[ad_1]

Original title: Is the “first stock” of new tea coming to drink? Naixue announced its Hong Kong IPO, created by a beauty born in the 1980s, with a valuation of 12.9 billion! This track is welcoming multiple IPOs from companies

Is the “first part” of new tea drinks about to be born?

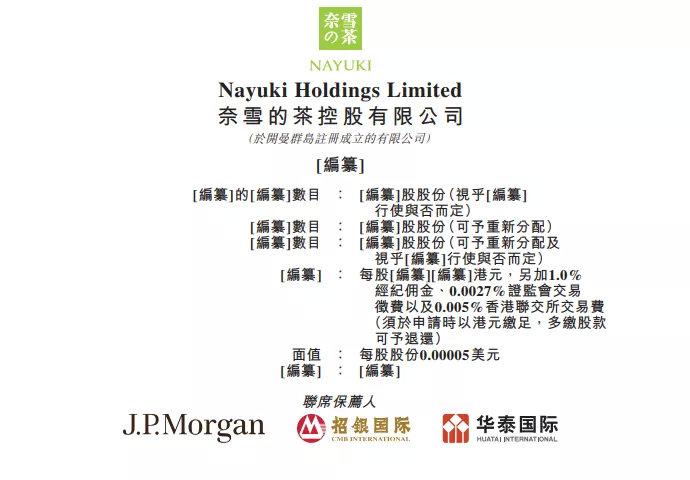

On New Year’s Eve, on February 11, Naixue’s Tea (hereinafter Naixue) formally submitted a listing application to the main board of the Hong Kong Stock Exchange, and the stock listing process was officially launched. From Hong Kong. The prospectus indicated their joint membership.SponsorforJPMorgan, CMB International and Huatai International. If included successfully, Nayuki will become the first new national tea drink.

According to the prospectus, in the first three quarters of 2020, NayukiOperating incomeIt reached 2.11 billion yuan,Lost27.51 million yuan. According to its official website, as new domestic teaMarkNaxue was founded in Shenzhen in 2015. In December 2017, Naxue started expanding outside of the Guangdong region and expanding domestically. The prospectus shows that, as of September 2020, it had opened 420 stores in 61 cities across the country.

Previously, according toBrokerageInvestigation reportEstimated after multiple roundsinvestmentLater, Na Xue was valued at 12.9 billion.

There are more than 420 stores with a valuation of 12.9 billion

New Year’s Eve, CapitalmarketIt is not peaceful. After completing round C of financing of more than US $ 100 million in early January, Nai Xue formally submitted an application for listing to the main board of the Hong Kong Stock Exchange and officially launched the stock listing process. From Hong Kong.

According to Nayuki’s prospectus, at the beginning of January this year, Nayuki has undergone 5 rounds of funding. From 2017 to 2018, Tiantu Investment invested around 400 million yuan in Naxue’s first three financing roundsRMB. From April to June 2020, Shenzhen Venture Capital, Hongtu Venture Capital, CourtCardHK Limited, etc., invested about 232 million yuan and launched a B-2 round of investment in it; in early January, in Naxue round C financing, PAG Taimeng Investment Group He YunfengbackgroundExpect to invest $ 100 million in it. According to previous estimates by Essence Securities Research Report, after the aforementioned investment rounds, Naxue’s valuation has been close to US $ 2 billion, or about 12.9 billion yuan.

Currently, Peng Xin and Zhao Lin have Naixue Holdingsshareholder, Jointly owned by Lin Xin Holdings and employee equity incentive platform ForthWisdom Limitedthe companyApproximately 75.36% of the voting rights.

As one of the leading new style tea beverage brands in China, Naxue has undergone rapid expansion since its establishment 6 years ago. Since opening its first store in Shenzhen in November 2015, it has opened more than 400 branches across the country. According to the prospectus, as of September 2020, Nai Xue’s stores have covered 61 cities in mainland China and a total of 422 stores in Hong Kong, Japan and other regions.

Nayuki said he will expand the network of tea shops and improveMarket penetrationSpecifically, the company plans to open between 300 and 350 Nayuki tea shops in 2021 and 2022, mainly in first-tier cities and new tier-one cities, of which around 70% will be planned as Nayuki PRO tea shops. by the company last year are mainly distributed in prime locations such as high-end shopping malls and office buildings.Passenger flowAmount of area.

Loss of 27.51 million in the first three quarters of last year

According to the prospectus, the average sale value of each Nayuki order in the first three quarters of 2020 reached 43.3 yuan, which is the highest among China’s high-end fresh tea chain stores. The current average sales value of each order in the industry is 35 yuan. However, based on the data disclosed by Nay Xue, in recent years, the average daily sales of each tea shop have shown a downward trend.

In 2018 and 2019, the daily sales of each Naxue store were 30,700 yuan and 27,700 yuan, respectively. In the first three quarters of 2020, it dropped to 20,100 yuan; the average daily order volume for each tea shop also increased since 2018. 716 orders in the year and 642 orders in 2019, which fell to 465 orders in the first three quarters of 2020.

In response, Nayuki said that the average daily sales andSales in the same storeThe number decreased over the period, mainly because the company continued to open new tea shops across the network, resulting in a more balanced visitor volume and order distribution in existing tea shops.

Overall, Nayuki’s profitability has been low over the past two years. The data shows that in 2018 and 2019, Nayuki lost about 69.729 million yuan and 39.68 million yuan respectively. In the first three quarters of 2020,Net loss27.51 million yuan. In 2019 and the first three quarters of 2020, NayukiNet profitThe rates are 1% and 0.2% respectively.

Nai Xue said in the prospectus that although it has made losses during the previous record period, its profitability has improved. Furthermore, despite the impact of the new corona pneumonia epidemic on related businesses, the company still managed to comply with International Standards. of Financial Information in the first three quarters of 2020.Net profit4.5 million yuan.

Nai Xue said: “The improvement in our overall profitability reflects the improvement in our operating efficiency at the group level, primarily due to our continued acceleration of business expansion to achieve considerable economies of scale.”

Many tea startups compete for the capital market

In fact, in addition to Nayuki, the news of the listing of Hey Tea and Michelle Ice City has also been reported.

According to the interface report, a Hong Kong investment banker said Hey Tea will submit a prospectus to the Hong Kong Stock Exchange in March.Guosen Values(Hong Kong) sources also claimed that Hi Tea could make an initial public offering in March. According to a report published by Hey Tea in early February, at the end of 2020, Hey Tea has opened 695 stores in 61 cities in the country and abroad.

According to the LatePost report on January 13, the first round of financing for the new Michelle Ice City tea brand that lasted more than three months was already completed earlier. Dragon Ball Capital and Hillhouse Capital jointly led the investment, each of which invested 1 billion yuan. Once the financing is completed, Michelle Ice City is valued at more than RMB 20 billion. It is understood that Michelle Ice City plans to list on the A-share market, and the preparations for the listing have reached the final stage.

According to the Nai Xue leaflet data, at the end of September last year, there were about 340,000 freshly brewed tea shops in my country, and the average price of freshly brewed tea was 13 yuan, of which about 3,200 was high. . -Finish the freshly brewed tea., The average selling price of your freshly brewed tea is not less than 20 yuan. Among them, there are around 100 high-end freshly made tea chain brands, operating around 2,400 tea shops across the country.

According to data from iiMedia Consulting, the size of China’s new-style tea market in 2019 was 204.48 billion yuan. In 2021, the new-style tea drink is expected to return to the pre-epidemic level , with a market size close to 280 billion yuan .CEO and head of IiMedia ConsultingAnalystZhang Yi believes that once Hey Tea, Naixue, and Michelle Ice City are on the market, the new tea drinking track will become more intense. Since the new tea market in the first and second tier cities is basically saturated, brands must turn to the sinking market for new growth points.

Essence Securities believes in the research report that the current awareness of drinking new style tea was initially established. As the leading high-end tea drinks, Xicha and Naixue enjoy high recognition from consumers. At the same time, stores are mainly concentrated in the first – and second-tier cities, sinkingMarket spaceStill widePerformanceTotal growth potential.

(Source: Brokerage China)

(Responsible editor: DF387)

I solemnly declare: The purpose of this information disclosed by Oriental Fortune.com is to spread more information and has nothing to do with this booth.

[ad_2]