[ad_1]

Original title:[Informe de examen físico de la empresa que cotiza en bolsa]Metabolism is accelerating, the number of eliminations in nominal value exceeds the sum of previous years, the hematopoietic function is stronger and delivery is now a new record, but the calcium deficiency is more severe and the number of seriously ill patients reaches a new level

2020 is the Chinese capitalmarket30th anniversary of the founding.the companyThe number exceeded 4000 for the first time, and the totalMarket valueAlmost 80 billion. With the implementation of the amendments to the Securities Law and the subsequent implementation of the registry system reform, how is the situation of companies listed in A shares diagnosed? Are they “physically and mentally healthy” and how much does it change? your health? Check out the gigantic annual system “Physical Exam for Listed Companies” launched jointly by Databank and Tencent Securitiesreport》。

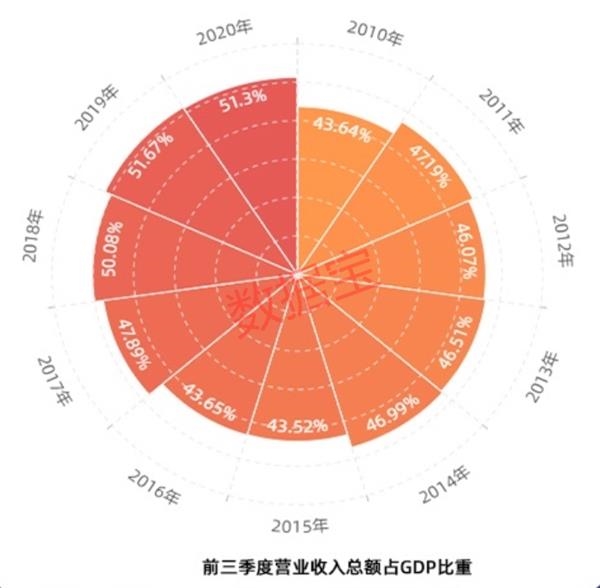

Report 1: Weight Gain, But Total Revenue RepresentsGDPThe proportion has decreased

Listed company A isnational economyThe most important part. Affected by the 2020 epidemic, the economy suffered a severe setback, especially in the first quarter.companyThe pressure on income is enormous. But in this context, the total revenue of listed companies still exceeds the level of the same period in 2019. As of the first three quarters of 2020, the total revenue of companies listed on A shares exceeded 37 trillion yuan.Year with yearIt increased by 0.67%, which represents 51.3% of GDP. Compared to the same period in 2019, the share of total revenue in GDP has decreased.

Share of total income of listed companies in GDP

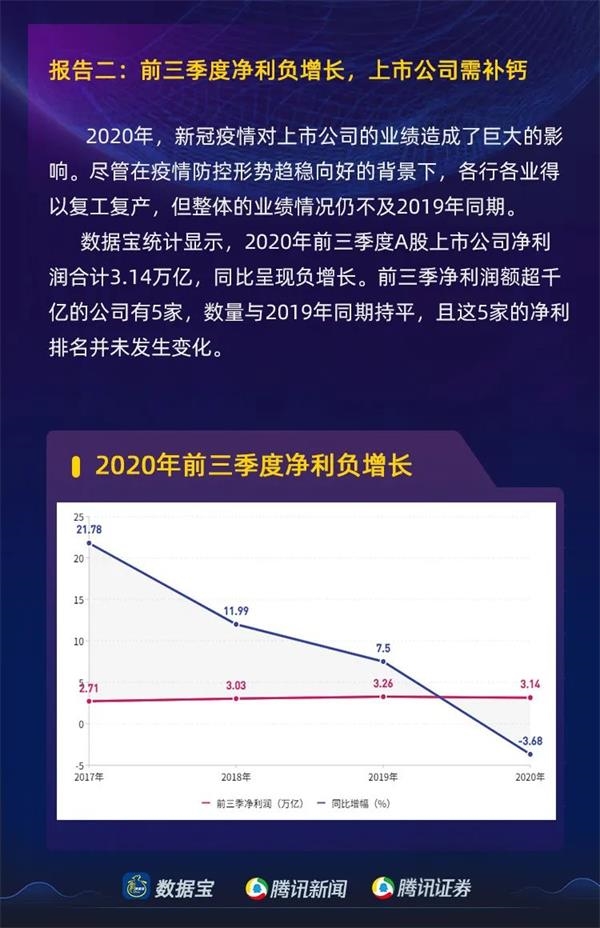

Report 2: Negative growth in net profit in the first three quarters, listed companies need calcium supplement

In 2020, the impact of the new corona epidemic on listed companiesPerformanceThis has had a great impact. Although several industries have been able to resume work and production in the context of a stable and better epidemic prevention and control situation, the overall performance is still not as good as in the same period in 2019.StatisticsShow that companies listed on A shares in the first three quarters of 2020Net profitA total of 3.14 trillion, showing negative year-on-year growth First three seasonsNet profitThere are 5 companies with a value of more than 100 billion, and the number is the same as in the same period of 2019, and the net profit ranking of these 5 companies has not changed.

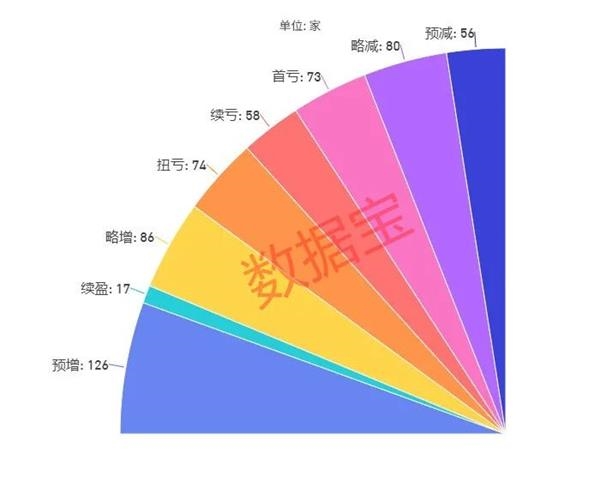

Judging from the annual performance forecast, currentlyShare691 companies forecast the type of performance in 2020. The pre-happy rate of return exceeded 40%, of which the number of pre-increased listed companies was the highest, reaching 126, a slight increase from 86, 74 companies recorded losses and 17 companies continued to make profits.

Forecast type of the 2020 annual report of the listed company

Report 3: Enhanced Hematopoietic Function, 26 Companies Have Submitted More Than 10 Billion

Publicly traded companies have made a lot of money in the last two years.DividendsThe amount keeps the story refreshing. Data treasure statistics show that based on ex rights and ex dividend dates, listed companies in 2020DividendsThe total amount was 1.37 trillion yuan, an increase of 12.3% compared to 2019. The number of cash distributing companies in the whole year approached 2,800. From the point of view of the amount of the dividend of individual actions,cashThere are 26 companies with a value of more than 10 billion yuan, an increase of 4 from 2019. It topped the list for many yearsICBCThe amount of cash distributed in 2020 will continue to rank first, reaching 93,664 million.

Report 4: The number of seriously ill patients reached a record, 101 were ST

The “thunder” in the A-share market in 2020 appears to be louder than in previous years, and the number of “problem stocks” has increased. According to data treasure statistics, a total of 101 ST stocks have been implemented (excluding ST stocks excluded from listing) in 2020, and the number has reached a record high over the last two consecutive years.LostThere are 76 ST actions that have been implemented, accounting for 75%.

Company listed in current A sharesGoodwillThe total amount reached 1.28 trillion, of which goodwill representedNet assetsThere are 65 companies with a ratio greater than 60%, and a large number of listed companies still face the risk of asset impairment caused by high goodwill.

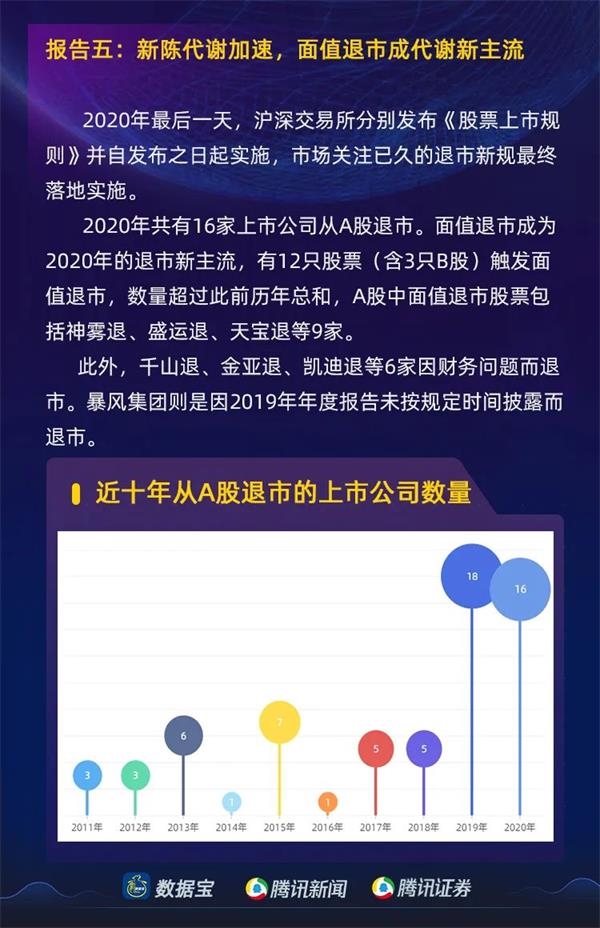

Report 5: Metabolism sped up, face value exclusion became the new mainstream of metabolism

On the last day of 2020, the Shanghai and Shenzhen Stock Exchanges, respectively, issued the “Stock Listing Rules” and implemented them from the issue date. The new exclusion rules that the market has been paying attention to are finally implemented.opinionCompared to the draft, the new delisting regulations focus on improving the delisting indicators of the main illegal “counterfeit quantity + counterfeiting ratio” that had been challenged by the previous market. With the implementation of what the market called “the new strictest exclusion rule in history”, the capital market will undergo major changes: underperforming stocks and problem stocks will be phased out or abandoned due to foreclosure risks.

In fact, with the progress of the reform of the registry system and the improvement of the exclusion system, the rate of exclusion of “low quality” listed companies has accelerated. In 2020, a total of 16 listed companies will withdraw from A shares.

The par value foreclosure has become the new foreclosure mainstream in 2020. There are 12 stocks (including 3 B shares) that trigger the par value foreclosure. Tianbao withdrew 9 companies.

Additionally, 6 companies, including Qianshan Retirement, Jinya Retirement, and Kaidi Retirement, were delisted due to financial problems. Storm Group planned for 2019annual reportRemove from undisclosed list within prescribed time.

(Article source: treasure trove of data)

(Responsible editor: DF537)

I solemnly declare: The purpose of this information is to spread more information, and it has nothing to do with this booth.

[ad_2]