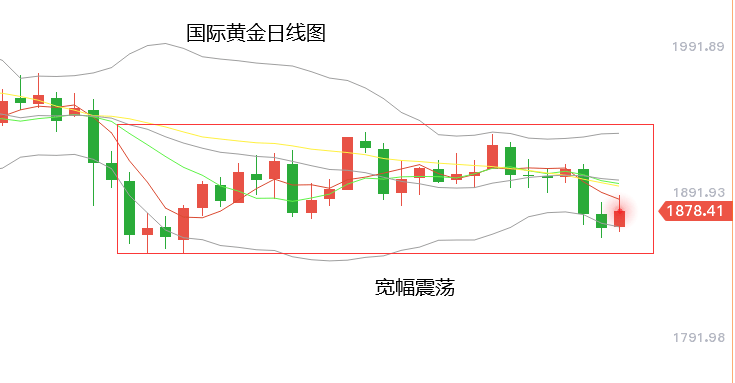

International Gold: On the monthly line, international gold has fallen for three consecutive months. The trend has been weak, but the decline has narrowed and the price has not fallen again. The lower part shows some support; on the weekly line, the price of gold plummeted in mid-August. After that, gold came out of a wave of volatility and tightened, and in the second wave of price adjustments in late September, the price of gold continued to maintain volatility and consolidation. The two gold dips did not show a significant drop in the price of gold. The bottom part showed some support. However, the high point gradually moved lower and the selling pressure was obvious. On the daily line, gold has been in a wide range of fluctuations in the last month from US $ 1840 to US $ 1940. The price fluctuated around US $ 1,900. The trend at the end of October was weak. In the last four hours, the price of gold bottomed out at the end of the month, easing downward pressure in the short term, then retraced after encountering resistance, and the trend was weak and volatile.

Overall, international gold holds a wide range of shocks, focusing on the previous low around US $ 1,848, followed by the October low around US $ 1,860, overhead resistance focusing in the vicinity of US $ 1,900, followed of 1885 dollars.

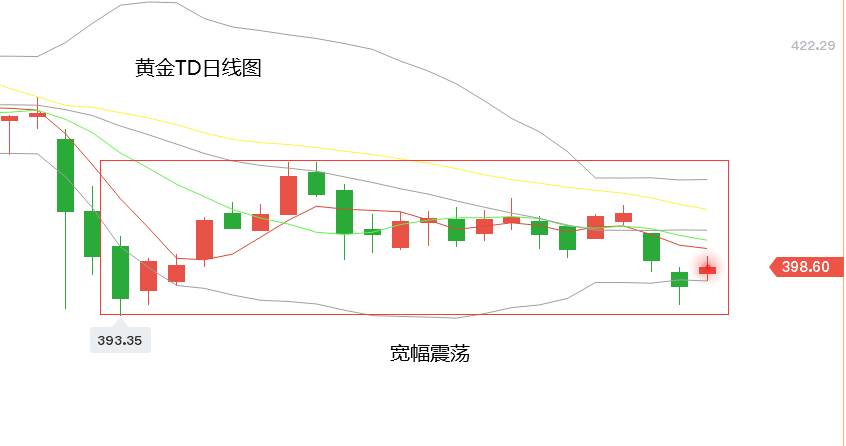

Gold TD: Gold TD fell for three consecutive months. The trend was weak, but the decline slowed. It found support near the 10-day moving average of the monthly line. The position of the 5-day moving average above the monthly line formed resistance. The current price range is from 394.7 yuan to 409.4 yuan. Between. On the weekly line, TD gold, like international gold, experienced a downward trend after two dips. At present, it is near the end of the second shock and the downward trend. There is a directional choice problem for price fluctuations and guidance on market news is needed. Pay attention to the results of the American elections. On the daily line, TD gold has maintained a wide range of 393 yuan to 410 yuan in the past month, and 400 yuan is the decisive position of the obvious price fluctuations. Within four hours, gold rallied slightly after the dip, and its short-term trend was weak and volatile.

Overall, the TD of gold maintains a wide range of shocks, focusing on the previous low near 393.3 yuan, followed by the October low near 394.5 yuan, and the upper resistance focused on near 400 yuan, followed by about 405 yuan, with 400-405 yuan being the most recent. The traditional fluctuation range of TD gold.

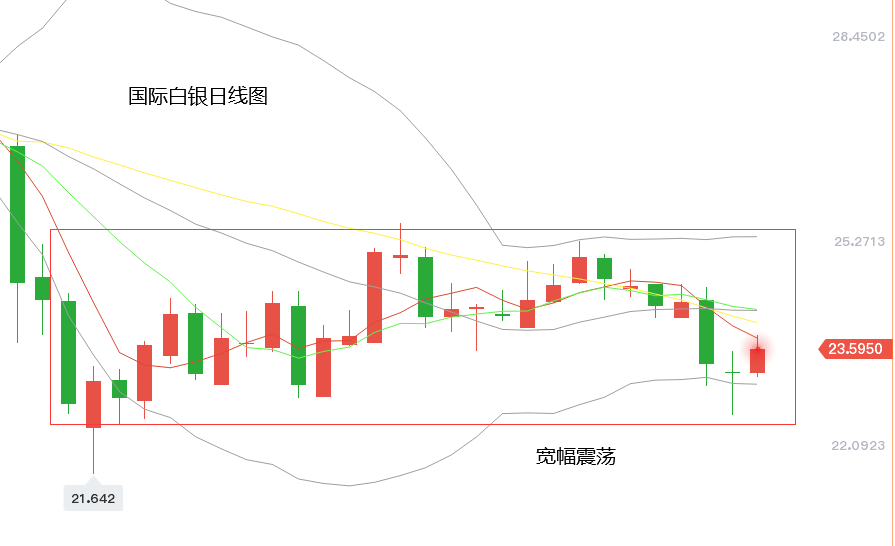

International Silver: After the sharp drop in September, international silver surpassed and fell back in October. It found resistance in the middle track of the monthly Bollinger Band. The top showed strong resistance and the bottom did not refresh the low point any further, showing some degree of support. In the weekly, international silver, like international gold, contracted and oscillated after two falls. In the last week of October, the price of silver fell below the important support position of the weekly Bollinger Band, but then recovered and finally stabilized and closed here, above the 10th. The moving average has formed a major suppression in the last month. In the daily line, international silver was mainly in a wide shock range of US $ 22.5 to US $ 25.5 in the last month, the price of silver fell at the end of October and the trend was weak and volatile . In four hours, silver bottomed out after refreshing this month’s low of $ 22.5, showing some degree of support, but short-term prices found resistance at the intermediate position of the 4-hour Bollinger Band.

Overall, international silver holds a wide range of shocks, focusing on the October low near US $ 22.5, followed by the entire mark of US $ 23, the overhead resistance is near US $ 23.8, the daily moving average position. 5 days, followed by US $ 24.2.

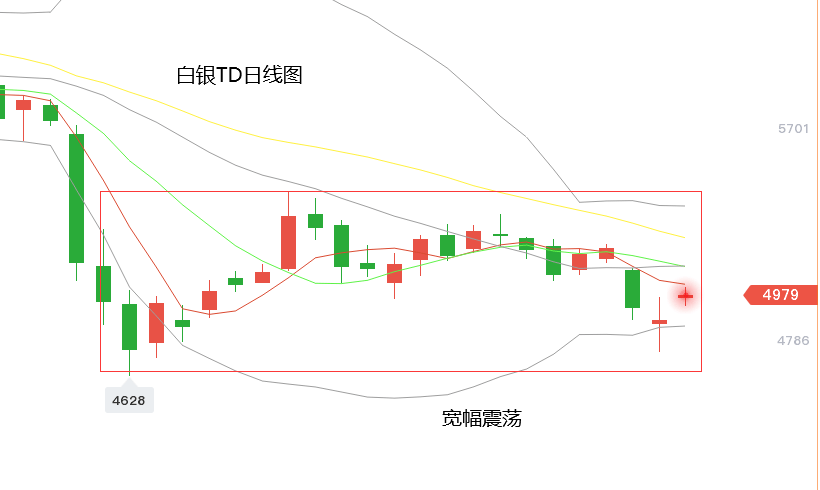

Silver TD: Silver TD has fallen for two months in a row, but the price has not set a new low and all have found support near the 10-day moving average of the monthly line. You can keep paying attention. On the weekly line, after the price of silver collapsed at the end of September, the main support of the silver trend moved from the 10-day moving average to the 30-day moving average, and the price showed a contraction and a shock consolidation. The price of silver fell last week, refreshing the October low of 4,732 yuan. The short-term trend is weak. On the daily line, silver has maintained a wide fluctuation trend between 4600 yuan and 5500 yuan in the last month. Silver fell in late October and the trend was weak and volatile. At present, the Bollinger Band has contracted and flattened, and silver price fluctuations have been further restricted. In 4 hours, silver hit a rally after refreshing the October low of 4,733 yuan. The price once passed the 5,000 yuan mark, but soon fell.

Overall, Silver TD maintains a wide range of shocks, focusing on the Bollinger Band daily bottom lane near 4840 yuan, the 30-day weekly moving average position, followed by the October low near 4732 yuan, resistance The top is centered on the daily 5-day moving average near 5022 Yuan, followed by the Bollinger Band center track at the daily line near 5100 Yuan.Return to Sohu to see more

Editor:

Disclaimer: The opinions in this article only represent the author himself. Sohu is an information publishing platform. Sohu only provides storage services.

[ad_2]