[ad_1]

Original title: State shot! The document of almost 7,000 words pointed to the critical point: “The old man was arrested to activate the social security card”, and the follow-up came

Summary

[¡Los documentos de casi 7000 palabras señalan el problema! “Se recogió a un anciano para activar la tarjeta de seguridad social” y “Se rechazó el pago en efectivo del seguro médico” seguimiento]Recently, a 94-year-old man in Hubei was detained for activating his social security card and posted a search on Weibo. In response, the bank involved said that the sense of service is not strong and has come to apologize. Another piece of news appeared in the Weibo search: An elderly man in Yichang, Hubei Province was denied cash health insurance in the rain. (China Securities Journal)

A few days ago, a 94-year-old man in Hubei was detained for activatingSocial SecurityCard news boardMicro ExpoHot Search InvolvedBankIn response,ServiceI am not conscious and I have come to apologize. Other news addressedMicro ExpoIn a hot search, an elderly man from Yichang, Hubei Province was denied cash health insurance in the rain.

The impotence of the elderly in the face of the “digital divide” has made many people feel sad.

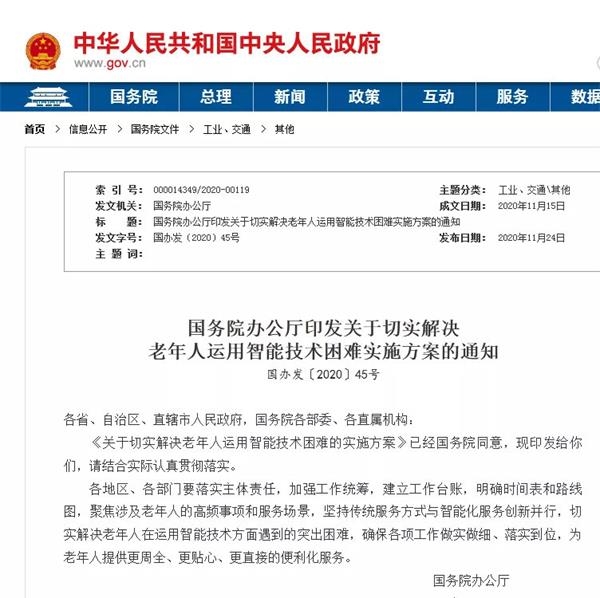

The country shot up fast! On the night of November 24, the General Directorate of the State Council issued the “Notice on the Implementation Plan for the Implementation of the Practical Solution to the Difficulties of the Elderly in the Use of Smart Technology” issued by the General Directorate of the Council of State. The difficulties encountered in the use of intelligent technology have allowed the elderly to better share the fruits of the development of computerization. The full text of the “Notice” and the implementation plan are close to 7,000 words.

Image Source: China Government Network

Hit the pain point

The implementation plan establishes a specific time node:By the end of 2020, we will concentrate our efforts to ensure that there are various traditional services, and we will rapidly introduce and implement a series of effective measures to solve the most urgent problems of the elderly in the use of smart technology and effectively meet the basic needs of old people.

By the end of 2021, focus on high-frequency matters such as travel, medical treatment, consumption, entertainment, and matters for the elderly.Service scenario, To promote older people to enjoy more commonly, traditional smart servicesservice methodmore perfect.

By the end of 2022, the level of access to smart services for the elderly will be significantly improved, convenience will continue to increase, online and offline services will be more efficient and coordinated, and basically a long-term mechanism for solve the “digital divide” faced by older people.

In the current special epidemic prevention and control period, the implementation plan also clarified several requirements that are well suited to the current reality.

One is to improve the management of the “sanitary code” to facilitate the passage of the elderly. All locations should not use the health code as the only pass certificate for staff.

The second is to maintainTraditional financeFor service methods, no unit or individual may refuse to accept cash in the form of standard terms, notices, statements, notices, etc.to get betterIn-person attention by service personnel, retail, catering, shopping malls, parks and other places of high frequency consumption for the elderly, basic servicesPublic serviceThe payment of fees and administrative fees must support cash andBankCard payment.

The third is to provide multi-channel registration and other medical services and to optimize online medical services for the elderly. It is a measure for the discomfort of the medical treatment of the elderly due to the widespread implementation of appointment systems in medical institutions during the period of prevention and control of the epidemic.

In addition, the implementation plan alsotrafficTraveling, convenient for the elderly to use intelligence.productAnd service applications, convenient services for the elderly, etc.jobsComplaint: In terms of financial services, the implementation plan also proposes to create concise, large print, audio, national language versions of mobile phones suitable for older people.BankAPP, improvemobile bankProductEasy to useAnd security, it is convenient for the elderly to carry out daily consumption such as online shopping, ordering meals, cleaning and living expenses.

Four main spaces for banking services

This hot search event also allows banking servicesattitudeThis old problem reappears inpublicGiven.

In fact, according to Zhongzheng Jun’s observation, the overall quality of the banks’ service is guaranteed due to the fierce competition in financial services in the provincial and tier-one capitals. “Just kneel on the ground to giveclientServed. “A bank teller told Zhongzheng Jun.

However, in some remote areas, where competition from financial services is not fierce and the concept is backward, some banking institutions still exist.Service awarenessNeeds to be improved, lacksInitiativeCase.

Zhongzheng Jun collected a lot of netizen comments and user interviews, and there are four main spaces.

Slot 1: insufficient humanization

“Normally people over 90 have limited mobility. Not to mention door-to-door service. At least they come. You have to prepare a seat for the business. If you don’t have to go to the bank and you have to do it at a self-service machine There is a problem and it is not human. ”A netizen commented like this, attracting about 1,500 likes.

There aren’t many things like that.

“The same thing happened when my grandfather went to activate it the last time. It was obvious that the elderly could not walk with a firm step. They had to go to the bank to activate the social security card, and they had to do it personally. I really don’t understand why ? “

Obviously, some banks still have a long way to go in terms of humanized services.

Slot 2: bad attitude

“Our bank is also promoting this machine to operate automatically. The staff member will point it out, and the attitude is hard to say … for fear of making a mistake, the staff is impatient.”

“An employee at a certain bank is impatient. I urge you to finish reading instructions xx and sign as soon as possible. I am here to apply for a money saving card.Service attitude? “

“The business was completed. The lobby manager directly took my mom’s mobile phone and didn’t ask for any consent to download my mom’s cell phone registration software. I saw that it was illegal and her attitude was particularly bad, saying: ‘ Who Said It Was Illegal?

Slot 3: low service efficiency

“I don’t know if I ask three questions in the lobby. There are three counters, two closed and one suspended. The bank has the best service attitude and the most efficient operation is the only ATM.”

“Is this the attitude of the current bank? I am waiting at the counter and the bank employees are chatting inside.”

During the unannounced visit to the bank, Zhongzheng Jun also came across a similar experience where bank employees were busy talking and laughing while he could only wait at the counter.

Slot 4: low professional capacity

The professional capacity of bank employees is often the subject of complaints.

“A certain bank is so messy, it asks three questions about the business, it loses half an hour”, the comments on the Internet are numerous.

two suggestions

For some of the customer spaces, bank employees also suffer.

A bank employee said: “Some things need to go through procedures to protect the legitimate rights and interests of some people, such as activating the card and setting a password without the person. How to control the risk of subsequent fraud? Conscience cannot prevent some risks. “

Some analysts noted that the financial industry is a highly compliant industry and many operations must be executed in strict accordance with procedures. Sometimes, it is not that bank employees are unwilling to help, but the process does not give flexibility to front-line staff. This person believes that to solve the problem of the “digital divide” for older people, at the level of financial institutions, alternative solutions can be established for the elderly in the design of the process. For example, in some banks in Shanghai, many older people can passAuthorizationFamily members can enjoy relevant financial services without leaving home. This method is usefulborrowJian.

Some netizens also said that the “initial heart” of the front-line commercial staff of financial institutions is also very important. Some netizens said: “In essence, what we are asking for are more caring and humane services. Although the bankSmart serviceThe level is getting higher and higher, and the service becomes more and more efficient and convenient, but after all, machines cannot replace humans and we look forward to more comforting services. “

(Source: China Securities Journal)

(Responsible editor: DF380)

I solemnly declare: The purpose of this information is to spread more information, and it has nothing to do with this booth.

[ad_2]