[ad_1]

Bill Gates, co-founder and co-chair of the Gates Foundation, shared his thoughts on the 11-page coronavirus pandemic, published by the Seattle Times.

The good news, he says, is that we can expect a relatively “normal” world in the next two months. How normal it will be, however, remains to be seen.

“People will be able to go out, but not as often or in crowded places,” Gates wrote. “The restaurants that work will accommodate people at separate tables, and on planes, every half will be empty.”

The secret fell: this is what happened to the biggest billionaires about the K-19

Gates said he believed schools would reopen, but stadiums did not.

“The overriding goal should be to allow activities that are of great benefit to the economy or human well-being but that present little risk of contamination,” said Gates.

In a separate article for Economist, the tech billionaire said that when historians write a pandemic book, what we’ve experienced so far will only take the first third.

“The main part of the story will be what happens next,” he writes. “Even if governments cancel quarantine and companies reopen their doors, people have a natural aversion to exposure to disease.

Airports will not have large crowds. The sport will be played in mostly empty stadiums. And the global economy will be depressed because demand will remain low. “

Gates said that life will only return to normal when the majority of the population is vaccinated, and that may take some time, although he hopes it may happen in the second half of 2021.

“If a vaccine is developed by then, it will be a remarkable achievement in history: the fastest development and production of a vaccine since the onset of disease,” Gates wrote.

What does billionaire investor Leon Kuperman think?

Billionaire investor Leon Kuperman also presented his outlook on life after the crisis subsided. And it includes: a lasting change in capitalism after a virus-induced recession.

According to Kuperman, CEO of Omega Advisers, whose net worth is estimated to be more than $ 3 billion, we will see an increase in taxes and regulations. The expert also believes that the “low interest rates” that make business loans cheaper are not necessarily a good thing.

“I think what we are going through will have lasting long-term effects. Capitalism as we know it is likely to change forever,” predicts the billionaire.

Kuperman, who previously called the market path “healthy” (although he lost “tons of money”), said there may be tighter regulations and higher taxes as the economy recovers from record job losses and lowering value. of equity.

“When the government is called to protect it from the opposite side, they have every right to regulate the opposite side. Therefore, capitalism is changing,” said Kuperman, referring to the trillion-dollar state aid that lawmakers have already provided. Americans.

In an interview with CNBC, Kuperman also criticized the reduction in federal interest rates that President Donald Trump lobbied long before the crisis forced the Federal Reserve to take such drastic measures.

“Consistently low interest rates are indicative of a struggling economy and should not be viewed favorably,” said the brilliant investor.

In terms of investments in the stock market …

The opinions of the experts on the new reality of the stock markets are quite diverse. Analysts are generally divided into two, with optimists and pessimists.

Pessimistic forecasts

These types of forecasts seem to dominate the participants of the stock market.

Legendary investor Mark Mobius has been known for many things over the course of his half-century money management history. But by far his many correct predictions stand out for the bull market start in 2009.

Perhaps this is because the Mobius forecast not only turned out to be correct, but also predicted the longest bull market start in the history of the United States.

And when asked if the recent 20% recovery from the fastest bear market bottom in the history of the United States signaled further growth and the start of a new bull market, Mobius issued a warning to investors.

“I think it is a bit early to predict that, given the global blockchain in so many countries around the world, the impact of this blockchain on business is still unclear at the moment,” said the founder of Mobius. Capital Partners YFi PM before Yahoo Finance. “So I think once the numbers start coming out, people will be a little disappointed.”

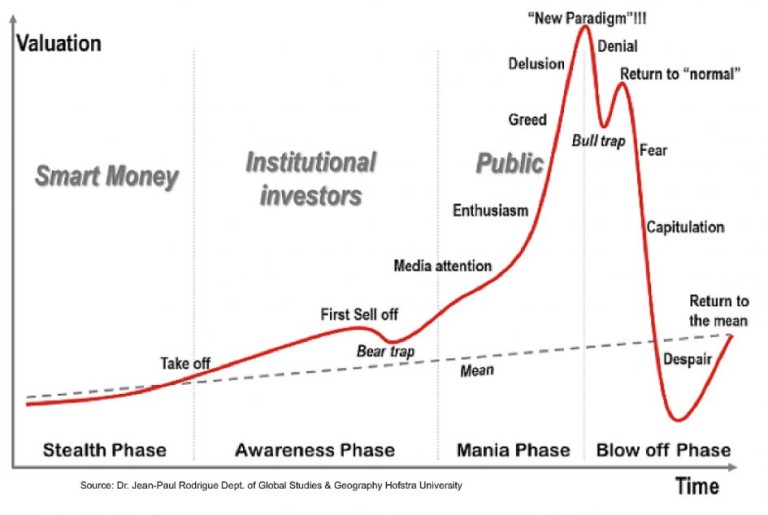

It’s hard to deny, although many people point out that, before the coronavirus, the stock market was on the verge of what might be called a balloon. Of course, balloons come and go, but as Jean-Paul Rodriguez suggests, this one had a particularly fierce reason.

“Although the craze and globes have happened many times before in history …,” he writes, “central banks seem to make matters worse by providing too much credit and are unable or unwilling to stop the process when things get out of hand. . “

Rodríguez explained that the balloons are being removed, an observation backed by 500 years of economic history. “Each fashion is obviously different,” he said. “But there are always similarities.”

His bubble concept has been circulating in financial circles for years. Recently, John Husman of the Hussman Investment Trust used Rodríguez’s chart to alert investors to what’s to come:

Husman, who has been repeatedly “burned” by his swords in recent years, told MarketWatch: “Has it taken me long to give up my belief in the” border “of Wall Street stupidity? No!”

According to Husman, the current position in this market recalls “a return to the normal stage of Rodríguez”. If this is the case, “fear” and “surrender” followed by “despair” are yet to come.

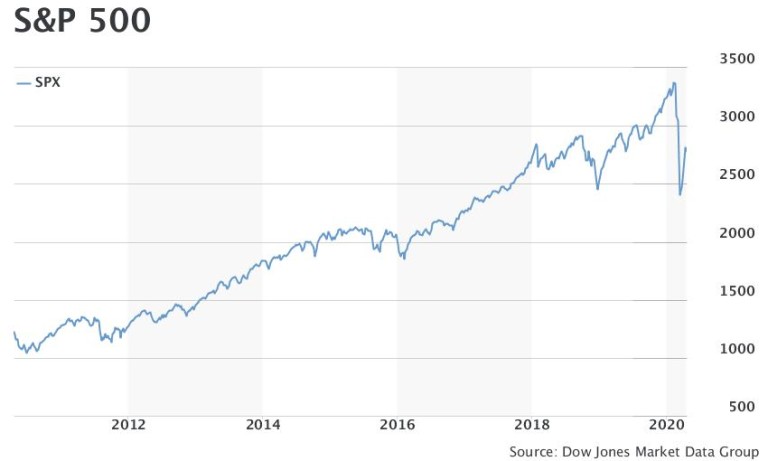

For comparison, this is where we are now:

“After clarifying the resale situation that arose several times in March,” Husman wrote in a recent letter, “we are now seeing a rather unusual combination of overbought conditions, renewed valuation extremes, and still unfavorable domestic market conditions.”

He cited May 2001, December 2007, and May 2008 as similar points in other recent globes. “All three cases had unfortunate consequences for investors,” said Husman.

Of course, there are also optimistic forecasts for the markets.

Not all experts have black eyes like the previous ones, although they are less numerous.

Ari Wald, senior analyst at Oppenheimer, quoted by Yahoo Finance saying:

“We are in what we believe may be a long-term bull market. The decline we had from February to March, which experienced a 35% decline over a 20-day period, was a bear market. Now I think we are entering a new bull market that I think can continue for the rest of the year, “Wald said.

Has there been much debate in the past few weeks as to whether we have seen the bottom of the markets and whether there are still days of panic?

Wold said investors should pay attention to technology and health as sectors.

“Overall, with the advancement of the base, you will see an improvement in latitude and indeed some of these stocks may start to go up in price. We are already seeing similar behavior in some of the high-growth names in technology and medical attention. I think that should stick, “he added.

Much of the growth in the market in recent weeks has been fueled by big names in the tech sector.

“They were able to lead both under and under … they were able to resist during the recession,” Wald said.

Wald predicts that the sector’s strength will likely continue from here.

“We see this premium suite in high-growth companies in this low-growth world. These trends seem to be just beginning,” said Wald.

Wald advises staying away from the energy sector. “We really don’t like these actions,” he said. “They are a big part of the recession not only in 2020, but they are also declining in recent years.”

Energy companies have been forced to cut their capital costs and suspend new projects amid a collapse in oil prices as economies stagnate due to COVID-19. This week, President Trump has established plans to assist American companies in the oil and gas industries, some of which are at risk of bankruptcy.

“While a partial stabilization of the sector would be welcome and reasonable, we are seeing more attractive investment opportunities in other parts of the market right now,” said Wald.

[ad_2]