[ad_1]

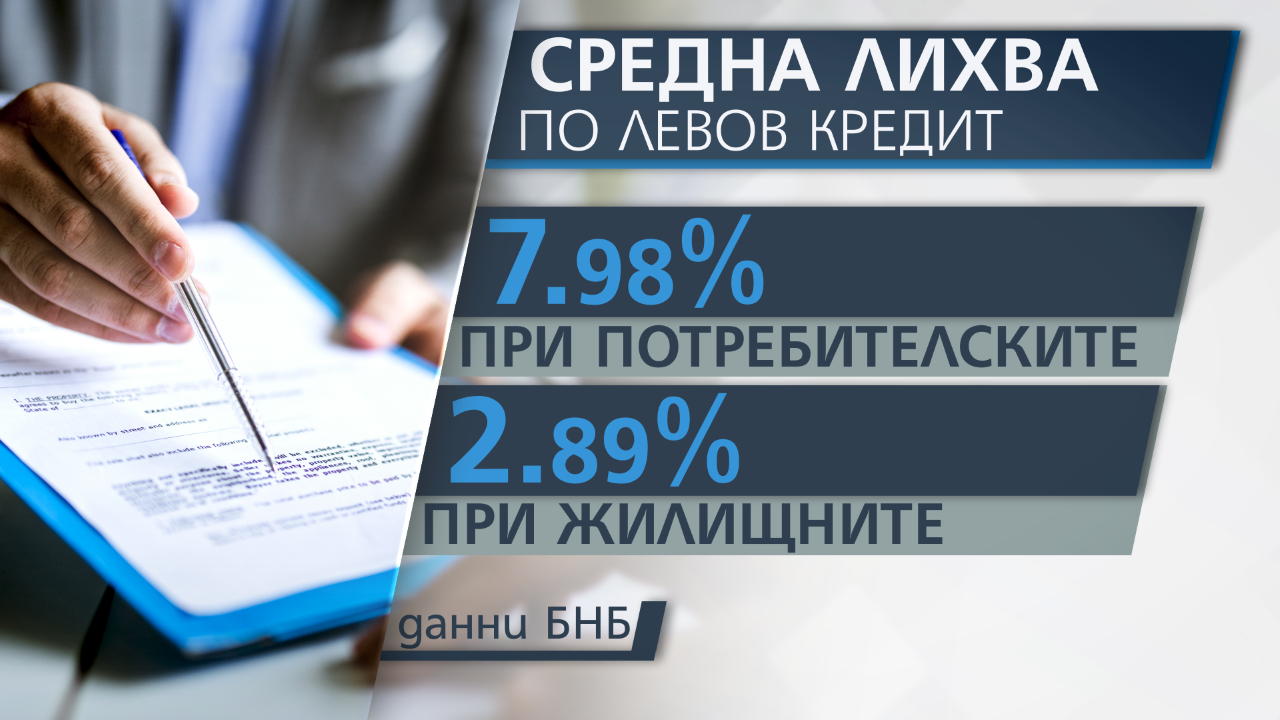

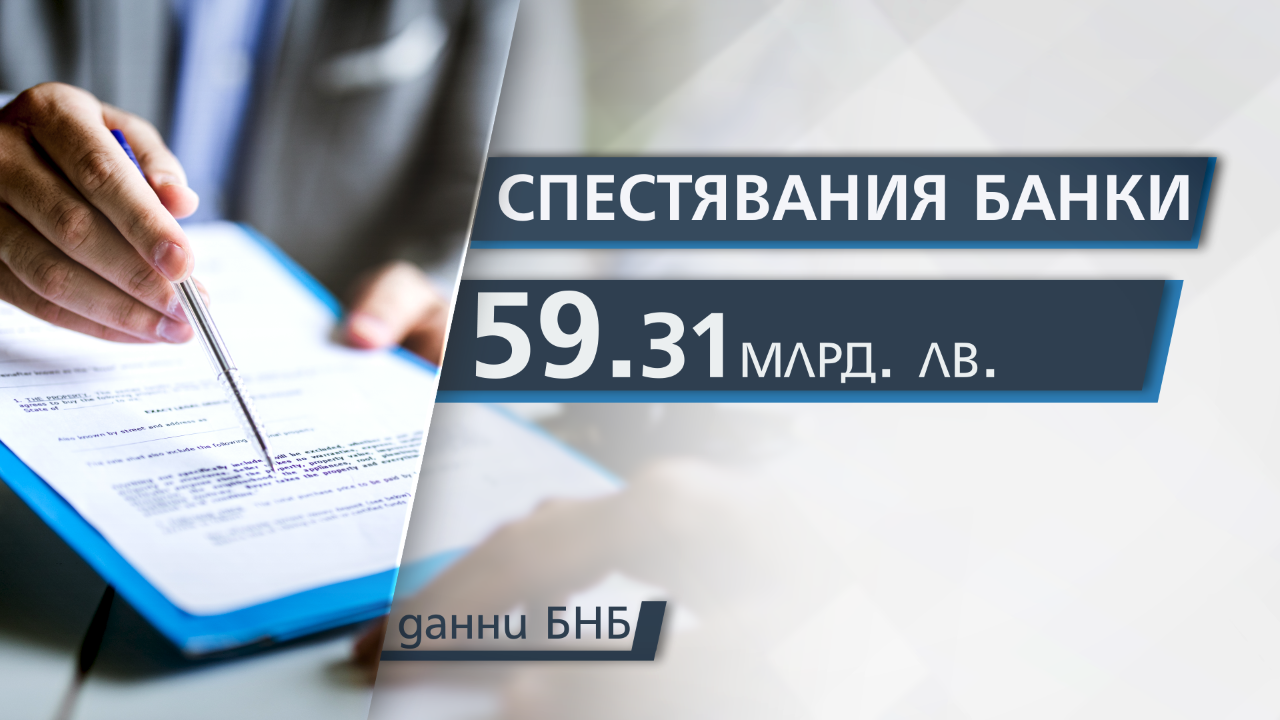

The interest rate on deposits in some banks reached 0.00%. Company savings are now charged at negative values. That is, we cannot count on interest to accumulate money on our savings. Often times, due to bank fees, it turns out that our deposit has decreased. Financiers explain that we can be lost and when the interest rate is lower than annual inflation. At the same time, at the other pole, in loans: the average interest rate on BGN loans to households in July this year was 7.98% for consumers and 2.89% for housing. According to BNB data, the savings of Bulgarians in banks are 59 billion and BGN 31 million, despite the fact that the amount continues to fall, but at a much slower pace.

Do you have to pay to keep your money in the bank? Consumers ask this question after zero interest rates are observed on household deposits in the banking market.

Experts don’t identify the trend as worrisome.

“Interest rates on deposits have not changed much. They have been close to zero for a long time. The largest banks in the country have quite large volumes of liquidity. They do not need this resource,” said Desislava Nikolova, financial analyst.

Experts explain the behavior of banks in our country with what is happening in the European banking market. “The fact that interest rates on deposits are so low is also an ECB policy, which has been in place for many years,” explained Nikolova.

Zero interest rates on deposits also raise questions about whether investing in real estate is not a more profitable solution. And although people are not satisfied with interest rates on deposits, they rarely look for an alternative to their funds.

5 banks under the direct supervision of the ECB

“For the Bulgarian, the most important thing is that his money is in a safe place. The fact that deposits in banks are guaranteed up to 100,000 euros gives this peace of mind,” said Tihomir Toshev, a financial expert.

“For the Bulgarian, the most important thing is that his money is in a safe place. The fact that deposits in banks are guaranteed up to 100,000 euros gives this peace of mind,” said Tihomir Toshev, a financial expert.

Expectations are to maintain these interest rates.

“People’s deposits have exceeded 57.5 billion. When there is a very large resource in the banks, it is an expense for them and the interest rates on deposits will remain at 0 in the coming years”, Toshev explained.

In a context of zero return on savings, interest rates on loans do not change significantly and remain stable.

In a context of zero return on savings, interest rates on loans do not change significantly and remain stable.

Subscribe FREE to the nova.bg newsletter HEREto receive the most important news of the day in your email.

[ad_2]