[ad_1]

Caijing Capital Market, Nov. 19, last night, after Haitong Securities issued an announcement due to the company’s breach of contract in the case of Yongmei Holdings credit bonds, China Everbright Bank and Zhongyuan Bank participated today.

According to a Financial Associated Press report on November 19, the Distributors Association conducted a self-discipline investigation of Yongcheng Coal and Electricity Holdings Group Co., Ltd. and interviewed several intermediaries.Top underwriters such as Industrial Bank Co., Ltd., China Everbright Bank Co., Ltd., and Zhongyuan Bank Co., Ltd., as well as China Chengxin International Credit Rating Co., Ltd., and Sigma Certified Public Accountants ( special general partnership) allegedly violated interbank rules. The behavior of self-discipline management rules in the bond market.In accordance with the relevant regulations, such as the “Regulation on Self-Discipline Measures in the Interbank Bond Market”, the Association of Operators will initiate a self-discipline investigation of the relevant intermediaries.

Public information shows that “20 Yongmei SCP003” is an ultra-short-term bond issued by Yongmei Holdings, with a total issuance of 1 billion yuan, a bond interest rate of 4.39% and a maturity of 270 days. The current principal and interest payment date is November 2020. On October 10, the repayable principal and interest amounted to 1.032 billion yuan.The main underwriter is China Everbright Bank and the joint underwriter is Centaline Bank.

Shares of Haitong Securities on the Shanghai Stock Exchange and the Hong Kong Stock Exchange fell on November 19, the biggest drop in a day since the fourth quarter of this year: Haitong Securities A fell 6.35% to close at 13.13 yuan; Haitong Securities H fell 5.28% to close at 6.45 HKD. Because on November 18, the Distributors Association released a message saying thatHaitong Securities and its related subsidiaries were found to be suspected of assisting Yongmei Holdings’ illegal bond issuance, as well as alleged market manipulation violations, involving non-financial corporate debt financing instruments in the interbank bond market and corporate bonds in the foreign exchange market.

“If it is discovered in the investigation that relevant institutions are suspected of disrupting market order, such as market manipulation, the Distributors Association will impose strict self-discipline sanctions and transfer them to the relevant departments for further processing. “According to the Dealers Association.

In response to this, Haitong Securities issued an announcement last night, stating: “The company will actively cooperate with self-discipline investigative work, strictly implement the relevant requirements of the Merchants Association Notice on Further Strengthening of Business Issuance Regulations. Debt Financing Instruments, and will implement them in a timely manner. Information Disclosure Obligations “.

On November 10, Yongmei Holdings issued an announcement stating that due to shortage of liquidity, “20 Yongmei SCP003” was unable to repay the principal and interest in full on time and constituted a substantial default. The principal and predetermined interest amounted to approximately 1.032 billion yuan. Regarding the reason for the default, Yongmei Holdings stated that it was mainly due to a shortage of liquidity and failed to collect all the cash on time.

Until this week, the credit bond market was affected by the Yongmei “black swan” incident. In addition to investment banking institutions, the bond market was also affected. On November 17, in the foreign exchange bond market, many bonds such as “19 TEDA 02”, “19 TEDA 01” and “16 Qingkong 02” fell sharply.

Industry insiders believe that the short-term credit bond market will be further divided due to recent multiple credit bond default events. The Caixian Press quoted Li Zhan, chief economist at Zhongshan Securities, to point out thatThe impact of credit risk events that exceed those expected on market liquidity is controllable, but the accelerated differentiation of the credit bond market has become an inevitable trend.

On November 17, according to 21 Financial Report, a journalist learned from various creditors that in the past two days, Yunenghua and Yongmei contacted the holders of “20 Yong Coal SCP003” through “20 Yong Coal SCP003”. Capital transfer is important. “If ’20 Yongmei SCP003 ‘can trade an extension, then it will not trigger a cross default,” said one investor. The source also revealed that if the extension of “20 Yongmei SCP003” can be negotiated with investors, then we will discuss the extension of “20 Yongmei SCP004” and “20 Yongmei SCP007” The two bonds will be held next Monday. maturity.

On November 18, the Shanxi provincial government held a special meeting for the heads of state enterprises and provincial financial institutions. Vice Governor Wang Yixin attended the meeting and said that regarding the bond risks that concern everyone the most, I can responsibly tell you that recently, together with relevant colleagues, I will be dealing with the bonds that state-owned enterprises in the province of Shanxi should redeem in the near future. After analyzing, there is no problem. Borrowing to pay the money is justified, these are the genes of Shanxi merchants. After the Yongmei bond default incident was reported by the media, Secretary Lou Yangsheng immediately sent me instructions and the provincial state operating company took a series of active risk prevention and control measures.

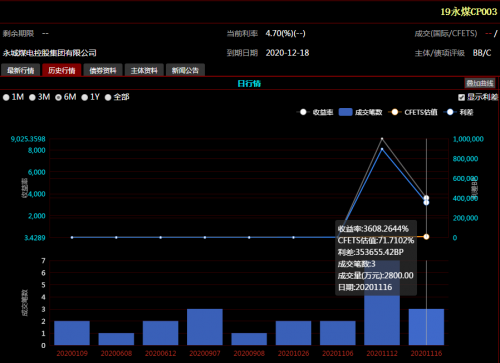

On the afternoon of November 19, data from the China Foreign Exchange Trading Center (CFETS) showed that at 2:48 p.m., the last net price of the remaining debt of Yongcheng Coal and Electricity Holding Group, “19 Yongmei CP003” , rose nearly 166% to 55.72 yuan. The bond is a general short-term bond of the company, according to IFIND data, its maturity date is December 18, 2020.

Source: IFIND, Caijing.com