[ad_1]

Car industryAsnational economyImportant part of theinvestmentPay close attention to.

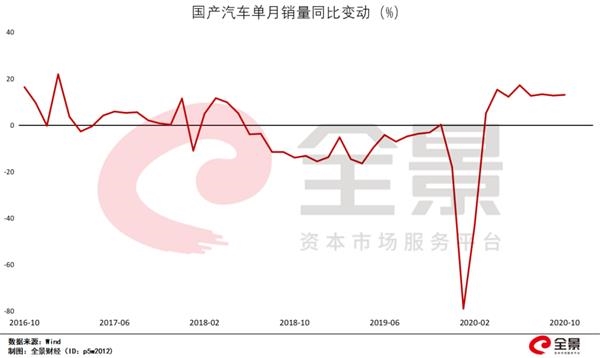

Since 2019, the monthly sales volume of domestically produced vehicles has started to slow down and gradually come out of the downward trend since 2016. By the end of 2019, the monthly sales volume of domestically produced vehicles has returned to positive growth after 17 months of continuous decline.

In the general adjustment of the industry, new energy vehicles, as a key direction of structural changes, have increased their sales significantly in the last five years and have always attracted the attention of investors, along withTeslaEnter Chinamarket, The market has reached a new level.

Regular repairs overlap with structural changes Late last year, the automotive industry started to heat up. But earlier this year, the epidemic spread across the country,Car industryHe also suffered I got into the epidemicEffective controlSince then, the country has worked hard to resume work and production. At the macro level, the state continues to introduce a series of policies to stimulate automobile consumption. At the industrial level, domestically produced vehicles and new energy vehicles continue to introduce explosive models to the market, both from the perspective of the industry as a whole and from the structure of new energy vehicles. From a sexual perspective, the market restoration has come swiftly and powerfully.

Consequently, the automotive sector in the secondary market this year has been low and then high. The overall performance of theCar industryThe index (CI005013) has registered an increase of more than 40% this year and is among the first in the market. Some stocks in the sector are highly sought after by funds, and their share prices continue to hit record highs.

Recently,panoramic·WiseBest of new fortuneAnalystNo. 1 in the automotive and auto parts industryChangjiang ValuesChief Automotive Industry AnalystGordon, I conducted face-to-face exchanges on investment opportunities in the automotive and spare parts industry in 2021, the future development of the industry, and the impact of industry changes on investment ideas.

Character introduction: Gordon

Changjiang ValuesChief Analyst for the Automotive Industry; New Fortune No. 1 Best Analyst in the Auto & Auto Parts Industry

Gordon believes that despite the impact of the epidemic, the overall trend in the auto industry remains positive. The recovery and reform of the entire industry is still in progress.Especially in view of the changing characteristics of the industry, also focused on the in-depth interpretation of intelligentization, through the analogy of smartphones.industry, Proposed three types of investment opportunities.

At the same time, he also believes that with the evolution of changes in the industry, the overall investment thinking for the automotive sector should be changed from the traditional weekly.Futures, Switch to a long-term high growth model.

Panoramic viewX Changjiang ValuesGordon

Industry recovery, technological change, automotive industrybeKeep improving

Panoramic view:What keywords or keywords do you think can summarize your 2021 automotive prediction?

Gordon:I think for the auto industry in 2021, it can be more comprehensive with two keywords.The first keyword is recovery and the second is change.

From a recovery perspective, auto sales have entered a process of continuous growth and recovery. Since July 19, the industry growth rate has gradually increased from the lowest point. After the Spring Festival this year, due to the impact of the epidemic, the industry growth rate plummeted. However, with the resumption of work and production, the industry’s growth rate has continued to return to an upward path. From this “big hole”, we have seen that the industry growth rate remains relatively high in May and June, especially in the third quarter.If we fill in the “big pot” and connect it to a trend line, thenThe growth rate of auto industry sales is in a continuous upward channel.

Looking ahead to 2021, we believe that, on the one hand, benefiting from the relatively low base in the first half of this year, there will be a better base for growth next year. On the other hand, as the epidemic subsides and the economy recovers, we believe that purchasing power will also increase, leading to a share of first-time car buying demand. We believe this may also provide relatively strong support for the growth of the industry next year.

From a recovery perspective, in addition to the cyclical factors of the industry, what we value is more important for the long-term development of the industry that will produce big changes.variable。We see that the automotive industry is experiencing electrification and intelligence. This is also a very big change that has been experienced in the last few decades. We believe this change will affect allIndustrial chainValue creation andValue distributionThey have a relatively large impact.We believe that some relatively long-term sustainable investment opportunities will also emerge in this process.。

Smart carIt will bring three types of investment opportunities

Panorama · Knowledge:In your opinion, what are the key drivers or drivers in investment opportunities under this change?

Gordon:At present, I believe that intelligence will become a relatively long-term transformative opportunity in the future. With reference to the development history of smartphones over the past decade, we believe that there are three main types of investment opportunities.

The first type of opportunity,Probably the best investment opportunity, it should still be similar toAppleThe whole machine.In the smartization process, the entire vehiclethe companyThe profitability model of traditional cars has changed, starting from a single link as the original new car manufacturing, the future will gradually develop to participate in the value creation of the entire car life cycle. So in this case,Vehicle companies will have broader revenue streams and higher profitability, while earnings volatility will decreaseIn addition to the intelligence broughtValue added servicesWe believe that the entire vehicle industry will create great value.

The second type of opportunity,We consider incremental parts. Like Sunny Optics and GoerTek in the mobile phone industry, some new parts will be needed to improve the intelligence of mobile phone. With increasing penetration rate and the value of a single product, these new parts will have a long-term sustainable effect. Growth opportunities.

The third type of opportunity,Everyone thinks it will look inconspicuous, but in fact, the opportunity to take advantage of all Chinese manufacturing is similar to Foxconn orLuxshare Accuracy。In the past, due tosupplyDispersion leads to further dispersion of the entire automotive industry chain and ultimately makes it impossible to concentrate the design and manufacturing of auto parts.But we see that intelligence is changing the entire industry, one of which ismarket shareIt will be more concentrated, and the design and production of parts will also be large-scale and modular.In this case, forcostStrong controllability,clientServiceThose who respond fastercompanyI think you will enjoy more dividends from the industry in this large-scale manufacturing process.

cycletogrowingChangeAutomotive Industry Investment FrameworkOr change

Panorama · Knowledge:In terms of your experience, in terms of the investment logic and investment methods of the entire automotive industry, has it changed from the past few years to the next few years?

Gordon:In fact, I just put more emphasis on intelligence performance, which also reflects changes in investment methods for the auto industry.

We have seen that there is a change taking place in the investment method or the research framework of the automotive industry, in fact, before this new cycle begins, everyone is moreborrowReflect to shift from the growth period to the market maturity period, this cyclical view judges the investment opportunities of the entire industry.

Regarding periodicity, we systematically did some research and summaries in 2008 and 2009. We have come to the view that the auto industry is gradually shifting from an era of high growth to an era of low growth. Your industry opportunities appear primarily when industry turning points appear. Find the automakers with the strongest new car cycle. In other words, investment opportunities depend on the entire cyclical tipping point, and this factor will be more important.

But why do we emphasize intelligence? Because we seeIntelligence brings new opportunities, similar to new energy 5 years agoWhat the new energy brings is the battery industry chain, which is a long-term, high-speed growth process. In this process, some good subsectors were bornMarket valueA relatively large leading company. Therefore, we also believe that the intelligentization of vehicles in the future will also produce similar new opportunities.

Then from the original traditional cyclical law to switch to a growing industry, I think there may be a change in the investment framework of the entire auto industry. AndWe preferGrowth ActionsOr such investment method for tech stocksThen the investment logic of individual stocks to pay attention to or look for in the future, including key tracking points, I think there may be some changes too.

(Article source: Panorama Finance)

(Responsible editor: DF537)

I solemnly declare: The purpose of this information is to spread more information, and it has nothing to do with this booth.

[ad_2]