[ad_1]

Original title:[China Merchants Macro Zhang Qiuyu]Chances of Further Fiscal Expansion in 2021 Weaken – December and Full Year Fiscal Data Comments

Summary

[Macro de comerciantes de China: la posibilidad de una mayor expansión fiscal en 2021 se debilita]The “proactive fiscal” in 2021 may be discounted from the “proactive” in 2020. The actual deficit in 2020 will be 2.5 trillion yuan lower than the budget deficit. When the national economic growth rate is generally restored to the level of potential economic growth, the possibility of fiscal expansion in 2021 will weaken. So far, there is no special bond issuance plan. We maintain our previous judgments that we expect a budget deficit of 3.3% in 2021 and the issuance of special bonds of 3 trillion yuan.

Central point of view:

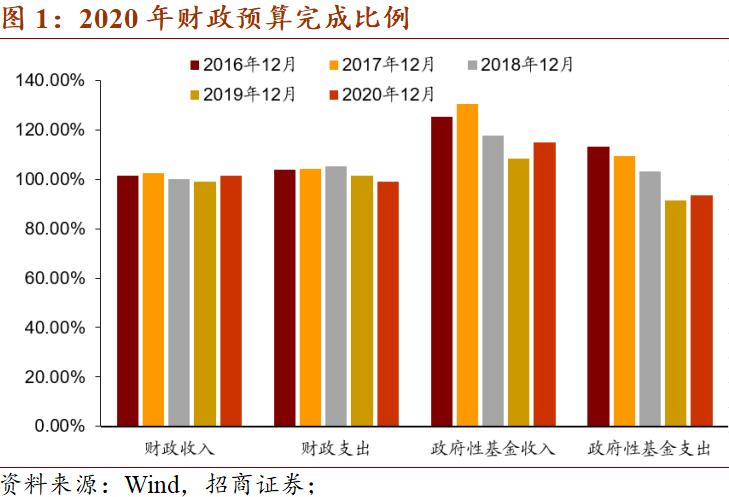

annualIncomeThe budget was exceeded and the percentage of tax expenditures completed was 99.1%. The completion rate of tax revenue in 2020 is 101.5%, which is an excess of fulfillment of the task. Annual tax revenue was 18.3 trillion,I andA decrease of 3.9%. The tax expenditure completion rate in 2020 is 99.1%. Fiscal spending for the year was 24.6 trillion yuan, an increase of 2.8% year-on-year. Government 2020backgroundThe revenue completion rate was 114.8% and the total revenue of government funds for the year was 9.3 trillion yuan, an increase of 10.6% year-on-year. In 2020, the proportion of completed government funds expenditures is 93.6%.Fund budgetSpending was 11.8 trillion yuan, a year-on-year increase of 28.8%. Together, the completion rate for general tax revenue in 2020 is 105.6% and the completion rate for the general expense budget is 97.2%.

In terms of pace, given that economic activity improved in the second half of the year, tax revenues grew strongly. Since the epidemic improved in April, the decline in tax revenue has slowed further. Among them, the growth rate of tax revenue in December was 17.4% year-on-year, significantly higher than the value of -2.7% before November, and the monthly growth rate was positive again. Main drivers of tax revenue in December include consumption tax, value added tax, personal income tax and tax revenue.Tax on deedsAnd so on, non-tax revenue has also started to turn positive year after year. Consumption tax in December was 79.8% year-on-year, significantly higher than the previous value of 2.2%. The annual growth rate of the value added tax in December was 7.8%, continuing the continuous positive growth since August. In December, personal income tax increased 24.5% year-on-year, maintaining a double-digit growth rate and a strong growth rate. At the same time, affected by the improvement of economic activities,companyHigher profitability,residence incomeincrease,Corporate taxAnd growth in residents’ personal income tax was strong. Driven by growth in real estate sales and better automobile consumption, the growth rate of the deed tax and the auto purchase tax also performed well.

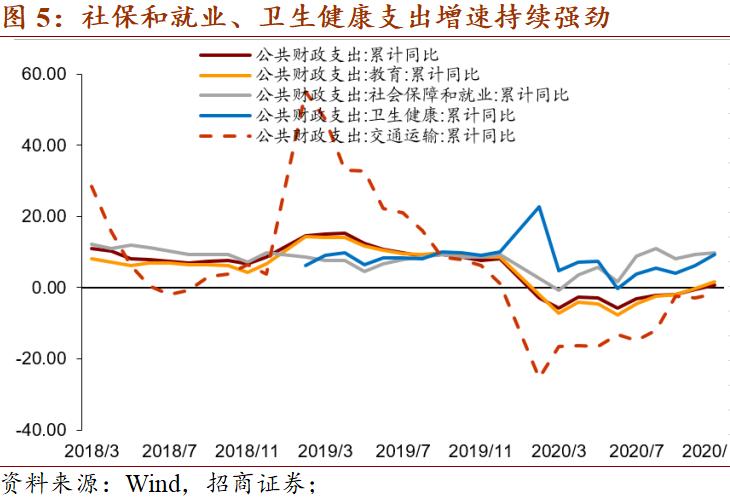

In general, although the pace of tax expenditures has increased in the second half of the year, tax expenditures in 2020 are lower than expected. In 2020, tax expenditures increased 2.8% year-on-year. Among them, central government budgetary spending fell 0.1% year-on-year.Local financeBudgetary expenditures increased by 3.3% year-on-year. Throughout the year, spending on health, social security andjobExpenses grew rapidly, with annual growth rates of 15.2% and 10.9% respectively. At the same time, it is worth noting that interest payments on debt have continued to maintain a double-digit growth rate since the second half of the year.

The “proactive fiscal” in 2021 may be discounted from the “proactive” in 2020. The real deficit in 2020 is 2.5 trillion yuan lower than the budget deficit, and the domestic economic growth rate generally resets to the level. potential economic growth, and the possibility of maintaining fiscal expansion in 2021 weakens. At the moment, there is no special bond issuance plan. We maintain our previous judgments that we expect a budget deficit of 3.3% in 2021 and the issuance of special bonds of 3 trillion yuan.

The following is the content of the text:

1. Annual tax revenue is over budget

The tax revenue completion rate in 2020 is 101.5%, beating the task. Total tax revenue for the year was 18.3 trillion, a 3.9% year-on-year decrease. The proportion of tax expenditures completed in 2020 is 99.1% and the total tax expenditure for the year is 24.6 trillion yuan, a year-on-year increase of 2.8%. In 2020, the completion rate of government funds income was 114.8% and the cumulative income of government funds for the whole year was 9.3 trillion yuan, an increase of 10.6% year-on-year. In 2020, the proportion of completed government funds expenditures is 93.6%.Fund budget expenses11.8 trillion yuan, a year-on-year increase of 28.8%. Taken together, the 2020 overhead tax revenue completion rate is 105.6% and the overhead budget completion rate is 97.2%.

2. Economic activity improved in the second half of the year and tax revenues grew strongly

Tax revenue for the full year 2020 totaled $ 18.3 trillion, a 3.9% year-on-year decline, and the rate of decline has slowed further since April. Among them, the central general public budget revenue was 8.3 trillion yuan, a year-on-year decrease of 7.3%; local general public budget revenue at this level was 10.0 trillion yuan, a year-on-year decrease of 0.9%.National tax revenueA year-on-year decline of 2.3%, the decline has been gradually reduced since April; non-tax revenue fell 11.7% year-on-year. Economic activity improved in the second half of the year and tax revenues grew strongly.For the whole year, personal income tax has accumulated 11.4% year-on-year, which may affect the futureResident consumptionIt has a negative impact.

The tax revenue growth rate in December was 17.4% year-on-year, significantly higher than the -2.7% value before November, and the monthly growth rate was positive again. In detail, the main drivers of tax revenue in December include the consumption tax, the value added tax, the personal income tax and the deed tax on tax revenue. Non-tax revenue has also started to turn positive year after year. Consumption tax in December was 79.8% year-on-year, significantly higher than the previous value of 2.2%. The annual growth rate of the value added tax in December was 7.8%, continuing the continuous positive growth since August. In December, personal income tax increased 24.5% year-on-year, maintaining a double-digit growth rate and a strong growth rate. Continued growth in tax revenue is in line with economic data and highly sustainable. At the same time, affected by the improvement in economic activities, corporate profits increased, residents’ income increased, corporate income tax and personal income tax grew strongly. Driven by growth in real estate sales and better automobile consumption, the growth rate of the deed tax and the auto purchase tax also performed well.

3. Spending on people’s livelihoods accounted for a relatively large percentage of growth

Fiscal spending for the full year 2020 is 24.6 trillion yuan, a year-on-year increase of 2.8%. Among them, the central fiscal budget spending was 3.5 trillion yuan, a year-on-year decrease of 0.1%, and the local fiscal budget spending was 21.0 trillion yuan, an annual increase of 3.3 %. For the full year, spending on health, social security and employment, spending on education, agriculture, forestry and water issues totaled 11.2 trillion, representing 45.6% of annual fiscal spending, and the year-on-year growth rate it was 15.2%. , 10.9%, 4.4% and 4.4%. Among tax expenditures in 2020, people’s livelihood expenditures account for a relatively large share and the growth rate is rapid. At the same time, it should be noted that interest payments on debt continued to maintain double-digit growth in the second half of the year.

Tax expenditures in December grew 16.5% year-on-year, a slight increase of 0.5 percentage points compared to the previous month. Among them, the growth rate of central government spending was 14.3%,Local tax expenditureThe growth rate was 16.8%. Specifically, spending on education is 19.5% year-on-year, the growth rate of cultural tourism is 26.7%, the growth rate of spending on social security and employment is 13.3% year-on-year and spending in health, it was 57.7% year-on-year, which may be related to the recent outbreaks scattered in various places and the strengthening of prevention and control.Spending on urban and rural community affairsThe growth rate was -10.7% and the annual growth rate of agriculture, forestry and water affairs was 2.3%.trafficThe growth rate of transportation spending was 92.1%. Overall, tax expenditures in a single month were 3.8 trillion yuan in December, a record.

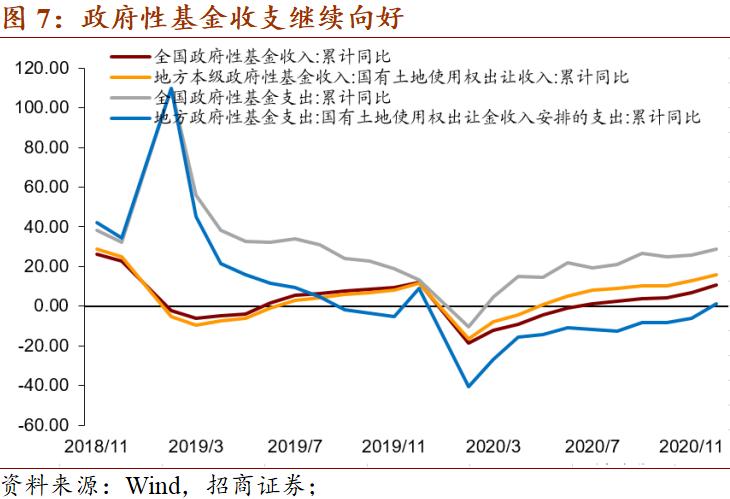

4. Strong growth in income and expenditures of public funds

In 2020, the governmentFund budget income9.3 trillion yuan, a year-on-year increase of 10.6%, of which the budget income of the central government fund was 356.2 billion yuan, a year-on-year decrease of 11.8%, and the budget income of the government fund local were 9.0 trillion yuan, an increase of 11.7% year-on-year.EarthRight to useSales revenue was 8.4 trillion yuan, an increase of 15.9% year-on-year.

In 2020, the budget expenditures of government funds will be 11.8 trillion yuan, a year-on-year increase of 28.8%. Among them, the budget spending of the central government fund was 271.5 billion yuan, a year-on-year decrease of 12.8%, and the budget spending of the local government fund was 11.5 billion yuan, a year-on-year increase of 30.2%, including state-ownedLand use rightsTransfer income and expenses were 7.7 trillion yuan, an increase of 1.0% year-on-year.

5. The possibility of a further expansion of tax expenditures in 2021 weakens

The real deficit in 2020 will be 2.5 trillion yuan lower than the budget deficit, and the domestic economic growth rate will generally be restored to the level of potential economic growth, and the possibility of further fiscal expansion in 2021 will weaken. expects the two sessions in 2021 to continue to maintain a neutral or even slightly tight fiscal policyattitude. So far, there is no special bond issuance plan. We maintain our previous judgments that we expect a budget deficit of 3.3% in 2021 and the issuance of special bonds of 3 trillion yuan.

(Source: Xuanyan Global Macro)

(Responsible editor: DF064)

I solemnly declare: The purpose of this information disclosed by Oriental Fortune.com is to spread more information and has nothing to do with this booth.

[ad_2]