[ad_1]

On December 21, A shares rose sharply, the box break was imminent, and the capital to the north continued to sweep away the merchandise. Hengqiang, the strongest player in the automotive photovoltaic and new energy sectors, hit new highs in leading stocks.

//Hillhouse Concept Actions Trigger Market //

Longji Actions(601012,Clinical Unit) On the afternoon of December 20, it was announced that Li Chunan, the company’s second-largest shareholder, intends to transfer 226 million shares of the company he owns to Hillhouse Capital by transfer agreement, representing the 6 % of the total share capital of the company. Calculated on the basis of a transfer price of 70 yuan per share, the total consideration for this transaction is 15.84 billion yuan. Early trading on the 21st,Longji’s stock opened 8% and eventually closed at the daily limit, with a total market value of 322.2 billion, a record.

Gao Ling also likesIt was Ningde(300750,Diagnostic unit), on the 21st it soared 12.07%, with a total market value of more than 750 billion.This also made new energy, electrical equipment and other sectors of the equities popular. In the end, the Shanghai and Shenzhen stock exchanges closed with gains, especially the Shenzhen components index rose 2.03%.

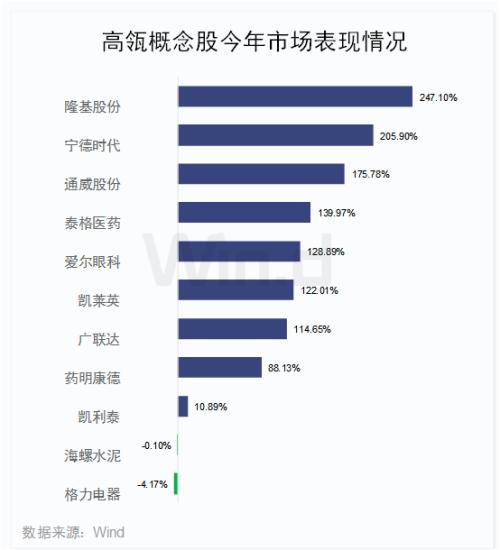

And since this yearHillhouse frequently makes new energy sales and has invested successively in Ning’s Times,Enjie shares(002812,Clinical Unit), NIO and other leading new energy companies.And these leading stocks have performed well this year, basically from the main Shenglang market which has doubled or even doubled.

Wind data display,Hillhouse Capital currently has 9 shares among the top ten A shareholders.In addition, Longi shares andTongwei Stock(600438,Diagnostic unit)(On the evening of December 9, Tongwei announced that it announced the results of the placement of nearly 6 billion orders, and Hillhouse Capital’s China Value Fund was subscribed for about 500 million yuan.)11 in total. This year, 7 of these 11 stocks have doubled their earnings.Popularized by market funds.

//The market interprets two extremes //

For one thing, industry leaders have continually rocketed and hit all-time highs.On the other hand, some suspicious actions by Zhuang continued to lower his limits.

On December 21, Ningde Times, a leading company in energy batteries for new energy vehicles, rose sharply, with a total market value of 757.1 billion.BYD(002594,Diagnostic unit) Closed at the daily limit, once again approaching the previous historical point. The company’s total market value exceeded 500 billion yuan. Since the beginning of this year, the cumulative increase has exceeded 300%.

On the other hand, some suspicions of Zhuang’s actionsJimin Pharmaceutical(603222,Clinical Unit) 、Suzhou Longjie(603332,Diagnostic unit) A continuous lower bound of a word.

//The net inflow of funds from the north is more than 7 billion

December 21The net inflow of funds from the north was 7.86 billion yuan, and the net inflow this month was 42.904 million yuan.Judging from the movement of funds north over the last month, although there have been occasional fluctuations, the overall net inflow has remained substantial and the number of days of large net inflows in a single day has increased significantly.

//The balance of the two financial institutions reached a new record //

Recently, the balance of the two financial institutions has fluctuated and risen, recently setting a new record again.As of last Friday (December 18), the balance of A-share margin trading and securities lending was 1,594,138 million yuan, an increase of 2,142 million yuan from 1,591,996 million yuan. yuan from the previous trading day. It has recovered for 5 consecutive days in the past week. The financial balance increased by nearly 20 billion yuan.

//European and US stock markets have fallen one after another .//

With the rise of domestic A shares, the British lockdown sparked market panic and ignited risk aversion.US stocks have fallen and European stocks have slumped across the board.

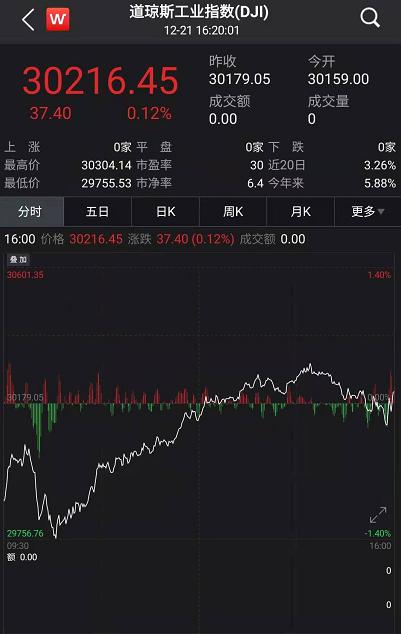

Wind quote screen,The Dow Jones industrial index fell sharply 1.4% during the intraday session, but the Dow still held strong and eventually recovered to regain lost ground, closed slightly at 0.12% and continued to trade above 30,000 points. .

andThe Nasdaq index and the S&P 500 index were slightly weaker and did not receive the red after falling, they fell slightly 0.1% and 0.39% respectively.Furthermore, the three main European stock indices fell across the board.Britain’s FTSE 100 fell 1.73%, France’s CAC40 index fell 2.43% and Germany’s DAX index fell 2.82%.

//The US dollar index fluctuates sharply //

As the European and American stock markets have fallen,The US dollar index rallied sharply by more than 1.2% in intraday trading on December 21, peaking at 91. However, the US dollar was still weak and then fell across the board from its high, and it finally closed 0.18% higher at 90.08.

CITIC clearly believes that, in the expectation that the US epidemic will remain severe and that the Fed’s monetary policy may loosen further after the launch of a new round of fiscal stimulus,The US dollar index may remain weak in the first half of next year, and the US dollar index may fall further. In the second half of next year, as the US economy may enter the recovery and stabilization and the marginal convergence of the Fed’s monetary policy caused by factors such as inflation, the US may play the role of the euro zone in 2017, and the US dollar index may usher in a stabilizing rally.

Guosheng Zhang Qiyao analyzed that the global economic recovery, the digestion of external uncertainties and the increased appetite for risk brought about by the expected warming of domestic policies will jointly promote the new year market.This round of the New Years Eve market is by no means a one-sided market for a few sectors, but rather a comprehensive market that moves up in each sector, driving the overall upward trend of the index. Please continue to be bullish on the current New Year’s Eve market through the first quarter of next year, and the level is expected to exceed expectations.