[ad_1]

Original title: The proportion of strategic placement reaches 80%! Launch of the ant emission plan, reached a new scale of more than 20 billion

October 21,Science and Technology Innovation BoardAfter the Securities Regulatory Commission approved the IPO to register, Ant Group updatedUser informationAnd announced the listing plan.Zhongzheng Jun found that ants set a higher matching ratio to stabilizemarket:strategyThe number of shares placed represented 80% of the initial issue, approximately 1,340 million shares.

Also, more for inclusiveinvestmentIn addition to the strategic location, the green shoemechanismBefore implementation, according to Ant’s latest market valuation, Ant Group is expected toMake newThe scale will exceed 20 billion yuan.

Image source: public information

The strategic placement ratio reaches 80%

Under the A share issuance agreement, Ant Group will issue no more than 1.67 billion shares in A shares and H shares.New crotch, The total does not exceed after issuance (before green shoes)Total equity11%. Among them, the initial strategic placement of A shares was 1.34 billion shares, accounting for 80% of the initial issue of A shares, setting an all-time record for science and technology.

You can see that Ant Group has increased its strategic allocation ratio. According to industry experts, the primary consideration is the market’s “weight-bearing” capacity, while allowing the most common investors to share in Ant Group’s dividend. In fact, in markets such as US stocks and Hong Kong stocks, a large proportion of institutional investors subscribe to new high-quality target stocks that are standard allocation trades. E.g,AlibabaListed in the US in 2014 and in Hong Kong in 2019Secondary listingAt that time, the institutional placement rate was 90%; Xiaomi andJingdongWhen Hong Kong shares are listed, the institutional placement rate is 95%. In the A share market,Beijing-Shanghai high-speed train、China General Nuclear PowerwithSMICThe proportion of other initial strategic placements is also 50%.

According to people familiar with the matter, CICthe companyAnd chinaSocial SecuritybackgroundYou have decided to participate in a strategic A share investment; international institutional investors also include Singapore Temasek and SingaporeGovernment investmentCompany, Abu Dhabi Investment Authority, Saudi ArabiaPublic investmentFunds and other major sovereign wealth funds in the world. With respect to the restriction period of the strategic placement, according to the issuance plan, strategic investors, including Alibaba Group and the world’s six major sovereign wealth funds, are required to pledge 50% of the shares placed in this placement with a period of 12 month restriction. The restricted period of% of shares is 24 months.

Image source: public information

“In fact,Strategic placement of the scientific and technological innovation board.The threshold is relatively high and there are requirements for investor ratings, capital buffers, and restricted sale periods. The courage to bring in more long-term investors reflects Ants’ self-confidence. Under the test of the above limitations, global institutional investors are still competing to target Ants, showing that investors fully recognize Ant’s development potential. “Western China ValuesPresidentWei Tao, assistant and director of the research institute, told Zhongzheng Jun: “Strategic location is not a one-way option, it is a relationship between the objective and the market.Mutual choice。 “

“With the return of the $ 100 billion super unicorn Ant Group, the A-share market will attract more Chinese companies to come back and attract more high-tech companies to choose A shares.”Guojin ValuesGuo Jingpu, deputy director of the Institute, said.

Reaches a new scale of more than 20 billion yuan

As a company of this size, will A shares be under more pressure? According to industry experts, comparing the price of other popular stocks: In 2009,Chinese architectureFinal A-share fundraising exceeded 50 billion yuan; in 2010,ABCThe final fundraising amount of A shares exceeded 68.5 billion yuan; in 2019,SMICThe science and technology innovation board has raised 53.2 billion yuan; in 2020,Beijing-Shanghai high-speed trainThe IPO raised more than 30 billion yuan … The absolute value of the new A-share market revealed by Ant is within the normal range.

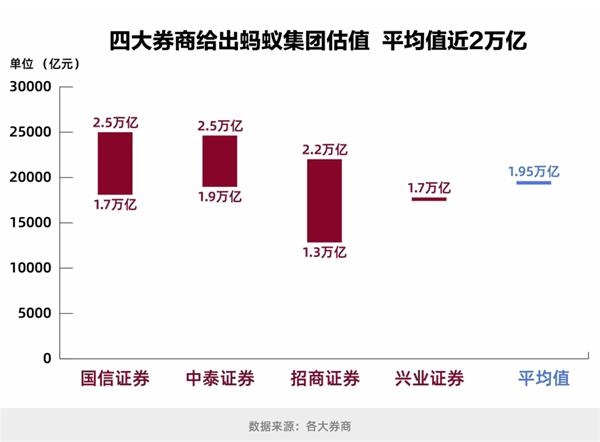

Under the issuance plan, Ant Group’s initial public offering is in addition to Hong Kong’s strategic placement and shares.Callback mechanismBefore the launch and before the launch of “Green Shoes”, market investors can share the subscription fee of 334 million shares online and offline. According to Ant Group’s current market valuation 2 trillion yuan, the new scale will exceed 20 billion yuan.

Image source: public information

Furthermore, if the underwriting situation is hot, triggering the launch of the callback mechanism and the “green shoe” mechanism, market investors may also share a larger stake. If the right to over-allotment of A shares is fully exercised, the total number of issued A shares will be expanded to within 1.92 billion shares.

Prior to this, Ant Group’s strategic placement also allowed ordinary investors to “share a piece of the pie.” As part of Ant’s strategic location plan, Ant Group joined fivefund companyFive innovative futures funds with ant share placement and a “one yuan investment” were issued, enthusiastically received by the market, all sold out on the night of October 8, with more than 10 million people subscribed.

During Double Eleven in 2014, Jack Mato acceptCCTV said in an interview: “Alipay will definitely be listed on the A-share market. The main purpose of listing is not for money, but for more participants to share.”

(Source: China Securities Journal)

(Editor in charge: DF398)

I solemnly declare: The purpose of this information disclosed by Oriental Fortune.com is to spread more information and has nothing to do with this booth.

[ad_2]