[ad_1]

This week, northbound funds focused on buying 38 shares.

7 billion northbound funds flowed into A shares

A shares have risen and fallen this week, and have continued to decline. The effect of losing money is strong. Except for a slight increase of 0.04% on Thursday, the Shanghai stock index closed lower for the remaining four days, with a cumulative decline of 2.83% throughout the week; a cumulative decrease of 1.58 for the GEM%. Although the market in general continued to fall, it did not affect the contrary purchase of funds in the north direction. The cumulative net inflow of A shares this week was 6.959 billion yuan, which has been a net inflow of A shares for 6 consecutive weeks. Among them, the cumulative net inflow of Shanghai Stock Connect was 7.327 million yuan and the cumulative net outflow of Shenzhen Stock Connect was 367 million yuan.

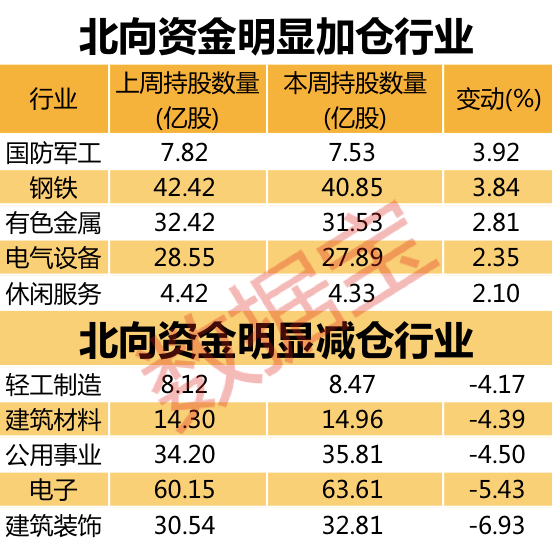

Military Industry and Procyclical Sectors Receive Key Increase in Northbound Funding

In the context of the decline in the total share of northbound funds, in terms of industries, there are 11 industries that have increased share of northbound funds this week. Among them, the steel industry has the largest increase in share. The latest holding of 4.242 million shares is higher. This week they rose 157 million shares, followed by banks and non-ferrous metal industries, which increased their holdings by 139 million shares and 88.589 million shares compared to last week. In terms of growth rates, the main quarter-on-quarter growth rates are the national defense, steel and non-ferrous metals industry, with growth rates of 3.92%, 3.84% and 2.81%, respectively. After last week, this week northbound funds continued to substantially increase positions in procyclical stocks, with the steel and non-ferrous metals industries in the top three in increasing positions. Among the industries where the share of northbound funds has decreased compared to the previous month, the industries that have decreased the share the most are the electronics, construction and decoration and utilities industries. Participation decreased by 345 million shares, 227 million shares and 161 million shares. According to statistics, the industries with the largest monthly drop in capital participation in the north direction are construction decoration, electronics and public services, with falls of 6.93%, 5.43% and 4.50% respectively. From looking at continuity, there are 6 industries that have received a continuous increase in Northbound funding. Industries such as steel, leisure services, and electrical equipment are the most popular. They have received funding from Northbound for 7 consecutive weeks, 7 weeks, and 6 weeks. Industries that have continually reduced their positions include Communications, Utilities, Media, etc., reduced their positions for 5, 4 and 3 weeks respectively.

Nearly 3 Billion Funds Going North to Increase Positions in Kweichow Moutai

A total of 32 stocks were on the active trading list this week. From an industry perspective, the electronics industry is the most concentrated, with 6 stocks listed. Kweichow Moutai had the largest transaction amount, totaling 14.855 million yuan this week; followed by Gree Electric, with a cumulative transaction amount of 7.143 billion yuan; China’s Ping An, Ningde Times, etc., have higher transaction amounts. According to the statistics of the net amount of the transaction, among the stocks on this week’s list, a total of 19 stocks were net purchases. Kweichow Moutai had the highest net purchase amount, with net purchases of 2.887 million yuan this week, followed by Longji and Hang Seng Electronics. The net purchase amount was 1,372 million yuan and 1.35 billion yuan, respectively. Among the net shares sold, the net amount sold was the Yanghe share, which was 1.432 billion yuan this week. In terms of capital flow, 5 actively traded stocks received the top net inflow of capital this week. The stock with the highest net inflow was Yanghe, with a net inflow of 742 million yuan. Weir also received the largest net inflow of principal capital. Actions, Haitian Flavor Industry. There are 27 stocks with net outflow from the top funds, with Eastern Fortune having the largest net outflow, with a net outflow of 3.759 billion yuan. The spirits sector is divided: When northbound funds rose significantly at Kweichow Moutai, they successively sold a net 1.808 billion yuan worth of Yanghe shares, the net best-selling shares this week. With the arrival of the peak sales season at the end of the year, Tmall announced the opening of Moutai’s largest monthly offer. Sales are expected to increase and gain recognition in the market. The target price given by the institution has already crossed the 2,000 yuan mark.

Smart Travel Leader Wins Northbound Funding

Northbound funds acquired a total of 625 shares this week. In terms of the ratio of increased holdings to outstanding shares, 38 shares increased by more than 0.5%. Zhongke Chuangda has the largest increase in holdings, with the latest holdings of 24,125 million shares, and the increase in holdings accounted for 2.07% of outstanding shares; followed by Flatt, with an increase of 1.42%; another increase in holdings is near. The former include Guoci Materials, Dangsheng Technology, Zaisheng Technology, Hang Seng Electronics, Silan Micro, etc. In terms of market performance, 17 of the top 20 Northbound Funds stocks to increase positions this week rose and 3 fell. Shanghai Machine CNC’s stock price rose 32.17% this week to take the top spot. Other top winners were Bank of Qingdao, Silan Micro, Zoomlion, and Keboda. The machine vision leader paying attention to smart travel has been targeted by Northbound funding. On December 4, the Thunder World 2020 Zhongke Chuangda Technology Conference was held in Beijing. Schneider Electric and Zhongke Chuangda launched an integrated intelligent industrial vision platform based on AWS. With the favorable policy of the Ministry of Transportation to support autonomous driving, Zhongke Chuangda Da focused on adding positions this week.

Northbound funds increase 24 shares for seven consecutive weeks

Statistics from the data hoard show that Northbound funds bought 109 shares for four consecutive weeks. In terms of industries, there are more stocks in the chemical, pharmaceutical and biological industries, each with 10 stocks. Extending the time, Northbound funds increased 24 shares for seven consecutive weeks. From the perspective of changes in the share index, Fangda Special Steel has seen the largest increase in shares, which accounted for 6.28% of shares outstanding compared to seven weeks ago. Other continued increases in holdings include Guoci Materials, Xingang, Qiaqia Food, Enjie shares, etc. From a market performance perspective, among the seven consecutive weeks of northbound financing stocks, 7 stocks rose this week, Jiejia Weichuang is up 10.97% in one week, and Yasui Foods is up 8.11%.

Northbound funds continually lighten these stocks

Statistics from the data hoard show that Northbound funds sold 112 shares for four consecutive weeks. In terms of industry, the computer industry has the largest number of shares, with 20 shares. From the perspective of changes in the share ratio, compared with four weeks ago, the ratio of 27 shares to lighten more than 1%. Wanfu Biology has the largest reduction in its position, which is 3.27% compared to four weeks ago. Other companies with a larger reduction are Jingce Electronics, Geosonic Fashion, Aoshikang, AVIC Optoelectronics and iFLYTEK. From a market performance perspective, among stocks in which Northbound funds have lightened their positions for four consecutive weeks, 23 stocks were up this week. The biggest increase was ST disposition, which was up 15.62% this week. Shanshan, Nanjing Cenbest, Luoyang Glass, etc. they also experienced larger increases. Among the successive reductions in stake, the shares of Rongtai Health, Aofei Entertainment and Caixun have fallen dramatically.

Disclaimer: All content of the Databank information does not constitute investment advice. The stock market is risky and investing must be cautious.