[ad_1]

Original title: Clear All Aviation Stocks! Now is a good time to buy stocks, the results of the epidemic may not be worse … The 35 key points of the Buffett shareholders meeting

Summary

The 35 key points of the Buffett Shareholders’ Meeting have been resolved: it is a good time to liquidate all aviation shares. It is a good time to buy stocks. In the long run, the return on stocks will be greater than the national debt.

A feast for value investors! The 2020 Buffett General Meeting is being held online for the first time ever! Oriental Fortune full live video stream, wonderful video review, click to view >>

3:45 pm local time on May 2 (4:45 time on May 3, Beijing time), the annual Buffett shareholders meeting was held. This is the 56th general meeting of shareholders since 1964. Unlike in previous years, the 2020 general meeting of shareholders was held in the form of an online meeting. The questioning session was completed by three reporters who collected the questions submitted by the shareholders in advance and selected the most interesting and important questions from them.

Let’s take a look at Times Jun’s hairstyle first, those topics were discussed at this Buffett shareholder meeting.

1. The sudden global epidemic did not anticipate “I don’t know what you don’t know”

In response to the New Crown epidemic, Buffett said that at this time last year the outbreak was not expected. The expansion of the new crown has a major impact on the global economy and the health of residents. “It affects the national economy and the psychology of the people. At the beginning we were not prepared.” Buffett noted that it is not yet possible to fully predict the future development of the new crown epidemic. “I do not know i do not know”. But the result may not be worse, nor will it be as deadly as the Spanish flu.

2. Virus Blocking Measures Are “A Considerable Experiment” The United States Economy Can Overcome The Difficulties Caused By The New Coronavirus

Buffett said the death rate from the new crown epidemic was not as high as the 1918 Spanish flu pandemic, but it was highly contagious. Recent virus-blocking measures by several countries are “a considerable experiment.” The US economy is believed to be able to overcome the difficulties caused by the new coronavirus.

3. The crisis caused by the epidemic bears no similarities to the 2008 subprime mortgage crisis. This time, we put the economic train on the test line.

Buffett said that in 2008 and 2009 (subprime mortgage crisis), the US economic train. USA He strayed from the track, and there were some basic reasons that led toBankWeak “This time, we just pulled the train and put it on the test line.”

4. The United States economy remains “very strong”. Don’t bet on the United States wrongly

Buffett said that shortly after his birth, he suffered a Great Depression. The Dow sank during this period, and it took 20 years for it to return to the level at which it was born. In the final months of 2020, no one knows what the future will be like in 1929-1930. But Americans “persistently, perseveringly, prosperous (professionals).” Miracles are happening, compared to 1789, we are now a better and richer country. The United States economy remains “very strong”. Don’t bet on the United States wrongly.

5. I never cut the US

Buffett said: “Even in the most dire circumstances, nothing can stop the United States. It has withstood the” Great Depression “test and can now be tested to some degree. In the end, the answer is never to belittle the United States. In my opinion, this is true today, as it was in 1789, even during the worst of the Civil War and the Great Depression. “” If you want to bet on a short circuit in the United States, be very careful, and anything will happen in the market. ” “I believe in the United States, and my past career has taken the opportunity for American success.”

6. In the long run, the return on shares will be greater than the national debt.

Buffett said the current 30-year Treasury yield is only 1%, and the inflation rate is only 2%. In the long run, the return on stocks will be higher than that on Treasuries, and will be higher when you hide cash under the mattress.

7. The diversified investment strategy has allowed me to achieve good results in the past.

Buffett said: “It is better to diversify investment and I did the same with good results.”

8. Be optimistic about the future.

Buffett: You believe in the United States, although we don’t know what will happen in a few weeks, a few months, or next year. I hope that investors can invest in stocks across the industry in a comprehensive and decentralized manner and are optimistic about the future.

9. I will bet now in the United States to buy the entire company directly

Buffett: I’ll bet on America now. Berkshire does not function in the same way as other companies. If we want to buy, we simply buy the entire company. We often do this. Of course, we don’t mind buying part of the capital from quality companies.

10. The United States economy tends to shut down: Our operating income is much lower than before the epidemic.

Buffett said the United States economy has a tendency to shut down. No matter what we do, this trend is happening. Our investment and operating income is much lower than before the outbreak. Some of our business closings are even more serious. OfinsuranceThe business of our railway company has also undergone some changes: it turned out that its business was ideal, but now it has been affected.

11. April Berkshire sold $ 6.5 billion in shares

Buffett: In April, Berkshire repurchased $ 426 million of shares, but sold shares of $ 6.509 million in the same period, making the net return of $ 6.1 trillion.

12. I don’t knowMidlandThe consequences of Chu’s action, but know the “consequences of not taking action”

Buffett said that after the outbreak,MidlandChu did nothing, instead,MidlandReservations are accelerated and measures are introduced. We don’t know what the consequences of (these measures) are, but we do know “the consequences of inaction.”

13. The aviation industry is now full of challenges, now buying airline shares is more risky

Buffett said: “The aviation industry is now a challenging and difficult industry. Being a CEO in the aviation industry is not a happy job, especially when the aviation business stops.” The aviation, cruise and hotel industries have been hit hard. Now it is riskier to buy airline shares. “

14. Not optimistic about airlines and aircraft manufacturers.

Buffett said he is not optimistic about airlines and aircraft manufacturers. The epidemic has an impact on many industries. I wonder if the market will need that many planes after the epidemic.BoeingWhat is the future of Airbus?

15. Hold $ 7-80 billion in shares of the top 4 US airlines. USA And sell them all

Buffett said that the top four US airlines (American Airlines,Delta Air Lines,southwest Airlines,United Airlines), Exceptsouthwest AirlinesIn addition, other airlines have international routes. The airlines suffered particularly large losses due to the epidemic. “We bought these four major airlines and invested between 7 and 80 billion dollars. Now we want to remove them. This is our fault. We are not talking about partial reductions.” The idea is to sell them to everyone. “I am not sure now, the impact of the epidemic on airlines in the future, if the United States will change lifestyle habits, I spent 7 weeks, the first time wearing a tie and the first haircut.

16. I still buy sharesHersheyOpportunity, but be prepared for a long-term response

Buffett said he still buys shares.HersheyOpportunity, but to be prepared for a long-term response to the epidemic, it may decrease after purchase. “It is a buy now, it may be correct, but it may go down next Monday, we cannot predict, we need to be prepared for the long-term response to the outbreak.”

17. Now I borrow moneyHersheyOpportunity, but Berkshire will not. Our money will be spent on the blade.

Buffett said that now is a good time for all Americans to borrow money. Although many people are unwilling to borrow money, they will not do so in Berkshire. “We won’t do that. We have returned some cash.” Our money must be spent on the knife. “

18. Powell’s high evaluation: deserves the same respect as former Fed President Volcker

Buffett said: “For many years, I have always paid special respect to Paul Volcker (former Fed Chairman). As far as the Fed Chairman is concerned, he is a particularly perfect candidate … I think Jay Powell) And the Board of the Federal Reserve deserves the same respect as Volcker for his actions in mid-March. “

Buffett said: “Perhaps what happened in 2008 and 2009 guided their work to some degree. They responded on an unprecedented scale, and since then, essentially everything has gone as it was. At 3 The monthly financing market was almost frozen and did not start to melt until March 23. And March was also the month with the highest share of corporate bond issuance. All who issue corporate bonds in late March and April should give The Fed wrote a letter of thanks because if they did not act with unprecedented speed and determination, it would be impossible to issue corporate bonds. “

19. No interested companies found

Buffett said at the shareholders’ meeting that no interested company has been found. Berkshire Hathaway does not currently have an investment company because “we have not seen anything attractive.”

20. We have always kept cash relatively high

Buffett said at the shareholders’ meeting that Berkshire’s first quarter operating income is much lower than before, ourinsuranceThe business of our railway company has also undergone some changes: it turned out that its business was ideal, but now it has been affected. It can be seen that Berkshire had $ 124 billion in cash at the end of the first quarter and almost $ 125 billion. We have always maintained relatively high cash. Although we could not wait for the epidemic in January, we have maintained that position.

21. The manufacturing industry is laying off personnel and, during the epidemic, residents’ electricity consumption has decreased by 10%.

Buffett said that due to the impact of the epidemic, some industries will have fewer employees. For example, in the business sector, “we are not in the hotel industry, but the tourism and leisure industry will undergo major changes, and the virus may increase further and have an impact on manufacturing.” The demand for personnel will decrease and layoffs will occur. “In the future, these industries will make adjustments according to the environment. Also, from the perspective of their energy companies, during the epidemic, residents’ electricity consumption decreased by a 10%, and your staff employment will also change.

22. The epidemic will change life habits for a long time, some small businesses may not open the door

Buffett has repeatedly expressed the epidemic’s change in residents’ living habits, which can completely change certain business rules or affect some industries for a long time. “Berkshire Hathaway’s manufacturing business may be fired, some may small businesses don’t open the door again. ” Faced with the empty seats below the video conference scene, Buffett couldn’t help but feel that the epidemic completely subverts life. At the same time, he also emphasized that health and the economy are complementary.

23. No matter if Buffett or Charlie are present or not, there will be no change in the company’s investment culture.

Berkshire Hathaway Vice President Greg Abel said that regardless of the presence of Buffett or Charlie, there will be no change in the company’s investment culture, and the company’s management team is working hard to find more investment opportunities for Maintain strong original momentum. “We have business intelligence, the ability to make economic deployments and positive change, and Berkshire managers have this ability.”

24. For the company whose losses are affected by the epidemic, it can be resold to others

At the Berkshire Hathaway annual video meeting, some investors questioned that Berkshire’s long-term policy will not be a bottomless loss. After the epidemic closes, some small businesses under Berkshire are not reopening. Will this affect Berkshire’s long-term policies? President Buffett said Berkshire’s long-term policy is to continue for more than 30 years. In our annual report, we have said that different companies have their own operations. Are they likely to lose money in the future under the epidemic situation? “Of course, we can sell these companies to others. In any case, we will not continue to maintain these companies. This is not a new policy, and this has not changed. We do this to the aviation industry.”

25. There is no reason to stop investing in the S & P 500 Index Fund

At Buffett’s Shareholders’ Meeting, some investors questioned that the good time for passive investing is over and that it will be a good time for active investing. What do you think Buffett said there is no reason to stop investing in the S&P 500 Index Fund. In addition, Buffett said: “I cannot promise that the Berkshire Hathaway stock price will perform better than the S&P 500 Index in the long term, but I will try to do better than the S&P 500 Index.

26. The epidemic has created great uncertainty: it is unimaginable that if the second wave of the outbreak occurs, the American people will react.

Buffett said the epidemic has brought great uncertainty, and it is unclear how the American people will react if a second wave of the epidemic occurs in the coming months.

27. The future of oil producers is unpredictable.

Buffett said at the shareholders’ meeting that crude oil production will decrease significantly in the coming years due to the sharp decline in demand. The price of $ 20 per barrel of oil will make it impossible for oil companies to continue, and drilling activities will decrease. It is not known whether oil prices will increase significantly in the future. The future of oil producers is unpredictable. If oil prices remain low, there will be many bad loans for energy, and it will be impossible to imagine what happens to holders of shares.

28. Buffett Talks About Candy Candy: He Won’t Sell This Investment 48 Years Ago

Buffett spoke about the Sees candy he acquired in 1972. Although the company faced major changes due to the new coronary pneumonia pandemic, it was still his beloved investment. Buffett said: “Easter is a great sales period for comics … Although basically we are closed. In the end it is a very seasonal business. But we have a lot of Easter sweets. We do not sell it. We have it since 1972, we love it we will continue to love. “

29. Buffett: Berkshire shares held will be donated

As for whether Berkshire will split, Buffett told the shareholders’ meeting that the Berkshire split may be a good result, but it will incur large fees, taxes or other expenses, which is not beneficial to shareholders. Berkshire’s structure is also highly beneficial for capital deployment. Buffett said all of his Berkshire stock will be turned over to charities in the future and donated. This decision was made 14 years ago.

30. Nothing can be higher than the national credit for printable banknotes

Buffett said at the shareholders’ meeting that there is nothing higher than the national credit for the notes. Although the national debt will increase, the economy continues to grow and the country’s debt is in its own currency, and the credit risk is not great.

31. Berkshire will buy back its own shares only when it is beneficial to shareholders

Buffett answered the share repurchase question at the shareholders’ meeting that the repurchase price was less than its value, which is a reasonable repurchase. Berkshire Hathaway will repurchase its own shares only if it is beneficial to shareholders who continue to hold the company’s shares.

32)BankThe system will not cause too much trouble.

Buffett said at the shareholders’ meeting that currently,BankThe system will not cause too much trouble. Although energy or consumer credit companies may experience some problems, the banking system has enough capital and plenty of reserves, so the banking industry is not our main concern.

33. Should I buy Berkshire shares now? Buffett responded this way

Ask shareholders “I did not buy Berkshire shares in March, and the price was down 30% at the time.” Buffett replied that, compared to January and February, he did not buy in March, when our share price was very short. Time has dropped 30%. But for Berkshire shares, the value of our shares has not changed much, but the market value has changed. Sometimes we change our minds. I don’t think it’s better to buy now, and 3 months, 6 months and 9 months ago, it’s better to buy Berkshire. It is possible, but we have to look at the future of the company.

34. Regarding credit cards, Buffett believes that yes

A shareholder asked on the scene: “About the credit card industry, the interest rates charged on credit cards have increased for many years, but currently government interest rates are so low. From this perspective, Will credit card companies lower their interest rates in the future? “Buffett replied that this will affect the bank stocks we buy next, includingAmerican expressOf course, for credit card companies, this is also a competition, since the possibility of loss in this area will be reduced, I have no further opinions to express. Berkshire’s interest in credit cards is not particularly great. Everyone uses a credit card as another available source of funds. A lady came to me to tell me she had some money, she said. What should I do with this money? I told him to pay his credit card, do not pay such high interest.

35. How to treat capitalism and capitalists?

Buffett: Our society and our country are still focused on the theory of capital, and many ideas for improvement have been proposed. The money I control is not what I could have imagined. We can keep the best part of the market system.

Rare! Berkshire lost 350 billion in the first quarter

On the night of May 2, Berkshire Hathaway, a subsidiary of Buffett, announced its financial report for the first quarter of 2020. The company suffered a loss of $ 49.746 billion (about 350 billion yuan) and a profit of 21.661 a billion dollars in the same period last year. Specifically, the investment loss was US $ 54,517 million, compared to a profit of US $ 15,498 million in the same period last year, the derived loss was US $ 1,100 million and the profit was US $ 608 million on last year;

Although there was a large loss in the first quarter, it’s worth noting that in the Berkshire ad, there is a special bold sentence that emphasizes that investment gains and losses in any quarter are generally meaningless and can be extremely misleading.

Furthermore, the company’s cash flow continues to be very abundant. At the end of the first quarter, Berkshire Hathaway United States cash, cash equivalents and Treasury bonds totaled $ 124.7 billion, including $ 105.5 billion in U.S. Treasury bonds. United. In the first three months of 2020, Berkshire paid $ 1.7 billion to buy back AB shares.

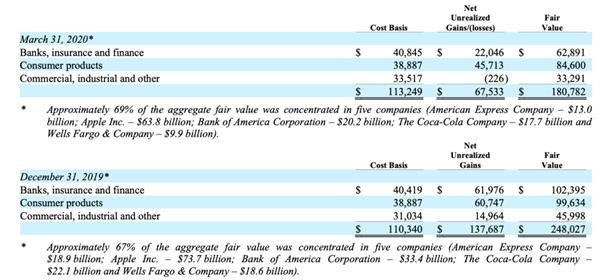

You can see from the financial report that Berkshire-held shares have fallen sharply. In just three months, the fair value of the equity investment fell by $ 67.3 billion. The 2020 quarterly report shows that as of March 31, 2020, the fair value of Berkshire’s equity investment reached $ 180,782 million. As of December 31, 2019, the fair value of Berkshire Hathaway shares was $ 248.207 billion.

At the end of the first quarter, Buffett’s top five positions represented 69% of his portfolio, which wereAmerican express: Fair value of $ 13 billion, loss of $ 5.9 billion from the previous month;The apples: Fair value of USD 63.8 billion, loss of USD 9.9 billion from the previous quarter; Bank of America: Fair value of $ 20.2 billion, loss of $ 13.2 billion from the previous quarter;Coke: Fair value of US $ 17.7 billion and loss of US $ 4.4 billion from the previous quarter;Wells Fargo Bank: Fair value of US $ 9.9 billion, with a loss of US $ 8.7 billion from the previous month. Five shares lost $ 42.1 billion in book value from the previous quarter.

In this financial report, Berkshire mentioned “COVID-19” 31 times. The company believes that the new coronavirus will continue to have a greater impact on the company’s operations in the second quarter. The company said in its financial report that COVID-19 quickly spread worldwide in the first quarter of 2020 and was declared a pandemic by the World Health Organization. The government and private sector response to curb its spread began to have a significant impact on our business operations in March and may have an adverse impact on almost all of our businesses in the second quarter, although this impact may be very different. It is currently not possible to reasonably estimate the duration and extent of the long-term effects. The risks and uncertainties caused by the pandemic may affect our future earnings, cash flow, and financial condition, including the nature and duration of the reduction or closure of our various facilities, and the long-term impact on demand for our products and services.

Join the Buffett 2020 Shareholders Meeting discussion and let the gods of stocks guide us. Find Valuable Stocks, Show Exclusive Opinions, Earn Cash Prizes >>

Related reports:

Too scary! 350 Billion Buffett lost a Gree gadget! The eight main points of the shareholders’ meeting

Is there any value in the stock market? Can I copy the background now? Read Buffett’s General Meeting in an article

The stock god also suffered a huge loss of 350 billion yuan in a single season! When will Buffett keep billions of dollars in cash?

For the first time in history! Buffett Video Shareholder Meeting Record: 5 Hours and 20 Main Points! These global investors are watching

The gods admit their mistakes! Cut the top four aviation companies and they said “the future of the oil companies is unpredictable”! The most general view of the shareholders’ meeting is here.

(Source: Securities Times Network)

(Editor in charge: DF142)

Solemnly declare: The purpose of this information posted by Dongfang Fortune.com is to spread more information, which has nothing to do with this booth.

[ad_2]