[ad_1]

Original title: Another city withdraws the new property market policy, this is the eighth case since the epidemic! Why is it so tempting to stop again and again?

Summary

[AnothercityiswithdrawingthenewrealestatemarketpolicyThisistheonlyreasonfortheepidemic

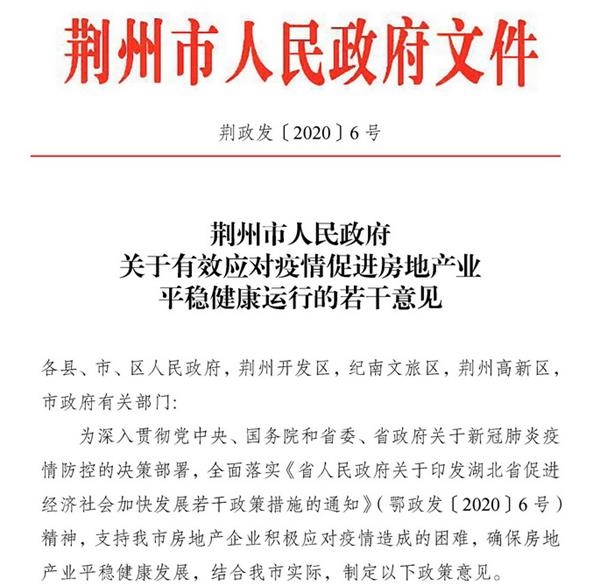

The Chinese stockbroker learned that the new stable real estate policy in Jingzhou City was launched on April 20. Among them, in addition to the policy of rescuing land tender deposits and paying land transfer prices in installments to rescue housing companies, the most concerned is the initial payment of the first mortgage loan.The proportion was reduced to 20%, and the share of advance for the second set was reduced to 30%; the maximum amount of provident fund loans increased from 450,000 yuan to 500,000 yuan; and the purchase of new homes before June 30 was fully reimbursed, including deed tax and other policies to stimulate demand.

So is this part of the demand stimulation policy inconsistent with provincial government documents?

Chinese brokerage reporters found the “Notice on Measures to Promote the Stable and Healthy Development of the Construction Industry and Real Estate Market” released by the Hubei provincial government on April 20. Among the measures to stabilize the real estate market, the notice emphasized: insist that “the house is used for living, not for using” speculated frequently “Positioning, adhere to the unchanged real estate macro control policy, fully implement the liability system of the city’s lead agency, effectively respond to the impact of the epidemic, prevent and resolve real estate market risks, meet the goal of stabilizing land prices, house prices and expectations, and promote real estate in the province The market developed steadily and healthily.

Specific measures include: a total of 17 measures, including reasonable adjustment of regulatory measures, effective reduction of costs and reduction of burden on companies, increased financial support, support to companies to accelerate the resumption of production and production, and strengthen security management. These measures basically provide supportive policies from the perspective of bailing out housing companies.

The content related to the individual demand for home purchase is to effectively reduce the reduction of costs and burdens for companies, and he mentioned that the housing provision fund should be implemented in a phased support policy. It is mentioned that, under the premise that the risk is controllable, for cities and counties with housing provident fund loan rates of less than 80%, the Administration Committee of the Provident Housing Fund reasonably determines the maximum amount of the loan from the housing provident fund.

In addition, as fiscal and financial support increases, it is mentioned to improve differentiated personal home loan services. This includes expediting the approval of personal home loans, reasonably delaying the repayment period for eligible staff, and reducing or exempting personal home loan interest.

Chinese brokerage reporters called the Jingzhou government office on the afternoon of 23 to ask what specific policy was inconsistent with the provincial documents. Relevant staff suggested that the journalist ask about the city’s Provident Fund Center. However, the reporter repeatedly called the city forecast center, the phone has not been connected.

Subsequently, the Chinese journalist from the brokerage firm also called the Jingzhou Urban-Rural Housing and Construction Bureau to ask. The relevant staff member said: “After the provincial government documents are issued, we will refer to the provincial government documents for implementation. Conflicts in municipal documents are, for example, provincial documents proposing the provident fund higher. The amount is adjusted appropriately. There is a specific number in the city document, but this must be determined by the Provident Fund Center; again, as the down payment ratio, the city document says that the first set is reduced to 20%, and the second set is reduced to 30%, but this should beBankTo pass. “

Previous staff also told the reporter from the China brokerage agency that the preferential deed tax policies have not been implemented, but the support policies for the companies mentioned in the provincial documents will also be implemented.

8 real estate relaxation policies have been suspended

In addition to Jingzhou, Chifeng’s stable real estate policy has recently stopped.

On April 16, the city of Chifeng, Inner Mongolia, enacted “various measures to stabilize the consumption of houses during the prevention and control of the epidemic”, and proposed to adhere to the position of “houses are used for living, not for speculation “to respond effectively to sales in the real estate industry during the prevention and control of the epidemic. Difficulties and problems will stimulate rigid demand, promote employment, stabilize expectations and maintain a stable and healthy development of the real estate market. Specific measures include encouraging people to buy houses, granting tax subsidies and abolishing sales restrictions. However, the policy was also suspended on April 19.

According to statistics from Chinese brokerage brokers, since the outbreak, in stable real estate policies issued in many places, the down payment for the first set of provident funds in Zhumadian has been reduced, the purchase restrictions on Guangzhou apartments have been loosened, Baoji has strived to reduce the down payment for the first set of houses, Jinan Industrial Park has canceled the purchase limit, Haining During the Housing Fair, the policy of stimulating demand in 8 cities was stopped , including a month of shopping restrictions, Qingdao’s 100-day time limit, Chifeng’s stimulus to buy individual homes and Jingzhou’s down payment reduction and increased provident fund loans.

Regarding the suspension of the real estate relaxation policy in many places, Yang Hongxu, deputy dean of the Shanghai Yiju Real Estate Research Institute, said in an interview with a Chinese brokerage reporter: “This shows that regulation central has a bottom line. I feel like it is difficult to cancel the public restrictions on buying and selling. This Red line cannot be broken at the moment, the specific limit of the property price can be adjusted according to local conditions, and The loan policy of the Central Bank’s Banking and Insurance Regulatory Commission also has a management bottom line. ” He said that because on April 17, the Politburo meeting reiterated that “housing is not speculated”, in fact, it shows the attitude. That is, some policy measures at the central level are temporarily inactive, and the caliber of regulation and control remains unchanged.

Zhang Dawei, chief analyst at Centaline Real Estate, believes that under the epidemic macroeconomic changes and strict real estate regulation in the past should be adjusted, especially in accordance with the principle of “homelessness and no speculation”. This policy does not violate the principles of regulation and control of the real estate market, nor will it have much impact on the market, however, even if the policies are relaxed, including a significant down payment, there is a suspicion of encouraging real estate speculation. Currently, most adjustments to the Purchase Restriction Policy, Talent Policy, Provident Fund Policy, and Enterprise Bailout Policy can be implemented, but only as long as the Purchase Credit Down Payment Policy housing fully recover. In general, real estate market policies continue to occur frequently, and temptations to loosen policies in cities around the world will still occur frequently. However, he noted that the local government did not consider it before introducing the policy and arbitrarily withdrew it after its introduction. For the market, the interference was very serious.

According to statistics from the Zhongyuan Real Estate Research Center, in mid-April, real estate regulatory policies were still issued frequently across the country. The cumulative number of regulatory policies issued reached more than 30 times during the month, most of which were related to talent policies.

Regulatory departments require strict supervision of the flow of credit funds.

It is worth noting that the “epizoic epidemic situation” has recently appeared on the Shenzhen property market, and someBankThe news was analyzed that small and low interest operating loans entered the real estate market in violation of regulations, which attracted great attention from regulatory authorities.

On April 22, Xiao Yuanqi, Chief Risk Officer and Spokesperson for the China Banking and Insurance Regulatory Commission, confirmed at the press conference that day that such a situation had actually occurred in Shenzhen. .

Xiao Yuanqi emphasized that the loan should be used according to the actual use of the fund when applying for the loan and cannot be misappropriated.If it is a loan requested through real estate mortgages, including commercial and mortgage loans, it must really comply with the use of funds at the time of request. The China Banking Regulatory Commission requires banks to control the flow of funds to ensure that funds are used as a target when applying for loans, and to resolutely correct the illegal entry of loans into the real estate market.

The same day, the Central Sub-branch of the People’s Bank of China in Shenzhen stated that it would adhere to the “housing, housing and speculation” orientation, fully implement the long-term management regulatory mechanism of “city policy “and would maintain the stability, continuity and consistency of real estate financial policies. The objective of stabilizing land prices, house prices and expectations is to urge commercial banks to strictly implement differentiated housing credit policies and to strictly prohibit the use of credit funds for home purchases.

On April 23, the Shanghai headquarters of the People’s Bank of China held a symposium on Shanghai property credit work to study and discuss the new situations and new problems that have recently emerged in the property credit market, and to deploy the next phase of shanghai real estate credit work. The relevant responsible comrades from the People’s Bank of China headquarters in Shanghai attended the meeting, and the responsible comrades from the 18 major commercial banks in Shanghai attended the meeting.

The meeting clearly stipulated that in the next stage, all commercial banks must adhere to the position of “housing, housing and speculation”, strictly prohibit the use of real estate as a guarantee of risk, break the requirements of credit policy disguised through consumer loan and operating loan, and providing funds to buyers in violation of the rules. , Affecting the stable and healthy development of the real estate market.

Prior to April 17, the Zhejiang Supervisory Office of the China Banking and Insurance Regulatory Commission issued two fines for violations of laws and regulations on personal consumption loans and personal operation loan funds that were not effectively controlled by the two local banks.

Yan Yuejin, Research Director of the Think Tank Center at the E-House Research Institute, believes that in the current context of lax financial liquidity, various types of illegal use of funds have increased. The position of the regulatory authorities reflects the continued strict management of capital flows and the further implementation of Policy Guidance.

Related reports:

Hubei Jingzhou to stop the down payment of the new policy of the new real estate market

20% down payment “two day tour”! Jingzhou real estate market loosening policy is urgently withdrawn, the guide price of second-hand housing in Shenzhen is expected to be introduced

(Source: China Brokerage)

(Editor in charge: DF120)

Solemnly declare: The purpose of this information posted by Dongfang Fortune.com is to spread more information, which has nothing to do with this booth.

[ad_2]