[ad_1]

Original title: 10.31 general elections approaching non-agricultural strikes on goldrawNext Week’s Latest Trend Analysis Source: FX168 Finance Network People Channel

The change in a person’s life begins when another leaves or enters their own life. If you also pay attention to finances, such as stocks, and you love investing, here I will have an exclusive view for you, keep independent thinking and make suggestions for you. Preservation of assets. If you are having trouble on the investment road, you can’t find an address, you are losing money for a long time, maybe you can talk to me. Whether you can cooperate or not, leaving aside, being able to untie your knots, this is the most important thing.

The one-week negotiation came to an end. Be it a loss or a gain, it started and ended. If you lose money, just think about the reason for your loss. The strength of the teacher is not good. Don’t you pay attention to stop the loss? Heavy warehouse operation? If you want to start over, those who make a profit will keep working hard. If you feel that you have suffered a serious loss, you can hardly recoup your loss, you feel trapped and have a feeling of helpless confusion, you can talk to Master Kanazawa Caishen, maybe he can help you open the knot, but you must remember, You have to take care well your sincerity, this market is not lacking in analysts, what is lacking is a responsible analyst of conscience.

News and important events in the gold and crude oil market

1. The quarterly rate of US GDP in the third quarter soared 33.1%, setting a record and beating expectations by 31.8%. However, this benefit failed to boost market confidence, the dollar rose slightly and gold fell. First, the results of the GDP improvement have been fully priced by the market in advance, and there is still a gap between getting back on the right track; Second, the COVID epidemic has intensified, even if a new round of stimulus bills is negotiated in the United States, it may not be able to prevent further deterioration in the economic outlook. The US financial report for the third quarter seems to reflect that even with the help of stimulus measures, in addition to the technology industry, many companies are still affected by the epidemic. This can also be reflected in non-farm employment data.

2. Ongoing negotiations on the US stimulus bill appear to have fallen into a US version of the “Brexit model”, while US President Trump has repeatedly stated that the scale of stimulus he expects is greater than that of the Speaker of the House of Representatives, Perrosi. Bigger.This makesGold priceSupported. It seems that as the new corona epidemic worsens, it is only a matter of time before the stimulus bill is reached. Successful completion of a larger stimulus bill will temporarily ease market pessimism and risk aversion, and the liquidity of the dollar will expand and further weaken the price of the dollar, thus providing upward mobility for gold.

3. Opinion polls show that although Biden polls and * odds suggest he is ahead, he is wary of the US presidential election to hatch the black swan again, because in 2016, Trang himself was not left behind but that attracted the black swan; the same is not true next week. The emergence of agricultural data, but it looks bleak before the general election.

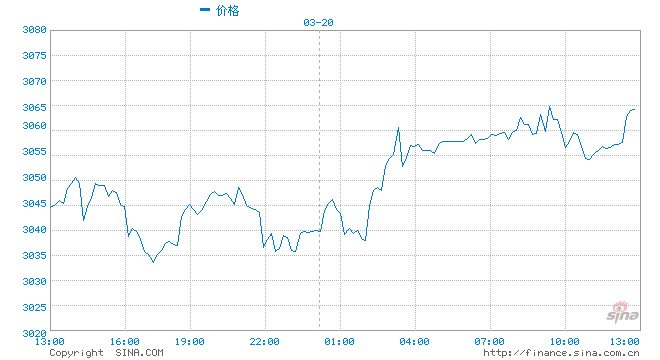

On Friday (October 30), the US Dollar Index strengthened as the stock market fell and closed above the 94 mark. The US Dollar was up 1.4% this week, marking its biggest weekly gain since September. Spot gold closed nearly $ 11 higher, and uncertainty of the U.S. general election voting results remained high, boosting demand for gold as a safe haven. Oil prices have fallen more than 10% this month, the biggest monthly drop since March. New measures against the epidemic in many countries threaten the fragile recovery in demand.

10.31 Interpretation of the gold market and trend analysis

Spot gold recovered slightly on Friday with the help of the US dollar. Gold prices fluctuated during the day and rose until around 1889 at night. Similar to the bounce trend prediction above, at midnight the US dollar rebounded under pressure again and fell to around 1880. There was no break of lows during the day. The short term is expected to rebound again around 1900, yesterday’s daily line closed the Yang line below the MA5 daily line.

From a gold technical point of view, gold received a Yinxian doji at the beginning of the fourth quarter, and the direction can be long or short. The structure of the overall long trend below is unchanged. The underpass is expected to form support here at 1800-1820, and this month it will be around MA5. The line closed at Yinxian and the price has a tendency to retreat. The monthly technical indicators are all weak and there is the risk of a callback, but there is also the market support message. The highest price of gold yesterday was close to around 1890, which is also the position of this 0.618 wave of decline. If the market wants to fall, the 1890 callback is also an earlier inflection point, but combined with the bounce structure of the K line, it should be explored around 1900. 1900 should be the long-short gap next week. Since the market has been volatile and declining recently, the 1900 position will not be broken. If it does not stabilize, the price of gold will continue to oscillate and fall. With the help of the news, the fall will be deep. But once the market holds firm in 1900, the space above will open again and the shock will basically be over. At least in the 1930s and even the 1960s, and if it pulls back, the fund will focus on the short-term double bottom support of 1860-1850. The price has yet to make a substantial breakout from the bearish situation on Friday, and there is still support. If it breaks, it can go to at least 1820. Even around 1800. In other words, next week, if it becomes strong, look at 1930-1960 or higher, if it weakens, look around 1820-1800.

10.31 Interpretation of the crude oil market and trend analysis

Crude rebounded around 36.5 on Friday and then fell back to 35.3. The floor did not break the previous low, but oscillated to a low level. The daily line closed again at a large Yinxian line. The main current negative impact comes from the blockage caused by the epidemic and the sudden market demand Less, the price is not well supported,

From a crude oil technical perspective, the price of crude closed on a large Yinxian line and there is no obvious city below. The downside is relatively large and the fundamentals have not remained positive. The crude oil situation in the market outlook is not very optimistic. From a weekly perspective, the middle rail is under pressure this week. A great Yinxian was received in the vicinity, and the technical side was in a weak position. Short-term and mid-line trading were bearish. From the daily level, the Yinxian was continuously closed this week. Technical indicators were short and the Bollinger Band was Below the Bollinger Band, the Bollinger Band opens and oil continues its downward trend. Short-term support below can be focused on the 34-35 range, which is also the position of the first price correction in June. If the price continues to fall, there will be demand for a short-term rally in prices. The MA5 daily line continues under pressure, and initial resistance at the top is at the 36.5-37 area. Considering the current price of oil compared to the current market recovery, the bottom does not rule out the bottom of the price of oil. Operation can be based on high altitude, low volume and range. Deal with shocks. Next week, focus on the 36.5-37 pressure from above and the 34-35 support from below.

The above content is for reference only. Every day, Moments will update the trend analysis and trading ideas. Those who need to check your strength can go see, and those who need to see suggestions can also pay attention. No charge, wait for me to consider it and keep up with the firm offer The trade is too late, after all, the market has opportunities every day.

There is a delay in posting online, and no matter how I update the reminder in time, I cannot keep up with the changes in the real market. From the moment I submit an item until you see it, it sometimes takes around 2 hours to review it. Therefore, the point of view and strategy I have issued is not for everyone to keep up with the operation, but for everyone to see a mindset and direction to order every day, so that you can find the suitable master in the huge market. The thinking and strategies of the Kanazawa Fortuna analyst team are updated and shared in major financial columns and on Weibo every day. If you agree with the philosophy and skills of the Kanazawa Fortuna analyst team, please feel that the Kanazawa Fortuna analyst team can guide you.To make a difference in this market, we invite you to join the Kanazawa Fortuna analyst team and get a personalized orientation service at the current price.

Let them know me in words, in character, in being caught up in technology, in goodness and in character.

Text / Jinze God of wealth-WeChat / Letter: jzcs66

Statement from Sina: Sina.com publishes this article for the purpose of conveying more information, and does not mean that I agree with their views or confirm their description. The content of the article is for reference only and does not constitute investment advice. Investors trade accordingly at their own risk.

Massive information, accurate interpretation, all in the Sina Finance APP

Editor in Charge: Li Tiemin