[ad_1]

Original Title: When Biden Is Celebrating, How Will US Stocks, The Dollar And Gold Fare?

In the early morning of the eighth hour of Beijing, the Democratic presidential candidate Biden modified his Twitter certification: the United States was elected president.

According to estimates by the US media on the 7th, the Democratic presidential candidate and former Vice President Biden won more than 270 electoral votes in the 2020 US presidential elections. The Republican presidential candidate and current President Trump later declared that the election is far from over. .

The current election of Biden is basically a foregone conclusion, and there will be further changes in the US capital market, so what are the specific effects of Biden’s election on global assets like the US equity market? Gold and the US dollar?

US stocks

In the past week, the top three US stock indices have been vigorous. The Dow Jones industrial average was up 6.9%. The S&P 500 and the Nasdaq gained 7.3% and 9.0%, respectively, their biggest weekly gains since April. The S&P 500 also posted its best election week performance since 1932.

Zhongtai Securities said that in the short and medium term, liquidity has driven the market this year, and the US dollar index is a key variable affecting the US stock market. If Biden is elected, the main policy-driven “cornerstone” behind the bullish US equity market In the past four years, the “Trump transaction” will face a full-scale reversal: Fed independence. It will rise, and active prevention and control of the epidemic can promote a rebound in the dollar index and unleash liquidity. The expected tightening of the sexual margin and the tightening of the financial regulatory cycle, especially in terms of tax policies; the abolition of all future tax reduction plans and a substantial increase in corporate and capital market taxes will simultaneously affect risk appetite and profit expectations. After Biden is elected, US stocks whose current valuations have reached historic extremes are expected to face a round of adjustments.

China Securities said that Biden made it clear that corporate tax was raised from 21% to 28%. Additionally, the increase in capital gains tax can also cause some stocks to sell earlier. The tax increase will be a direct negative for US stocks, especially It is an American corporation with many global designs.

In addition, Kaushik Rudra, global head of credit and interest rate research at Standard Chartered, believes that after Biden wins the US election, the relative performance of assets in high-risk emerging markets such as Latin America and Eastern Europe It may be better.

gold

According to data from Wind, COMEX gold futures were up 3.81% this week.

Whether during the sharp fall in US stocks last week or this week, the US presidential election brought uncertainty to the market, gold as a traditional safe haven asset, its safe haven properties have become less and less important recently.

However, many analysts still believe that after a short dip, regardless of the outcome of the US elections, the prospects for the gold market will continue to strengthen.

The most optimistic is CoastCapital chief investment officer James Rasteh, who said that no matter who is elected, the US government will likely launch a large-scale fiscal stimulus plan, so gold will benefit. America will print money on a large scale and ultimately give gold a huge boost.

Deutsche Commerzbank analyst Daniel Briesemann said: “If the Democrats win the Senate seat and Biden becomes president, we will see an economic stimulus plan much larger than the two parties can currently achieve.” Central banks to ease the new crown The impact of the epidemic on the economy and unprecedented money printing can trigger inflation, and gold is seen as a hedging tool.

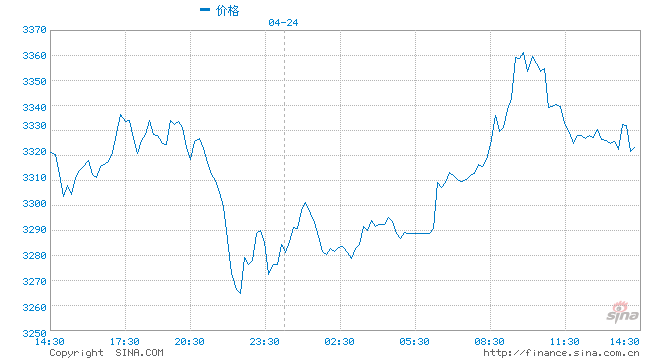

Standard Chartered precious metals analyst Suki Cooper emphasized that Biden’s win is the most favorable factor for gold.Gold priceIt will rise to $ 2,000 an ounce in the fourth quarter of this year and rise to $ 2,100 in the first quarter of next year.

American dollar

The US dollar index has fallen successively this week, falling 1.80% this week.

Since March of this year, the dollar index has remained weak. Will this reserve currency, which dominates the world, come out of a different market due to the change of president of the United States?

Kyushu Securities believes that Biden’s election is negative for the US dollar, primarily because the fiscal stimulus that Biden advocates is expanding the US fiscal deficit and is negative for the US dollar. Judging by the recent and continuing weakening of the US dollar, it does show that this expectation is extremely strong.

Deng Haiqing, chief economist at the AVIC Fund, believes that Biden’s attitude toward the US dollar also has a dilemma, namely “trade first” or “dollar hegemony first.” From a trade priority perspective, the weaker the dollar, of course, the better. However, a very weak dollar will undoubtedly lead to the loss of global confidence in the United States, which will reduce capital inflows to the United States, reduce the use and acceptance of the dollar, and lead to the loss of the hegemony of the United States. dollar.

The agency believes that the direction of the US dollar may not be as simple as current market consensus expectations. The trend of the depreciation of the US dollar is very detrimental to the “hegemony of the dollar”, which I am afraid that Biden hopes to see.

CITIC Securities noted that Biden’s election is basically a foregone conclusion, and a moderate policy will restore market confidence. Until the last trading day of this week, the market still could not fully reflect the expectations of Biden’s election, but Biden’s current election is basically a foregone conclusion. Biden’s election will cause the market to pay more attention to large-scale fiscal stimulus bills and form stronger expectations for economic recovery and inflation fixes. Biden’s main task after taking office is to control the epidemic. It is expected that while increasing policies related to social distancing, it will do everything it can to promote a new round of fiscal stimulus bills to prevent the economy from slipping back into recession.

The agency believes that, in the future, the US dollar index will fall further with the introduction of the US fiscal stimulus plan, which will benefit international prices of raw materials, promote active inventory replenishment in medium and cyclical industries. high and will stimulate the accelerated inflow of cross-border capital to RMB assets.

raw:

NYMEX Crude Oil futures fluctuated this week and eventually rose 4.75%.

JPMorgan Chase strategists predict that if Biden wins the election and Democrats win the Senate, oil prices will rise by as much as 15% under the combined effect of a weak US dollar and fiscal stimulus measures.

Goldman Sachs predicts that if the Democratic Party wins, most policies can increase the cost of US oil production and limit the growth of shale oil supply.

Bitcoin

Bitstamp’s quote shows that Bitcoin is back at more than $ 15,000 per coin and, as of press time, is reported at $ 15034.1.

William, the lead researcher at OKEx Research, believes that the US elections have little effect on the Bitcoin price trend.

“It is necessary to emphasize that Bitcoin is still a niche alternative investment market and has not yet been included in the traditional investment field. It is difficult to influence the US elections,” said William.

Massive information, accurate interpretation, all in the Sina Finance APP

Editor in Charge: Tang Jing