[ad_1]

One in three – one in three The monthly insurance is lost in the fees of the funds.

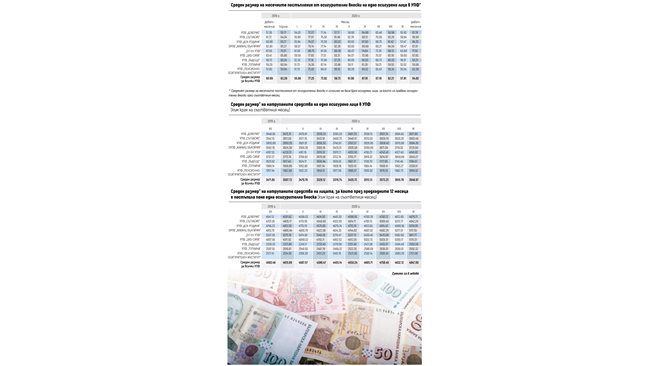

One in every second three-month pension insurance is used to pay contributions to private pension funds, instead of accumulating in the personal account of those born after December 31, 1959.

This is clear from the latest reports from the nine pension companies to the Financial Supervision Commission, which cover the third quarter of 2020.

Each of the more than 3 million Bulgarian citizens insured in private funds for a second pension paid an average of BGN 194.46 in social security contributions for the period from July to September.

Medium size

in the monthly

contribution for all

funds for

the first nine

months of

the year is

BGN 64.82

5% of salary is paid as a contribution for a second pension.

At the same time, however, an average of BGN 133.84 was accumulated in the accounts for the period, which means that the accounts did not include an average of BGN 60.62 per person, or almost the entire monthly fee, due to the rates of the funds.

The value of accounts is also affected by the performance achieved in the period, but in the third quarter the stock markets rose and the funds managed to achieve a positive performance.

Up to 3.5% commission of

each one done

safe

contribution

pension companies are charged according to the Social Security Code. In addition, there is a fee for investments managed by the funds, which amounts to 0.5 percent of the account value and is charged once a year.

9% is the real deduction from the money for a second pension, announced in an interview for “24 hours” the economist of “Podkrepa” Vanya Grigorova.

9% of contributions for the second pension are deducted from the funds as fees, says Vanya Grigorova from Podkrepa.

According to their accounts, the funds manage more than 13 billion BGN.

your income

of the rates are in

size of

1.3 billion BGN

The recently announced proposals by the government for changes to the Social Security Code (RSC) for the payment of second pensions stipulate that the account from which they will be paid is at least equal to the nominal amount of the insurance contributions made. This means that if there is no return, the funds must return the fees withheld over the years to the account. On the other hand, they will charge a commission for money management in the years in which the second pension is paid.

BGN 3,648.97

it was average

value of

lots at the end

in September

for the nine universal pension funds. For comparison, at the end of June the value of an average lot was BGN 3,515.13 and at the beginning of this year 3507.73 BGN. Therefore, the lot increase for the months of January to September averaged BGN 141.24. or just over two monthly contributions to social security. In the first four months of the year, however, due to the pandemic and the collapse of the stock markets, the funds were lost, and in the middle of the year they compensated for the losses mainly from incoming insurance, as already wrote “24 Chasa” .

The average value of the lots.

is not indicative

for the real ones

accumulations,

however, they claim

private

companies

The reason: it includes accounts of people who have small accumulations because they have not paid contributions for years due to emigration or unemployment.

The most certain indicator, according to the funds, is the value of the accounts of the people who have made at least one installment in the last 12 months.

BGN 4,847 is the average value of these accounts at the end of September, according to the Financial Supervision Commission. At the end of June it was BGN 4,665.71. According to this indicator, the accumulation in the accounts is 181.29 BGN for the third quarter of 2020. Thus, in fact, of the average of 194.46 BGN paid for the three months as insurance, only 13 are lost. BGN, or about 7% of the contributions made.

BGN 5,611.77

the tallest

value of

medium batch,

which are provided by individual pension companies. So it is in NN.

Policyholders at DSK-Rodina, Allianz-Bulgaria and CCB-Sila also average more than BGN 5,000 each. However, these companies also have the highest average social security contributions, which means that they are selected by people with higher incomes. In NN, for example, the average insurance contribution is BGN 71.55, which means that the average income of the insured in this fund exceeds BGN 1,400 per month.

However, in Toplina, where the average lot at the end of September was only BGN 2,692.32, the average monthly insurance is BGN 59.96, which means that the average income of the insured in it does not exceed BGN 1,200 .

The lowest is the value of the accounts in the universal pension fund “Future” – only 2550, 09 BGN, according to the data announced by the Financial Supervision Commission.

[ad_2]