[ad_1]

Original title: Market value of 2,700 million, previous loss of 2,400 million to 3,400 million. The performance of another A-share company “exploded”, the Shenzhen Stock Exchange quickly followed, 34,000 shareholders panicked …

To sharesthe company“Explosion Thunder”!

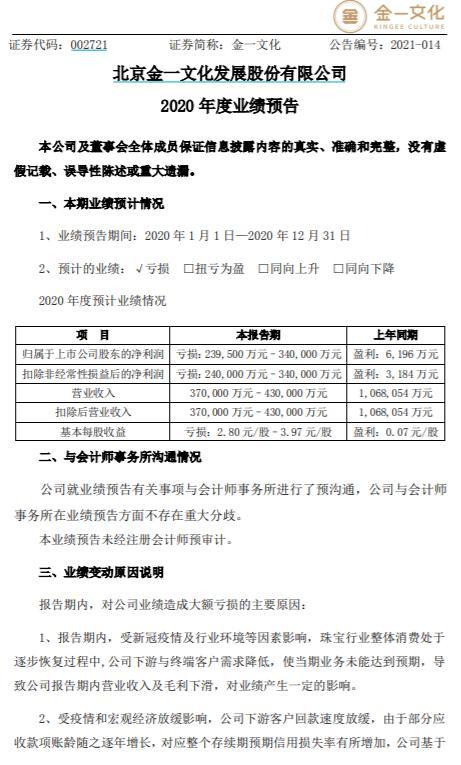

On the night of the 25th,Jinyi culturead, Expected to be net in 2020LostFrom 2.395 million to 3.4 billion yuan, a profit of 61.96 million yuan in the same period last year. The company carried out a systematic impairment test on the goodwill formed by the previous acquisitions of Zhenbaotong, Jinyi Jewelry, Gefu Jewelry and Yuewang Jewelry, all of which showed signs of impairment. Based on objective factors and future business development judgments, the company intends to determine where the aforementioned subsidiaries are located. The goodwill of the group of assets is provided for impairment.

Some netizens have expressed their doubts, are you sure this is really a loss?

Jinyi cultureA provision is planned for the impairment of goodwill, and the exchange is quickly affected

Jinyi cultureThe announcement stated that during the full 2020 reporting period,PerformanceThe main reasons for large losses:

1. During the reporting period, affected by factors such as the new crown epidemic and the industry environment, the overall consumption of the jewelry industry is gradually recovering.Demand from the company’s end and downstream customers declined, causing the current business to fall short of expectations., Resulting in the company’s reporting periodOperating incomeAnd the decrease in gross profit has a certain impact on performance.

2 ,Affected by the epidemic and the macroeconomic slowdown, the company’s intermediate customers slowed, Since the aging of some accounts receivable has increased year after year, which corresponds to the expected duration of the entire durationcreditThe loss ratio has increased, the company is based on the principle of prudence, according to the “companyaccountingCode and companyAccounting policiesIn accordance with the relevant regulations, accumulated credit impairment losses in the current period increased year on year.

3. During the reporting period, the company completed the acquisition of subsidiaries Zhejiang Yuewang Jewelry Co., Ltd. (hereinafter “Yuewang Jewelry”), Shenzhen Jiefu Jewelry Co., Ltd. (hereinafter referred to as “Yuewang Jewelry”). “Jiefu Jewelry”). ), Zhenbaotong (Shenzhen)The InternetTechnology Co., Ltd. (hereinafter “Zhenbaotong”) and Shenzhen Jinyi Jewelry Co., Ltd. (hereinafter “Jinyi Jewelry”) have actively pursued resource sharing and business integration throughout the group. . Thanks to the efforts of the management team, the brand image,productDesign, production and processing of sales channels.MOTHERPlanning for transformation and upgrade, but due to the impact of domestic and foreign epidemics in 2020, market macroeconomics and changes in the general consumer environment, the performance growth of the mentioned companies has not met expectations and development The group of assets in which they are located has been affected to varying degrees. Decline, performance suffers and losses occur. Considering the possible impact of the prevention and control of the epidemic of the new crown in the jewelry industry, the impact on the flow and consumption of passengers is difficult to eliminate in a short time, and the future prospects are not optimistic. The company has expectations for the future development of the aforementioned subsidiaries. According toChina Securities Regulatory Commission“Warning of accounting regulatory risk No. 8 – Impairment of goodwill” and “Business accountingThe relevant provisions of Standard No. 8-Impairment of Assets,The goodwill formed by the previous acquisitions of Zhenbaotong, Jinyi Jewelry, Gefu Jewelry and Yuewang Jewelry has been systematically tested for impairment, and signs of impairment have appeared. Based on objective factors and future business development judgments, the company intends to determine where the aforementioned subsidiaries are located. Provision for impairment of the goodwill of the asset group。

Regarding the announcement made by Jinyi Culture, the SME Board Management Department of the Shenzhen Stock Exchange issued a letter of concern.

The attention letter noted that on January 25, 2021, your company disclosed the “2020 Annual Results Forecast” (hereinafter, the “Announcement”), indicating that it is subject to the company’s operating and gross income.interest rateAs a result of the decrease, the increase in the provision for credit impairment losses and the provision for goodwill impairment, your company is expected to lose from 2.4 billion to 3.4 billion yuan in 2020.

It is worth paying attention to the following points:

1. The “Announcement” stated that due to factors such as the new corona epidemic and the industry environment, the overall consumption of the jewelry industry is rebounding, causing the company’s current business to fail with expectations, resulting in operating income and gross income during the reporting period.interest rateDecline Please finishcontractThe operating income of other listed companies in the industry in the first three quarters of 2020,Net profit、 Main financial indicators such as net cash flow from operating activities and gross profit margin,Analyze in detail if the main financial indicators of your company are significantly abnormal compared to other publicly traded companies in the same industry。

2. On October 29, 2020, your company released the “Asset Impairment Provision Announcement”, stating that it intends to withdraw 222 million yuan in various asset impairment reserves in the first three quarters of 2020 and various assets in the third The reserve value was 107 million yuan and the provision for bad debts was 101 million yuan in the third quarter. Furthermore, your company’s “Third Quarter 2020 Report” shows that, as of September 30, 2020, your company’s accounts receivable balance was 3.842 billion yuan.Provide additional information on the basis of your business’s provision for credit impairment losses, the steps taken by your business to collect accounts receivable, and whether your business has adjusted earnings and engaged in “big bath” financial behavior.。

3. Your company’s “2020 Semi-Annual Report” shows that, as of June 30, 2020, your company’s goodwill balance reached 1,571 million yuan. Among them, Zhejiang Yuewang Jewelry Co., Ltd., Zhenbaotong (Shenzhen) Internet Technology Co., Ltd., the corresponding goodwill balances of Shenzhen Jinyi Jewelry Co., Ltd., and Shenzhen Jiefu Jewelry Co., Ltd. (in hereinafter “Jiefu Jewelry”) are 316 million yuan, 377 million yuan, 327 million yuan and 541 million yuan respectively. The “Announcement” indicates that your company intends to make a provision for impairment of the goodwill of the group of assets in which the aforementioned subsidiary is located. Add the following items:

(1)Provide additional information on the amount of goodwill impairment that your company intends to withdraw for the subsidiaries listed above.。

(2) Explain in detail the test method, the selection of parameters and the basis for the impairment of goodwill, explain if the moment of impairment of goodwill is precise, if the impairment of goodwill in previous years is appropriate and if this impairment is online. with the companyAccounting standardsRelevant regulations. The annual audit accountant is asked to express a clear opinion.

(3) Your company’s “2020 Semi-Annual Report” shows thatJeff Jewelery First Half 2020Net profit15,645,600 yuan Please provide additional explanation based on your company’s disposition on impairment of goodwill in jewelry。

The highest market value has evaporated more than 30 billion, 34,000shareholderCaught in it

Jinyi Culture’s high share price in 2015 was 36.85 yuan per share, with a market value of 35.4 billion yuan. At the close of the 25th, the stock price was 2.85 yuan per share and the market value was 2.736 million yuan.

Image source: each drawing

As of September 30, 2020, Jinyi Culture still has 34,300 shareholders.

Image source: each drawing

Some netizens said: “The market value is 2.7 billion and the loss is 2.4-3.4 billion. Are you sure this is really a loss?

“How to do it? Higher than market value”

(Source: Daily Economic News)

(Responsible editor: DF524)

I solemnly declare: The purpose of this information is to spread more information, and it has nothing to do with this booth.

[ad_2]