[ad_1]

Original caption: Moutai made a decision: 820 million yuan will not be donated! Brokers see stock prices high at 3000 yuan

Summary

[Moutai tomó una decisión: ¡no se donarán 820 millones de yuanes! Los corredores ven el precio de las acciones hasta 3.000 yuanes]On February 9, Kweichow Moutai again set a record, with the total market value reaching the 3 trillion yuan mark for the first time. On the same day, Kweichow Moutai also made an important decision: to end four donations totaling 820 million yuan. This decision by Moutai was interpreted by the market as a “historic victory” for small and medium shareholders! The CITIC Securities research report noted that in the short term, non-standard products are expected to be the first to catalyze growth and sustain the price of Pfeiffer to consolidate the potential for price increases. One to two years are expected to unleash more growth potential. . After the company’s market value of 3 trillion yuan, there is still ample long-term space. The company’s one-year target price rises to 3,000 yuan, and the “buy” rating is maintained. (Daily economic news)

February 9Kweichow moutaiOnce again set a high record, totalMarket valueFor the first time, it reached the 3 trillion yuan mark. In the same day,Kweichow moutaiAn important decision was also made: to end four donations totaling 820 million yuan.

Moutai’s decision was interpreted by the market as small and mediumshareholder“Historic victory”!

End four donations of 820 million yuan

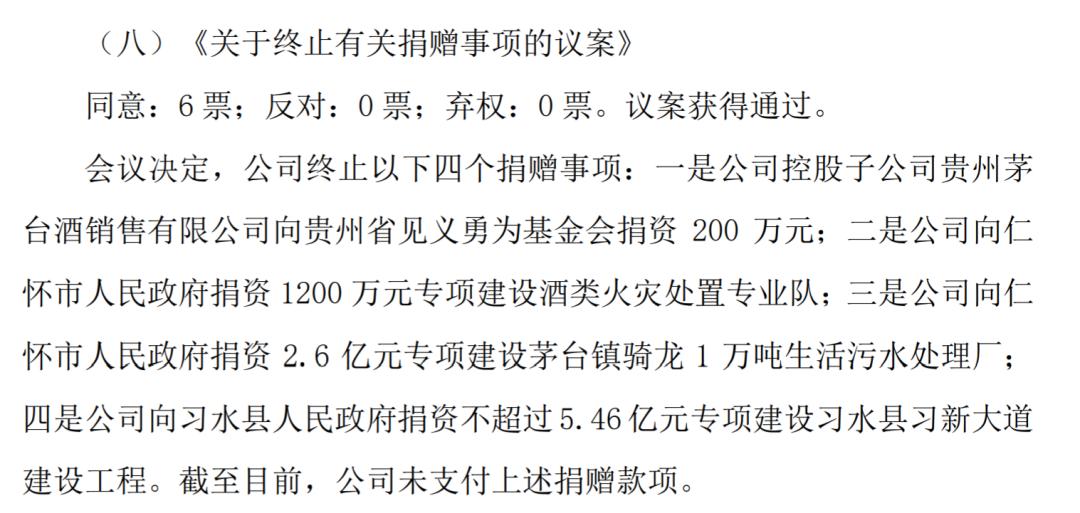

On the night of February 9Kweichow moutai(600519) Publish the third board of directors for the first time in 2021meetingresolutionad, One of the “Proposals on the termination of donation-related matters” decided to terminate Kweichow Moutai and its subsidiariesthe companyThe total amount of the four donations from the company reached 820 million yuan.

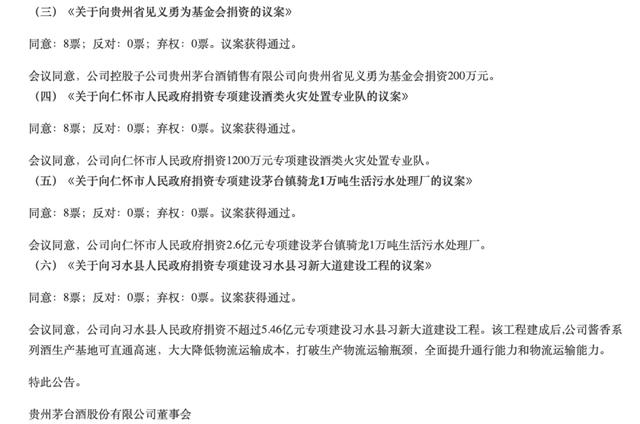

According to the announcement, Kweichow Moutai canceled the following four donations: First, the company’s subsidiary, Kweichow Moutai Liquor Sales Co., Ltd. offered to Guizhou province to do everything possible.backgroundWill donate 2 million yuan. Second, the company will donate 12 million yuan to the Renhuai City People’s Government to build a special alcohol fire suppression team. Third, the company will donate 260 million yuan to the Renhuai City People’s Government to build 10,000 tons of Maotai Qilong City The domestic sewage treatment plant, fourth, the company donated no more than 546 million yuan to the Xishui County People’s Government for the special construction of Xixin Avenue in Xishui County. So far, Kweichow Moutai has not paid the mentioned donations.

In the announcement, Kweichow Moutai also revealed a number of construction project proposals, the most important of which is the continued construction of the wine warehouse in the Chinese region during the 13th Five-Year Plan.ConstructionFor the project, the investment does not exceed 460 million yuan, and the company itself will raise the necessary funds. This project foresees the construction of 15 wine cellars with a total designed wine storage capacity of 18,400 tons.

“Moutai Time and Space”publicThe author stated: “Moutai’s cancellation of the relevant grant proposal is not a denial of his responsibility and ideals of public welfare. Rather, you need to cultivate the soil and the basis for consensus with stakeholders from the system level. From the perspective of meaning, property of the statecompanyFor decision making and subsequent amendments, there should be a discussion and approval process that is not too short, for this, more investors have also reported tolerant and positive comments. “

The above four donations were approved by the Kweichow Moutai Board of Directors in September 2020. At that time, Kweichow Moutai issued an announcement that four of the six proposals at the meeting were related to donations.

But then, the aforementioned donations raised external doubts and up to 200 shareholders took part in class actions. The voluntary termination of the Moutai donation is certainly a timely response to the position of the small and medium shareholders.

The total market value is 3 trillion yuan.

On February 9, the market value of Kweichow Moutai officially surpassed the 3 trillion yuan mark, and the share price also surpassed 2,400 yuan per share for the first time.

On February 10, after opening higher at 2,485 yuan a share, Moutai’s share price rose to a record 2,589.99 yuan a share in half an hour. At closing, Kweichow Moutai’s share price was reported at 2,601 yuan, an increase of 5.89%, with a total market value of 3,267.4 million yuan.

Looking back at the share price trend, Kweichow Moutai hit the 1 trillion yuan mark on January 15, 2018. After June 2020, Moutai’s share price has been moving forward, breaking the mark of 1,500 and 2,000 yuan successively. The total market value stood at 2 trillion yuan on July 6, 2020. From this point of view, it took two years for the market value of Kweichow Moutai to jump from 1 trillion to 2 trillion yuan, and only It took 7 months to go from 2 trillion to 3 trillion yuan.

Behind the all-time high of the Kweichow Moutai share price, it has a lot to do with the collective organization of the main institutions. By the end of last year, Kweichow Moutai was in the hands of 1,361 funds, firmly occupiedPublic offerThe biggest heavyweight stock. And this is already the sixth consecutive quarter that Kweichow Moutai has becomeRaised fundsThe most popular heavyweight action.

The production and operation situation of Kweichow Moutai in 2020 shows that in 2020, the company will produce 50,000 tons of Moutai base liquor and 25,000 tons of base liquor in series; it is expected to achieve a total operating income of about 97.7 billion yuan.I andIncrease of approximately 10%, of which the companyWholly owned subsidiaryKweichow Moutai Jiangxiang Wine Marketing Co., Ltd. is expected to achieve a total operating income of about 9.4 billion yuan (about 10.6 billion yuan in sales, tax included);Net profitAbout 45.5 billion yuan, an increase of about 10% year-on-year.

CITIC valuesInvestigation reportPoint out that in the short term, non-standardproductIt is expected to take the initiative to catalyze growth and accelerate, maintaining Pfeiffer price stability and consolidating the potential for price increases, and expecting more growth potential in the 1-2 years. Looking at the longer dimension, the company has a solid foundation for a steady increase in volume and price, with a long dimension.PerformanceWith a high certainty of growth, we hope to fully enjoy the valuation premium. Chinese New Year 2021Movable pinConstantly building a stronger consensus, investment in the spirits sector remains optimistic, Moutai has both offensive and defensive capabilities, and more catalysts are expected to drive the industry up. After the company’s market value of 3 trillion yuan, there is still ample long-term space. The company’s one-year target price rises to 3,000 yuan, and the “buy” rating is maintained.

Shigekura Moutai’s online celebrity fund is again restricted

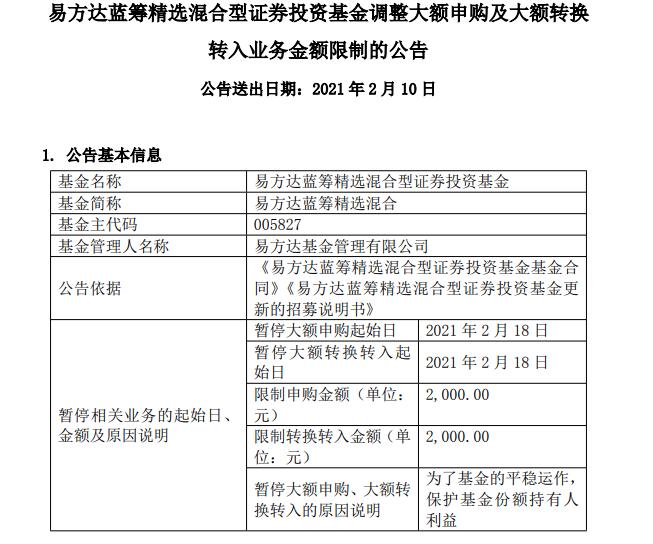

In less than half a month, Zhang Kun’s E Fund Blue Chip Selected Fund had “limited flow” again.

TodayFund EManagement Co., Ltd. issued an announcement stating that it has decided to adjust the Blue Chip selection of E Fund as of February 18, 2021HybridInvestment in sharesThe limit on the number of high-value subscriptions and high-value conversion fund transfers across all sales institutions has been adjusted from “the amount of a single fund account cumulatively subscribed to the fund in a single day does not exceed 5,000 yuan “to” a single fund account is cumulatively subscribed to the fund in a single day. The amount does not exceed 2,000 RMB. “

This is the third time this year that the fund has adjusted the upper limit for large purchases. On January 8, E Fund Fund lowered the purchase limit for a single one-day account selected by E Fund Blue Chip from 1 million yuan to 100,000 yuan. On January 28, E Fund Blue Chip Selection further adjusted the original purchase limit from 100,000 yuan to 5,000 yuan.

According to the announcement, if the amount of a single fund account for a single fund purchase exceeds 2,000 (excluding) in a single day, 2,000 yuan will confirm the success of the subscription, and the part that exceeds 2,000 yuan (not included ) will be confirmed as a failure; as a single day If the fund account has multiple cumulative subscriptions for the fund with an amount of more than 2000 yuan (excluding), the requests will be ranked in descending order of the amount applied.Fund managerThe application that is accumulated one by one up to the limit of 2,000 yuan (inclusive) is confirmed successfully and the remaining amounts of the application have not been confirmed.

The announcement stated that the specific time for resuming bulk purchases and bulk conversion transfers will be announced separately.

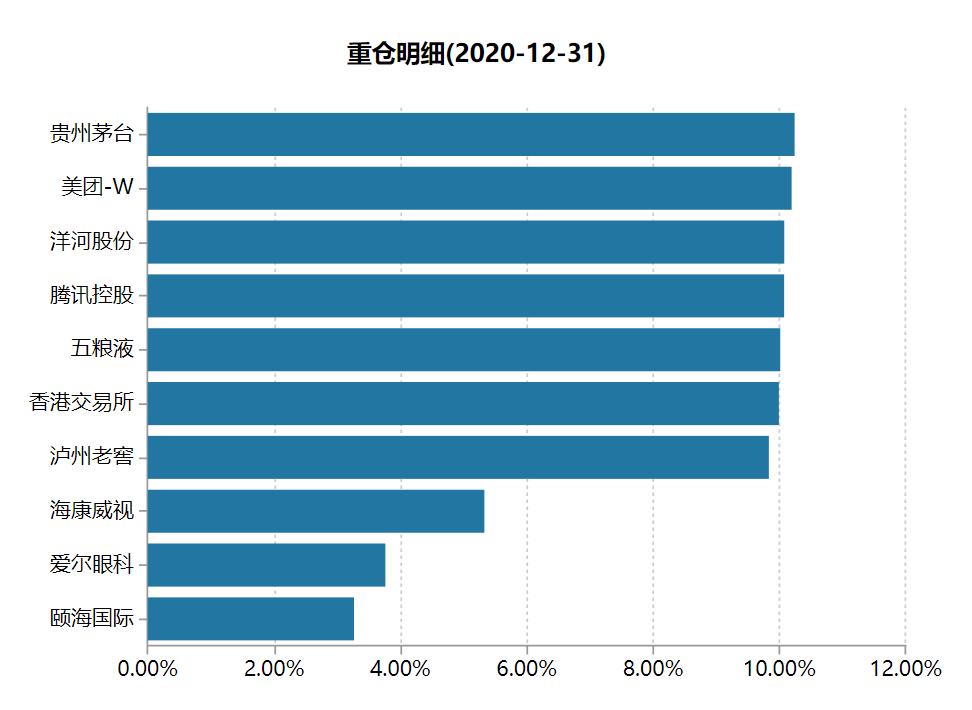

At the end of the fourth quarter of 2020, the number of selected top-line mixed investment stocks in Fund E represented 91.12% of the fund’s total assets. The top ten stocks were Guizhou Moutai (600519.SH),Meituan-W(03690.HK)Yanghe Stocks(002304.SZ) 、Tencent Holdings(00700.HK) 、Wuliangye(000858.SZ) 、Hong Kong Stock Exchange(00388.HK) 、Luzhou Laojiao(000568.SZ) 、Hikvision(002415.SZ) 、Ophthalmology Aier(300015.SZ) 、Yihai International(01579.HK)

(Source: Daily Economic News)

(Responsible editor: DF537)

I solemnly declare: The purpose of this information is to spread more information, and it has nothing to do with this booth.

[ad_2]