[ad_1]

Hong Xiaotang, Reporter for the Economic Observer Network On November 3, Ant Group, which was originally scheduled to be listed on the 5th, was suddenly pressured by the exchange to go on hiatus.

On the night of November 3, the Shanghai Stock Exchange announced that it had decided to suspend the listing of Ant Group. The reason is that the relevant departments conducted supervisory interviews with the actual Ant Group controller, president and CEO, and the company also reported major issues such as changes in the financial technology regulatory environment. This important event may cause Ant Group to fail to comply with the issuance and listing conditions or the disclosure requirements.

Later that day, the Hong Kong Stock Exchange also announced the suspension of Ant Group’s H shares.

On November 4, Ant Group issued an announcement on the return of equity funds on the Hong Kong Stock Exchange stating that the request funds Hong Kong’s public offering (along with a 1.0% brokerage fee, a Hong Kong Securities Regulatory Commission transaction of 0.0027% and Hong Kong Stock Exchange transaction fee of 0.005%) Will be returned in two lots without interest.

Ant Group, which completed its listing on the doorstep, experienced a number of unexpected events in one day, causing many people in the industry to feel that Ant Group may not have much hope of listing this year.

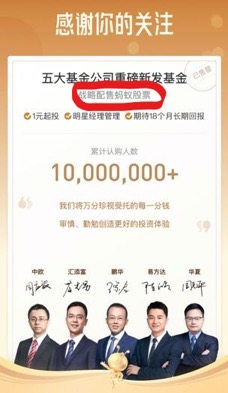

The reporter was informed that the Shanghai Stock Exchange and the Hong Kong Stock Exchange are conducting fund return work. The five funds that can participate in Ant Group’s strategic IPO placement have become the focus of attention for many ordinary investors.

Performance difference

On November 4, E Fund, China Asset Management, China Europe Fund, Penghua Fund, and China Universal Fund issued announcements stating that because Ant Group suspended its A + H listing plan, innovative future fund Centaline plans to invest in the trading strategy of Ant. The corresponding suspension. Currently, the funds have been established and the operation of the funds will not be affected.

As early as October 13, after news that Ant Group was listed or postponed that day, reporters from the Economic Observer had paid attention to the report. For related reports, see “Ant Group Listing Variables? How Does the 60 Billion Ant Matching Fund Just Raised Work?”

Now 5 funds have been established. The first established is E Fund’s Innovative Closed Hybrid Fund for the next 18 months. Establishment date is September 29. The Penghua Innovations Closed Hybrid Fund for the next 18 months was established on September 30. China Europe Innovation Future 18 Monthly closed mixed fund was established on October 9. The establishment date of the China Innovative Futures 18-month Closed Mixed Fund and the China Universal Innovations Closed Mixed Fund for the next 18 months is October 13.

According to public information, the establishment dates of the five ant control funds are slightly different, but all five have already performed, and performance during this time period varies greatly.

Among them, the first two Penghua Innovation Future and E Funda Innovation Future have lost 0.28% and 0.25% respectively since their creation; China Innovative Future has also lost 0.13% since its inception. Only Huitianfu Innovation Future and China Europe Innovation Future have made a profit since their inception. Holding gains were 0.06% and 0.15%.

Disputed

Regarding the suspension of Ant Group’s listing, the five fund companies said it would not affect the fund’s operation, but many investors questioned that it was originally because they were promoting participation in Ant’s strategic placement, and were quick to participate. on the Ant IPO and subscribe to funds. The investment objective’s listing date has disappeared. Should the relevant fund hold a general meeting of holders to discuss the next arrangement of the fund?

However, the reporter reviewed the fund’s contract and found that none of the five above funds found the words “participated in the Ant Group’s strategic placement” in the fund’s contract.

Promotional materials

Promotional materials

Promotional materials

Promotional materials

In the “Strategic Fund Investment Placement Strategy,” it reads: “We will actively pay attention to, analyze and thoroughly demonstrate the investment opportunities of strategic equity allocation. Through a comprehensive analysis of the prosperity of the industry, the fundamentals valuation levels and other issues. Factors, combined with judgment of future market trends, select strategic allotment stocks. After the lockdown period for strategic allotment shares is over, the fund may make judgments on the investment value of the shares, combined with the market environment, and select the appropriate options with the premise of identifying and preventing risks effectively The time to exit the fund and strive for a higher return on investment The Remaining closed period of the fund must be longer than the lock period of the placement atagic of actions.

“Several companies previously promoted this type of fund to invest in Ant, but now the listing of Ant is suspended, which makes it impossible to invest indirectly in Ant. The advertising does not coincide with the real investment operation,” believes an investor subscribed to the Ant Match Fund.

“Advertising by some agency managers and agencies is problematic because they did not take into account the risk that Ant would not go public or be postponed.” A public equity compliance person believes: “This content is not reflected in the fund’s contract, but through advertising Of course, there is still some controversy about whether it is against the rules in the end, because the propaganda claims that the The prerequisite for participating in the strategic ant placement is that the ant is on the list, but now the prerequisite is not there. “

At present, the aforementioned fund is in normal operation. Some informants said that the fund had been established and a series of fees had accrued such as administration fees, custody fees, and legal fees. It should be difficult to refund. The biggest possibility is like the original CDR. The fund is operating normally.

However, some senior fund experts said that if such an emergency occurs, the fund management company may choose to hold a meeting of holders to discuss the fund’s next step or establish an open period for investors who wish to withdraw. In fact, all five funds are great companies and they can afford to lose some of their expenses and gain reputations.

“In fact, many investors value ant placement rights to subscribe, but the biggest bright spot is gone, which has a more obvious impact on investors. Even if these funds do not lose money through stable operation, they actually still agree with investors. The mismatch in risk appetite has hurt investors’ interests, “said a public offering seller.

Copyright notice:The above content is the original work of “Economic Observer” and copyright belongs to “Economic Observer”. Reprinting or duplication is strictly prohibited without the permission of the “Economic Observer”; otherwise, the relevant actors will be liable in accordance with the law. For cooperation on copyright, call:[010-60910566-1260].

[ad_2]