[ad_1]

Original title: Quick look! If you participate in these jobs starting in 2021, there will be no withholding or prepayment of taxes in this situation!

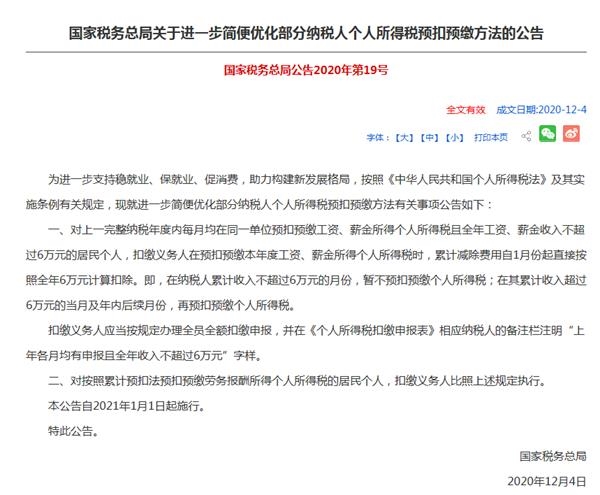

The State Tax Administration recently publishedtaxpayerpersonalIncome taxWithholding and prepayment methodad“(Hereinafter” Announcement “) clearly:

As of January 1, 2021, the above is completedFiscal yearWithholding and prepayment in the same unit every monthsalary, Wage incomePersonal taxesResident persons whose annual salary and salary income do not exceed 60,000 yuan,Withholding agentWithholding and prepayment of the current yearIncome from wages and salariesIn the case of personal income tax, the accumulated deduction expenses will be calculated and deducted directly at the annual rate of 60,000 yuan from January. That is, in the month that the accumulated income of the taxpayer does not exceed 60,000 yuan, the individual income tax will not be withheld and paid in advance temporarily; In the month when the taxpayer’s accumulated income exceeds 60,000 yuan and the subsequent months of the year, the individual income tax will be withheld and paid in advance.

The “Ad” primarily optimized the withholding and prepayment methods for two types of taxpayers. Which includesinsuranceMarketers andValuesrunner。

What methods of retention and prepayment of taxpayers have been optimized?

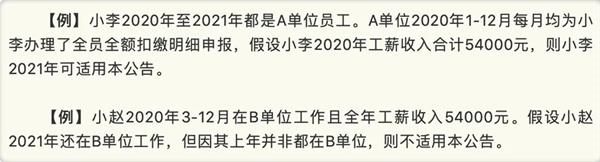

One is the resident natural person who has deducted and declared personal income tax on wages and salaries in the same unit every month for the last full fiscal year, and the annual income from wages and salaries did not exceed 60,000 yuan. Specifically, three conditions must be met at the same time:

(1) All worked in the same unit from January to December of the previous fiscal year and had withheld and prepaid personal income tax on wages;

(2) Accumulated salary income from January to December of the previous fiscal year (including one-time incomecousinAnd other wages and salaries, without deduction of expenses andtax freeIncome) does not exceed 60,000 yuan;

(3) Since January of this taxable year, they are still employed by the unit and obtain wages and salaries.

The second is withholding and prepayment under the cumulative withholding method.ServiceResident individuals with personal income tax on remuneration, such asinsuranceSecurities dealers and brokers. The following three conditions must also be met at the same time:

(1) From January to December of the previous year, the remuneration was paid in the same unit and the withholding and prepayment statement was made in accordance with the accumulated withholding method.RemunerationPersonal taxes;

(2) Accumulated labor compensation from January to December of the previous fiscal year (without deduction of expenses andTax-free income) No more than 60,000 yuan;

(3) As of January of the current fiscal year, the unit still derives the earned compensation income from withholding and prepaid tax according to the accumulated withholding method.

What is the optimized method of withholding and prepayment?

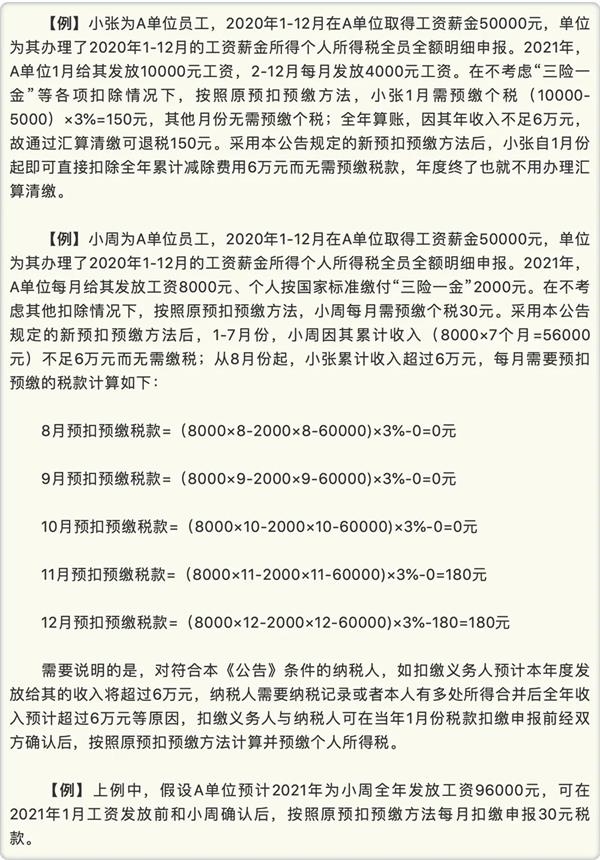

For taxpayers who meet the requirements of the “Announcement”, when the withholding agent withholds and pays in advance the individual income tax for the fiscal year, the accumulated deduction rate will be calculated directly and deducted at the annual rate of 60,000 yuan from January. That is, in the months when the accumulated income of the taxpayer does not exceed 60,000 yuan, there is no need to withhold and prepay the personal income tax; In the month when the accumulated income of the taxpayer exceeds 60,000 yuan, and the following months of the year, the individual income tax is withheld and paid in advance. At the same time, according toTax LawIt is stipulated that the withholding agent will continue to handle the withholding statement for all employees and the total amount in accordance with the tax law.

After the announcement

How should the withholding agent operate?

Natural personElectronic taxOffice retentionclientWhen the withholding agent calculates and withholds personal income tax in January of the current year, the system will automatically summarize and notify the employees who may meet the requirements based on the withholding statement situation for the year previous. After verifying and confirming the list, the withholding agent can withhold and prepay the personal income tax according to the method specified in this “Announcement.” If a paper return is adopted, the withholding agent must determine taxpayers who meet the “Announcement” requirements based on the withholding statement from the previous year, and then run this announcement and start with the withholding tax return in January of the current year. In the “Request for withholding income tax for individualsReport》 Complete the column of observations of the corresponding taxpayer with “declared in each month of the previous year and the annual income does not exceed 60,000 yuan”.

(Source: CCTV Finance)

(Responsible editor: DF380)

I solemnly declare: The purpose of this information disclosed by Oriental Fortune.com is to spread more information and has nothing to do with this booth.

[ad_2]