[ad_1]

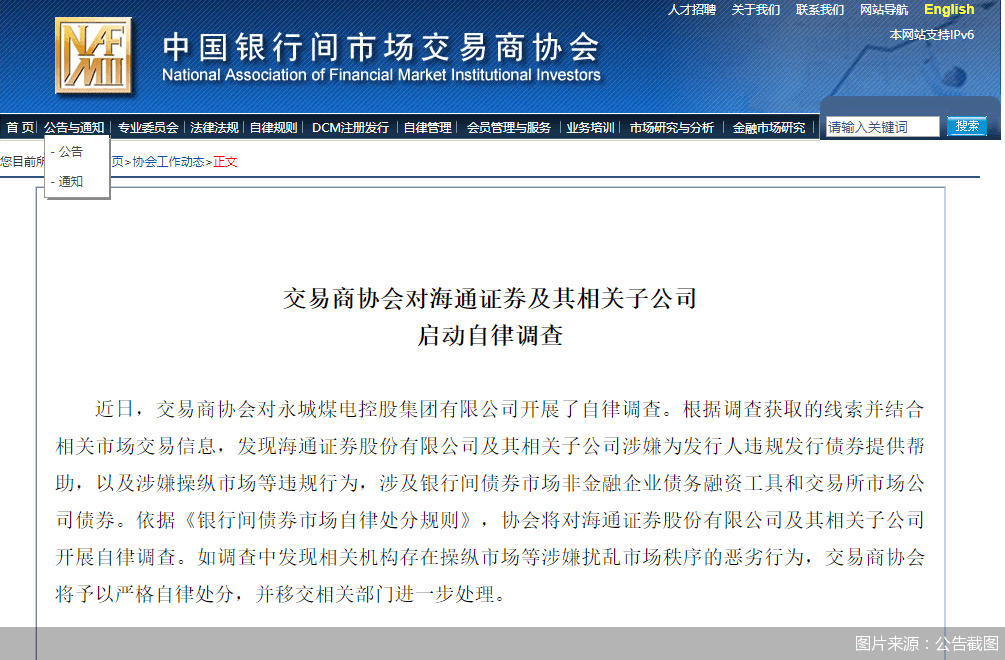

In the event of a default on Yongmei’s coal bonds, Haitong Securities and its related subsidiaries were caught up in the storm. On November 18, the China Association of Institutional Financial Market Investors (hereinafter “Distributors Association”) announced on its official website that Haitong Securities and its subsidiaries were suspected of being Yongcheng Coal and Electricity Holdings Group Co., Ltd. (hereinafter “Yongmei Holdings”). ) Self-discipline investigations will be initiated for infractions such as bond issuance in violation of the regulations to provide assistance.

Haitong Securities under investigation

In the recent period, there have been frequent defaults in the credit bond market, and the sudden default of the permanent carbon high-grade credit bond directly triggered market sentiment. On November 18, the official website of the Distributors Association stated that during Yongmei Holdings’ self-discipline investigation, it was discovered that Haitong Securities and its related subsidiaries were suspected of providing assistance to the issuer to issue bonds in violation of regulations, as well as alleged violations of market manipulation, which involved the banks. Non-financial corporate debt financing instruments in the interbond market and corporate bonds in the foreign exchange market.

On November 10, Yongmei Holdings issued an announcement stating that due to shortage of liquidity, “20 Yongmei SCP003” was unable to repay the principal and interest in full on time and constituted a substantial default. The principal and predetermined interest amounted to 1.032 billion yuan. Public information shows that Yongmei Holdings is a large state-owned coal company in Henan province, the majority shareholder is Henan Energy and Chemical Group Co., Ltd., and the actual controller is Henan SASAC.

The event of Yongmei’s default caused quite a stir in the market. He Nanye, a brokerage investment banker, commented: “Yongmei Holdings is a state-owned company. Compared with private companies, their default has a greater negative impact on the market, and has a greater impact on the entire market of credit bonds, and also has a greater impact on the price and interest rate of credit bonds. Volatility. ” According to the bond listing and circulation announcement displayed by Chinamoney.com, the “20 Yongmei SCP003” and “20 Yongmei MTN006” bond ratings are all AAA.

On November 12, the Distributors Association issued an announcement stating that Yongmei Holdings had a substantial default after issuing “20 Yongmei MTN006” on October 20, 2020, which will reveal whether the issuer and intermediary agencies are indeed in the process. business development. Risks are disclosed in full, whether or not applicable obligations are strictly adhered to and self-discipline investigations are initiated.

Emergency response and self-regulatory research

In the aforementioned announcement issued on November 18, the NAFM also mentioned that it will carry out a self-discipline investigation of Haitong Securities and its related subsidiaries. If it is discovered during the investigation that relevant institutions are suspected of disrupting the market order, such as market manipulation, they will be subject to strict self-discipline and will be transferred to the relevant departments for further processing.

In response to the possible impact of this incident on the company’s business, a reporter for the Beijing Commercial Daily called the Haitong Securities Secretariat, but the call was not returned. However, on the night of November 18, Haitong Securities issued an urgent announcement stating that the company will actively cooperate with the relevant work of the self-discipline investigation and will strictly implement the relevant requirements of the Distributor Association Notice on Further Strengthening of the Commercial Regulations of Debt Financing Instruments, and Comply with the obligations to disclose information in a timely manner.

So if Haitong Securities confirms that there is a violation in the self-discipline investigation, what punishment will be punished? “If an infringement is confirmed, in accordance with the pertinent provisions of the Securities Law, and depending on the degree of infringement, the pertinent sanctions may be imposed such as notifications, criticisms, fines, etc. The sanctions may have an adverse impact on the The company’s business. First, it will lead to loss of customers and new business. Development is hampered. The second is to affect the reputation of the company’s brand and adversely affect the other businesses of the company, “he commented He Nanye.

He Nanye also mentioned that Haitong Securities needs to control the incident from the following aspects. The first is to activate an emergency response mechanism for the incident and actively cooperate with the supervisory authority to investigate. The second is to conduct a self-examination, reorganize the internal internal control mechanism, discover problems and further prevent the emergence of risks. The third is to reform the incentive mechanism of the company and implement an appropriate income deferral for commercial personnel.

The third-quarter report shows that in the first three quarters of 2020, Haitong Securities operating income was 28,254 million yuan, an increase of 10.61% over the same period last year; Net profit attributable to shareholders of listed companies was 8.52 billion yuan, an increase of 15.12% year-on-year.

The broker bond business sounded the alarm

With the frequent occurrence of bond defaults in the market, there have been increasing cases of administrative penalties and civil liability for securities firms as underwriters and trustees, and the alarm bell for risk control is ringing urgently.

Regarding the problems that securities firms should pay attention to and avoid when writing bonds, Wang Jianhui, a veteran of the securities business, thinks there are probably three aspects. First, underwriters may not have sufficient due diligence and may not attach great importance or take preventive measures when issuing relevant opinions on risk control. Second, the bond issue may not be fully issued or may even fail. Therefore, underwriters will form an underwriting syndicate for personal benefit to ensure the success of the bond issue, and there may be inconsistencies in the relevant information during the underwriting syndicate recommendation process. The possibility of full disclosure also misleads the market to some extent. Furthermore, underwriters can also mislead prices, so the issue price cannot really reflect the situation of the company.

A reporter for the Beijing Commercial Daily noted that during the year, several securities companies had been “trashed” due to the bond underwriting. On July 19, the China Securities Association (hereinafter “China Securities Association”) issued an announcement stating that Guotai Junan, Haitong Securities, China In the bidding process for the issuance of China Nuclear Financial Leasing Company bonds by 8 companies including China Gold, Ping An Securities, Shenwan Hongyuan Underwriting Sponsor, Tianfeng Securities, CITIC Securities, and CITIC Construction Investment, the underwriting fee listing was low, raising doubts in the market. At the same time, the China Securities Association announced that it would initiate a self-discipline investigation on related matters and take self-discipline measures against the relevant institutions.

Also, it is not uncommon for brokers to charge penalties for underwriting bond violations. For example, on June 30, the China Securities Regulatory Commission issued seven fines in a row, naming and criticizing six securities firms and one businessman in charge. The reasons for the penalty were related to the bond underwriting business. The securities firms involved included Hongta Securities, Shanxi Securities, Wanhe Securities, etc. . The results of the punishment include ordering corrections, issuing warning letters, or taking supervisory conversational measures against the relevant people in charge.

Beijing Business Daily reporter Meng Fanxia and Li HaiyuanReturn to Sohu to see more

Editor:

Disclaimer: The opinions in this article only represent the author himself. Sohu is an information publishing platform. Sohu only provides storage space services.

[ad_2]