[ad_1]

News in the early morning of October 30 Beijing time,AmazonThe third quarter financial report for fiscal year 2020 was released today. The report shows that Amazon’s net profit in the third quarter was $ 6.331 billion, an increase of 197% compared to net profit of $ 2.134 billion. dollars in the same period last year; Net sales were $ 96,145 million, an increase of 37% compared to $ 69,980 million in the same period last year. Excluding the impact of exchange rate variations, a year-on-year increase of 36%.

Amazon’s performance in the third quarter beat Wall Street analysts’ expectations, and its fourth-quarter revenue outlook also beat expectations, but its share price fell more than 1% after the market.

Main achievement:

In the fiscal quarter ending September 30, Amazon’s net income was $ 6.331 billion, with diluted earnings per share of $ 12.37, which far exceeded the same period last year. In the third quarter of fiscal 2019, Amazon’s net profit was $ 2.134 billion, with diluted earnings per share of $ 4.23. Amazon’s operating profit in the third quarter was $ 6.194 billion, compared with $ 3.157 billion in the same period last year.

Amazon’s net sales in the third quarter were US $ 96,145 million, an increase of 37% compared to US $ 69,981 million in the same period last year. Excluding the $ 691 million positive impact of exchange rate changes on Amazon’s net sales, Amazon’s third-quarter net sales were up 36% compared to the same period last year.

Amazon’s third-quarter revenue and diluted earnings per share beat Wall Street analysts’ expectations. According to data provided by the Yahoo Finance Channel, 39 analysts had previously expected Amazon’s revenue in the third quarter to reach US $ 92.7 billion, and 40 analysts had previously expected Amazon’s earnings per share in the third quarter. quarter to $ 7.41.

In July of this year, Amazon predicted that net sales in the third quarter of fiscal 2020 will reach between $ 87 billion and $ 93 billion, a year-on-year increase from 24% to 33%, including about 20 points. basic negative changes in the exchange rate expected to bring. Impact, the median value of this outlook is US $ 90 billion, exceeding analysts’ expectations at the time; Operating profit is expected to reach $ 2 billion to $ 5 billion.

Performance of each department:

-Divided by region:

Third-quarter net sales for Amazon’s North American division (United States, Canada) were US $ 59,373 million, an increase of 39% over the same period last year, US $ 42,638 million; Operating profit was $ 2,252 million, an increase of 76% over the $ 1,282 million in the same period last year.

Third-quarter net sales for Amazon’s international division (UK, Germany, France, Japan and China) were US $ 25,171 million, an increase of 37% from US $ 18,348 million in the same period of the year. past. Excluding the impact of changes in the exchange rate, it increased 33% year-on-year; The profit was US $ 407 million, compared to an operating loss of US $ 386 million in the same period last year.

Net sales of Amazon AWS cloud services in the third quarter were US $ 11.601 billion, an increase of 29% from US $ 8.995 billion in the same period last year. Excluding the impact of changes in the exchange rate, it also increased 29% year-on-year; operating profit was US $ 3.535 billion, compared to the same period last year. From 2,261 million US dollars it increased 56%.

Amazon’s sales in the third quarter of the North American division represented 61% of total sales, compared to 62% in the same period last year; sales from the international division represented 26% of total sales. It is flat compared to the same period last year; AWS cloud service sales accounted for 13% of total sales, up from 12% in the same period last year.

-Divided by service and type of business:

Amazon’s third-quarter net sales from online stores were US $ 48.35 billion, an increase of 38% compared to US $ 35.039 million in the same period last year. Excluding the impact of changes in the exchange rate, it was an increase of 37%.

Amazon’s net sales in physical stores in the third quarter were $ 3.788 billion, down 10% from $ 4.192 billion in the same period last year. Excluding the impact of changes in the exchange rate, it also fell 10% year-on-year.

Amazon’s third-quarter net sales for third-party seller services were US $ 20.436 million, an increase of 55% compared to US $ 13.212 million in the same period last year. Excluding the impact of changes in the exchange rate, it was an increase of 53%.

Amazon’s third-quarter net sales for subscription services were $ 6.572 billion, an increase of 33% compared to $ 4.957 billion in the same period last year. Excluding the impact of changes in the exchange rate, it was a year-on-year increase of 32%.

Amazon’s Q3 net sales of AWS cloud services were $ 11,601 billion, an increase of 29% from $ 8,995 million in the same period last year. Excluding the impact of changes in the exchange rate, it also increased 29% year-on-year.

Amazon’s third-quarter net sales from other companies were $ 5.398 billion, up 51% from $ 3.586 billion in the same period last year. Excluding the impact of changes in the exchange rate, it was a year-on-year increase of 49%.

Cash flow information:

In the 12 months ended June 30, 2020, Amazon’s operating cash flow was $ 55.3 billion, an increase of 56% compared to the same period last year; For the 12 months ended June 30, 2019, Amazon’s operating cash flow is $ 35.3 billion.

In the 12 months ending June 30, 2020, Amazon’s free cash flow was $ 29.5 billion, higher than the same period last year; In the 12 months ending June 30, 2019, Amazon’s free cash flow is $ 23.5 billion. After deducting the principal repayment, Amazon’s free cash flow in the last 12 months was $ 18.4 billion, which was higher than the same period last year; in the 12 months ended June 30, 2019, after Amazon deducted the above items. Free cash flow of US $ 14.6 billion. After deducting repayment of principal and assets acquired under the capital lease, Amazon’s free cash flow in the last 12 months was $ 17.9 billion, higher than in the same period last year; in the 12 months ended June 30, 2019. Here, Amazon’s free cash flow after deducting the aforementioned items is $ 10.5 billion.

Performance Outlook:

Amazon predicts that in the fourth quarter of fiscal 2020, net sales will reach $ 112 billion to $ 121 billion, a year-over-year increase from 28% to 38%, which includes approximately 90 basis points of the positive impact that will be expect them to bring changes in the exchange rate. For 116.5 billion US dollars, beating analysts’ expectations. Amazon also predicts that operating profit in the fourth quarter of fiscal 2020 will reach $ 1 billion to $ 4.5 billion, compared to $ 3.9 billion in operating profit in the same period of 2019. According to data provided by Yahoo Finance Channel, 39 analysts on average expect Amazon’s fourth quarter revenue to reach $ 112.32 billion.

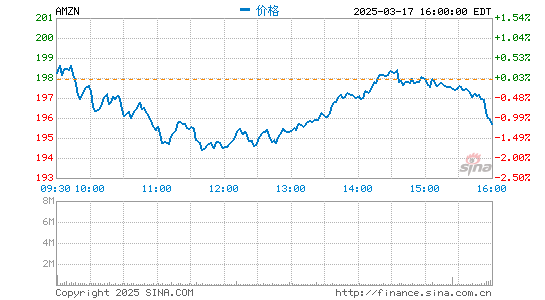

Changes in the price of shares:

On the same day, Amazon’s stock price rose $ 48.23 in Nasda regular trading to close at $ 3,211.01, an increase of 1.52%. In subsequent after-hours trading until 4:25 p.m. ET Thursday (4:25 a.m. Beijing time Friday), Amazon’s share price fell $ 40 to $ 3,171.01, a decrease of 1.25%. In the past 52 weeks, Amazon’s highest price was $ 3,552.25 and the lowest price was $ 1,626.03.