[ad_1]

Recently, declining iron ore supply, rising demand for steel and potential short-term supply disruptions caused by the Western Australian storm have worried commodities analysts.

Vale, the world’s second largest iron ore producer, lowered its supply expectations, further compounding these concerns. The Brazilian company recently lowered its production forecast for 2020 and lowered its production forecast for next year.

At the same time, Brazil’s exports to the rest of the world fell to a six-month low in November.

Erik Hedborg, a senior analyst at commodities company CRU, said China’s strong economic performance and infrastructure stimulus program have led to an increase in demand, reducing already low inventories and leading to a trend in market conditions. market. tight.

At the same time, maritime supplies from major iron ore countries like Australia and Brazil have also declined.

On December 11, in the Asian market in the early trading, the main domestic iron ore contract broke the 1,000 yuan mark, and the current increase has expanded to 8%.

Recently, the China Iron and Steel Association issued a document stating that the vice president of the association asked Australian mining giant BHP Billiton about rising iron ore prices. Regarding the recent hurricane warning issued by Western Australia, BHP Billiton stated that unfavorable weather will not affect monthly shipping volume and will maintain the originally planned level.

According to BHP Billiton, production is expected to remain strong in the new fiscal year starting in July, and production will reach the upper limit of guidance production (276 million-286 million tonnes).

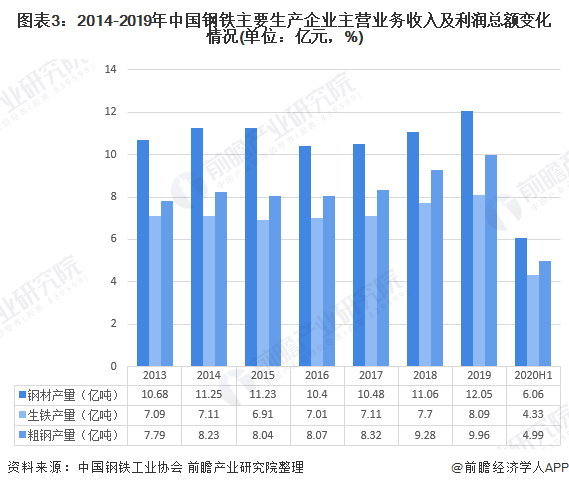

In 2019, China’s top iron and steel producing companies achieved 4.27 trillion yuan in revenue and 189 billion yuan in total profit

According to the Foresight Industry Research Institute analysis, the iron and steel industry was one of the fastest growing industrializing industries in the world. In the last 100 years, the iron and steel industry has developed rapidly, whether in terms of production value, product structure or industrial technology. There has been an unprecedented improvement. In the 21st century, steel remains an irreplaceable raw material for humanity and an important indicator to measure the comprehensive national strength and industrial level of a country.

From 2014 to 2019, the main business income of China’s top steel producing companies declined amid fluctuations, and total profit showed a trend of first increasing and then decreasing. In 2019, the main business revenue was 4.266.2 billion yuan, an increase of 10.12% year-on-year; the total profit obtained was 189 billion yuan, a year-on-year decrease of 30.90%. This is mainly due to the widespread increase in the prices of major raw materials, such as domestic iron ore concentrates, imported iron ore, steel scrap and coking coal, which continue to operate at a high level.

This article comes from Qianzhan.com, please indicate source for reprint. The content of this article only represents the personal opinions of the author, this site only provides references and does not constitute any investment advice or application. (If there is any content, copyright or other issues, please contact: [email protected])