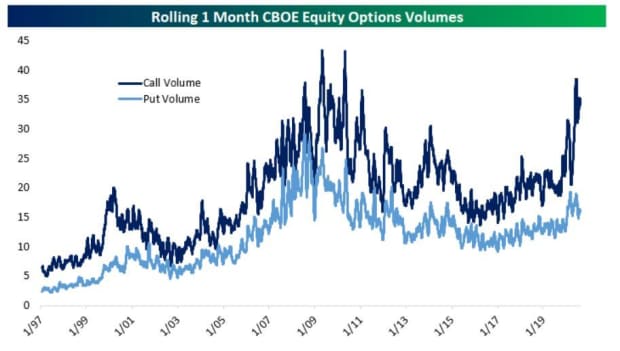

Even if the stock market trades in record-setting territory, despite the economy being in the throes of a viral pandemic, Wall Street is betting for further gains at its highest level since the dot-com bubble, according to research from Bespoke Investment Group.

Options bet that the S&P 500 SPX,

will expand its inflow in the coming months is nearly doubling, far more than trading in securities that would be used to bet that a decline in stock values was threatening.

Call options give holders the right, but not the obligation, to buy a certain number of shares (100 per optics contract) for a certain price (strike price) for a certain date (expiration date).

Calls are considered a bullish bet on an asset, as opposed to put options, and Bespoke indicates that the hunger for calls, particularly among individual investors, has blossomed.

“Retail enthusiasm for the market through commission-free trading apps plus the enormous volatility earlier this year have led to a massive boom in options volumes,” the analysts at BIG wrote. “Most of the increase in trading activity in these derivatives has gone to talks,” she wrote (see chart below).

Custom investment group

The declining stance in the options market comes as market partners become increasingly concerned about the market rally, which has taken the S&P 500 and the Nasdaq Composite Index COMP,

from the depths of a Coronavirus-induced sale in March back to a series of highs in a few short months (The Dow Jones Industrial Average DJIA,

stands within 4% of its own record-breaking last hit on February 12), comes for itself and has fallen for the first time.

Bespoke writes that it is difficult to predict when a market slippage may occur, but notes that the extent to which leveraged bets are made on further head can increase the decline if a bearish catalyst emerges.

“In any case, the prevalence of call buying in our view is a clear signal that sentiment is expanding after a blistering stock market rally since March,” the analysts wrote.

As of Thursday afternoon, the S&P 500 was on pace for its 19th record close to 2020 and its fifth straight record finish, which would represent the longest streak of all-time highs since a period of six sessions ended on January 9, 2018, according to Dow Jones Market Data.

A number of strategists have expressed concern that markets are heading for euphoria after the seemingly sustained climb.

Indeed, Sean Darby, global head of strategies at Jefferies, said in a research note earlier this week that some “indicators are starting to move into the ‘euphoria’ stage, and warned that managing risk aversion is advancing.”

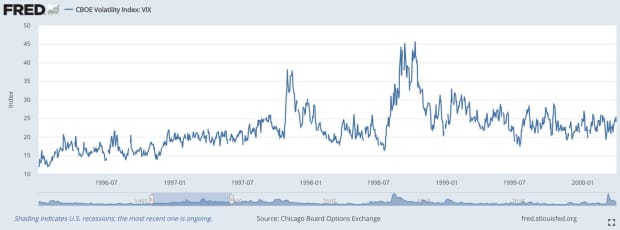

However, one measure of the market’s concerns remains high. The Cboe Volatility Index VIX,

VX00,

131 trading days remained above the historical average of 19.40, which is the longest period above its historical norm since the 335 trading days ended on December 21, 2009, amid the financial crisis of 2007-09.

The VIX, which typically jumps at large stock market sales, also tends to fall back at long, slow rallies, has remained firmly elevated at the last check, at 24.37.

Analysts at DataTrek said on Thursday afternoon that the increase in VIX and the rise in equities is unusual, but not without a breakthrough, and draws a comparison with the period between 1996 and 2000 when the VIX held well above 20 without lasting damage to the stock market rally,

The VIX consistently remained more than 20 (S&P 500 + 33%), 1997 (+ 28%) and 1999 (+ 21%). Stressful periods in 1997 (Asia Crisis) and 1998 (Long Term Capital) took the VIX even over 35 without lasting damage to the rally in U.S. equities, ‘DataTrek wrote.

However, Jesse Felder, author of the popular Felder Report financial blog, notes that recently the volatility index and equities have been rising at the same time, which he described in the short term as a bearish sign. On Thursday, in fact, the VIX was up 4.5% as shares rose.

Felder said extended deviations from the normal relationship could signal “a threatening reversal.”

.