[ad_1]

Original title:[Cierre del oro]With the strong news coming out of the US election soon, will gold drop to a minimum?

Latest market news

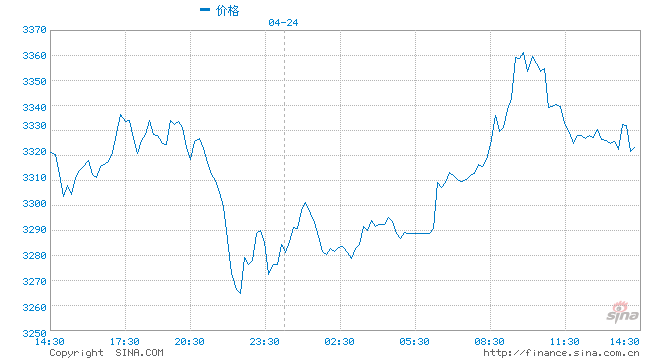

Hot market on Thursday (Oct 29): Spot gold continued to decline sharply, with the lowest falling to $ 1,859.87 per ounce, and the highest falling to more than $ 25.silverBelow the 23 mark, the low touched US $ 22,573 / ounce. Market risk sentiment has fallen sharply, and the joint decline in the European and US markets has also affected risk assets.rawprice. At the same time, hit by the epidemic, prospects for already weak crude oil demand have become more fragile and oil prices have met a “double death” and then collapsed.

OvernightGold priceIt fell 1.61% because there are no signs that the United States will take fiscal stimulus measures to reduce the impact of the new corona epidemic on the economy. The investor bought US dollars. The US dollar index posted the largest increase in 11 business days, dragging the price of gold down. Also, the US elections due to the increase in the T-Lang-Pu support rate have led to a bullish dollar and gold is temporarily on the defensive.

On Thursday night Beijing time, investors will introduce US third-quarter GDP data. If the performance of the data falls short of expectations, it may increase investor concern about the recovery of the US economy, thus exacerbating the stock market crash, and gold prices may take another hit. Since there is no indication that the United States is about to take fiscal stimulus measures to reduce the impact of the new corona epidemic on the economy, investors bought dollars. Furthermore, investors are concerned about the increase in new coronavirus cases in Europe and the uncertainty of the US presidential election next week, choosing the US dollar as their preferred safe haven currency.

As for the epidemic: Germany and France, two of the main European countries, announced on the 28th the closure of their entire territory. European equity markets fell across the board, dragging the euro down and supporting the dollar. The Dow Jones Industrial Average and the Standard & Poor’s 500 Index also posted their biggest declines since June. A lot of data was released that day, including the third quarter GDP and the basic US PCE price index, the unemployment rate and the CPI in Germany in October, the Bank of Japan’s attention to the announced interest rate resolutions. by the Bank of Japan and the European Central Bank and the speeches of two central bank governors.

At the same time, the proximity of the US elections has also tested investors’ nerves. With just six days left until the election, Wall Street’s panic index rose to its highest level since June 15. Concerns that the winner might not be announced on the night of November 3 also spurred the market sell-off. According to Reuters / Ipsos polls, Democratic presidential candidate Biden leads President Trump by 10 percentage points nationally, but in the undecided states that will determine the outcome, competition is stagnant.

Important events affecting gold and the reasons for the decline:

① The two parties in the United States faced each other over the new round of economic stimulus bills. Trump and his aides blamed House Speaker Pelosi, hinting that they would not approve the economic stimulus plan before the US elections and that it would be implemented anytime soon. Press gold prices. At the same time, severe epidemics in Europe and America pushed up the safe-haven dollar and put pressure on gold prices. On the other hand, when looking at the huge challenges facing the US economy, the likelihood of new lax stimulus is relatively high, and a further increase in the price of gold after the adjustment remains a high event. probability.

②The results of the current US general elections generally favor Biden’s election. Biden’s election means that the market will usher in further economic stimulus. At that point, the dollar index will fall and the demand for hedge and safe-haven gold will form support. But the US dollar index has fallen from 103 to around 92 in a row, and there are expectations for Biden’s election.

Furthermore, the European and American epidemics recovered strongly and the demand for the US dollar as a safe haven currency rebounded. The number of recently confirmed cases in the Midwest of the United States has risen and the number of hospitalizations has reached a record high. According to Reuters statistics, in the last seven days, about 500,000 people in the United States have been infected with the new corona virus. To slow the spread of the epidemic, Illinois, New Jersey, Idaho and other states have successively introduced a new round of restrictions. Hospitals in many European cities are almost full. German Chancellor Merkel agreed to impose a partial month-long blockade on Germany; French President Macron is considering tougher restrictions and plans to restart the country for a month starting at midnight tomorrow. Blocking. The rate of increase in new coronavirus cases is alarming and new lockdown restrictions have been imposed, raising concerns that economic growth will weaken again. Along with the uncertainty about the actual outcome of the US election, investors are being forced to withdraw their bearish bets on the dollar.

Gold technical analysis

Gold crashed yesterday, world stock markets crashed, as did gold and silver. Gold fell below the recent low of 1890 and then fell to the lower line of 1869, but there is still room for the more important support below 1848, indicating that it became short in the short term and yesterday closed the great Yinxian. These days you may hit the low before the decline, but the overall fluctuation is still within 1933-1848, and we can only look at the wide-range fluctuations first.Fang focused on the 1848 support. If it breaks, it will open the space below. In the medium term, it will become emptier and will call again. Before the American elections, focus on the fluctuations of the 1848-1933 interval, and finally, wait for the election results.It is impossible to judge whether it will be a big increase or a big drop after the election. You can wait for the result to show your address before proceeding.If it falls below the 1848 support, the final callback target may be 1700-1600 in the future.(Please note that the analysis graph below was drawn in the morning, but it does not affect the trend. The shock has broken at present. Pay attention to 1876-1890 above)

From the 4-hour chart, gold fell and fluctuated. It is currently below the short-term line, the short-term line is going down, the medium-term line is going down, the MACD is going down, the KDJ is going down, and the indicators are bearish. Gold was still fluctuating in the triangle range before. Yesterday, it collapsed abruptly. It fell below the range of the triangle and accelerated its decline. It fell to the 1869 line at the lowest point. At present, it has not really stabilized. In the short term, it may fall further. The impact is important. Supported by the 1848 low, if it breaks below, it will shorten in the medium term. If it does not fall below and stabilize, there may still be a sharp rise. Therefore, it is not yet possible to say that it will fall in the future, and it can still be repeated.Today’s short-term trade, Guo Yuyuan, suggests being short-term first and bouncing first. The long-short inflection point is 1885, below which it is possible to look to 1869, then to 1858 and 1848. If you break 1885, you can look to 1890, 1895 and 1900. The top focus is on the resistance of 1885-1890 , and the bottom focus is on the 1860-1855 bracket.

——Gold Operation Strategy Recommendations——

Multiple strategy

Reference idea 1: Gold callback is very close to 1865-1867, stop loss is 1859, profit limit is close to 1880-1885 (recommendation is for reference only, investment is risky and must be careful when entering the market)

Reference idea 2: gold falls back around 1850-1848, stop loss in 1845, target 1860-1870-1880, breaks around 1885-1900-1910 (recommendation is for reference only, investment is risky, you should be careful when entering the market)

Empty order strategy

Reference Idea 3: Gold bounces in the vicinity of 1885-1890. The entity can go short without breaking, stop losses in 1896, stop gains, around 1870-1860, and look at the 1840-1810-1790 range in the long term. (The recommendation is for reference only. Investment is risky. Be careful when entering the market)

Reference Idea 4: Gold bounces back to 1905-1910 without breaking near gap, stop loss in 1915, stop gain, 1900-1880, and look at the band near the 1860-1840 range (recommendations are for reference only, the investment is risky and you should be careful when entering the market)

Before the general election approaches, do not be preconceived in the operation and think that the future will definitely go up or down. The actual direction will remain clear after the end of the US general election. Although it is currently volatile, it can stabilize and rebound at any time, so you need to be cautious in trading. Just wait for the market to stabilize before entering the market, aggressive trading should be abandoned! The most stable thing is to wait for the elections to finish and then follow up. The duration will not be short. Don’t be afraid to miss opportunities. There are opportunities and the most important thing is to control the risks.

Massive information, accurate interpretation, all in the Sina Finance APP

Editor-in-Chief: Tang Jing