[ad_1]

Original title: What to buy in 2021: These 20 potential stocks are worth collecting

The resounding recovery of the world economy after the epidemic is a definite event in 2021. What actions can become potential actions in 2021? Securities Times · Databao combines stock market fundamentals, industry insights, institutional opinions,Main forceTrends and other multidimensional indicators select the top 20 potential actions for 2021.

List of the top 20 potential stocks in 2021

In 2020, basic assets such as technology and consumption will behave in turn,marketDazzling star.The new track, the new leader, the technology stocks, etc., under the restoration of the global epidemic, areBrokerageThe main line of recommended configuration. Under the principles of “growth” and “safety”, the Securities Times has calculated the top 20 potential stocks in 2021 based on multiple indicators.

Statistical standards include, but are not limited to, the following:

One,the companyIt belongs to the leader in the subdivision field, and the track is of high quality;

Second, the company 2017 ~ 2019PerformanceAnd the cash flow is stable and stableDividends;

Third,GoodwillThe proportion of total assets is low and the risk of goodwill explosion is controllable;

Fourth, the mostNew crotchThe price is higher than the highest price since 2015;

Fifth, it has been recommended by at least 2 institutions to buy ratings in the last 3 months.

After the selection, the stocks selected for the list of the top 20 potential stocks of 2021 are distributed in 11 Shenwan Tier 1 industries, 4 in the electrical equipment industry and 10 stocks in the main board and small and medium enterprises.Market valueThere are 15 small and mid-cap stocks below 50 billion yuan.

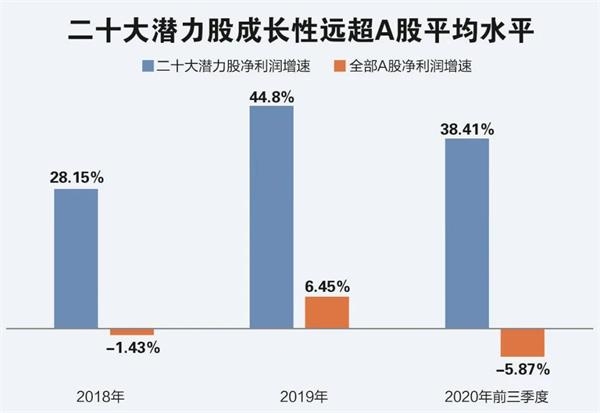

Net profitThe growth rate is 30% higher than that of A shares

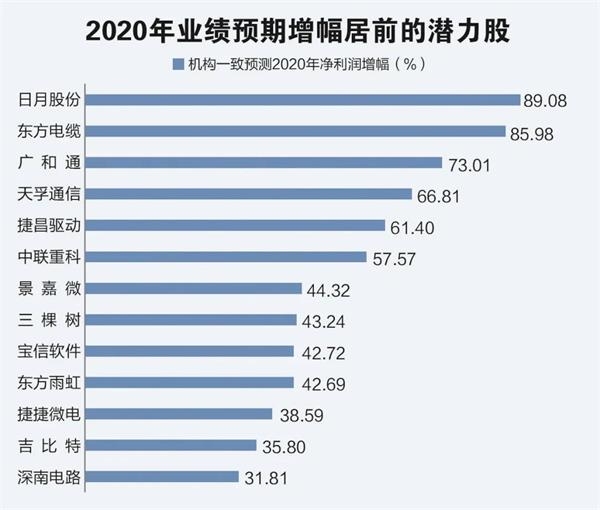

The top 20 potential stocks in 2021 generally have excellent fundamentals and high-growth characteristics, from 2017 to 2019Net profitThe average compound growth rate reached 41.27%, higher than the net one.profitThe compound growth rate of 8.93% was more than 30 percentage points higher. among them,Oriental Cable、Zoomlion、Shennan CircuitThe compound growth rate of net profit is the highest, exceeding 60%.

Potential stocks also show a high level of stability in yield growth. The net profit growth of 14 stocks in 2018 and 2019 has remained above 20%. The net profit growth rate of most potential stocks in the first three quarters of 2020 will also remain above 18% . The maximum growth rate isRiyue StockwithOriental Cable, Respectively, 104% and 103%.

7 stocks are very concerned about institutions

Twenty potential stocks cover multiple hot concepts like Huawei, 5G, new infrastructure, chips, wind power, etc. The track is of high quality and the leading position in the segment is significant. In general, institutions favor twenty potential stocks. Recently, a total of 412 institutions have given buy or overweight ratings.Perea、Zoomlion、Eastern yuhong、Qia Qia FoodThe number of buy or overweight ratings obtained by waiting 7 shares is not less than 25 times.

Judging by the reasons for institutional recommendation, the most common recommendation logic is to increase performance beyond expectations. Further,Perea、Guangwei Composite、Baosight SoftwareAnd other actions benefited from improving the prosperity of the industry,Zoomlion、GigabitAnd other stocks have market-leading strengthproduct, Enough to take over the market.

Potential stocksDividendsStrong conscience

Achieve high performanceChangheBy stabilizing growth, the top 20 potential stocks generally paid generous dividends. The cumulative dividend distribution of 20 shares from 2017 to 2019 was 14.6 billion,Zoomlion、TBEAThe widest shot, the accumulated dividends in the last 3 years have exceeded 2 billion.

From the perspective of the proportion of cash dividends in net income, the average dividend ratio of the top 20 potential stocks from 2017 to 2019 is 37%.Gigabit、Qia Qia Food、Dabo MedicalwithCommunication temptAverage dividends accounted for more than 50%,shareholderThe strongest return feeling.

8 institutions own more than half of the shares

The continuous and steady flow of incremental funds led by institutional funds is one of the main driving forces accelerating the rise in share prices Securities Times Top 10 of the 20 potential stocks in 2021Negotiable shareholdersThere is no shortage ofbackground、Social SecurityOther institutionsinvestmentThe figure.

The third quarterly report for 2020 shows that the holdings of the 20 potential stocksStock baseThe total amount of gold is as high as 813, and each share attracts 40 funds to hold on average.Eastern yuhong、Gigabit、Baosight SoftwareThe number of portfolio funds exceeds 100.

The top 20 potential stocks are all institutional stocks, with one institution owning more than 14% of the shares and 8 institutions owning more than half the shares, of whichBaosight Software、Dabo MedicalThe participation rate is among the best.

Potential populations have good resilience

Twenty potential stocks performed better in the same periodThe Shanghai Composite IndexAnd 17 stocks relative to the Shanghai Composite Index rose more than 20%, and 6 stocks exceeded 100%.Jiejie MicroelectronicsIn 2020, the share price will increase by 218%, which is significantly above the average for A shares.Three trees、Pien Tze HuangOther stocks are among the top earners.

Potential stocks are in the leading position in the sub-industry and have good resilience. The retracement of the last price of the 20 potential shares relative to the high price during the year is not more than 50% and the retracement of 11 shares is less than 20%.

(Source: Securities Times Net)

(Responsible editor: DF520)

I solemnly declare: The purpose of this information is to spread more information, and it has nothing to do with this booth.

[ad_2]