[ad_1]

Original Title: Bitcoin Is Crazy Again, Has The Russian Army Become A Gamer Behind The Scenes? The price exceeded $ 56,000 and 85,000 people broke their positions in 24 hours! Can you guide the rebound in A-shares this time?

Summary

[Bitcoinsevolviólocodenuevosuperólos56000dólaresestadounidensesy85000personasrompieronsusposicionesen24horas¿PuedeestavezguiarelrebotedelasaccionesA】Alas9:?30pmdel10demarzohoradeBeijingEstadosUnidosanuncióelIPCparaelajusteestacionaldefebreroquesubióun04%mesamesyseesperaquesubaun04%yelvaloranteriorsubióun03%DespuésdelapublicacióndeestosdatoselíndicedefuturosdeaccionesdeEEUURepuntóentodoslosámbitosyelaumentodelosrendimientosdelosbonosdeEEUUSeredujoYlomáslocoesBitcoinTraselanunciodelosdatosanterioresBitcoinacelerósutendenciaalcistaysuperólos$56000Enlasúltimas24horasmásde85000personashanperdidosusposiciones(CorredordeChina)[¡Bitcoinsevolviólocodenuevosuperólos56000dólaresestadounidensesy85000personasrompieronsusposicionesen24horas!¿PuedeestavezguiarelrebotedelasaccionesA?】Alas9:30pmdel10demarzohoradeBeijingEstadosUnidosanuncióelIPCparaelajusteestacionaldefebreroquesubióun04%mesamesyseesperaquesubaun04%yelvaloranteriorsubióun03%DespuésdelapublicacióndeestosdatoselíndicedefuturosdeaccionesdeEEUURepuntóentodoslosámbitosyelaumentodelosrendimientosdelosbonosdeEEUUSeredujoYlomáslocoesBitcoinTraselanunciodelosdatosanterioresBitcoinacelerósutendenciaalcistaysuperólos000Enlasúltimas24horasmásde85000personashanperdidosusposiciones(CorredordeChina)

Bitcoin is crazy again!

At 9:30 pm on March 10 Beijing time, the United States announced the seasonal adjustment for February.CPI, Up 0.4% month-on-month, it is expected to rise 0.4%, and the previous value rises 0.3%. Following the release of this data, the US equity futures index rebounded across the board and the rise in US bond yields slowed. And the craziest thing is Bitcoin. Following the announcement of the above data, Bitcoin accelerated its uptrend and surpassed $ 56,000. In the last 24 hours, more than 85,000 people have lost their positions.

Judging from the news, according to the Xinhua Daily Telegraph, the Russian military is also mining Siberia recently.China Merchants ValuesPrevious report, BitcoinpriceOnlybadgeOf the mirror. The higher the level of international liquidity, the higher the price of Bitcoin. Also, the trend of the price of Bitcoin takes A shares to a certain extent. So when Bitcoin hits its previous highs again, can it again guide A stocks to rally?

Bitcoin’s skyrocketing = continuation of expected water release?

The most important data in the world is the United States price index. The data came out at 9:30 p.m. Beijing time on Wednesday. The US CPI rose 0.4% month-on-month after February seasonal adjustment, and is expected to rise 0.4%, with the previous value rising 0.3%; the underlying CPI was not seasonally adjusted in February.Year with yearIncreased 1.3%, expected to rise 1.4%, previous value increased 1.4%, non-seasonally adjusted CPI increased 1.7% year-on-year in February, expected to rise 1.7%, previous value increased 1.4%.

After the release of this data, some organizations said that due to improving public health and gradually increasing demand for services such as air travel, the US CPI rose steadily in February and recorded the largest annual increase in a year. core inflation remains subdued. With the data falling short of expectations, the pattern of global asset prices changed in an instant.Oil priceThe rapid rise, the US dollar index plummeted, US 10-year Treasury yields declined rapidly, and the US stock market index rose across the board.

The most exciting thing is still Bitcoin. After the above data was released, Bitcoin quickly surpassed $ 56,000.

According to data from Bitcoin Homes, 277 million funds were liquidated in the last hour and almost 85,000 people liquidated their positions in the last 24 hours, with a loss of more than 3.7 billion yuan.Renminbi! Among them, the largest burstCertificate of depositIt occurred in MXC-BTC worth 4.48 million US dollars (approximately 29 million RMB).

China Merchants ValuesZhang Xia believes that Bitcoin is either the mirror image of the currencies of the major world economies or the mirror image of the G7 currencies when facing a general crisis such as the subprime mortgage crisis and the new crown crisis. , then the G7 currencysupplyA substantial increase will depreciate against Bitcoin, and Bitcoin will appreciate in dollar terms. This is thePricesin accordance with. Judging from the current situation, the market seems to continue to expect a looser monetary policy.

Jiasheng GroupAnalyst JOE PERRY said the market may have included the expansion of the European Central Bank on Thursday.LinkPurchase, verbal suppressioninterest rateAnd exchange rates.

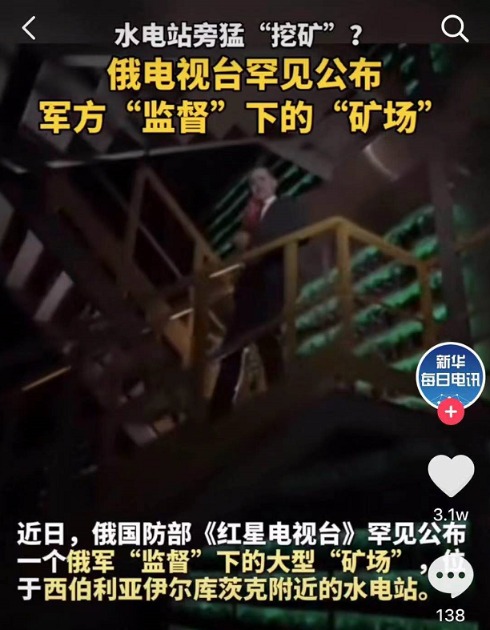

Is the Russian army coming into the game?

In fact, the number of Bitcoin super players is also increasing. This point has something to do with oil-rich countries, where electricity is cheap.

According to the Xinhua Daily Telegraph, according to the Russian Defense Ministry “Red Star TV”, a hydroelectric power station near Irkutsk in Siberia hides a hugeCryptocurrencyThe weather in Siberia is cold all year round, and the local cold weather can be as low as -40 degrees. It is one of the coldest places in the world. It can be a large-scale “mine” under the “supervision” of the Russian army with thousands of “mining machines”. “” Provides good heat dissipation conditions. At the same time, the low water and electricity costs here can greatly reduce mining costs and maximize profits for the “miners”. It is said that this huge “mine is the Russian army and private investors”.joint projectDeal.

According to a Bloomberg report earlier this year, a Russian companythe companyBitcluster mines Bitcoin in the Siberian city of Norilsk, located above the Arctic Circle. The company’s co-founder, Vitaly Borschenko, said that electricity in Siberia’s polar regions is 25% cheaper than the Russian grid, and Norilsk can create its own electricity through natural gas and hydroelectric power. The company costs as little as 2.75 rubles (roughly per kilowatt) at a price of US $ 0.039).

In addition to Russia, Iran’s dependence on Bitcoin may be even greater. Late last year, the Iran Daily, the official newspaper of the Iranian government, reported that due to increasing pressure from the normal use of hard currency in the country, the The government revised its regulations on cryptocurrencies to make digital assets exclusively used for imports.ProductThis means that Bitcoin and other cryptocurrencies that are officially mined under the supervision of the government will have to be supplied directly to the Iranian Central within the authorized limit.Bank(Central Bank of Iran, CBI), and the limit depends in part on the amount of subsidized energy used by the miners. Iran has abundant oil reserves and relatively cheap electricity. It can provide a large amount of subsidized electricity to miners and offset most of the cost of mining cryptocurrencies like Bitcoin for companies that follow the rules.

Since May 2018, the United States has imposed a total of around 800 economic sanctions on all levels of the Iranian economy, causing $ 1 trillion worth of damage to its economy. This may be the main reason for Iran’s coin mining. The semi-official Iranian news agency Tasnim reported in a report cited on February 21 that at present, Iran’s daily cryptocurrency trading volume continues to rise. Tasnim reported that the number of active investors in Iran’s local cryptocurrency market has exceeded one million, adding that a total of 20 platforms have a daily transaction volume of 50 trillion riyals (200 million US dollars), which come mainly from Bitcoin.

Like Iran and Russia, Venezuela, which has been sanctioned by the United States, has long been involved in coin mining. Venezuela is also rich in oil resources and electricity costs are quite low.

Can you guide the rebound in A-shares this time?

Except in some countries and regions where Bitcoin can be used as a payment function, it is useless to have Bitcoin in most countries in the world. So why does the price of Bitcoin keep increasing, including the recent oneTeslaDo companies invest in Bitcoin?

Zhang Xia said that the total assets of central banks in Europe, America and Japan can explain 67% of the changes in bitcoin prices after 2015. Other factors that affect bitcoin prices include confidence, mining efficiency, the halving mechanism and global government regulatory policies on bitcoin. Wait. In addition to Bitcoin, RMB assets can also be used to some extent as a tool to protect against excessive issuance of G7 coins, especially when the People’s Bank of China is severely restricted or restricts the money supply in advance, the RMB is best hedging tool against G7 currencies. Considering volatility, there are also many investors with a high appetite for risk who will buy futures of the FTSE A50 index in Singapore in anticipation of higher returns. From a financial attributes perspective, the correlation between Bitcoin price and A50 index futures has become even higher.

Compared to FTSE A50 index futures, Bitcoin has no underlying assets and Bitcoin has no use value, so Bitcoin is a purely liquid commodity. The FTSE A50 will ultimately be based on the price of its component shares. .DeliveryBased on the fact that the price of the constituent shares of A50 is quoted in A shares, although foreign capital has some influence, it mainly depends onNational investmentThe price of the A50 constituent shares is affected by the performance of the A50 constituent shares, internal liquidity, and risk appetite.

From this perspective, Bitcoin more quickly reflects changes in global liquidity, while A50 is relatively lagging in response to the impact of fundamentals. Therefore, historically, the price of Bitcoin has a certain leading effect at A50, and the price of Bitcoin has repeatedly predicted the sharp fall of A shares in advance, even after the end of 2017, the A50 peaked. a month after the sharp fall of Bitcoin; in 2018 Bitcoin plummeted in November, and the last round of relatively large adjustments occurred at A50 in the following month; When A shares emerged from the epidemic and rebounded significantly in March 2020, Bitcoin’s steep decline reflected the impact of global liquidity. then the A50 has dropped drastically; And last time around, the A50 index has also corrected close to 10% after a 20% drop in Bitcoin.

Jianghai Securities believes that the risk assets represented by the equity market are still weak and the central bank has kept relatively loose capital under the central bank’s care, providing a more bond market friendly environment.interest rateRisks to the upside are limited, however hidden concerns of rising inflation and looming supply pressure leave the market in a cautious mood, leading tointerest rateLack of further downside momentum. Therefore, in the short term, the pattern of narrow fluctuations in interest rates is likely to continue, and the market pattern will continue with a stronger allocation than trading.

(Article source:BrokeragePorcelain)

(Editor-in-charge: DF380)

I solemnly declare: The purpose of this information is to spread more information, and it has nothing to do with this booth.

[ad_2]