[ad_1]

After regaining profitability in the second quarter, Meituan’s core business (3690.HK) resumed positive growth in the third quarter.

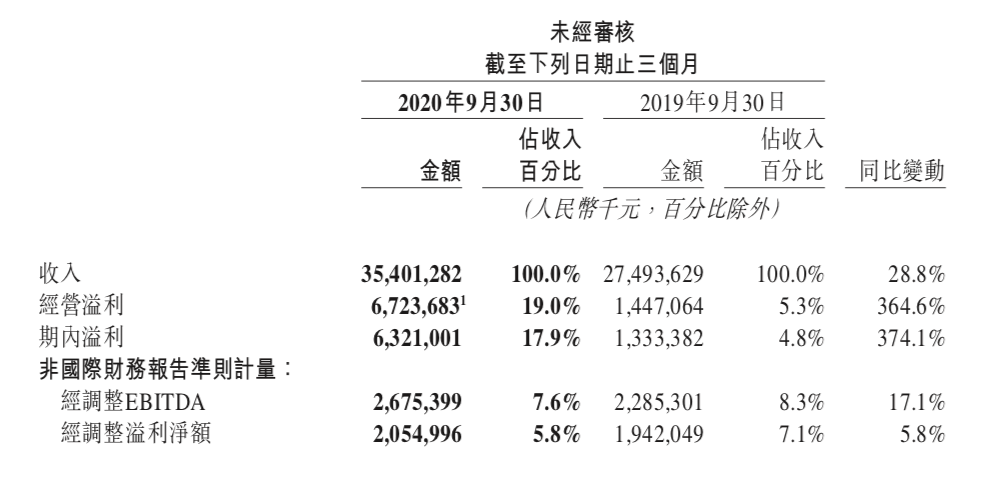

On November 30, Meituan announced its third quarter 2020 results. The financial report shows that Meituan’s total revenue increased 28.8% year-on-year to 35.4 billion yuan, and its adjusted net profit was 2.055 billion yuan, an increase of 5.8% year-on-year. Among them, the number of annual active merchants increased to 6.5 million, and the number of annual transaction users reached a record 480 million, reflecting the rapid growth in both supply and demand brought by the digitization of life services.

Image Source: Screenshot of Meituan Financial Report

It is worth mentioning that after experiencing the continued impact of the epidemic on the wine travel business in the first two quarters, Meituan’s wine travel business finally achieved positive growth in the third quarter. The financial report shows that Meituan’s revenue from the shopping, hotel and tourism businesses increased 4.8% year-on-year to 6.5 billion yuan. Operating profit increased from 2.3 billion yuan in the third quarter of 2019 to 2.8 billion yuan in the third quarter of 2020, and the operating profit margin increased from 37.7% to 43.0%.

In terms of new business, Meituan formally established the “Preferred Division” on July 8, which immediately triggered a vigorous community group buying battle between internet giants. As the war has escalated, Meituan has also invested in purchases from community groups. It is gradually expanding.

According to the financial report, the operating loss of the new business of Meituan and other divisions in the third quarter increased from 1.5 billion yuan in the second quarter of this year to 2 billion yuan. According to Meituan’s financial report, some of the reasons for this come from the flash sale and Meituan Optimal. Decrease in operating profit margin due to business expansion.

Since the beginning of the year, Meituan’s cumulative increase has reached 230%, and the increase has reached 380% from the lowest point. After its market value surpassed Ping An in August this year, it outperformed traditional financial giants with a market value of 1.98 trillion Hong Kong dollars in early November. Bank.

However, at the close of November 30, Meituan’s share price was trading at HK $ 290, a drop of more than 7% from the previous trading day, with a total market value of 1.71 trillion Hong Kong dollars.

Net profit increased by more than 3 times for the store and wine trips to resume growth

The data shows that Meituan’s revenue in the third quarter reached 35.4 billion yuan, slightly beating previous market expectations of 34.047 billion yuan, a year-on-year increase of 28.8% and a monthly increase of 43.2%. In terms of net profit, Meituan Q3 achieved a profitable net profit of 6.32 billion yuan, an increase of 374.1% compared to 1.333 billion yuan in the same period last year, and its operating profit margin increased from 5.3% in 2019 to 19.0%. Meituan explained in his financial report that the net profit includes 5.8 billion yuan of fair value gains from investments in listed entities.

Specifically at the business level, with the significant improvement in the internal epidemic situation, Meituan’s core business achieved substantial growth in the third quarter. The financial report shows that Meituan’s food and beverage delivery transactions reached 152.2 billion in the third quarter, and the average daily volume of transactions recovered to 34.9 million. Among them, the number of food delivery members also reached a new record.

At the same time, the number of newly launched takeaway brands in the third quarter increased 157% year-on-year, leading to a 4.5% year-on-year increase in consumer unit price. At the same time, Meituan’s platform advantage had a higher synergistic value in this quarter, as takeout and catering merchants converted more effectively.

It is worth mentioning that with the relief of the domestic epidemic, the volume of transactions on the Meituan platform and the marketing needs of merchants have shown a clear recovery trend. The financial report shows that Meituan’s revenue in the quarter reached 6.5 billion yuan in the retail travel and liquor business sectors. Meituan said in its financial report that the volume of transactions and the value of the transactions of the store segment in this quarter have achieved positive year-on-year growth. In addition, the recovery of the marketing needs of the merchants in the store branches is also on track.

Regarding the hotel reservation business, thanks to China’s effective control measures against the epidemic and strong demand for summer tourism, the recovery of inter-city tourism and business tourism has been good compared to the last few quarters. . Data shows that consumption on the Meituan platform The volume of national hotel nights in the third quarter of 2020 registered a year-on-year growth of 3.7%.

“The recovery of the domestic consumer market this quarter has led to a steady recovery in the life services industry. Through continuous improvement of the service experience of multiple categories and scenarios, Meituan has become the choice of more consumers and merchants “. Meituan CEO Wang Xing said: “In ‘Under the Food + Platform strategy, we promote the digital development of the industry through technological innovation and generate more job opportunities. In the future, we will always adhere to the creation of social value to achieve commercial value, and with a more open attitude, we will work with the upstream and downstream actors of the industry chain. Partners, fulfill the mission of ‘helping everyone eat better and live better’ “.

New business losses expand to 2 billion yuan, buying competition from community groups intensifies

While overall growth in its core business has resumed, Meituan’s investment in new business has continued to increase.

The financial report shows that the operating loss of the new business of Meituan and other divisions increased by 68.8% compared to the same period in 2019. Compared with the income of new businesses in the second quarter of this year, the loss Meituan’s new business increased from 1.5 billion yuan. At 2 billion yuan. However, in planning for Meituan, the new business has focused more on long-term value.

Meituan said in its financial report that the increase in operating losses was mainly due to the expansion of new businesses such as grocery retail, mainly due to the decrease in operating profit margins of Meituan Flash Sale and Meituan Optimal as they his business was expanding.

The “Daily Business News” reporter noted that the expansion of new business has also led to an increase in the platform’s cost of sales. Data shows that Meituan’s cost of sales increased by 52.2%, from 16.1 billion yuan in the second quarter of 2020 to 246 in the third quarter of 2020. The percentage of total revenue increased from 65 , 3% to 69.4%.

In terms of selling costs, in addition to passenger subsidies and other payment costs, Meituan revealed in its financial report that it was mainly driven by the growth of Meituan’s B2B catering supply chain services and grocery purchases. Meituan flash sales and Meituan grocery purchases increased. The cost of other outsourced labor increased by 370 million yuan; Furthermore, the increase in the number of employees caused by the expansion of new companies also increased Meituan’s employee welfare spending by 230 million yuan.

However, despite the expansion of losses and investments, the revenue from the new Meituan business has also increased.

The financial report shows that the revenue from the new business of Meituan and other divisions increased by 46.1% from 5.6 billion yuan in the second quarter of 2020 to 8.2 billion yuan in the third quarter of 2020, mainly due to the higher recovery from the epidemic and business expansion, which led to B2B restoration. Revenues from supply chain services, bike sharing services and grocery retail services increased.

It is worth mentioning that since the second half of the year, with the successive entry of Didi, Meituan and other Internet giants, the purchase of community groups has become the absolute focus of the current competition and has become the project number one of almost all companies in the future.

Meituan stated in its financial report that Meituan is still focusing on iterating business models and developing core capabilities, while exploring different ways to improve storage efficiency and team leader management capabilities, and accumulating experience in a broader range. of SKU products.

At the same time, Meituan will use existing supply chain resources and offline marketing capabilities to further accelerate the pace of expansion, improve operational efficiency and strengthen SKU management, and continue to instill the brand in consumers. and group leaders as their business scales expand in the future. awareness.

In this regard, Wang Xing said in a conference call after the financial report was released that Meituan Optimal’s current focus is still on optimizing operations and developing core capabilities, and it will turn Optimal into a more open business, with more local industries. upstream and downstream. Traders develop together.

Consultation in real time of the new global epidemic of pneumonia