[ad_1]

After an intense day of arguments, expositions and voting, this Thursday Congress finally passed into law the bill that will allow a second withdrawal of the savings of the Pension Fund Administrators (AFP), so that those who have pension funds can face the economic difficulties derived from the coronavirus pandemic.

The initiative that was approved in both chambers with broad cross-sectional support, had several modifications regarding the project that was presented at the last minute by the government, in response to the constitutional reform that was promoted by parliamentarians for the same purpose, remaining almost the same except for taxes.

But finally, What was approved? Here we explain how, when and what conditions the second withdrawal has.

Universal access (except for high authorities of the State): All people who have money in their individual capitalization accounts will be able to access to withdraw 10% of their savings, with a minimum amount of 35 UF ($ 1 million), and a maximum of 150 UF (approximately $ 4.3 million). If the person has less than a million pesos in their account, they can withdraw all the money.

Two installments: Unlike the first withdrawal, it was established in the regulations that although the money will be delivered in two installments, if the amount is less than $ 1 million, it will be deposited in a single installment. This is what the administrators did on their own initiative the previous time, which was considered at that time.

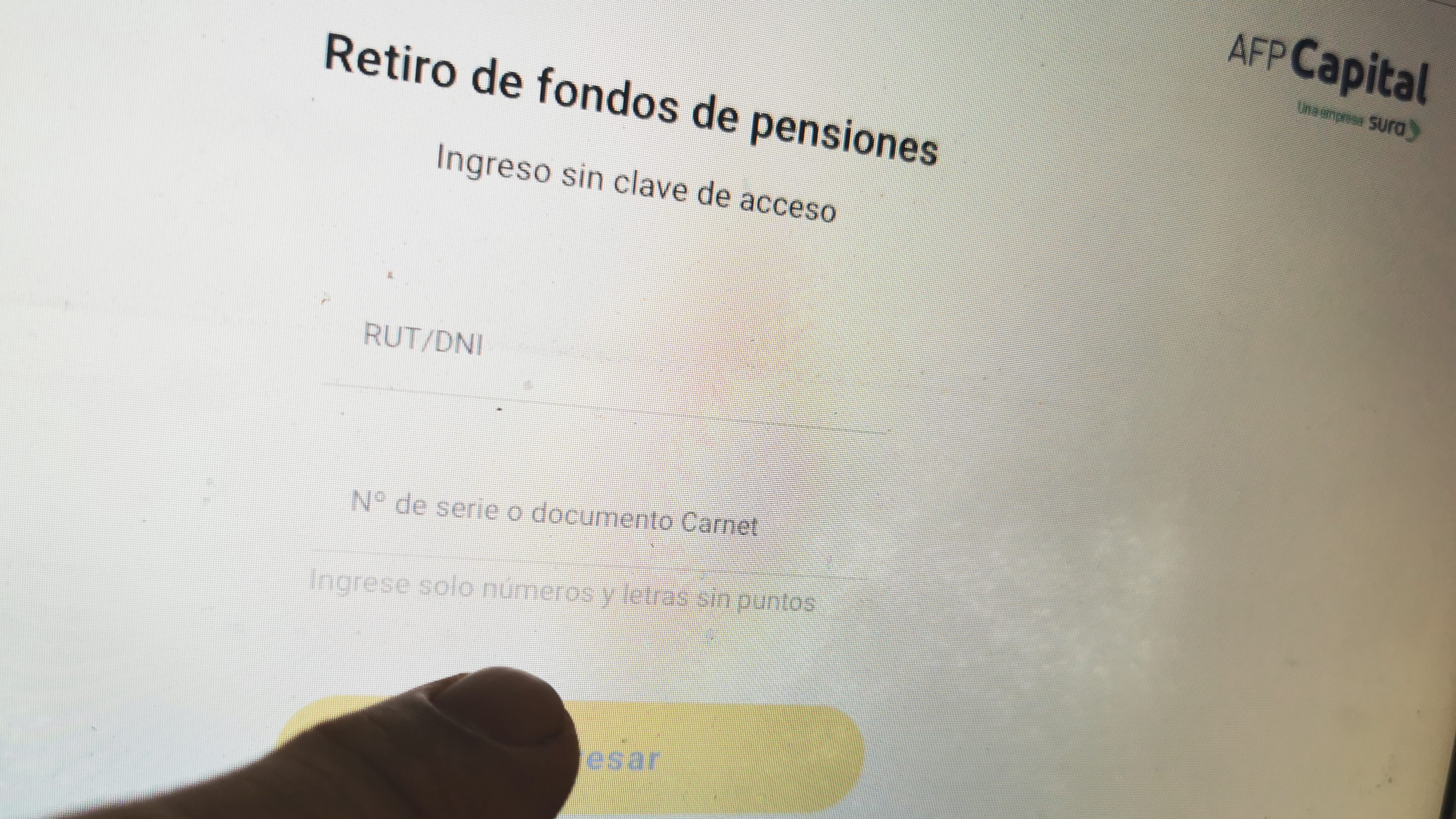

Will the money be available before Christmas?: Much of the rush to legislate was that contributors can access their amounts before Christmas, but for it to materialize as before, first must be promulgated by President Sebastián Piñera, who has five business days to do it. Then, the administrators will be able to start receiving withdrawal requests.

Then the AFPs will have 10 business days from the issuance of the request from the contributors to pay the first installment, and another 10 business days for the second.

Further, as with the first project, there will be a term of one year -from its promulgation- to withdraw money from personal accounts.

Taxes: This was one of the points that generated the most controversy in the parliamentary discussion, since the Executive wanted it to collect an amount from those with incomes greater than $ 700 thousand. But nevertheless, after a series of negotiations, and requests even from government parties, the tax was set only for those with incomes over $ 1.5 million.

Should I return it?: No. This condition was the last to be analyzed and the majority and almost unanimous response of the parliamentarians was against, since For many it was considered a “self-loan”, so people will not have to return the amount withdrawn.

What about alimony debtors? Since during the first withdrawal it was a point that was somewhat unfinished, this time the legislators made sure to establish that the Family judges may authorize the plaintiffs to request that the debtor withdraw their money from pension savings to pay all or part of the maintenance debt.