[ad_1]

Original Title: Evergrande’s 130 Billion War Vote Suspense Announced! 125.7 billion common shares converted from state-owned companies in Guangzhou and Shenzhen to take over 30 billion Evergrande properties to be listed soon

Summary

[¡Se anuncia el suspenso de inversión de guerra de 130 mil millones de Hengda! 125.700 millones de acciones ordinarias convertidas de empresas estatales en Guangzhou y Shenzhen para adquirir más de 30.000 millones de propiedades Evergrande que se cotizarán pronto]With a paper announcement, the issue of divestment of China Evergrande’s $ 130 billion war investment has been resolved. On November 22, China Evergrande (3333, HK) announced that of the 130 billion war investment, 125.7 billion of the war investment have signed an agreement to be converted into common stock, and the 4.3 billion One billion remaining war investments have been bought back after China Evergrande cash payment. . (China corridor)

With a piece of paperad,In the spotlightChina EvergrandeThe 130 billion war vote agreement has been resolved.

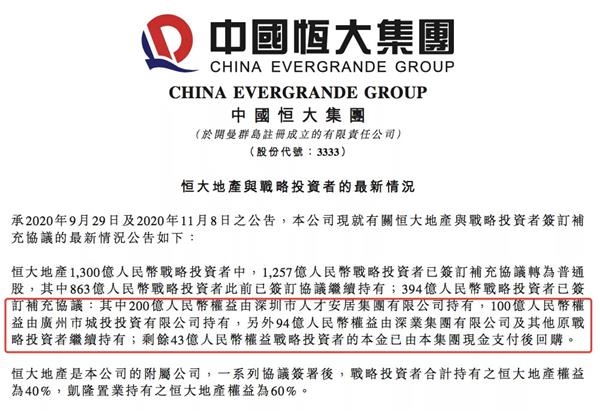

November 22thChina Evergrande(3333, HK) announced that of the 130 billion war investment, 125.7 billion war investment has signed an agreement to convert into common stock, and the remaining 4.3 billion war investment has beenChina EvergrandeAfter payment in cashRepurchase。

BrokerageChinese reporters noted that the top two state assets in Guangzhou and Shenzhen are among the 39.4 billion newly signed war investments.companyTogether, Shenzhen Talent Anju Group has 20 billion shares and Guangzhou Urban Investment Co., Ltd.the companyto hold. This also means that the pressure to redeem the war that worries the outside world is completely removed.

It is worth mentioning that, on the road to debt reduction, China Evergrande has solved the problem of war investments of 130 billion and Evergrande Property has advanced in its listing.cleaveThe price also favors a further reduction in the debt ratio of China Evergrande.

Two state-owned companies in Guangzhou and Shenzhen acquire more than 30 billion

On November 22, China Evergrande andShandong Highway(600350, SH) Announcement, the official announced the final suspense solution of China’s 130 billion permanent war investment.

Previously, in orderReorganizationIn deep real estate, China Evergrande introduced 130 billion strategic investors, and the subsequent restructuring was finalized, and the question of whether or not the 130 billion strategic investment was retained became the focus of market attention.

On November 8, China Evergrande revealed that it had invested 130 billion yuan in a strategic investment, of which 86.3 billion of strategic investors had previously signed a supplemental agreement and agreed not to demandRepurchaseAnd they continue to uphold the rights and interests of China Evergrande; 35.7 billion strategic investors have also been negotiated and a complementary agreement is about to be signed.shareholderThe reorganization of assets under negotiation. The rest of the capital of 3 billion strategic investors has been paid by the group and will be bought back soon.

On November 22, the mystery was further revealed. In this announcement, China and Singapore made it clear that 39.4 billion of strategic investments have signed a supplemental agreement for common shares. Among them, 20 billion shares are held by Shenzhen Talent Anju Group, 10 billion shares are held by Guangzhou Urban Investment Investment Co., Ltd., and the other 9.4 billion shares remain held by Shenye Group and other original strategic investors.

According to the data, Shenzhen Talent Housing Group is a large state-owned company in Shenzhen with total assets of 135.1 billion yuan, which focuses on talent housing investment and financing platform. The professional version of the Tianyancha application shows that the company is 100% owned by Shenzhen SASAC.

Guangzhou Urban Investment Investment is a large state-owned company in Guangzhou with total assets of 211.7 billion yuan. It focuses on the investment and financing, construction, operation and management of urban infrastructure. Guangzhou SASAC owns 100% of the shares.

This means that China Evergrande has not only completely removed the redemption pressure from the outside world, but has also been backed by heavyweight state-owned companies. In addition to investing in stocks, the two powerful state capitals have entered the market, and in the future, they may also develop greater business cooperation with China Evergrande.

Vow of WarShandong HighwayLet’s take the exit as an example, the acquisition is Shenzhen Talent Anju Group. On the night of November 22Shandong HighwayAnnouncement that the company participated in the establishment ofindustryinvestmentbackgroundChangying Jincheng signed an agreement with Shenzhen Talents Anju Group and China Evergrande. Shenzhen Talents Anju Group received a 1.1759% transfer from China Evergrande held by Changying Jincheng for 5 billion yuan.Capital transferPayment will be made in 3 installments within 12 months.

Analysts believe that all 125.7 billion strategic investments were converted into ordinary shares, and the choice of long-term cooperation with China Evergrande shows the appreciation of state capital and strategic investors for the management and healthy development of China Evergrande, and also shows the recognition of the healthy development of China Evergrande. Confident in development prospects.

Evergrande Property to be listed soon

Since the beginning of this year, China Evergrande has been striving for “high growth, scale control and debt reduction.”Business developmentUnder the guidance of the new strategy, the company has achieved steady development, especially in terms of sales and deleveraging.

In terms of debt reduction, China Evergrande increased its cash flow through high sales growth, and alsoAssignmentMethods such as attracting capital, paying off debt in advance, and dividing and listing high-quality assets have further reduced the debt ratio and achieved good deleveraging effects.

Evergrande Property will be listed soon. On November 22, Evergrande PropertyExecutivesA promotional meeting was held in Hong Kong to present the general business situation in detail. The offer price is expected to range between HK $ 8.5-9.75.

Evergrande Property Management is reported to have covered over 280 cities across the country so far, and has signed and serviced 1,354 projects, with a contract area of 513 million square meters and an area under management of 254 million square meters.

Benefiting from good operations, all of Evergrande Properties’ business indicators have increased significantly. In the first half of 2020, the company achieved total revenues of 4,560 million,Net profit1,148 billion.

From 2017 to 2019, Evergrande PropertyOperating incomeThey are 4,399 million yuan, 5,903 million yuan and 7,330 million yuan, respectively.Net profitIt was 107 million yuan, 239 million yuan and 931 million yuan respectively.

From 2017 to 2019, operating income, grossprofitThe compound growth rate of net income reached 29.1%, 101.4% and 195.5% respectively. Among them, the three-year net profit growth rate ranked first in the industry.

With the backing of leading Chinese real estate company Evergrande, Evergrande Property’s commercial scale will continue to grow, and Evergrande Property will also vigorously expand and expand third-party projects.MOM, 65% of the IPO funds raised will be used for strategic investments and acquisitions.

The Evergrande Property listing will help China Evergrande further reduce its debt. Xia Haijun, vice chairman and chairman of the board of China Evergrande, once said that Evergrande Property only introduced HK $ 23.5 billion in strategic investment, which is expected to reduce the net debt ratio by 19 percentage points.

China Evergrande also performed well this year in terms of sales. China Evergrande launched the “online home sales” marketing initiative during the epidemic. From January to October this year, China Evergrande achieved sales of 632.59 billion yuan and 530.74 billion yuan in sales.PayBoth surpass last year’s data.

(Source: Brokerage China)

(Responsible editor: DF380)

I solemnly declare: The purpose of this information is to spread more information, and it has nothing to do with this booth.

[ad_2]