[ad_1]

oneCommentary

The

2020-04-26 08:46:40

Source:Prism

Author:Li Ran

The next Guodian Nanzi

In the early morning hours of September 11, 2001, Robert Iger, 50, was training at his home in the morning.

He was promoted to chief operating officer of Disney a year ago and became the company’s second-in-command. Iger moved his family from New York to Los Angeles, but he still doesn’t change the habit of getting up at 4:15 every day.

More than five in the morning, he watched television and saw a passenger plane burst into the North Tower of the World Trade Center. At this time, New York on the east coast was the peak of the morning. Before he could react, six minutes later, another passenger plane hit the South Tower of the World Trade Center.

This attack shocked the world and also shocked Disney – no one knows where the next target will be. On the way to the company, Iger contacted Disney CEO Michael Eisner to discuss countermeasures, and the two decided to close the two Disneylands immediately.

However, the crisis soon came to Disney’s head. In just a few days, Disney’s stock price fell three-quarters. The drop triggered a liquidation and major shareholders were forced to sell $ 2 billion in shares, prompting another round of declines.

The instantaneous closure of the tourism industry soon turned into an economic downturn, and all commercials at the Disneyland, ABC TV and movie box offices were affected. Disney lost $ 158 million that year and laid off more than 4,000 people.

19 years later, Disney again found a crisis, but it was only an improved version of the plot: the world’s six major Disney parks were closed, the theater box office hit was collectively withdrawn, and its television stations had almost no shows. To trow. Since April 20, Disney stopped paying wages to its 100,000 employees to save $ 500 million in monthly expenses, almost half of its employees worldwide are affected.

Disney’s share price has also plummeted. Market value has evaporated more than $ 80 billion in two months. The share price fell back to the level of six years ago. In mid-April of this year, NETFlix had exceeded market value.

Who can think that Disney, which has been considered a benchmark by the global entertainment industry, was the most affected in this epidemic? Two months ago, Iger had just retired from the CEO position, and now he has to get his shirt back to save the Disney Empire from blood loss.

Reconciliation with Steve Jobs, revival of Disney animation, acquisition of Pixar and Marvel, construction of Shanghai Disney, acquisition of Fox, entrance to the media … In the last 15 years, Iger has done enough to influence at Disney’s destination.

In his tenure, Disney’s market value has soared from $ 46.7 billion to more than $ 270 billion, an increase of nearly six times. Before Iger resigned, I thought I had clearly planned the future, but I didn’t expect the epidemic to interrupt all rhythms.

This time, can Disney’s Son of Heaven still change course?

Paradise lost a billion dollars, Iger’s comeback challenge is huge

Robert Iger suddenly resigned two months ago.

On February 25, Disney announced that Iger, who had been in command for 15 years, had resigned as CEO, his powerful general Bob Chapek took office for a two-year term, and the decision went into effect immediately.

Shortly before Iger left, Disney had just released good news: Disney +, the streaming medium that is undergoing the company’s transformation, has registered 26 million registered users in North America in just two months, exceeding management expectations. At the same time, several blockbuster movies like “Hua Mulan” are also set to come out.

The only bad news is that Shanghai and Hong Kong Disney had to close due to the new crown epidemic. At the time, Disney made a projection that the two Disney companies expect to close for two months and would lose $ 175 million.

It seems that expectations at the time were still overly optimistic. In the following month, things fell sharply: After March, infected people grew exponentially in Japan, South Korea, Europe, and the United States. After participating in the general meeting of shareholders to announce the delivery in early March, Iger and Bao Zhengbo went directly to Orlando Disneyland for inspection. The next day, they announced the closure of the two main Disneyland parks in the United States.

So far, all six Disney parks in the world are closed. From paradise to the cruise ship, through movies and television stations, Disney’s main business sectors have not been spared.

On March 23, Disney’s stock price fell to $ 85.7, which is almost a record low compared to the record high of $ 150 last November.

In this case, the New York Times reported in mid-April that after Bao Zhengbo briefly took office, Iger recently regained power to participate in major Disney events as chief executive.

“This big crisis has a big impact on Disney and he decided he should go back to help.” Iger said in an email to the “New York Times”: “The company is happy to come back to me, after all, I have been the leader for 15 years.”

After returning, Iger faced a tough battle.

The two largest Disneyland parks in the US USA They must be closed at least until the end of May, and Tokyo Disneyland must be closed at least until mid-May. China’s two largest Disney companies have closed for three months since the end of January.

“Prism” previously reported that the top two Disney companies in the United States will lose $ 200 million in half a month and will then feature all four Disney companies in China, Japan and France. The park business is estimated to lose at least $ 1.3 billion. If the US epidemic USA It still does not decrease in June, this number will double.

Four Disney cruises were also declared closed for two months, and three new cruises are still under construction. However, the tragedy of the “Diamond Princess” has made the entire cruise industry bleak for the next two to three years.

Paradise is Disney’s largest business unit, with annual revenues of more than $ 26 billion. To cut costs, as of mid-April, more than 70,000 employees of the two largest Disney parks in the United States will be suspended from work and only a few hundred people will be responsible for maintaining the park. If you count the four parks abroad, there will be more than 100,000 Disney employees worldwide who have no job to open.

The second largest business segment with annual revenues of more than $ 20 billion, the television network business, has also been mixed. The good news is that its ABC and other television stations are welcoming new highs for the user’s home, and the concern is that the television show during filming and broadcasting will be discontinued starting in late April, and advertising revenue will also decrease. Among them, ESPN, which lived on live streams, was the most difficult: the NBA, NHL, MLB, and other major events were closed. The rankings of this paid channel have fallen by more than half.

The cinema department with unlimited landscapes is also in chaos. “Mulan” and “Black Widow” with an investment of 200 million US dollars were postponed to July and November of this year, respectively. Pixar’s new movie “The Magic of 1/2” closed when the theater closed and had to be streamed online.

To give an example, Iger and Bao Zhengbo have announced that they will abandon this year’s salary, and the management of their vice presidents and superiors has also collectively reduced their salaries. Iger’s base annual salary is $ 3 million, but after calculating various types of compensation, options, and stock awards, he received $ 47.5 million last year.

Faced with this protracted war, according to the New York Times, Iger is already considering giving up his television stations for advertising and investment promotion meetings, and the trial broadcast of television shows will be cut, and even expenses will be cut. of office space.

Earn the trust of Steve Jobs

Ten years ago, it was another crisis Disney fell into that gave Iger a chance to take over as CEO.

When the September 11 incident occurred in 2001, Iger was finally promoted to Disney’s chief operating officer, and at this time Disney’s various businesses were under pressure.

Disney’s film business was based on animation at the time, but due to fear of Eisner’s Disney chief executive officer, Eisner, of “manipulating” his subordinates, including Iger, Kazanberg, who was in charge of the film. , went to create DreamWorks. In the early 2000s, Disney Animation headquarters has decreased significantly.

After the September 11 outbreak, Disneyland, the largest revenue segment, was hit hard. Not only did it expose Disney’s business problems, but the conflict between Eisner and the board also emerged.

The second generation of the Disney family, Roy Disney, is a member of the board of directors. He was already dissatisfied with Eisner. In 2003, he launched a vigorous “Save Disney” campaign, which reduced Disneyland’s popularity, declining television ratings, and deteriorating relationships with Pixar. Eisner’s problems are all the same size. Shareholders refused to extend Eisner’s term with a high electoral participation rate of 48%.

In 2005, Eisner, who had finished his term, relented, and second-hand Iger became the CEO of Disney.

After taking office, Iger quickly avoided the major mistakes made by his predecessor and overcame the crisis with clever tricks.

The first big thing is making friends with Roy Disney. Iger saw Roy Disney’s willingness to intervene in Disney affairs, hired him as a Disney consultant, supported him to return to the board of directors as honorary director, and actively invited him to participate in public events such as the opening of the inaugural film. Disneyland and company celebrations. Roy Disney quickly abandoned the boycott and the crisis was resolved.

Immediately after Iger changed the company’s administrative structure, he drastically cut off the strategic planning department left behind by his predecessor. At the time, the Strategic Planning Committee was Disney’s central department. There were more than sixty people, all of them MBA graduated from the best business schools. Large and small Disney companies had to deal with this department.

But Iger, who stepped up from below step by step, always disliked this department that lacks practical experience. After cutting dozens of executives, the royal business department regained operational decision-making power, morale rose dramatically, and Iger also received more support within the company.

Finally and the most critical step: repair the relationship with Jobs. After Kazanberg’s departure, Disney’s animation business was in jeopardy, and 3D animations such as “Toy Story”, “Monster Power Company”, “Undersea Story” and “Superman Story” released by Pixar to Disney were sold.

However, eccentric work is not easy to deal with. Iger took advantage of this and strongly supported the new Apple iPod: Apple users can download Disney’s popular American dramas through iTunes on the first day of the product’s launch. Upon discovering that Iger was different from his predecessor, Jobs’ attitude softened.

Eiger immediately began promoting a bolder plan: Let Pixar rescue Disney animation. In his opinion: if the Disney animation drops, all Disney will be gone.

Pixar was a public company at the time, with a market value of $ 6 billion. In Iger’s eyes, Pixar’s most valuable asset is not the animation, or Jobs’s name, but Pixar’s highly imaginative creative team. “In the content industry, the most critical asset is not hardware or intellectual property, but talent.”

Eiger first convinced the board of directors to support him, and then found the courage to find jobs. He thought he would be ridiculed, no one thought Jobs was surprised. He invited Iger to visit Pixar. The creators of Pixar showed him the “Racing Story” he just completed, “The Ratatouille Story” and “Robot Story” still in production, and the “Flying House Journey” and the “Brave Legend” just finished start. Continuous creativity is completely shocked.

Then Jobs made an offer: $ 7.4 billion. Far above Pixar’s market value.

But a few months later, Disney devised a wholly owned acquisition plan, making Jobs one of Disney’s largest individual shareholders.

On January 24, 2006, Disney officially announced the acquisition of Pixar. At this time, Jobs had already trusted Iger. Half an hour before the transaction was announced, Jobs told Iger: His pancreatic cancer had relapsed and there wasn’t much time left. In addition to Steve Jobs’ doctor and family, he was the first stranger to hear the news.

It is of great importance to earn Jobs’ trust. In 2009, it was with Jobs’ backing that the major Marvel shareholders agreed to sell the company to Disney. (For details, see “Who is the creator of Marvel’s 20 billion box office?”)

Jobs died in 2011. Iger said in an autobiography published last year: If Jobs is still alive, Disney and Apple may have merged into one company.

Ai format expansion: Marvel, Star Wars and Shanghai Disney

After introducing Pixar executives as John Lasseter, the Disney headquarters animation finally “revived.”

In 2010, Disney’s first 3D animation “Tangerine” topped $ 500 million at the box office. It was Disney Animation’s most successful work in the 16 years since the “Lion King” in 1994. Three years later, “Frozen” finally reached the top in one fell swoop, not only did it win the best Oscar-winning animated feature film. It also became the most commercially successful animation in Disney’s nearly 100-year history, from the box office to the soundtrack and Aisha’s sold skirt.

Disney’s expansion under Iger’s leadership has just begun. During his appointment as CEO, Iger proposed three main strategic objectives for Disney to the board of directors:

1. Time and capital must be used to create high quality branded content;

2. We must embrace technology holistically, use it to create high-quality products, and deliver them to consumers in a more timely manner;

3. Become a truly global company;

To achieve the first main objective, Iger’s strategy is to continue acquiring the most promising content (capital) brands commercially, and then rationalize the Disney movie list and lean towards box office success (time).

Three years after the Pixar acquisition, Disney first grabbed Marvel for $ 4 billion, and three years later it bought Lucasfilm, which owns the rights to the Star Wars series, for $ 4.05 billion.

As Iger said, the most critical capital of content companies is not intellectual property but talent. When Disney announced the acquisition of Marvel, the outside world doubted whether this transaction was a loss, because Marvel had already sold the best-known IP: Spider-Man had already been sold to Sony, X-Men, and Fantastic Four. With Fox, the Hulk is in the hands of the world.

But Iger has a bottom of my mind: Before the acquisition, Kevin Fitch of Marvel Pictures had made clear to him the Marvel movie’s plan for the next ten years. As long as the movie is on, these characters will soon become big IPs, bringing new growth points to film and television companies, paradise and Disney derivatives.

With Pixar, Marvel, and Star Wars, plus the resurgence of its own animation, Disney abandoned small and medium-cost movies, and leaned entirely toward high-entry and high-exit blockbusters. In 2019, the number of films released by Disney in a year is only half or even 1/3 of its counterparts in Warner, Universal, etc., but it has garnered 7 highly successful films with a global box office of over a billion dollars, and the total box office exceeded 13 billion dollars.

After increasing content production capacity, it is imperative to increase revenue and realize it. Drawing on the experience of his predecessors, Iger also launched a new round of Disneyland construction plans.

Paradise is Disney’s firm, and every CEO wants to maintain its performance. For Eisner, his performance was Paris and Hong Kong Disney, and for Iger, it was Shanghai Disney. From site selection to park opening, it went on for eighteen years.

In 1998, his wife, who got the baby pregnant in September, flew to Shanghai for the first time to inspect the Disneyland site, and finally discussed with China the location of Pudong in the Shanghai suburbs.

Iger recalled in his autobiography that Pudong at the time was far from being modernized: “There are more bikes than cars. Most of the places we pass are towns. There are wild dogs running on the road.”

Facts have shown that the world has underestimated China’s development speed and Chinese people’s enthusiasm for Disney.

2016 Shanghai Disneyland opened. Before opening, Wang Jianlin, the boss of Wanda, said: Wanda is here to make Disney unprofitable for 20 years. But 15 months after it opened, Shanghai Disney started making money.

Shanghai Disney, from the official website of Shanghai Disney

The opening of Shanghai Disneyland has made Disney’s global design a big step forward.

“Only Disney can contend”

In fact, a few years ago, Iger had already begun to consider his career after retirement.

After completing three strong acquisitions of Pixar, Marvel, and Lucasfilm, Shanghai Disney also opened successfully, and Iger’s status in Hollywood is second to none. “” Executive Director “CEO of the Year”, “” Zhongyi “Annual Entertainment Characters”, “” Annual Business Characters “” Times Weekly “… Various media are chasing him to wear a high hat.

At this time, Iger once considered participating in the US presidential election. USA 2020 after the contract expires in 2018. To this end, he also studied the US health insurance, tax, immigration and international trade policies. USA

But in August 2017, an invitation from Murdoch changed Iger’s plan: The media mogul invited Iger to his family to speak about Hollywood erosion by the Silicon Valley tech company.

For Amazon, Netflix, Apple and other companies in the big motion of the film and television industry, Iger knows well too: be it Murdoch’s Disney or 21st Century Fox, they are seeing their users flow to their competitors.

Right now, Amazon’s market value has exceeded $ 600 billion, Apple exceeded $ 800 billion, and Disney’s market value is 160 billion, and Fox’s assets are less than 50. billion.

“We (Fox) have no scale to fight against, the only one with scale is you (Disney).” After hearing Murdoch repeat this sentence several times, Iger understood the lead. After hearing the views of his subordinates, he called Murdoch the next day and formally proposed to acquire Fox’s assets.

In December 2017, Disney officially announced that it would acquire the majority of 21st Century Fox’s assets for $ 52.4 billion. After Murdoch deliberately let him go, Comcast also joined the tender, increasing the bid with a bid of $ 65 billion.

It was not until March 2019 that Disney and Murdoch finally reached an agreement to acquire Fox Film, National Geographic Channel, FX TV and other Fox assets under $ 71.3 billion.

When Murdoch accepted the Disney acquisition, he proposed an additional condition: Iger must continue to serve as CEO. After Murdoch’s request and Disney’s high-wage stay, the CEO’s term of Iger was extended again until 2021.

Looking back, it can be said that the acquisition of Fox by Disney is a replica of the acquisition of ABC by Disney that year: through these two acquisitions, Disney achieved a substantial increase in assets, escaped twice from the wave of mergers and acquisitions in the media industry and remained independent. During this period, competitors Warner, Universal, Paramount and Colombia were saved and were successively acquired by large media groups.

After completing the Fox acquisition, Disney’s market value exceeded $ 200 billion, the brand’s territory expanded further, and Fox’s assets in Europe, India and other foreign markets were also obtained.

At this point, the three strategic objectives set by Iger 15 years ago have completed two of them, leaving only the last one: How does Disney use technology to retain its audience?

Before Murdoch reached the door, Iger had already paid attention to the general trend of media streaming. In 2015, a company called BAMTech, before the fifth season of “Game of Thrones” aired, created HBO Now, the first broadcast medium for HBO, that made Disney stand out. The company started by developing an online platform for Major League Baseball (MLB), and the media streaming technology is very mature.

Disney first invested in BAMTech for $ 1 billion in 2016, hoping that this company will create broadcast media for its sports station ESPN. As large numbers of users turn to watch live streams online, ESPN paying users have suffered a huge loss, impacting Disney’s performance.

On August 10, 2017, Disney spent nearly $ 1.6 billion to acquire the remaining shares of BAMTech and became a wholly-owned shareholder. At the same time, it announced in the financial report that ESPN and the Disney broadcast media They will be released in 2018 and 2019, respectively.

As soon as it was over, Disney’s stock price rose sharply.

Defending the broadcast media: Disney’s transformation is imminent

At the time, even investors knew that the enemy was almost around the corner.

In 2017, entering the streaming media decade, Netflix’s annual revenue exceeded $ 10 billion, this year the total box office for North American theater movies was $ 11 billion. In other words, it took Netflix ten years to recreate a movie market.

Disney’s transformation cannot wait any longer. After announcing the commercial media broadcast schedule, Iger summoned the heads of his film and television departments to meet one by one and asked them to dedicate their energy to creating new content for the new broadcast media.

Streaming media is new to Disney as a whole, but for executives there is an additional hurdle: their salary is closely related to the performance of their respective business units, but to invest in streaming media, not only did Gain not start , but also loss.

To motivate executives to participate in this long-term strategy-related business, Iger, with the support of the board of directors, proposed a special reward for actions for executives who actively respond to the broadcast business.

In November of last year, Disney’s broadcast media, Disney +, was officially launched in North America and the Netherlands, and gained 10 million users on the first day of launch. In March of this year, Disney + entered 8 countries, including Britain, France, Italy, and Germany, and relied on Fox’s Hotstar to enter the Indian market in early April.

On April 8, Disney announced that Disney + paid subscribers exceeded 50 million; It took Netflix seven years to reach the same number of subscribers. Hulu and ESPN +, Disney’s other two main streaming media, have surpassed 30 million and 7.6 million paying users, respectively.

Judging from the situation after September 11, Disneyland’s popularity must be restored for at least a year. The impact of the epidemic on the television business will collectively appear in the second quarter as soon as possible: on the one hand, paid users who do not have ESPN live streaming will accelerate the loss, on the other hand, advertising revenue from public television stations like ABC will also decrease.

The annual revenue of tens of billions of dollars in the film industry sector, not only to survive the collective closure of world cinema in the first half of the year, but also carry the additional cost of hundreds of thousands of dollars per day caused by the blocking of “Shang Qi” and other highly successful movies. To minimize the loss, Disney put the Pixar animation “1/2 Magic” on the broadcast media half a year in advance, and motion pictures like “Artemis’ Fantasy Adventure” and “New Mutants” will also be released. Do the same.

That is, under the influence of the epidemic, Disney’s only media streaming business is growing rapidly. As the only Hollywood giant to launch a streaming business before the epidemic, Disney also monopolized epidemic dividend competitors Warner and HBO Max and Peacock, the global affiliate’s broadcast media, only arrived late in May and July. .

But unfortunately, the media streaming business needs a lot of capital to invest in content. The early years are destined to lose money and can only rely on the “transfusion” of the business sector with stable gains.

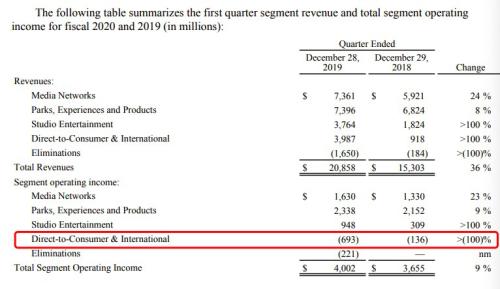

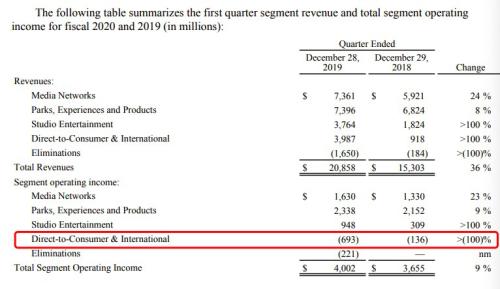

“Prism” looked at Disney’s financial report and noted that in the first quarter of fiscal year 2020 (October-December of last year), Disney’s broadcast and international business lost nearly $ 700 million (below), an increase significant of 5 with respect to the same period of the previous year. The billions of dollars are primarily due to the loss of Disney + online, ESPN +, and the loss caused by the acquisition of Hulu, another major streaming medium after the Fox acquisition.

This means that the loss of the media streaming business throughout the year can be more than $ 2 billion.

When other affairs are carried out normally, Disney can handle it. However, the deterioration of the epidemic has seriously damaged Disney’s businesses, and all plans have to be reopened.

Due to high mergers and acquisitions of Fox assets, plus the initial investment of several major broadcast media, last year Disney’s total liabilities (total liabilities) exceeded $ 100 billion, current liabilities (current liabilities). ) increased to almost $ 34.8 billion. Among them, the loan maturing in one year reached $ 10 billion, and at the end of last year, Disney had only $ 6.8 billion in cash.

For this reason, Disney had to issue $ 6 billion in debt in mid-March to cope with the next debt payment pressure.

If the epidemic continues for a long time, Disney’s broadcast media is also at risk of breaking down. As a new platform, Disney + desperately needs to produce world-class exclusive content to entice viewers to pay, but “Falcon and Winter Soldier,” “Wanda Vision,” “Rocky” and other high-profile Marvel episodes have been hit. He was forced to stop filming.

The next few months may be the most difficult time for Iger since he took over as CEO. Whether he can survive the epidemic will ultimately determine what kind of legacy Disney has left.

Eiger rarely shows anxiety in front of people. Tuiteó el mes pasado, citando la famosa cita del líder de los derechos civiles Martin Luther King: “El criterio final para medir a una persona no es mirar su desempeño en la prosperidad, sino ver cómo enfrenta desafíos y disputas “.

No es tanto decirle a los 220,000 empleados de Disney que esta oración es más como animarse a sí mismo.

Materiales de referencia:

1. The Ride of a Lifetime, Robert Iger, Random House;

2. Bob Iger pensó que se estaba yendo arriba. Ahora, él está luchando por la vida de Disney, NYT;

3. El pago anual del CEO de Disney, Bob Iger, cae a $ 47.5 millones, The Hollywood Reporter;

4. The Big Picture, Ben Fritz, Houghton Mifflin Harcourt Publishing Company;

5. “Disney War”, James B. Stewart, CITIC Publishing House;

6. El recuento de suscriptores pagos de Disney + supera los 50 millones de hitos, el sitio web oficial de Disney;

7. Informe financiero de Disney FY2020Q1 &; FY2019Q4, el sitio web oficial de Disney;

8. Netflix Financial Report FY2017, sitio web oficial de Netflix;

9. Historia del precio de las acciones de Disney-58 años, tendencias macro;