China has been making progress to lessen its dependence on foreign companies that manufacture semiconductors. According to our report titled “Mainland China’s Semiconductor and Equipment Markets: Analysis and Manufacturing Trends,” China imported 445.13 billion ICs in 2019, a 6.6% year-on-year increase. The amount of imports was $ 305.55 billion, a 2.1% YoY decrease. The export of integrated circuits was 218.7 billion units, an increase of 0.7% YoY. The export value was $ 101.58 billion, an increase of 20% year-on-year.

Semiconductor Manufacturing International (SMIC) (OTCQX: SMICY) is the fifth largest pure gaming foundry (a foundry that manufactures chips for customers only and does not make chips for its own use). The company’s revenue grew 26.8% yoy in the first quarter of 2020. With a 5.0% share of total first quarter revenue, the company is significantly smaller than Taiwan Semiconductor Manufacturing Corp. (TSMC), which will be the focal point of this article.

Today, SMIC operates seven fabs: three 200mm fabs and four 300mm fabs. Total 8-inch monthly production capacity is 233,000 pieces, an increase of 2.2% over the previous month, mainly due to the expansion of the 8-inch Tianjin line. Total 12-inch monthly production capacity reached 243,000, an increase of 10.2% month-over-month, mainly due to the expansion of the 12-inch 40-28 nm Beijing and Shanghai SN1 advanced process lines.

SMIC capabilities compared to TSMC

In mid-May 2020, the US Department of Commerce imposed further restrictions on Chinese Huawei, preventing any tech company from doing business with Huawei without an approved US license. Sanctions prevent these providers supply chips directly to Huawei and eliminate Huawei’s ability to circumvent prior restrictions by having TSMC manufacture its chips. The problem is Huawei’s 5G modem chip called Kirin.

I discussed the production of 5G modem chips not just from Huawei but from the competition in a Seeking Alpha article from January 10, 2020 titled “Taiwan Semiconductor: My Top Semiconductor Pick For 2020”.

Due to U.S. sanctions against Huawei (and its chip affiliate HiSilicon), TSMC will no longer manufacture Huawei Kirin modems, which have historically been manufacturing Huawei’s HiSilicon chips, ranging from its 14nm, 12nm chipsets. or even 7 or 5 nm.

Unable to circumvent U.S. government sanctions, Huawei is shifting its orders for 14nm chipsets from TSMC to SMIC. Huawei’s new chipset, the HiSilicon Kirin 710A is based on the 14nm process and has entered the mass production stage. I think Huawei is relaunching the Kirin 710 processor branded Kirin 710A, but this time with a 14nm FinFET process. The original Kirin 710 SoC is made using the 12nm node by TSMC.

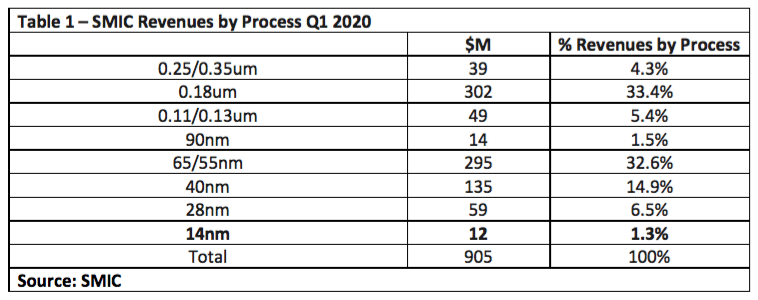

Table 1 shows the SMIC revenues for the first quarter of 2020 segmented by technological process. Processes of 14nm or more advanced accounted for only 1.3% of its production, which is far behind the major foundry companies. With the introduction of the Kirin 710A, the 14nm processing ratio will increase.

For comparison, 36% of TSMC’s revenue came from 7nm processing in the second quarter of 2020. In fact, TSMC expects to see that 5nm process technology represents approximately 8% of its total revenue from wafers in 2020, compared to 10% previously estimated.

Table 2 shows a comparison of the technological process nodes between TSMC and SMIC based on the time line of the initial volume production and the delay in years and quarters. Interestingly, SMIC was able to maintain its four-year lag behind TSMC from the 65nm node in 2010 to the 14nm / 16nm node in 2019.

To carry inverter

There are two important questions that are considerations for SMIC and Huawei in light of the recent escalation in trade restrictions. The first question is if SMIC can go to 7nm, how much will it cost?

If we follow the four-year timeline in Table 2, SMIC could reach 7nm by 2021. And if SMIC develops a 7nm process and builds a 7nm wafer factory, how much would it cost? Table 3 presents my analysis of the cost of chip production as it moves to smaller and smaller nodes. This table incorporates the SMIC charge to customers of $ 329 per chip at 14nm, decreasing 30% to $ 232, which I have highlighted in bold. Huawei will incur the design cost and the packaging company chosen by Huawei will incur the assembly / packaging test.

The second important question is how SMIC reaches 7nm. As an overview, ASML’s EUV lithography (ASML) technology is cost effective at 7nm and below, and readers can refer to several of my most recent January 27 Seeking Alpha articles on ASML and EUV titled “ASML: My Company of Collect superior semiconductor processing equipment. “

Essentially, although there are cost benefits of using EUV at 7nm, DUV can easily replicate 7nm patterns. In fact, TSMC’s first generation 7nm process is performed by DUV in combination with multiple exposure technology.

This is an important consideration, because although SMIC ordered an EUV ASML system, there have been repeated delays and excuses why it has not yet been delivered. With the technological embargo escalating, the issue is a major hurdle for SMIC and its EUV roadmap.

Finally, SMIC has been able to move beyond 14nm without the quantum step to move directly to 7nm. SMIC’s N + 1 process has entered the stage of customer presentation and product certification. Compared to 14nm performance, the N + 1 process has a 20% improvement in energy consumption, a 57% reduction in energy consumption, a 63% reduction in logical area and a reduction in 55% in the SoC area, which is close to the 7nm TSMC Process.

On May 15, the new US government export control rules were designed to block Huawei’s chip development efforts through HiSilicon and TSMC, which makes all 7nm smartphone modems. Huawei.

However, under the strictest restrictions, non-US companies must apply for a license to use US technology or software to produce chips designed by Huawei.

Until now, the US government has blocked China’s technological advances for violations determined by the US Department of Justice, for example, blocking activity with the Chinese chipmaker Fujian for IP theft, and readers You can learn more about whether in my Seeking Alpha article from November 6, 2018 titled “The United States Restricts Exports of Some Chip Production Equipment to China – Memory Impact and Equipment Suppliers. “

In addition, three years ago, sanctions were imposed on ZTE in violation of the United States sanctions against Iran and North Korea. In addition, ZTE was the subject of a new and separate bribery investigation by the Department of Justice, focused on possible bribes that ZTE paid to foreign officials to gain advantages in its global operations.

The current sanctions are an instinctive reaction to the COVID-19 allegations. But this is an election year, Trump is being hit by a wobbly economy, and these sanctions will negatively impact the American economy. Many American companies have manufacturing facilities, and these penalties will affect them. For example, in 2019, Intel (NASDAQ: INTC) earned 28% of its total revenue from Chinese customers, along with Nvidia (NASDAQ: NVDA) at 25% and Qualcomm at 67%. Furthermore, the Chinese government has threatened its own sanctions against US companies Apple (NASDAQ: AAPL)Boeing (NYSE: BA)Cisco (NASDAQ: CSCO) and Qualcomm (NASDAQ: QCOM).

This free article presents my analysis of this semiconductor industry. A more detailed analysis is available on my Marketplace newsletter site Semiconductor deep dive. You can learn more about it here and start a 2-week risk-free trial now.

Divulge: I / we have no positions in any mentioned action, and we have no plans to initiate any positions within the next 72 hours. I wrote this article myself and express my own opinions. I receive no compensation for it (other than Seeking Alpha). I have no business relationship with any company whose shares are mentioned in this article.