[ad_1]

Original title: Publication of the first list of New Year’s dragons and tigers: institutions and hot money are poured into the same sector, but foreign capital is in a different way

Summary

[Se publica la primera lista de dragones y tigres de Año Nuevo: instituciones y dinero caliente en el mismo sector, pero el capital extranjero es de una manera diferente]After today’s market, the exchange announced the listing of dragons and tigers for the first trading day of the new year. The list shows that both institutional seats and hot money are actively traded, with large purchases of 100 million yuan in many popular stocks with daily cap. The attitudes of foreign investors are different. They are also daily limit actions. Foreign investors are more inclined to buy the aquaculture sector with relatively low valuations. (Shanghai Stock News)

On the first trading day of 2021, the A share market is thriving.The Shanghai Composite Index、Market Business Growth IndexBoth were at important points in the round, with the two cities’ turnover exceeding the billion mark.

After trading today, the exchange announced the first trading day of the new year.Longhubang. The list shows that both institutional seats and hot money are actively traded, with large purchases of 100 million yuan in many popular stocks with daily cap. The attitudes of foreign investors are different. They are also daily limit actions. Foreign investors are more inclined to buy the aquaculture sector with relatively low valuations.

Concentration of institutional placesAdd warehouseMilitary Industry Unit

DongcaiElection dataShow, institutional seats appeared on the list of 37 stocks on the first day of the new year. Sorted by net purchases of listed institutions,Aero motorIn the last three business days, two institutional seats were purchased for a total of 498 million yuan and one institutional seat was sold for 151 million yuan. Listed institutions bought a total of 347 million yuan, ranking first among all stocks.

Records of partial transactions of institutional positions on the Dragon and Tiger List on January 4

Corresponds to the surface of the disc,Aero motorThe share price has continued to rise sharply in the last three business days, with a cumulative increase of 27.22%. This afternoon,Aero motorIt was even higher and closed the price cap, with a total turnover of 4.213 billion yuan during the day, making it the largest single-day turnover in Shenwan’s defense industry.

Driven by institutional funds, Hangfa Power’s short-term share price rose, becomingMilitary sectorA microcosm of the recent surge in funding attention. Also on the list of dragons and tigers announced by today’s exchange,Aviation control、Shanghai Hanxun、Zhongtian rocket、Tianqin TeamThe 4 shares of the military industry were bought in institutional seats,Aviation control、Shanghai HanxunThe listed institutions have net purchases of more than 40 million yuan.

In this round of structural market at the end of the year, thanks to the strongPerformanceCertainly, the military sector has become one of the key directions of the organization.

Feng Fuzhang Core ValuesteamA few days ago, the 2021 military industry annual investment strategy was unveiled. The current economic situation, military industry cycle and order levels are believed to determine the steady growth of the industry in 2020.the companyThe growth rate is still around 30%. Considering that during the “XIV Five-Year Plan” period, aerospace equipment is expected to enter a rapid high volume stage, the industry growth rate is expected to continue to maintain rapid growth, and may show acceleration in 2021 and 2022.

All the veterans hot money seats showed up

Hot and enthusiastic money is naturally unwilling to let go of the recent good market. On the Dragon and Tiger list on the first trading day of the new year, all the first hot money seats appeared on last year’s list.

Stocks bought with hot money are relatively scattered, but they have always been unable to escape the military industry, new energy,food and drinkWait for the latest hot spots.

CITIC valuesShanghai Liyang Road Sales Department will be listed 496 times in 2020, with a total turnover of 28.8 billion yuan, ranking among allBrokerageThird place in the sales department – Today, this seat ranks highZhenhua Heavy IndustryBuy a single-day listing position, the purchase amount is 14,064.8 million yuan, accounting for 7.57% of the total daily turnover of individual shares. From the disk,Zhenhua Heavy IndustryThe share price has risen considerably since the end of last year, in the last 4 trading days it reached 3 daily limits and the accumulated increase reached 32%.

Industrial valuesShaanxiBranch officeIt’s a pop-up seat that came out last year. The stock selection direction of the funds behind it is obviously biased towards first-class stocks that are grouped by institutions. They are interested in small funds with traditional hot money.Market valueThe style of action is different. This seat was listed 453 times in 2020, with a total turnover of 28 billion yuan, ranking fourth among all brokerage business departments.

Today, the seat appeared in the lithium battery leader.Ganfeng LithiumThe single-day listing ranked third among purchases, with a purchase amount of 84,899,700 yuan.Industrial valuesIn addition to the Shaanxi branch, today also addressedGanfeng LithiumThose who bought the list are the headquarters of two institutions,Shenzhen Stock ConnectSeats and hot moneyHuatai ValuesRongchao Business Center Sales Department, Yitian Road, Shenzhen.

Large flows of foreign investment in aquaculture reserves

Unlike institutions and hot money that continue to cluster in popular sectors, foreign investors remain cautious about these sectors with relatively high valuations and continue to explore relatively low-value products in operation.

On the first business day of the new year, the livestock sector renewed its strength and Shenwan’s livestock husbandry rate increased by 8.20% in a single day. Prior to this, the index continued to decline after peaking in July last year, until it fell more than 20% from the peak late last year.

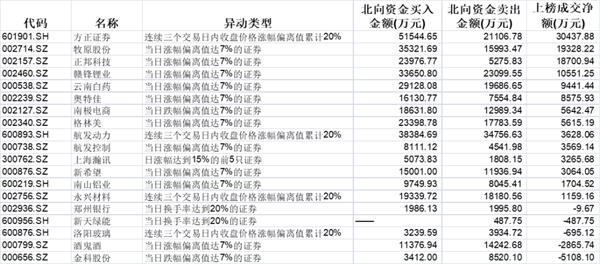

Data visualization,Shanghai Stock ConnectThe SZSE and Shenzhen Stock Connect seats appeared on the 19-share list today. Among them, 4 shares with a net purchase of more than 100 million yuan areMuyuan shares、Zhengbang Technology、Founder’s valueswithGanfeng Lithium。

Northbound Funds Jan 4 Dragon and Tiger List Transaction Logs

Pig tapMuyuan sharesEarly todayBlock daily limit, The trading volume was 3.265 billion yuan for the whole day. On the list of dragons and tigers for a single day outside of business hours, Shenzhen Stock Connect ranked first in purchase, buying 353 million yuan and selling 160 million yuan, achieving a total net purchase of 193 million yuan.Zhengbang TechnologySimilarly, the daily limit was earned and the Shenzhen Stock Connect seat was also the highest buy, achieving a net purchase of 187 million yuan.

PorkpriceThe recent rally is one of the factors driving the recovery in share prices in the aquaculture sector.National Statistical OfficeThe announced changes in the market prices of important means of production in the field of circulation at the end of December 2020 show that the price of live pigs (three external yuan) increased by 2.9% to 34.9 yuan per kilogram at the end of December 2020 compared to mid-December.RMB。

andMuyuan sharesThe latest pig sales report also shows that in December 2020,ProductThe price of pigs shows an upward trend as a whole. The average selling price of the company’s commercial pigs is 30.15 yuan / kg, 14.55% more than in November 2020.

Kaiyuan Securities stated in its 2021 investment strategy for the agriculture, forestry, livestock and fisheries industry that after the outbreak of African swine fever, the costs of reproduction between different entities have diverged significantly and the transformation has become a consensus of the industry. However, it takes time to accumulate experience and it is difficult for most of the production capacity to achieve low-cost reproduction in a long time dimension. At this point, the headcompanyDepend onborrowThe rich experience and learning capacity accumulated in the early stage continue to iterate on their own breeding system, and the cost level that has been lower than that of peers also shows that their competitive advantage will continue for a long time.

(Source: Shanghai Securities News)

(Editor in charge: DF537)

I solemnly declare: The purpose of this information is to spread more information, and it has nothing to do with this booth.

[ad_2]